Modern accounting is built on accurate, timely information. For UK accounting firms, that increasingly means having access to up-to-date bank transaction data. Whether it’s reconciling accounts, managing cash flow, or preparing client reports, real-time insights from bank feeds are now a necessity rather than a luxury.

That’s where bank data providers come in. These platforms connect directly to client bank accounts using open banking APIs, allowing accountants to access and work with live transaction data. Instead of chasing clients for statements or logging into online banking, firms can use secure integrations to fetch the information they need, all in one place.

But with dozens of providers on the market, it’s important to choose one that’s reliable, FCA-authorised, and built to handle the practical needs of accountants. In this blog, we’ve shortlisted five bank data providers that stand out in 2025 for their coverage, data quality, and ease of use.

1. Finexer

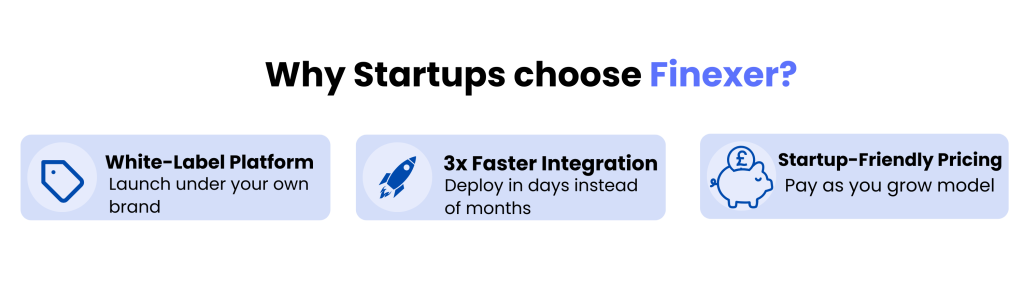

Finexer is a UK-first platform designed specifically for accounting firms and small businesses that want full control over how they access and use bank data. It offers both AIS (Account Information Services) and PIS (Payment Initiation Services), allowing firms to pull live transaction data and also initiate payments like payroll or supplier transfers from the same platform.

What makes Finexer stand out among bank data providers is its local focus. Unlike global platforms that split attention across regions, Finexer is fully UK-based and FCA-authorised. It supports 99 percent of UK banks and is built to align with the needs of UK compliance and accounting workflows.

For practices managing multiple client accounts, Finexer offers white-label features that let you present banking tools under your own branding. It also includes startup-friendly pricing and access to a full sandbox for testing before going live.

Best For:

- Accounting firms working with UK-based clients

- Firms handling reconciliation, payroll, or supplier payouts

- Practices looking for a UK-focused bank data provider with strong API support

Key Features:

- Real-time access to 99% of UK bank accounts

- Support for both AIS and PIS

- Full FCA authorisation and UK compliance

- White-label options for client dashboards

- Sandbox access and developer-friendly documentation

Pros:

- Built specifically for the UK market

- Transparent pricing with no hidden fees

- 3x Faster setup than market with clear integration paths

- Handles both data access and payments

Cons:

- Not suitable for firms with international clients

- Relatively new compared to legacy platforms

Finexer is an ideal choice for UK accounting firms that want a dependable and locally optimised bank data provider. It balances coverage, control, and simplicity, making it easy for firms to connect client accounts and reduce manual admin.ce for UK accounting firms that want a dependable and locally optimised bank data provider. It balances coverage, control, and simplicity, making it easy for firms to connect client accounts and reduce manual admin.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

2. Salt Edge

Salt Edge is one of the most established bank data providers for firms that need advanced financial data aggregation and enrichment. Headquartered in London and fully FCA-authorised, Salt Edge connects to over 5,000 banks worldwide, including broad coverage of UK business and personal accounts.

For UK accounting firms, Salt Edge provides more than just raw transaction feeds. It includes features like merchant identification, transaction categorisation, and data normalisation — all of which make reconciliation, advisory, and onboarding easier and faster.

Salt Edge also offers a flexible API and white-label support, making it a suitable choice for firms building custom workflows or client portals. Its infrastructure is ISO 27001 certified, giving peace of mind when handling sensitive financial data.

Best For:

- Firms that need enriched transaction data

- Accounting practices supporting onboarding, affordability checks, or advisory

- Firms looking for a global or multi-client data aggregation tool

Key Features:

- Access to 5,000+ financial institutions including UK banks

- Real-time transaction feeds and account balances

- Enrichment tools including categorisation and merchant detection

- Strong compliance: FCA-authorised and ISO 27001 certified

- White-label deployment options available

Pros:

- Extensive bank connectivity

- Highly detailed and enriched financial data

- Flexible for firms building tailored workflows

- Well-established in financial and compliance sectors

Cons:

- May be more technical to implement than simpler tools

- Not focused solely on UK accounting needs

Salt Edge is one of the most comprehensive bank data providers available today. For firms that need more than just basic feeds — especially those involved in advisory, reporting, or compliance — it’s a strong, reliable option.compliance — it’s a strong, reliable option.

3. Bud Financial

Bud is a UK-based open banking platform that helps accounting firms make better use of financial data through enrichment, categorisation, and behavioural insights. Unlike some bank data providers that focus only on data access, Bud specialises in making sense of transaction-level detail — turning raw feeds into clear, structured outputs that support advisory and affordability work.

Bud’s platform is frequently used behind the scenes in lending, budgeting, and client onboarding applications. For accounting firms offering cash flow planning, income verification, or affordability assessments, Bud offers the tools to go deeper into a client’s financial history without needing to manually tag transactions.

Bud is also FCA-authorised and integrates with 90 percent of UK banks. While it doesn’t offer payment initiation, its strength lies in making financial data more usable and insightful.

Best For:

- Firms providing budgeting, planning, or affordability services

- Accounting practices supporting lenders or fintechs

- Use cases where categorisation and income analysis are critical

Key Features:

- Real-time AIS access with enriched data

- Advanced transaction categorisation and tagging

- Income and affordability insights

- Strong support for lending and financial analysis workflows

- FCA-regulated and UK-focused

Pros:

- Highly detailed enrichment for better advisory

- Ideal for planning and budgeting use cases

- Trusted by leading fintechs and lenders

- Strong API documentation and developer support

Cons:

- No support for payments (PIS)

- Requires technical setup for custom integrations

Bud stands out among bank data providers for its focus on insight rather than just access. If your firm is helping clients understand their finances in more detail — whether for lending, planning, or reporting — Bud offers a reliable, insight-rich solution.lending, planning, or reporting — Bud offers a reliable, insight-rich solution.

4. TrueLayer

TrueLayer is one of the most widely recognised bank data providers in the UK and Europe. Known for its developer-first approach and strong infrastructure, it offers both AIS (data aggregation) and PIS (payment initiation), making it a flexible option for firms that need access to financial data as well as tools to process payments.

For accounting firms, TrueLayer provides real-time access to bank transactions, balances, and account details. Its enrichment features help categorise transactions and identify patterns, which can support tasks like reconciliation, cash flow tracking, and financial planning.

TrueLayer is also FCA-authorised and integrates with over 90 percent of UK banks. It offers branded integrations, allowing accounting platforms or portals to use its services without exposing the TrueLayer brand directly to clients.

Best For:

- Firms that want both data access and optional payment tools

- Practices with in-house developers or accounting software platforms

- Use cases requiring real-time financial visibility

Key Features:

- Real-time bank data access (AIS)

- Optional payments via PIS and VRP (Variable Recurring Payments)

- Transaction categorisation and enrichment

- Branded integration options

- FCA-authorised with strong UK coverage

Pros:

- Offers both AIS and PIS in a single API

- Solid performance and uptime for live bank feeds

- Well-documented and developer-friendly

- Works with many accounting-related apps

Cons:

- Not focused solely on accountants

- Branding control is limited unless fully embedded

As one of the most flexible bank data providers, TrueLayer is a strong fit for accounting firms with digital workflows or development teams. It’s particularly useful for firms that want to embed open banking directly into their client-facing tools.

5. Yodlee

Yodlee, part of Envestnet, is one of the most established names among global bank data providers. With over two decades of experience in financial data aggregation, it offers a mature and reliable platform for accounting firms that require broad data coverage and advanced analytics.

In the UK, Yodlee is FCA-authorised and supports a wide range of bank connections through both open banking and direct integrations. While it was originally built for personal finance management tools and financial institutions, Yodlee now supports use cases that align well with accounting, including transaction tracking, income analysis, and budgeting support.

For firms working with a mix of UK and international clients, or those that want to build advanced reporting tools, Yodlee provides a scalable and secure option with strong historical data depth.

Best For:

- Firms supporting clients with complex or multi-jurisdictional finances

- Practices offering financial wellness or budgeting services

- Use cases that require long-term transaction history and analysis

Key Features:

- Broad data aggregation, including UK and global banks

- Transaction categorisation, income and expense tracking

- Long-term transaction history access

- FCA-authorised in the UK

- Strong security and compliance infrastructure

Pros:

- Well-established and trusted by financial institutions

- Rich historical data access

- Supports a wide range of financial data sources

- Reliable for analytics-heavy workflows

Cons:

- Less tailored to small accounting firms

- Integration may be more technical than newer platforms

Yodlee remains a go-to choice for firms that need a proven, analytics-ready bank data provider with an extensive financial data history. Its scale and experience make it a strong candidate for firms that go beyond basic reconciliation and reporting. financial data history. Its scale and experience make it a strong candidate for firms that go beyond basic reconciliation and reporting.

Comparison Table: Top Bank Data Providers for UK Accounting Firms

| Provider | UK Bank Coverage | Real-Time Data | Transaction Enrichment | White-Label Support | FCA Authorised | Best For |

|---|---|---|---|---|---|---|

| Finexer | 99% of UK banks | Yes | Yes | Yes | Yes | Firms needing UK-focused payments and data access |

| Salt Edge | Broad UK and global coverage | Yes | Advanced | Yes | Yes | Firms needing in-depth categorisation and onboarding tools |

| Bud | 90%+ of UK banks | Yes | Advanced | Yes | Yes | Firms offering affordability checks and insights |

| TrueLayer | UK and EU coverage | Yes | Yes | Branded integrations | Yes | Firms wanting both data and payment APIs |

| Yodlee | UK and global coverage | Yes | Yes | Yes | Yes | Firms needing historical data and cross-border access |

Choosing the Right Bank Data Provider

Not all bank data providers are built the same. Some focus on enriching transaction data for budgeting and advisory services. Others are better suited to firms that need both data and payments in one platform. What matters most is choosing a provider that fits the way your accounting firm operates — and the kind of clients you support.

If your firm is working with UK-based businesses and wants a provider that offers real-time access, FCA-compliant infrastructure, and the ability to manage payments and bank feeds under one roof, Finexer is a strong choice. It’s particularly well suited for practices that want to move quickly, reduce manual admin, and maintain full control over branding and integrations.

For firms looking to go deeper into affordability insights or onboarding, Bud and Salt Edge are excellent options thanks to their categorisation and enrichment tools. Meanwhile, TrueLayer offers flexibility for those who want both AIS and PIS access with branded integrations. And if your needs stretch across regions or require long-term financial history, Yodlee brings the scale and experience to support more complex operations.

Whatever direction your firm is heading, the right bank data provider will help you deliver better insights, save time, and stay connected to your clients’ financial realities, all without relying on outdated methods or manual work.

What is a bank data provider?

A bank data provider is a platform that uses open banking APIs to give businesses and accounting firms secure access to real-time financial data from client bank accounts.

Are bank data providers secure and FCA-regulated?

Yes, the leading bank data providers in the UK, including Finexer, Salt Edge, Bud, and others, are fully FCA-authorised and meet high data protection standards.

Can I connect bank feeds from these providers to Xero or QuickBooks?

Most bank data providers offer integrations with tools like Xero, QuickBooks, and Sage, helping accounting firms automate reconciliation and reporting tasks.

Which bank data provider is best for UK-only accounting firms?

Finexer is ideal for UK-only firms. It offers 99% UK bank coverage, FCA-compliant infrastructure, and both data access and payment initiation tools in one platform.

Do bank data providers offer enriched transaction data?

Yes, providers like Bud and Salt Edge specialise in enriched data, including categorisation, merchant tagging, and income analysis, for better financial insights.

Get Accurate Bank Data for your Accounting Firm ! Schedule your free demo and get a 14 days Trial by Finexer 🙂

![5 Leading Financial Data Aggregators for UK Accounting Firms in 2025 1 5 Leading Bank Data providers for UK Accounting firms [2025]](/wp-content/uploads/2025/04/Leading-Bank-data-providers.png)