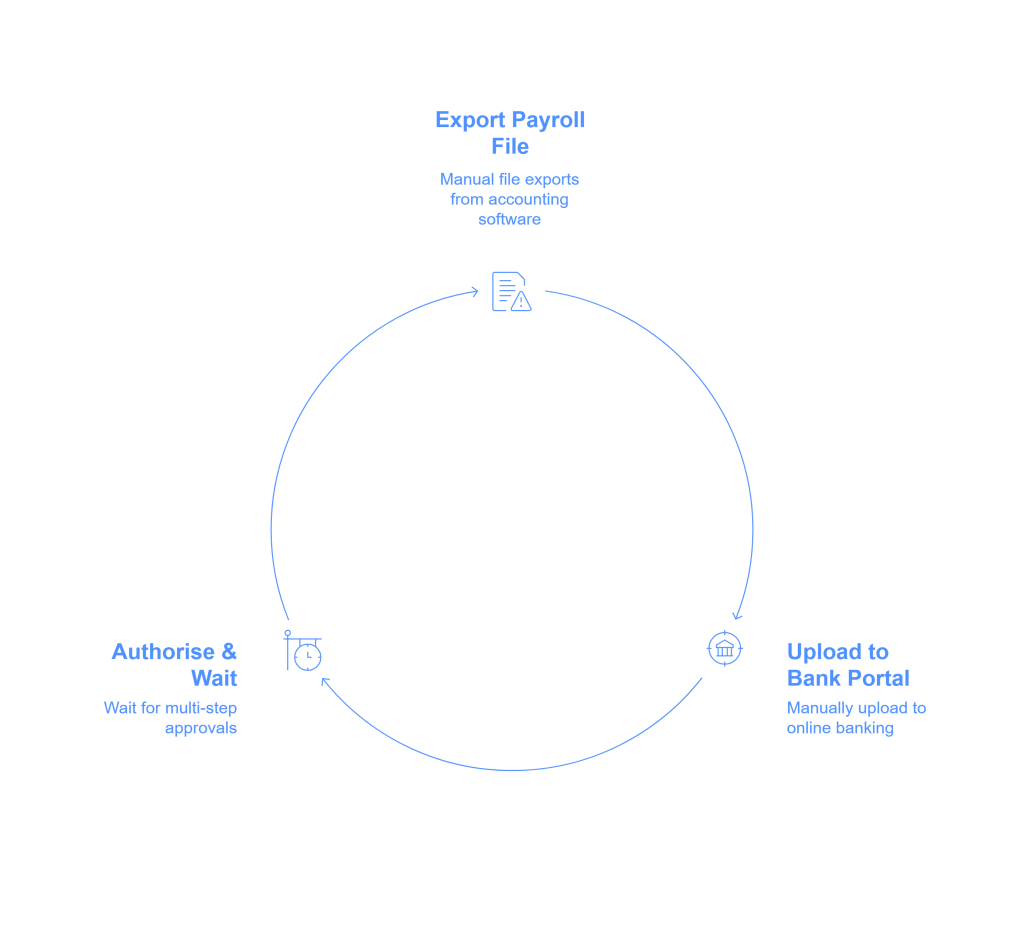

Payroll shouldn’t be this frustrating. Every month, finance teams spend hours jumping between their accounting software and online banking portals just to get employees paid. You export a file, double-check the numbers, upload it to the bank, and then wait. If anything’s off, you’re back at square one.

This back-and-forth wastes time, increases the chance of errors, and slows everything down.

But it doesn’t have to be that way. With open banking payroll, you can trigger payments directly from your accounting system. No more uploading CSVs or logging into multiple platforms. You simply approve the run, and the money moves from your account to your employees’ accounts. It’s secure, fast, and completely bank-authorised.

In this guide, we’ll walk you through how open banking payment initiation works, why it’s catching on across the UK, and how it helps you reduce payroll processing time by as much as 70 per cent. If you’re ready to take payroll off your to-do list and get it done in a few clicks, you’re in the right place.

Keep reading or Jump to the section you’re looking for:

1. Why Traditional Payroll Workflows Are Costing You Time

If you’re still processing payroll the old-fashioned way, you’re not alone. Many UK businesses follow the same tedious process every month: export a payroll file from your accounting software, upload it to your bank portal, verify everything line by line, and then authorise the payments.

This might seem normal, but it’s actually costing your team time and increasing risk with every manual step.

- File exports and uploads

You’re moving data between systems that don’t talk to each other. Every time you export a file, there’s a risk of version errors or formatting issues. - Manual approvals and double-checking

Most banks require extra layers of authentication, which adds delays. If there’s a mistake in one line of the payroll file, you may need to cancel the whole batch. - Lack of real-time visibility

Once the file is uploaded, you’re left in the dark. There’s no immediate insight into which payments went through or if an account was flagged.

All of this creates friction, especially for finance teams trying to close the books quickly. The bigger the payroll, the more time it takes. And if you’re paying weekly or bi-weekly, the hours stack up fast.

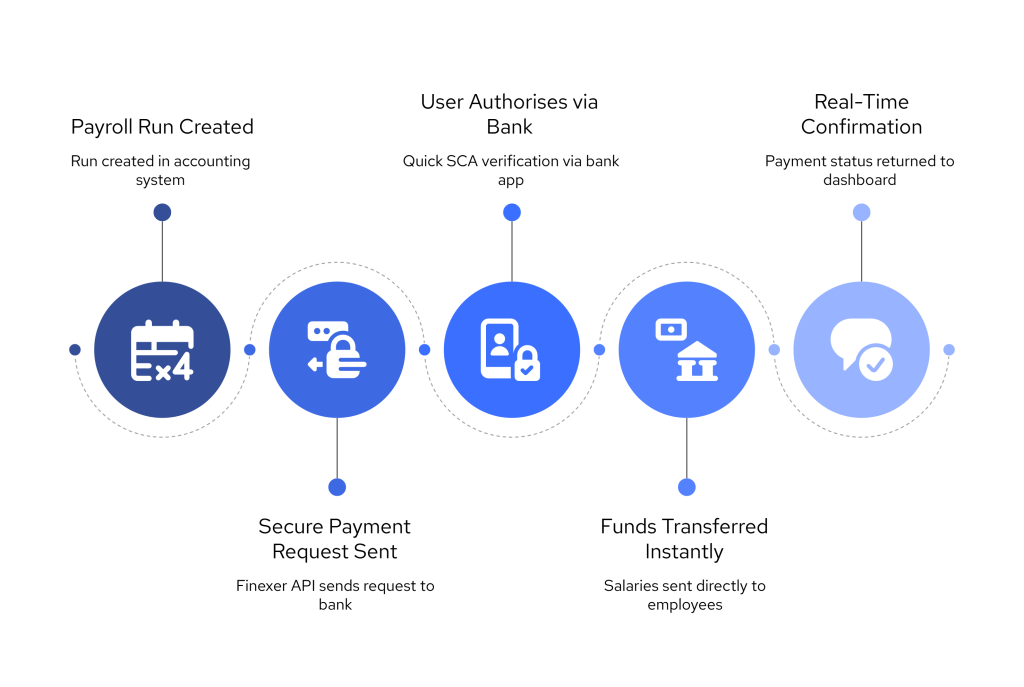

2. How Open Banking Payment Initiation Works

- Your payroll run is created and approved inside your accounting system

- Finexer’s API sends a payment request securely to your bank

- You or an authorised team member completes a quick verification through the bank’s app or web interface

- Funds are transferred directly to employee accounts, with confirmation sent back to your system in real time

The entire process is FCA-regulated and uses Strong Customer Authentication (SCA), so it’s just as secure as using your bank portal but much faster.

This type of payroll payment automation is growing fast across the UK. Businesses no longer want to deal with error-prone file uploads, slow authorisations, or multiple approval loops. With the right accounting system integration, everything happens within a single workflow, without leaving the dashboard.

And since open banking is built on real-time bank connectivity, finance teams also gain instant visibility into payment status, no more guessing when funds will land.

3. Integrating Payroll with Direct Bank Payments

One of the biggest benefits of open banking payroll is how easily it can plug into the systems you already use. Whether your team runs payroll through Xero, QuickBooks, Sage, or a custom ledger, it’s now possible to initiate payments directly, without switching between apps or downloading files.

This is made possible through accounting system integration with Open Banking APIs. Instead of relying on file-based workflows, Finexer connects your accounting platform to 99% of UK banks using secure, real-time payment initiation services. The result is a direct link between your payroll software and your bank account.

Here’s what that looks like in practice:

- You run payroll in your accounting system

- Approved payments are passed to the bank via API

- An authorised user verifies with biometric or bank app login

- Employees receive payments with no delays, no manual uploads

This type of direct bank payment flow not only cuts down errors but also eliminates the need for finance teams to access multiple platforms. Everything happens inside the tool they already use to manage payroll.

With the right provider, setting up this accounting system integration takes just a few days, not months. There’s no need to build a custom solution from scratch. And for teams looking to improve internal controls, open banking also supports role-based access, payment approval tiers, and detailed audit trails, all baked into the platform.

4. Benefits of Automating Payroll via Open Banking

Switching to open banking payroll isn’t just about convenience; it’s about upgrading your entire payroll process. By replacing file uploads and portal logins with direct bank payments, finance teams are unlocking real savings in time, accuracy, and control.

Here’s what that looks like when put into practice:

1. Up to 70% faster payroll processing

With payment initiation directly built into your accounting system, you skip all the back-and-forth. No exporting, uploading, or rechecking files. Everything happens in one place, and you get instant confirmation when funds move.

2. Fewer errors and more confidence

Manual workflows are prone to mistakes. By automating payroll payment initiation through Open Banking APIs, you reduce human error and ensure that every payment is authorised securely with bank-level authentication.

3. Real-time status tracking

Instead of wondering whether a payment has gone through, Open Banking gives you full visibility. You know exactly when funds leave your account and when they hit the employee’s bank — all within your accounting system integration.

4. Stronger internal controls

Want to set multi-step approvals? Need payment logs for compliance? Open banking payroll solutions like Finexer include built-in approval workflows, audit trails, and secure user permissions so finance leaders stay in control.

5. Zero need for switching systems

Because this all happens within your existing accounting or payroll software, there’s no disruption to your current process. You’re simply adding a smarter layer of automation where it matters most.

In short, payroll payment automation helps you do more with fewer clicks and gives you peace of mind every pay cycle.

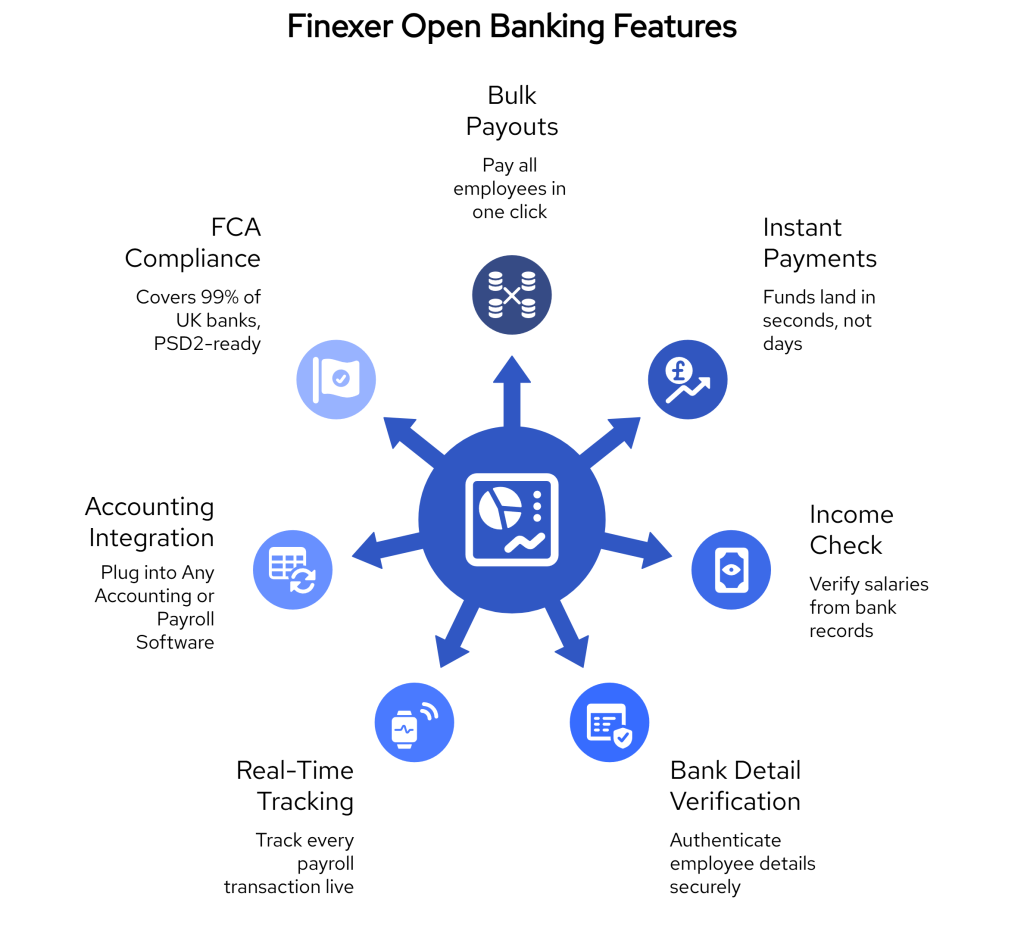

5. How Finexer Supports Open Banking Payroll Integration

Finexer is purpose-built to make open banking payroll effortless for UK businesses. Instead of dealing with file uploads, outdated data, or failed payments, you can automate the entire payroll cycle from income verification to final payment within one secure platform.

1. Bulk Payouts with One Click

Pay your entire team instantly with a single approval. Finexer’s bulk payment capability lets you disburse salaries to hundreds of employees at once, reducing transaction costs and saving hours of admin time.

2. Instant Payments, No Delays

Avoid late salaries and strained employee trust. With real-time payment initiation, you can deposit funds into employee accounts instantly, no cards, no waiting, and no hidden fees.

3. Real-Time Income Verification

Use Income Check to verify earnings directly from an employee’s bank, ensuring accurate salary calculations and reducing errors during payroll adjustments.

4. Automated Bank Detail Collection and Verification

Finexer’s Authenticate tool collects and verifies employee bank details using Open Banking, cutting onboarding mistakes and enhancing compliance.

5. Live Payment Tracking and Audit Trails

Get a real-time view of all payroll transactions. You’ll know exactly when payments are initiated, cleared, or flagged, helping your team resolve issues quickly.

6. Seamless Accounting System Integration

Whether you’re using Xero, QuickBooks, Sage, or a custom system, Finexer plugs into your existing workflow. No custom builds, no developer dependency, just a fast, reliable API-led experience.

7. Compliant and Scalable

With full PSD2 compliance and coverage of 99% of UK banks, Finexer offers an FCA-authorised, white-labeled solution that scales with your business.

If your team is still spending hours running payroll through manual steps and outdated portals, it’s time to move to a faster, more accurate solution that actually works for modern finance teams.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Rethink Payroll with Open Banking!

Manual payroll workflows may feel familiar, but they no longer serve fast-moving finance teams. When you’re juggling multiple systems, reconciling files, and worrying about late payments, the process becomes more of a liability than a function.

Open banking payroll flips that model completely. With direct bank payments, real-time visibility, and automated data checks, you’re not just saving time, you’re gaining control, accuracy, and confidence with every pay run.

Whether you’re a finance director, payroll administrator, or accountant managing disbursements at scale, the shift to payroll payment automation is not just a nice-to-have. It’s now a practical, secure, and scalable way to stay ahead of deadlines without the stress.

What is open banking payroll, and how does it work?

Open banking payroll allows businesses to initiate employee salary payments directly from their accounting or payroll systems using secure payment initiation services. Instead of uploading files to a bank portal, payments are triggered through APIs connected to UK banks, ensuring real-time processing and full visibility.

Can I automate payroll payments without using my bank’s online portal?

Yes, with open banking payment initiation, you can automate payroll directly within your accounting system. Tools like Finexer integrate with platforms such as Xero or Sage to handle direct bank payments securely, without needing to log into your bank.

How secure is payroll payment automation via open banking?

Open banking payroll uses Strong Customer Authentication (SCA) and is fully FCA-compliant. Each transaction is authorised through secure channels, with real-time tracking and full audit logs, making it safer than manual transfers.

What accounting systems can integrate with Finexer for payroll?

Finexer supports seamless accounting system integration with any Accounting platform like Xero, QuickBooks, and Sage. Custom integrations are also available via API, allowing finance teams to initiate bulk payouts without developer overhead.

How can I process bulk payroll payments using Finexer?

Finexer’s bulk payout feature allows you to process multiple salary payments in one go. It reduces transaction fees and simplifies large payroll runs, making it ideal for businesses with growing teams or frequent pay cycles.

Trigger instant, secure salary payments from your accounting system with no manual uploads or delays. Try Finexer Now!

![Open Banking Payroll in 2025: A Practical Guide for UK Finance Teams 1 Open Banking Payroll: Pay Your Team in One Click [2025]](/wp-content/uploads/2025/05/Open-Banking-Payroll.jpg)