For UK accountants, client onboarding is no longer a back‑office formality; it’s a regulatory obligation and a client experience benchmark. Accounting firm client onboarding often still means chasing PDF bank statements, requesting utility bills, and manually checking income sources. A recent NatWest survey found that UK businesses using Open Banking in their payment systems spend an average of 44.5 hours per month on finance tasks, compared to over 57 hours for those not using Open Banking, adding up to more than 150 hours saved per year, or over four full working weeks. This outdated manual approach not only slows approvals and drains staff time but also frustrates clients who expect a fast, digital-first experience.

Open Banking APIs are reshaping how firms onboard clients by providing instant, FCA-regulated access to bank data. Instead of weeks of document collection and cross-checking, firms can now verify income, categorise transactions, and complete compliance checks in minutes.

📚 Top 5 Digital Onboarding Software

Open Banking APIs and the Future of Onboarding

Open Banking APIs are shifting the way accountants think about client onboarding. Instead of relying on outdated paperwork, firms can securely connect to a client’s bank with consent and pull real-time financial data in seconds. This technology is FCA-regulated, meaning accountants can meet compliance requirements while giving clients a faster, digital-first experience.

Here’s how Open Banking transforms accounting firm client onboarding:

- Instant account verification – No more chasing PDFs or waiting days for clients to send documents. APIs fetch verified data directly from banks.

- Digital KYC process – Automated checks on identity, income, and source of funds reduce the need for manual reviews.

- Automated bank data checks – Transactions are categorised and matched against accounting records, cutting hours of manual work.

- Audit-ready records – With standardised data pulled directly from banks, firms can generate reports that meet FCA and HMRC expectations.

The result is onboarding that takes minutes, not weeks, giving firms the ability to improve compliance while winning client trust from day one.

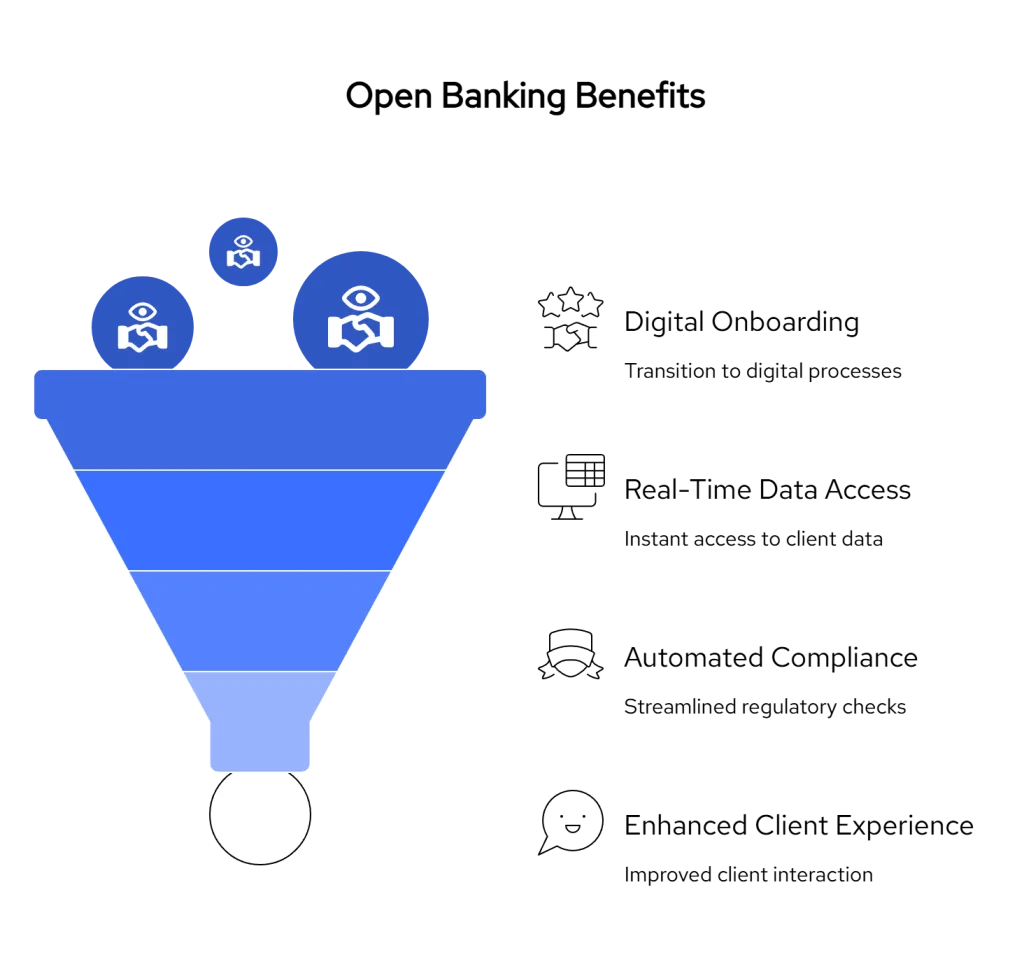

Benefits of Open Banking for Accounting Firms

For UK practices, the biggest shift comes from turning onboarding into a digital-first experience that balances compliance with client satisfaction. Open Banking doesn’t just remove paperwork, it brings measurable gains across the business.

Faster Client Approvals

Manual onboarding often stretches across days or weeks, slowing down the start of new engagements. With Open Banking onboarding, firms can access verified transactions in real time, accelerating approval decisions and allowing accountants to begin advisory work sooner.

Compliance Made Simpler

FCA and HMRC obligations require detailed checks on income sources and client funds. Open Banking APIs automate much of this, reducing the margin for error. By relying on digital KYC processes and standardised data feeds, firms maintain strong audit trails without overburdening staff.

Better Client Experience

Clients expect fast, mobile-friendly interactions. Instead of uploading statements or sending repeated emails, they simply grant consent for secure data access. This creates a smoother accounting firm client onboarding journey, improving satisfaction and reducing drop-offs.

Key Features to Look for in an Onboarding API Infrastructure

Not every Open Banking provider is designed with accountants in mind. When evaluating technology for an accounting firm client onboarding, there are a few essential features that separate the right partner from the rest.

- FCA Authorisation

Any provider must be fully regulated by the Financial Conduct Authority. This ensures both Account Information Services (AIS) and Payment Initiation Services (PIS) meet UK compliance standards. - UK Bank Coverage

Broad connectivity across high street and digital-first banks guarantees no data gaps when verifying client accounts. Limited coverage risks incomplete checks. - Integration with Accounting Platforms

The onboarding process should flow directly into systems firms already use, from Xero and QuickBooks to bespoke practice software. This reduces duplication and creates a smoother workflow. - Automated Compliance Features

Look for automated bank data checks, categorisation, and audit-ready reports. These tools make it easier to prove compliance to HMRC or during client audits. - Deployment Speed and Support

The faster an API can be deployed, the quicker firms can realise value. Providers that offer dedicated onboarding support make adoption smoother for accountants who don’t want to spend months integrating.

How You Can Do It with Finexer

Finexer was built specifically for UK accountants. With FCA authorisation, coverage of 99% of UK banks, and a platform designed for accounting workflows, it transforms accounting firm client onboarding into a fast, compliant, and client-friendly process. Firms also benefit from usage-based pricing, white-label options, and a deployment speed that’s 2–3x faster than the market average.

Practical Example: Traditional vs. Open Banking Onboarding

To see the difference in action, let’s compare how an accounting firm would onboard a new client using traditional methods versus an Open Banking API.

Traditional Onboarding

- The client is asked to provide 3–6 months of bank statements, usually as PDFs.

- Staff manually review transactions, trying to verify income sources and spot red flags.

- Missing or incomplete documents mean repeated email follow-ups.

- The process often takes 1–2 weeks, delaying the start of any real work.

Open Banking Onboarding with Finexer

- The client simply grants consent through secure authentication with their bank.

- Finexer’s API pulls categorised transactions instantly, covering up to 99% of UK banks.

- Automated checks flag anomalies and prepare audit-ready records.

- The entire accounting firm client onboarding process is completed in minutes, freeing accountants to move straight into advisory or compliance work.

This shift doesn’t just save time, it transforms the client’s first impression. Instead of chasing documents, firms show professionalism and efficiency from the very first interaction.

Why Choose Finexer for Client Onboarding

Accounting firms in the UK need more than a generic Open Banking provider. They need a solution built specifically for compliance, client experience, and audit readiness. That’s where Finexer stands out.

- UK-First Design – Focused entirely on the UK market, with FCA-authorised infrastructure and workflows aligned to HMRC and accounting compliance standards.

- Comprehensive Bank Connectivity – Connects to 99% of UK banks, ensuring no gaps when verifying client accounts.

- Faster Deployment with Support – Firms can go live 2–3x quicker than the market average, backed by 3–5 weeks of hands-on onboarding support to ensure smooth adoption.

- Flexible Pricing – Usage-based billing keeps costs transparent and scalable for firms of any size.

- Built for Accountants – Categorised transactions, audit-ready records, and integrations with leading accounting platforms make it a natural fit for day-to-day practice work.

- White-Label Capability – Deliver a branded experience while Finexer powers the data behind the scenes.

By choosing Finexer, accounting firms can transform client onboarding from a paper-heavy, compliance-driven burden into a fast, digital process that strengthens client trust from day one.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking KYC solutions.

Try NowHow do Open Banking APIs improve client onboarding?

Open Banking APIs allow firms to access verified bank data directly, with client consent. This removes the need for manual document collection and makes onboarding faster, more accurate, and fully compliant.

How quickly can an accounting firm adopt Open Banking for onboarding?

With the right provider like finexer, deployment can be 2–3x faster than the market average. Many firms are able to integrate within weeks and start using Open Banking onboarding almost immediately.

Talk to our team and see how Finexer transforms an accounting firm’s client onboarding with open banking!