Marketplace payouts are the backbone of every successful platform in the UK, powering seller earnings across retail marketplaces, gig economy apps, and rental platforms. The reliability and speed of these payouts directly influence seller trust and overall platform growth. Delays, errors, or high fees can cause significant reputational and operational damage.

Traditional payout methods such as bank transfers, card networks, and digital wallets often fall short. Transfers can take days, card fees average 4%, and many wallet-based solutions face compliance challenges under FCA rules.

This is where Open Banking has emerged as a modern alternative. By enabling direct account-to-account transfers through regulated APIs, Open Banking delivers faster, cheaper, and more transparent payouts. Adoption is accelerating: over 27.5 million UK users now use Open Banking services, and account-to-account payments are projected to reach $235 billion by 2027.

In the sections ahead, we’ll examine the current payout landscape, the benefits of Open Banking, and how providers like Finexer enable UK marketplaces to deploy compliant, real-time payout systems at scale.

How Marketplace Payouts Work Today

Unlike direct e-commerce stores, where payments go straight from buyer to seller, marketplace payouts follow a more complex flow. The platform sits in the middle, collecting payments from buyers, deducting its commission, and then disbursing the balance to sellers.

Typically, the process includes three main elements:

- Commissions – Marketplaces charge sellers a fixed or variable fee on each transaction, ensuring the platform can cover operational costs and generate revenue.

- Split Payments – Buyers often purchase from multiple sellers in a single order. The platform must split the payment accurately, allocate commissions, and route funds to each seller.

- Seller Payouts – Once payments are settled, funds are transferred to sellers’ bank accounts. These payouts might be scheduled weekly, monthly, or on demand, depending on the marketplace model.

The challenge? Traditional payout methods in the UK, such as BACS transfers or card-based settlements can delay disbursements by several business days. Sellers are left waiting, reconciliation becomes more complicated, and customer support teams spend extra time handling payout issues.

For modern platforms, inefficient marketplace payouts are more than an inconvenience; they can directly erode seller trust and platform growth.

What are marketplace payouts?

Marketplace payouts refer to the process where a platform collects payments from buyers, deducts its commission, and then distributes the remaining funds to sellers or service providers. They are essential for maintaining seller trust and smooth platform operations.

Why are marketplace payouts important for UK platforms?

The speed and reliability of payouts directly impact seller retention. Delayed or error-prone payouts can damage a platform’s reputation, while instant, compliant payouts strengthen loyalty and support growth.

Key Benefits of Open Banking for UK Marketplaces

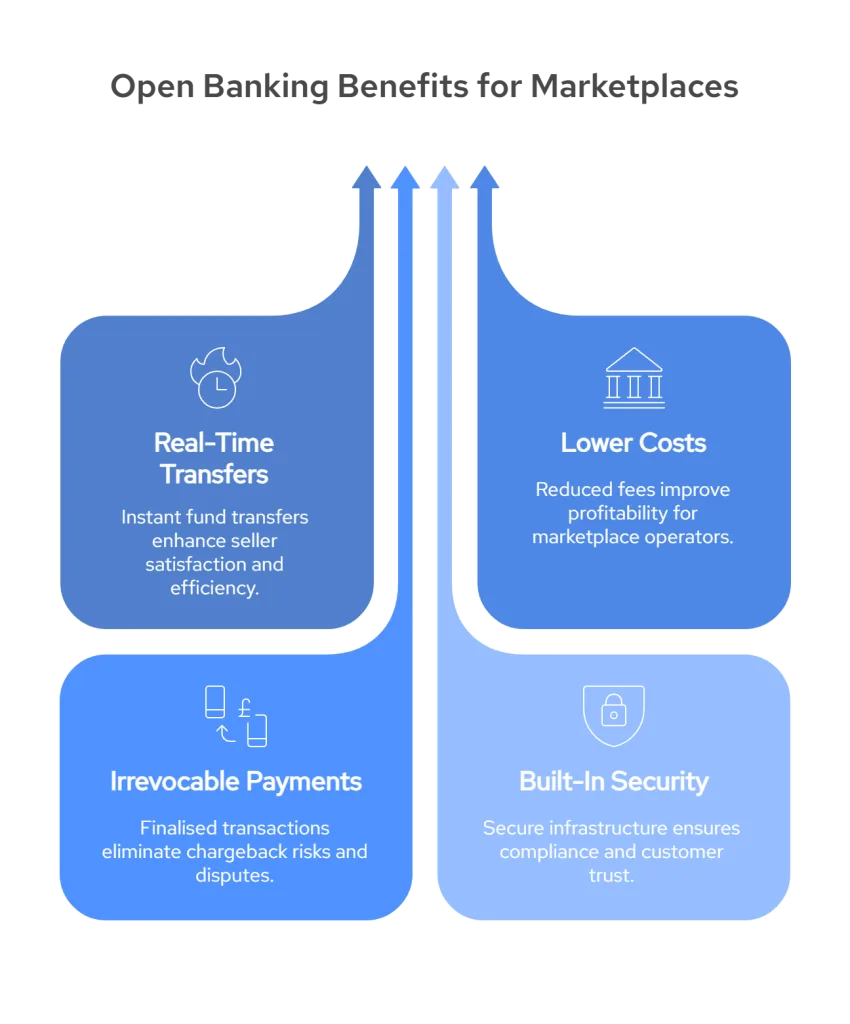

For UK platforms, switching to Open Banking doesn’t just improve payment speed, it reshapes how marketplace payouts are handled across the board:

1. Faster Payouts

Instead of sellers waiting days for BACS transfers, funds arrive in real time. This strengthens seller trust and allows marketplaces to offer daily or on-demand payouts.

2 . Lower Costs

Card networks and intermediaries add fees that eat into margins. Open Banking routes payments directly between accounts, reducing per-transaction costs at scale.

3. Stronger Compliance

With PSD2 and FCA rules in place, marketplaces face strict payout regulations. Open Banking APIs come with built-in secure authentication and audit trails, reducing compliance burdens.

4. Improved Seller Experience

Predictable payouts without chargebacks or failed settlements give sellers clarity and confidence, encouraging them to stay and grow on the platform.

5 . Smarter Data Insights

Direct access to verified transaction data makes reconciliation easier and supports services like cash advances or automated credit checks for sellers.

How to Integrate Open Banking Payouts

Adding Open Banking payouts to a marketplace platform doesn’t have to be complicated. In most cases, marketplaces can integrate through two main approaches:

Integration with an Open Banking Provider

When you partner with a payout provider, you typically choose between:

- Open Banking API Integration – A fully customisable option that allows marketplaces to build tailored payout flows. It gives complete flexibility but requires more development resources and technical expertise.

- Integration Tools (HPPs or SDKs) – Hosted payment pages or software development kits that make it quicker to embed payouts with less engineering work. These are ideal for platforms that want faster deployment, though with slightly less customisation.

The right provider will guide you through the integration process and outline your responsibilities along the way. Experienced partners often assign specialists to oversee setup and offer best practices from previous successful integrations.

When considering integration, it’s important to clarify a few key points with your provider:

- Integration Timeline – How long will it take to go live, and what are the milestones?

- Objectives – Are you aiming to reduce costs, improve payout speed, or simplify compliance?

- UX/UI Guidance – How should payout flows be designed for a seller-friendly experience?

Why Finexer Stands Out

For UK marketplaces, this is where Finexer makes a difference. Built specifically for the UK ecosystem, Finexer connects to 99% of UK banks via an FCA-authorised API. Deployment is 2–3x faster than the market average, meaning marketplaces can start running Open Banking payouts in weeks rather than months.

With Finexer, you also gain:

- White-label dashboards – Branded tools for sellers to view and manage their payouts.

- Usage-based pricing – Flexible costs without heavy upfront commitments.

- Built-in compliance – PSD2 and FCA requirements handled at the infrastructure level.

For platforms managing high transaction volumes, Finexer provides Faster Payment rails that keep sellers paid on time, buyers satisfied, and operations fully compliant.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowFuture of Marketplace Payouts in the UK

The shift to Open Banking is not a passing trend; it’s becoming the foundation for how money moves in the UK digital economy. According to industry forecasts, account-to-account payments are expected to make up a growing share of online transactions in the next few years, with marketplace payouts among the most active use cases.

Several factors are driving this growth:

- Regulatory Support – The FCA continues to push for stronger Open Banking adoption, ensuring marketplaces have access to secure, compliant rails.

- Seller Expectations – As gig workers, freelancers, and SMEs grow accustomed to instant earnings, they will expect faster disbursements as the standard.

- New Financial Services – Marketplaces will be able to layer lending, cash advances, and embedded financial products on top of Open Banking data, extending value beyond payouts.

- Scalability – Platforms that adopt Open Banking now will be better prepared to handle higher transaction volumes without escalating payout costs.

Providers like Finexer are already building for this future. With its FCA-authorised infrastructure and near-total UK bank coverage, Finexer ensures that marketplaces can scale payouts confidently while staying ahead of regulatory and user expectations.

How does Open Banking improve marketplace payouts?

Open Banking enables direct account-to-account transfers via regulated APIs. This allows payouts to be processed in real time, reduces fees by bypassing card networks, eliminates chargebacks, and ensures transactions are FCA and PSD2 compliant.

What types of marketplaces benefit most from Open Banking payouts?

Retail marketplaces, gig economy apps, rental platforms, and B2B service marketplaces all benefit from faster and cheaper payouts. Any platform handling large volumes of seller disbursements can see major improvements.

How does Finexer help UK marketplaces with payouts?

Finexer provides an FCA-authorised Open Banking API that connects to 99% of UK banks. With faster deployment (2–3x quicker than competitors), white-label dashboards, usage-based pricing, and built-in compliance, Finexer helps marketplaces scale payouts confidently.

Modernise your marketplace payouts today! Speak with Finexer to explore affordable, compliant Open Banking APIs designed for Marketplaces