Across the UK, small and mid-sized businesses are moving toward integrated digital banking, a setup where payments, cashflow, and bank data come together in one connected view.

Instead of logging into multiple bank portals or reconciling spreadsheets, finance teams can now manage everything in one place. It’s faster, clearer, and built for how modern businesses actually work.

This new form of digital banking for SMEs isn’t just about going online; it’s about creating a single system that talks to your accounting tools, payment apps, and bank accounts seamlessly.

With open banking for SMEs, the process becomes even smarter. Businesses can collect, verify, and move money securely — all while keeping full control of their financial data.

In this guide, you’ll learn what integrated digital banking means, why it’s gaining ground among UK SMEs, and how Finexer makes it easy to connect directly to your banks for real-time data and instant payments.

What Is Integrated Digital Banking?

Integrated digital banking goes beyond online access to your business account.

It’s about creating one connected system where banking, payments, and financial data work together seamlessly.

Here’s what it actually means for UK businesses:

- All-in-One Access

Manage your accounts, payments, and cashflow from a single platform — no switching tabs or juggling multiple logins. - Automatic Updates

When your accounting software and bank feeds are connected, every transaction syncs in real time.

No more manual uploads or mismatched records. - Simplified Daily Operations

Pay suppliers, track balances, and reconcile transactions from one dashboard — saving hours every week. - Built on Open Banking

With digital banking for SMEs, your existing accounts connect securely through open banking technology. You stay in control of what’s shared and for how long. - Better Decisions, Less Error

One clear view of your money means faster insights and fewer mistakes.

In short, integrated digital banking brings every part of your financial workflow together, making business management simpler, faster, and more transparent.

Why UK SMEs Need It Now

Managing business finances has never been more demanding.

Rising costs, multiple bank accounts, and manual processes often leave teams chasing numbers instead of acting on them.

Here’s why more UK SMEs are turning to integrated digital banking:

- Too Many Systems, Not Enough Time

Most SMEs juggle separate tools for payments, accounting, and cashflow.

Integration brings them together — reducing admin and saving valuable hours. - Real-Time Visibility

With live account data, business owners can see exactly what’s paid, pending, or overdue.

That clarity helps prevent shortfalls and improves planning. - Simpler, Faster Payments

Direct bank-to-bank transfers powered by open banking mean funds move instantly, without delays or card fees. - Fewer Errors and Manual Checks

Automated syncing between banks and ledgers keeps data consistent, cutting out human mistakes. - Better Financial Control

Digital banking for SMEs gives one dashboard to track everything — balances, inflows, and expenses — in real time.

In short, integration gives small businesses the control they’ve been missing i.e faster processes, cleaner data, and fewer moving parts to manage.

Key Benefits of Integrated Digital Banking for SMEs

1. Real-Time Cashflow Visibility

With integrated digital banking, every transaction updates instantly.

You always know your true balance, upcoming payments, and available funds — no more waiting for end-of-day reconciliations.

2. Faster Payments and Collections

Using open banking for SMEs, businesses can send and receive money directly from bank to bank.

Payments arrive within seconds, helping you keep suppliers happy and maintain steady cashflow.

3. Less Manual Work

Forget retyping transactions or matching payments line by line.

Digital banking for SMEs connects your systems so balances, invoices, and statements stay in sync automatically.

4. Improved Accuracy

Human error disappears when data moves directly between trusted systems.

Integrated connections ensure what you see on screen is exactly what’s in your account.

5. Stronger Compliance and Security

All data sharing runs on bank-level encryption.

With open banking, you decide what information to share and can withdraw consent anytime.

How You Can Do It with Finexer

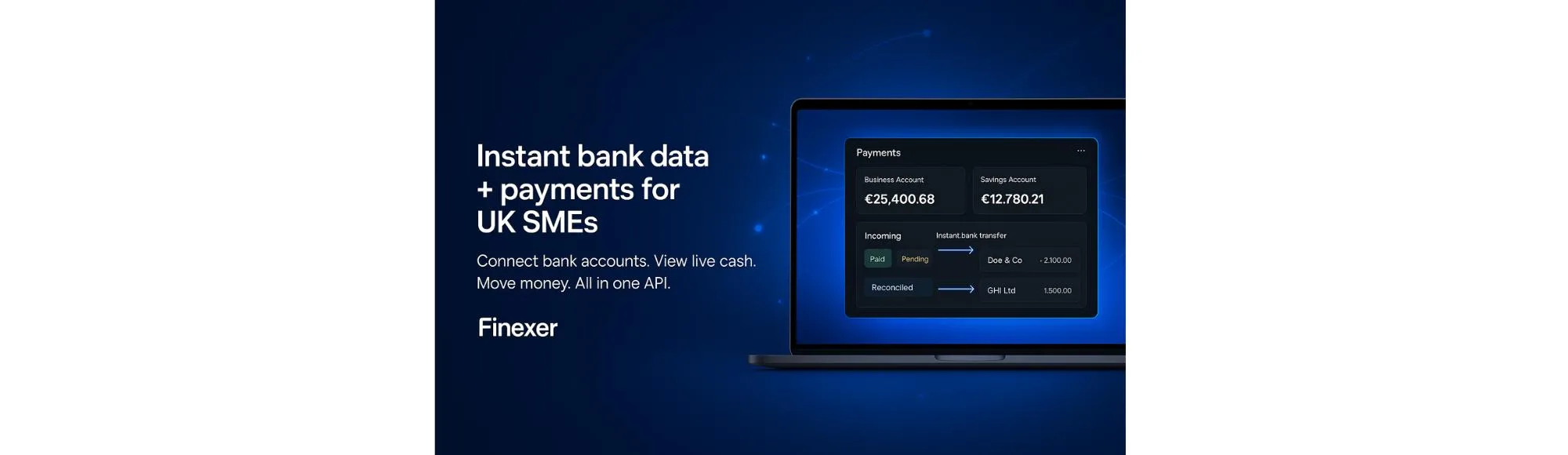

Finexer helps UK businesses connect banking and financial data in one place without complexity or setup delays.

Here’s how you can make it work for your business:

1. Connect to Your Bank Accounts

Finexer links directly with 99% of UK banks.

Once connected, you can view balances, transactions, and payment activity instantly.

2. Access Real-Time Financial Data

Every account update appears the moment it happens.

No manual downloads, no waiting for statements — just live data you can trust.

3. Automate Payments and Reconciliation

Send payments, collect funds, and match them automatically against invoices. Finexer’s API handles both data and payments together in one flow.

4. Keep Everything Secure and Compliant

All connections run on regulated, consent-based access.

You stay compliant while customers remain in control of what they share.

5. Scale Without Hidden Limits

Fetch up to seven years of transaction history.

No caps on data calls, and pricing stays flexible as you grow.

Finexer gives UK SMEs one simple platform to manage data, payments, and banking activity, saving time while improving visibility across the business.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowA Smarter Way Forward for UK SMEs

Modern UK businesses are rethinking how they handle money.

Instead of dealing with delays or missing information, they now use connected tools that show every payment and balance in real time.

For most SMEs, this change means more than saving time.

It helps them make better financial decisions, stay organised, and manage cash with more confidence every day.

Finexer makes that possible.

By bringing live bank data and payments together in one place, it helps businesses stay clear, quick, and in control of their finances.

Is integrated digital banking secure?

Yes. It uses regulated Open Banking connections, encryption, and customer consent for every data access — ensuring full control and safety.

What does integrated digital banking mean for SMEs?

It means linking your business bank accounts, payments, and financial tools into one connected system that updates in real time.

How can integrated banking help small businesses?

It saves time on manual work, speeds up payments, improves cashflow visibility, and keeps financial records accurate automatically.

How long does it take to get started?

Integration with Finexer is quick and guided. Most UK businesses can start viewing live data and sending payments in just a few steps.

See your business finances in real time with Finexer. Connect your bank accounts, view live data, and make instant payments