UK businesses are facing a real problem with payment costs. Transaction fees eat into margins, reconciliation takes days, and failed payments disrupt cash flow. A2A payments through open banking address these issues directly – no card networks, no middlemen, just bank-to-bank transfers that complete in seconds.

The right provider makes the difference between operational headaches and genuine efficiency. When evaluating open banking providers for account-to-account payments, businesses need a framework that focuses on what actually matters for UK operations. Explore how A2A payments work for payroll and invoicing.

What Should Bank Coverage Actually Mean for Your Business?

Coverage numbers get thrown around, but the real question is simpler: can your customers actually pay?

Providers should cover the banks your customers use. In the UK market, this means connecting to all major high street banks, digital challengers, and business banking platforms. A provider claiming 99% UK bank coverage removes the risk of losing sales because a customer’s bank isn’t supported.

Partial coverage creates operational problems. Your checkout process needs fallback options, customer support handles confusion, and you lose transactions. Full coverage removes these issues.

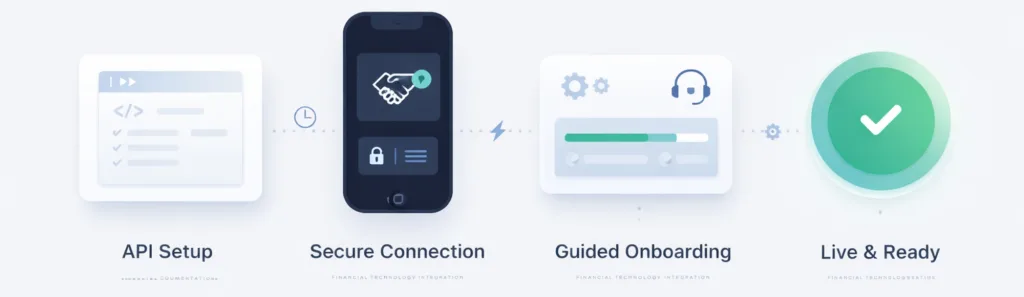

How Quickly Can the System Go Live?

Implementation timelines affect when you start saving money. Some providers take months to deploy. Others complete integration in weeks.

The difference comes down to technical setup and support structure. API documentation quality matters. Pre-built integration guides help. Having dedicated technical support during onboarding prevents delays.

Businesses using Finexer typically deploy 2-3 times faster than market alternatives, with onboarding support lasting 3-5 weeks. This matters when payment costs are affecting your bottom line today, not in six months.

What Do Payment Failures Actually Cost You?

Failed payments don’t just mean lost revenue. They trigger customer service inquiries, create reconciliation work, and damage conversion rates.

Open banking payment success rates in the UK typically exceed 95% when the provider has proper bank connectivity and real-time status updates. This happens because the payment instruction goes directly to the customer’s bank. No card network decline codes. No mysterious authorization failures.

The operational impact shows up in reduced support tickets and cleaner financial reporting. Your finance team spends less time chasing failed transactions.

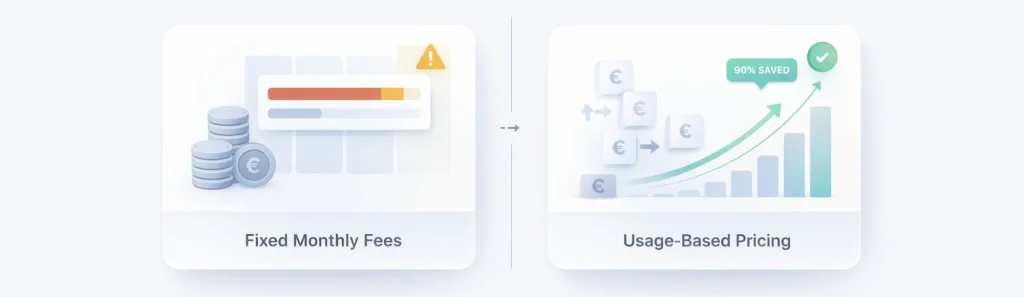

Does Pricing Match Your Transaction Patterns?

Fixed monthly fees work against businesses with variable payment volumes. You pay for capacity you don’t use, or you exceed limits and pay overage charges.

Usage-based pricing models charge for actual transactions. This approach benefits businesses in growth phases, seasonal operations, or those testing new markets. You’re not locked into tier structures that don’t match reality.

Transaction cost reduction of up to 90% compared to card payments becomes possible when percentage-based fees disappear. The savings scale with volume.

Can the Solution Adapt to Your Brand Requirements?

White-label capabilities matter for businesses that need payment experiences matching their brand. Generic checkout flows create friction. Customers notice when they’re redirected to third-party interfaces.

Providers offering white-label solutions let businesses maintain consistent branding through the payment journey. The customer stays in your environment, using your styling, with your trust signals present.

This affects conversion rates, particularly for high-value transactions where brand trust matters most.

How Does This Apply to Your Specific Use Case?

Different business models need different payment approaches. Whether you’re processing payroll, managing supplier payments, or handling customer invoices, account to account payments deliver speed and cost reduction that traditional methods can’t match.

B2B payments see improved cash flow from faster settlement. Subscription businesses reduce failed payment rates. Marketplaces simplify multi-party settlements. The common factor is removing card network dependencies.

UK businesses already using A2A payments report operational improvements beyond cost savings. Reconciliation happens automatically. Chargebacks don’t exist. Payment data comes through cleanly for accounting systems.

What About Security and Compliance?

Open banking in the UK operates under FCA regulation. Providers need proper authorization as Account Information Service Providers (AISPs) or Payment Initiation Service Providers (PISPs).

Security happens at the bank level. Customers authenticate directly with their bank using existing security measures. The payment provider never touches login credentials. This removes PCI compliance requirements from your infrastructure.

Strong Customer Authentication (SCA) is built into the process, not added as a friction point. The regulatory framework ensures customer data protection while enabling instant payments.

A2A Open Banking Payments – Buyer Checklist (UK)

| Criteria | What to Evaluate | Why It Matters |

|---|---|---|

| UK Bank Coverage | Does the provider support all major UK high street banks, digital challengers, and business banking platforms? | Incomplete coverage leads to lost transactions, customer confusion, and operational issues |

| Speed to Go Live | How long does onboarding and implementation take? | Faster deployment means earlier cost savings and reduced payment friction |

| Integration & Support | Are API documentation, integration guides, and technical onboarding support provided? | Poor setup increases delays and operational complexity |

| Payment Success Rates | Are success rates consistently above 95% with real-time payment status updates? | Failed payments create revenue loss, support tickets, and reconciliation work |

| Pricing Structure | Is pricing usage-based rather than fixed monthly fees or rigid tiers? | Variable pricing aligns better with changing transaction volumes |

| Transaction Cost Reduction | How much cheaper are A2A payments compared to card payments? | Removing card network fees significantly improves margins at scale |

| Brand Experience | Are white-label payment flows available? | Consistent branding improves trust and conversion rates |

| Use Case Coverage | Does the solution support payroll, invoicing, subscriptions, and B2B payments? | Different business models require flexible payment flows |

| Reconciliation | Is reconciliation automatic with clean payment data? | Reduces manual finance work and reporting delays |

| Security & Regulation | Is the provider FCA-regulated and compliant with UK open banking standards? | Ensures customer authentication, data protection, and regulatory compliance |

Ready to Reduce Payment Costs?

Selecting an open banking provider for A2A payments requires evaluating actual operational needs against provider capabilities. UK businesses need UK-focused solutions with complete bank coverage, fast deployment, transparent pricing, and reliable technical support.

Finexer delivers these requirements without the unnecessary complexity. The platform works with 99% of UK banks, deploys 2-3 times faster than alternatives, and charges based on usage rather than fixed tiers. Get started with Finexer and start reducing transaction costs immediately.

What makes A2A payments different from card payments?

A2A payments transfer money directly between bank accounts using open banking, removing card networks and their associated fees from the process.

How long does an A2A payment settlement take?

Settlement typically completes within seconds through real-time payment rails, compared to days with card payments.

Do customers need special accounts for A2A payments?

No, customers use their existing UK bank accounts and authenticate through their regular banking app or online banking.

Can A2A payments handle refunds?

Yes, refunds are processed as standard bank transfers back to the customer’s account, with full tracking and confirmation.

What happens if a customer’s bank is down?

Payment status updates in real-time, allowing the customer to try again or use an alternative account without failed transaction fees.