Your bookkeeping system works perfectly. It tracks every transaction. Your team knows it inside out.

But HMRC wants digital VAT returns. Your software doesn’t submit them natively. That’s where bridging software comes in.

It pulls VAT data from your existing system. Then formats everything for HMRC’s digital standards. The submission happens automatically.

Pick the wrong solution and problems appear quickly. Submissions fail at deadline. Finance teams scramble to fix errors. Penalties arrive in the post.

The right MTD bridging software prevents all of this. Your operations continue without disruption.

What Does MTD Bridging Software Actually Do?

It connects your existing accounting system to HMRC. Your software already has all the VAT data. Bridging software pulls that data and sends it to HMRC in the right digital format.

Bridging software extracts your VAT figures. It converts them into the required digital format. Then submit everything directly to HMRC.

You don’t abandon your current bookkeeping tools. They still handle day-to-day records. The bridging layer adds compliance on top.

Authentication with HMRC gets managed automatically. Data validation happens before submission. Tracking keeps you informed throughout.

Your finance team keeps familiar tools. Regulatory requirements are met without disruption.

Can Your Current System Connect Without Issues?

Not all bridging software works with every accounting platform. Some integrate only with specific systems. Others claim broad compatibility but need complex setup.

Excel users face particular challenges. Many businesses run VAT calculations in spreadsheets. Finding MTD bridging software Excel support becomes essential.

Spreadsheet-based records need to flow into HMRC submissions. Platform migration isn’t practical for established operations.

Check the integration method before committing. Does it need API access? File exports? Manual data entry? Each approach affects the time your team spends on returns.

The process should be transparent upfront. No surprises during implementation.

How Does Data Accuracy Get Verified?

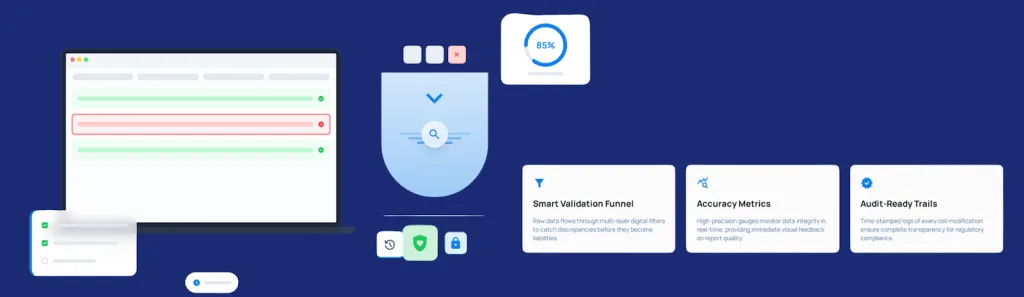

Incorrect VAT returns create serious headaches. HMRC rejects them. Your team fixes mistakes under pressure. Penalties might follow.

Good bridging software catches errors before they reach HMRC. Calculation accuracy gets checked automatically. Missing information gets flagged. Inconsistencies stand out clearly.

Timing matters here. Real-time validation spots problems immediately. Pre-submission reviews give you a final check before filing.

Failed submissions waste hours. Built-in error checking reduces these failures dramatically. Your team sees exactly what needs attention.

Problems get fixed before HMRC sees anything. Much better than discovering issues after rejection.

What Happens When Something Goes Wrong?

Technical problems choose the worst possible moments. Month-end closing. Filing deadline day. That’s when systems decide to misbehave.

Support availability becomes critical in these situations. Email-only support means waiting hours for responses. You need answers during filing windows, not after deadlines pass.

Look for providers offering phone or chat support during UK business hours. Submission problems get resolved in minutes rather than days.

Documentation quality matters too. Clear guides help teams handle minor issues independently. Troubleshooting resources reduce support ticket dependency.

You shouldn’t need external help for routine tasks. Good software makes basic operations self-service.

Does the Pricing Structure Match Your Filing Frequency?

MTD VAT bridging software pricing varies widely. Per-submission charges suit quarterly filers. Monthly subscriptions work better for businesses managing multiple entities or frequent adjustments.

Managing multiple entities? Volume affects pricing significantly. Some providers charge per company registration. Others offer unlimited entities at fixed rates.

Hidden costs appear in unclear pricing models. Setup fees. User limits. Volume thresholds. These extras inflate the total cost.

Request complete pricing details before signing anything. Know exactly what you’ll pay. Avoid unexpected invoices later.

Can the Software Scale with Business Changes?

Businesses evolve constantly. Structures change. New entities form. VAT schemes switch between standard and flat rate.

Your bridging software needs to handle these changes. Platform replacement for every business shift isn’t practical.

Multi-entity support becomes crucial as you grow. Different VAT registration numbers. Varying filing frequencies. Multiple accounting periods. One interface should manage everything.

Scheme flexibility prevents future replacement needs. Standard VAT today might become flat rate tomorrow. Software should adapt without fuss.

How Does This Fit with Broader Payment Operations?

MTD compliance represents just one piece of financial operations. Supplier payments happen daily. Customer invoices need processing. Cash flow requires constant management.

MTD-compliant software handles regulatory requirements. Pair it with efficient payment methods and operations improve significantly.

Transactions feed into accounting automatically. Accounting data moves into HMRC submissions without manual work. The entire financial operation becomes integrated.

What About Security and Data Protection?

HMRC authentication demands secure connections. OAuth 2.0 provides the standard framework. Your bridging software should use this rather than storing credentials.

Financial data moving between systems needs encryption. Current security protocols aren’t optional. They’re essential.

GDPR compliance applies to every UK business tool. Providers must explain data handling clearly. Storage methods. Processing procedures. Protection measures.

Data retention policies matter. Where are servers located? How long is information kept? These details affect your compliance position.

Account-to-account payments cut transaction costs. Settlement speeds up. Cash flow improves. Connect these with MTD bridging and data flows seamlessly.

What Should Your Checklist Include?

| Checklist Item | What to Check |

|---|---|

| System Compatibility | Does the software work with your current bookkeeping platform? Excel users need specific MTD bridging software with Excel support. |

| Data Validation | Are errors caught before submission? Real-time checking prevents failed returns. |

| Support Availability | Can you reach technical support during UK business hours? Phone or chat support resolves issues faster than email. |

| Pricing Transparency | Are all costs clear upfront? Check for setup fees, user limits, and volume charges. |

| Multi-Entity Handling | Can the software manage multiple VAT registrations? Important for growing businesses. |

| Security Standards | Does the provider use OAuth 2.0 and encrypt data transmission? HMRC requires secure connections. |

Ready to Meet MTD Requirements?

MTD bridging software selection comes down to practical needs. Compatibility with existing systems. Support quality when problems arise. Pricing that matches filing patterns.

UK businesses need solutions that work reliably. Error checking before submission. Support available when deadlines approach.

Finexer provides payment infrastructure that integrates with financial operations. Bridging software handles MTD compliance. Our A2A payment solution cuts transaction costs while improving cash flow.

Together, they support smoother operations from payments through to compliant tax submission workflows.

Understanding both compliance and operational efficiency drives better decisions.

What is MTD bridging software?

Software connecting non-compliant bookkeeping systems to HMRC’s Making Tax Digital platform for digital VAT submissions.

Do I need bridging software if my accounting system isn’t MTD-compliant?

Yes, HMRC mandates digital submission and bridging software adds compliance without replacing your existing system.

Can MTD bridging software work with Excel?

Yes, certain solutions extract data from Excel spreadsheets and format it for HMRC submission requirements.

How much does MTD VAT bridging software cost?

Pricing varies by provider through per-submission fees, monthly subscriptions, or annual plans based on filing frequency.

What happens if my VAT submission fails?

Software should identify errors beforehand and provide clear correction guidance to prevent HMRC rejection.

Get MTD-Compliant

Connect your accounting system to HMRC with reliable bridging software and efficient payment infrastructure.

Get Started