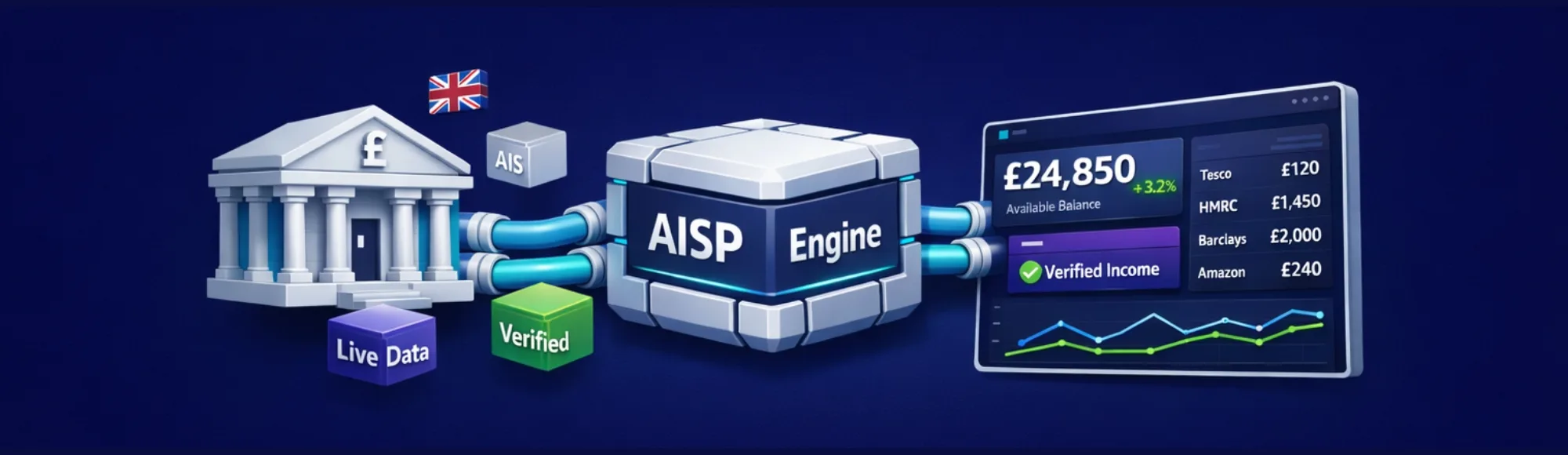

Platforms building financial features don’t need another explanation of what AISP Open Banking is. They need reliable infrastructure to access bank data without spending months on integrations.

Your platform needs AIS banking capabilities for verification, reconciliation, or aggregation. Building direct bank connections takes 6-12 months. Using account information service providers cuts that to 3-5 weeks.

This article explains what matters when implementing AISP Open Banking, real problems platforms face, and what to evaluate when choosing infrastructure.

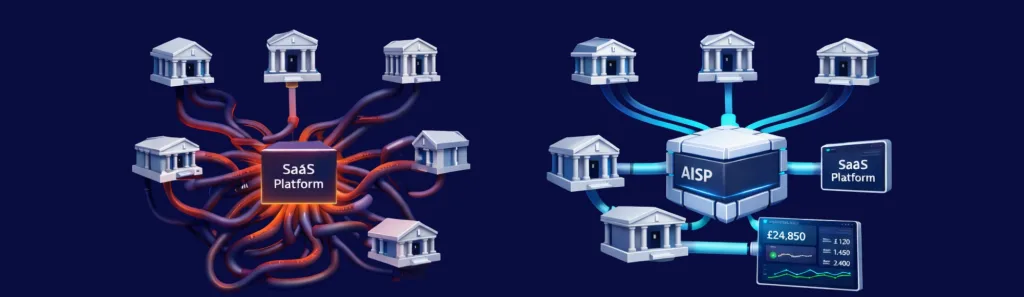

Why Platforms Choose AISP Open Banking Over Direct Integrations

Direct bank integrations don’t scale. Each UK bank has different APIs. Maintaining 50+ bank connections requires dedicated engineering teams.

Account information service providers handle bank connectivity, regulatory compliance, and API differences. The regulatory burden matters. AISP infrastructure handles FCA authorisation and Open Banking AIS compliance requirements.

Most platforms recognise this after attempting their second direct bank integration.

What AISP Open Banking Must Deliver for Production Use

Critical capabilities for production deployment:

- Bank coverage: 99% UK bank support prevents “your bank isn’t supported” errors during onboarding

- Consent management: AISP vs PISP infrastructure handles authorisation, renewal, and revocation seamlessly

- Transaction normalisation: Raw AIS banking data arrives inconsistent. Production-grade providers deliver standardised formats

- Historical access: Verification needs 3-6 months minimum. Some banks provide up to 7 years via Open Banking AIS

- Real-time updates: Real-time bank data via webhooks eliminates polling delays

Without normalisation, categorisation logic breaks. Without webhooks, financial snapshots lag behind reality.

Common Problems Platforms Face with AIS Banking

Integration timelines exceed estimates: Teams budget 6 weeks. Without proper support, it takes 4-6 months.

Consent flows damage conversion: Generic redirects feel untrustworthy. White-label consent maintains product continuity.

Broken refreshes go unnoticed: Screen-scraping breaks silently. Support discovers issues from complaints, not monitoring.

Limited historical data: Some providers only access 90 days. Credit checks need deeper history.

What to Look For in Account Information Service Providers

When evaluating AISP Open Banking infrastructure:

| Criteria | Why It Matters | What to Expect |

|---|---|---|

| UK Bank Coverage | Users shouldn’t see “not supported” errors | 99% including challengers |

| Historical Depth | Verification needs 3–6 months minimum | Up to 7 years (bank-dependent) |

| Consent Flow | Generic redirects damage conversion | White-label, branded experience |

| Real-Time Updates | Polling creates data delays | Webhook notifications |

| Sandbox Access | Test before production | Full-featured test environment |

| Onboarding Support | Self-service takes 6+ months | 3–5 weeks hands-on assistance |

Operational reliability matters more than feature lists. APIs that work in demos often break in production.

How Platforms Use Open Banking AIS for Business Outcomes

Account information service providers enable: income verification using transaction data, affordability assessment based on spending patterns, account aggregation from multiple banks, transaction reconciliation via Open Banking data, and real-time risk monitoring.

AIS banking capabilities deliver data. Your platform delivers the experience.

Where Does Finexer Fit?

Finexer provides AISP Open Banking connectivity infrastructure using FCA-authorised infrastructure for UK platforms.

We connect to 99% of UK banks. Integration takes 3-5 weeks with hands-on technical support. Pricing is usage-based without large upfront commitments. Sandbox APIs available for testing.

Platforms use Finexer’s AISP infrastructure to build income verification, reconciliation, affordability checks, and aggregation features without managing individual bank integrations.

What I Feel About AISP Open Banking

AISP Open Banking has shifted from regulatory requirement to competitive advantage. Platforms without bank data access lose to competitors offering embedded verification.

Most provider evaluations focus on wrong metrics. Coverage charts don’t show reliability. Pricing sheets don’t reveal integration costs. Marketing doesn’t explain what happens when consent expires.

The difference emerges during integration. Choose infrastructure you’ll rely on for years, not vendors optimising for demo calls.

What is AISP Open Banking?

AISP Open Banking is FCA-regulated infrastructure that allows Account Information Service Providers to access bank account data with user consent via standardised APIs.

What do account information service providers do?

Account information service providers handle bank connections, regulatory compliance, consent management, and data normalisation so platforms can access structured bank data via APIs.

What is Open Banking AIS?

Open Banking AIS (Account Information Services) enables authorised providers to retrieve bank account data, transaction history, and balances with user permission.

What is AIS banking?

AIS banking refers to Account Information Services that provide read-only access to bank account data through regulated Open Banking infrastructure.

How long does AISP Open Banking integration take?

Most platforms complete AISP Open Banking integration in 3-5 weeks with technical support, including sandbox testing and production deployment.

Ready to Build with AISP Open Banking Infrastructure?

See how Finexer’s FCA-authorised infrastructure provides reliable AIS banking access for UK platforms.

Book Demo Now