You’ve done the work. Invoices are approved, and suppliers are waiting. Your accounting system can generate the payment list, but now comes the part no one talks about: getting those payments actually out the door.

This is where most finance teams hit a wall.

You’re stuck either re-entering dozens of payments into your bank portal or trying to upload a CSV file that throws errors, breaks formats, or needs another round of approvals.

Instead of streamlining operations, your batch payment processing becomes a bottleneck.

The Real Cost of Manual Payouts

- Time wasted formatting or reformatting payment files

- High risk of paying the wrong supplier or entering the wrong amount

- Approvals get scattered across email threads or are delayed entirely

- Supplier trust suffers due to missed or late payments

- End-of-month reconciliation becomes a manual nightmare

And when you’re dealing with 10, 50, or even 500 payments each cycle, these problems scale fast.

Manual batch payments aren’t just inefficient. They’re risky, error-prone, and unsustainable.

What Is Batch Payment Processing?

Batch payment processing is the practice of sending multiple supplier or contractor payments in one consolidated workflow. Instead of approving each transfer separately, you bundle them and process all payments together. This approach reduces time spent, improves control, and helps avoid errors.

Traditionally, this meant exporting a payment file, usually in CSV, XML, or ISO 20022 format, from your accounting system and uploading it to your bank’s portal. But most banks aren’t designed to work smoothly with external file exports.

The result? Manual work, errors, and delays. You may spend hours checking formats, re-uploading failed files, and chasing internal approvals. Even when payments go through, you often have no real-time insight into what succeeded or failed.

How Open Banking APIs Help

Modern finance teams are moving away from manual file uploads and toward real-time, API-based payment automation using Open Banking infrastructure.

With Finexer, you don’t need to export files at all. Instead, your accounting system can send batch payment data directly through Finexer’s Open Banking API. This lets you:

- Push payment instructions securely in real time

- Authorise the entire batch with one approval

- Process payments across 99% of UK banks

- Get instant confirmation and status updates

This shift eliminates the friction between accounting systems and banking portals, replacing it with secure, compliant, and fully automated batch payment processing.

📚 Bank Payment Delays & How to Fix it

How Finexer Enables Direct Batch Payment Integration

Finexer provides a seamless link between your accounting system and UK bank networks by offering API-first, Open Banking-powered batch payment processing.

Instead of downloading CSVs or re-entering payment data, your accounting or ERP platform connects directly to Finexer through a secure API. This eliminates manual exports and enables real-time payment automation from the systems your finance team already uses.

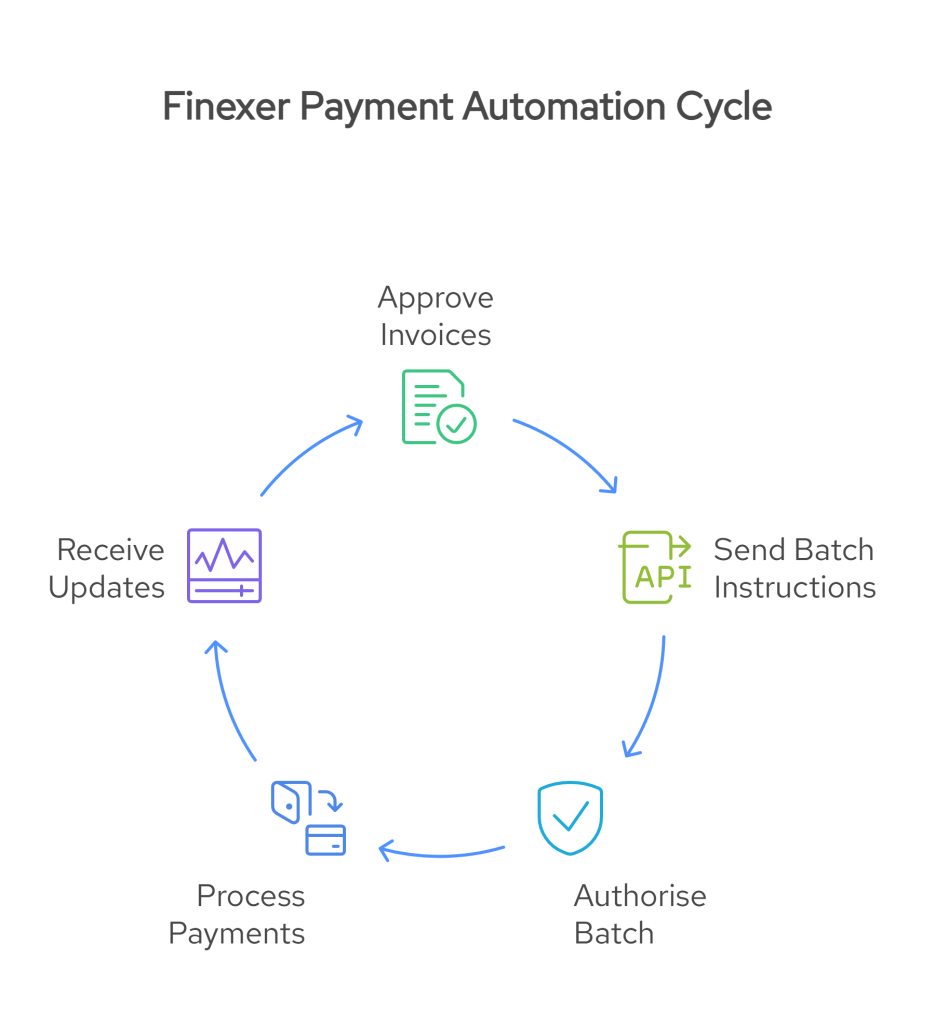

Here’s how it works:

- You approve supplier invoices in your accounting software

- Payment instructions are pushed directly to Finexer via the API

- One consolidated authorisation covers the entire batch

- Payments are routed to multiple recipients using the UK Faster Payments network

- Finexer returns real-time status updates for each transaction

This level of accounting software integration removes bottlenecks from your supplier payout workflow and ensures each payment is delivered securely and on time.

Built for Supplier Payment Efficiency

Whether you’re handling recurring payroll, weekly supplier invoices, or contractor disbursements, Finexer gives your team:

- End-to-end visibility and control

- The ability to process payments across 99% of UK banks

- A secure, FCA-authorised infrastructure

- Reduced manual steps across every payment run

In short, Finexer helps you implement modern, API-driven batch payment processing that scales with your business and improves efficiency across your finance operations.

Business Benefits of Batch Payment Automation with Finexer

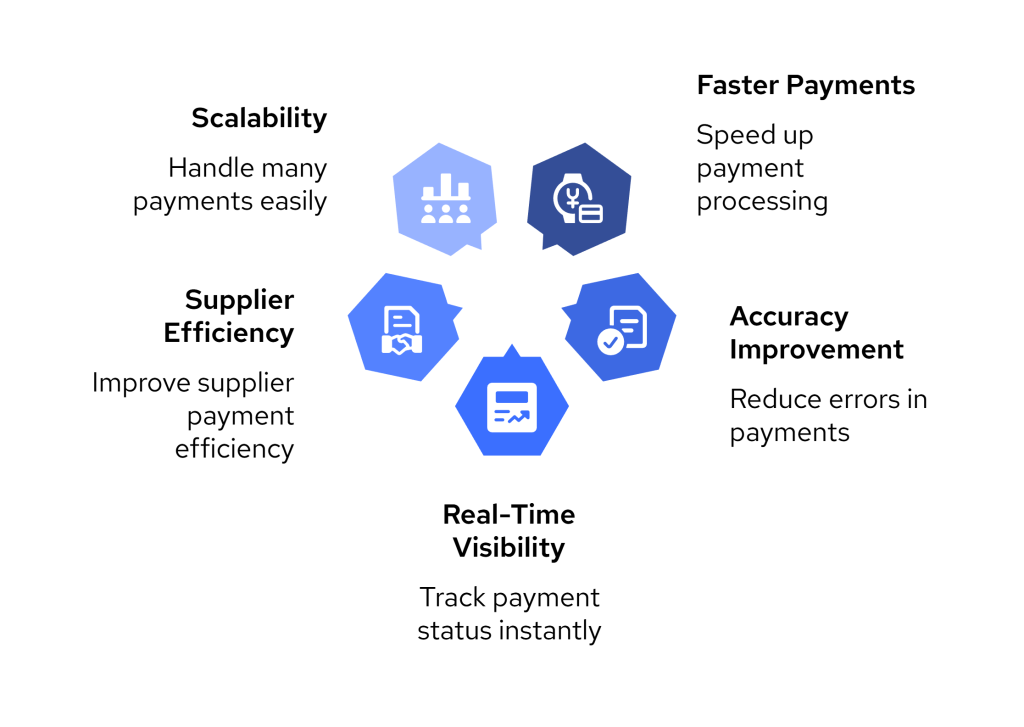

Implementing API-driven batch payment processing isn’t just about removing friction. It transforms the way your finance team operates, improving accuracy, accelerating timelines, and reducing reliance on outdated processes.

Here’s what you gain by automating batch payments through accounting software integration with Finexer:

Faster Payment Runs

Instead of juggling spreadsheets or portal uploads, your accounting system pushes approved payment data directly. With Finexer, you authorise one batch, and payments are processed in minutes. This speeds up weekly, biweekly, or monthly runs without adding overhead.

Fewer Errors and Greater Accuracy

By eliminating manual file handling and data entry, you reduce the risk of overpayments, missed suppliers, or incorrect account numbers. Every payment flows from your software to Finexer through structured, pre-approved API instructions.

Real-Time Visibility and Control

With real-time status updates and payment logs, you always know which supplier payments have cleared, which are pending, and what needs action. This improves cash flow visibility and helps your team stay ahead of reconciliation tasks.

Improved Supplier Payment Efficiency

Reliable, on-time payments build supplier trust. Finexer ensures payouts are not just faster, but more transparent, helping you reduce back-and-forth emails, avoid missed cutoffs, and maintain better relationships with vendors and contractors.

Scalable Without Complexity

Whether you’re handling 10 payments or 500, the setup stays the same. Finexer’s infrastructure and Open Banking API allow you to scale payment volumes without adding more tools, file checks, or manual work.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Ready to Automate Your Batch Payment Processing?

If your team is still relying on exported files, spreadsheet uploads, or manual approvals, it’s time to modernise your approach.

Finexer helps finance teams move away from file-based workflows and implement secure, real-time batch payment processing using Open Banking APIs. Whether you’re managing supplier payouts, payroll, or recurring disbursements, you can connect your accounting system directly and automate the entire process.

With Finexer, you get:

- Seamless accounting software integration via API

- Instant authorisation and payment automation

- Support for multi-recipient payments across 99% of UK banks

- Real-time confirmation and audit-friendly logs

- A scalable, FCA-regulated payment infrastructure

What is batch payment processing?

Batch payment processing is the ability to send multiple payments to different recipients in one consolidated workflow. Instead of approving each payment manually, you group them together, process them in a single run, and receive real-time status updates.

Can I use Finexer with my existing accounting software?

Yes. Finexer supports accounting software integration through secure APIs. Your system can push structured payment data directly to Finexer, whether you’re using a cloud-based platform or an on-premise ERP.

Do I still need to export CSV files to make payments?

No. With Finexer, CSV exports are no longer required. Your accounting system sends payment instructions directly through Finexer’s Open Banking API, removing the need for file uploads entirely.

Is Finexer compliant with UK Open Banking standards?

Yes. Finexer is FCA-authorised and fully compliant with Open Banking standards. All payments are processed using Strong Customer Authentication (SCA), and all transaction data is encrypted and securely logged for audit and reporting purposes.

Book a demo with Finexer and make your batch payments smarter, faster, and fully automated!