If you’re still managing supplier payouts by exporting CSV files, logging into your bank portal, or uploading batches to BACS, you’re not alone — but the cracks are starting to show.

Manual payment processes are time-consuming, error-prone, and often delay vendor relationships. Finance teams have to juggle approval chains, email threads, and last-minute changes — all while chasing accurate reconciliation at month-end.

But there’s a better way.

Thanks to Open Banking APIs, UK businesses can now automate supplier payouts directly from their accounting or ERP systems. No more downloads, uploads, or guesswork. Just secure, real-time payments triggered through a single integration.

Whether you’re sending weekly disbursements to 200+ vendors or managing ad-hoc contractor payments, Open Banking APIs give you more control, faster settlement, and cleaner audit trails — all without relying on outdated rails like BACS.

In this guide, we’ll walk through:

What Is Open Banking & How It Applies to Supplier Payouts

Open Banking is a secure, regulated way for businesses to access financial services through APIs. While it’s often associated with account data access, one of its most practical applications for businesses is payment initiation — the ability to trigger bank payments directly from your system.

In the context of supplier payouts, this means using a Payment Initiation API (PIS) to move money from your business account to your suppliers’ accounts without relying on traditional payment rails like BACS or manually logging into your online banking platform.

How It Works:

- Your system sends a payout request to an Open Banking provider.

- The provider initiates the payment through your connected bank.

- The funds are transferred directly between accounts, without cards, delays, or third-party processors.

Why This Matters for Supplier Payments

Traditional supplier payment methods come with limitations:

- BACS takes up to three working days to settle.

- Bank portals often require manual entry and dual approval steps.

- Reconciliation is delayed or inaccurate due to timing mismatches.

With Open Banking APIs, supplier payouts are:

- Faster: Real-time settlement across most UK banks.

- Automated: Fully integrated into your finance workflows.

- Traceable: Complete visibility with payment status updates and audit trails.

- Cost-efficient: No hidden charges or card processing fees.

Instead of relying on fragmented payment processes, Open Banking allows you to centralise and automate payouts using your existing tools, with far more control and speed.

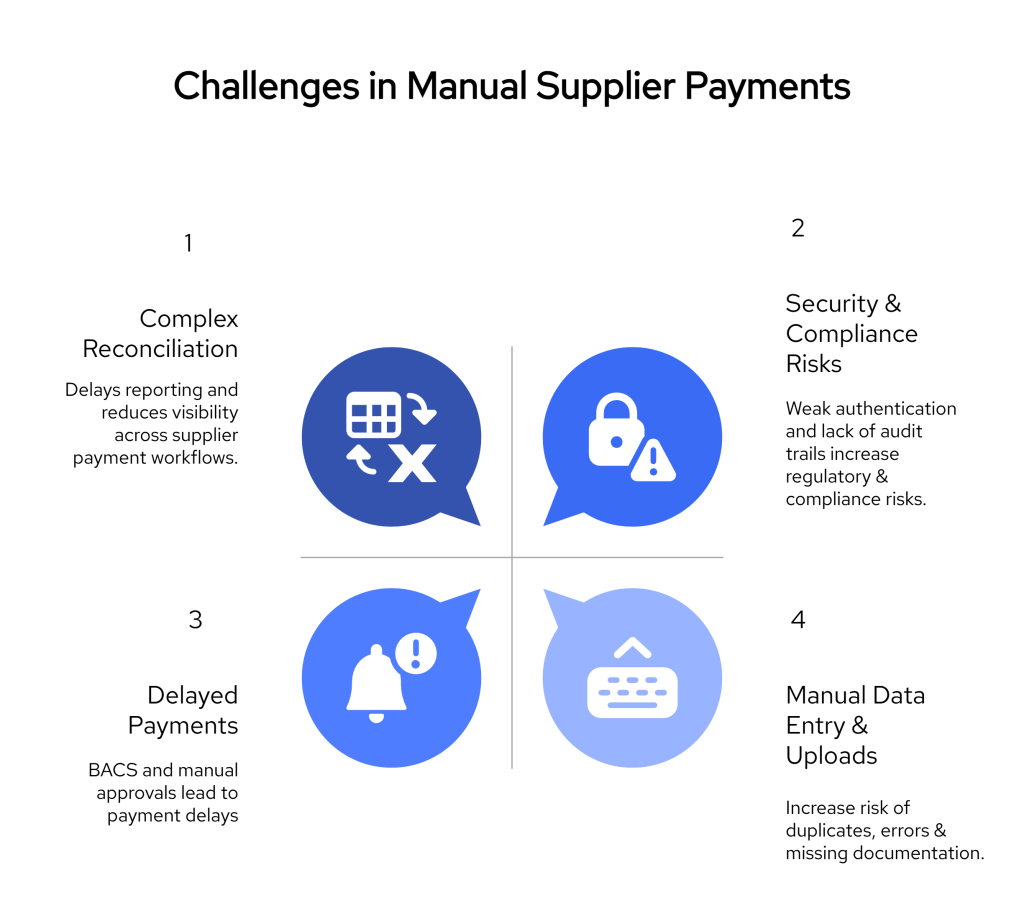

Common Challenges in Manual Supplier Payments

Even with modern accounting tools in place, many UK businesses still rely on outdated processes for managing supplier payouts. These methods often appear simple on the surface but introduce significant operational risk and inefficiency at scale.

Here are some of the most common issues finance and operations teams face when handling supplier payments manually:

1. Delayed Payments

Traditional BACS payments can take up to three working days to settle. For suppliers depending on timely payments, this delay can impact trust, operations, and contract terms.

2. Manual Data Entry and Uploads

Payouts often involve exporting CSV files from ERP systems, formatting them for bank portals, and manually uploading them. Each manual step increases the risk of:

- Payment to incorrect accounts

- Duplicated entries

- Incomplete audit logs

3. Approval Bottlenecks

Finance teams frequently manage approvals via email, spreadsheets, or informal Slack messages. This leads to:

- Missed or delayed approvals

- No single source of truth

- Weak auditability in case of errors or disputes

4. Complex Reconciliation

With payment confirmations arriving late (or not at all), month-end reconciliation becomes a drawn-out task. Teams often work backwards to match outbound payments with invoices, resulting in:

- Increased month-end close time

- Difficulty identifying payment failures or mismatches

- Reduced financial visibility in real time

5. Security and Compliance Risks

Manual processes create gaps in control. There’s limited authentication beyond login credentials, no structured access control, and minimal logging — making it harder to meet internal policies or external compliance requirements.

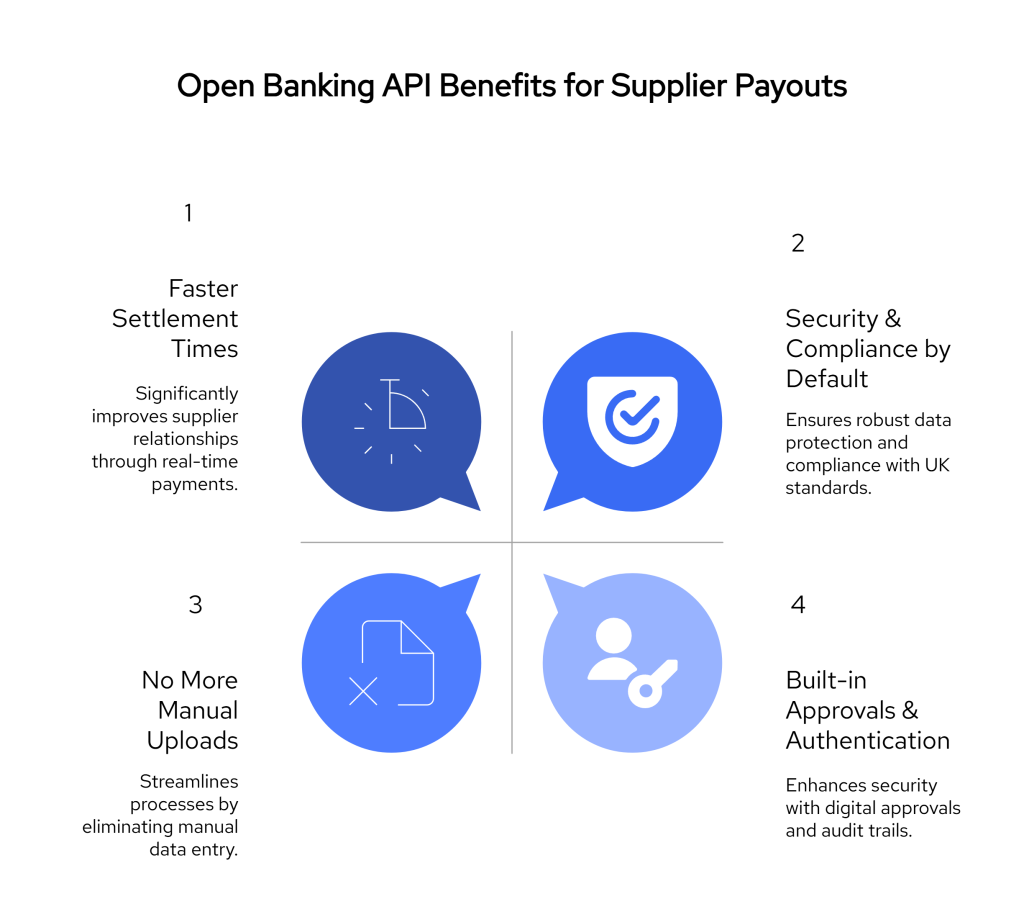

How Open Banking APIs Solve These Payout Problems

Open Banking APIs allow finance teams to move away from fragmented, manual payment systems and replace them with a controlled, real-time payout process. By integrating payment initiation capabilities directly into your financial software, Open Banking addresses the most persistent issues in supplier payments.

Here’s how:

1. Faster Settlement Times

Open Banking enables account-to-account (A2A) payments that typically settle within seconds. This eliminates the need to rely on slower BACS processes and improves supplier relationships through more predictable payments.

2. Elimination of Manual Uploads

With API-triggered payouts, there’s no need to export and format CSV files or log into online banking portals. Your team can:

- Trigger payouts directly from your ERP or accounting software

- Send single or bulk payments in one action

- Remove the need for spreadsheet-based workflows

3. Structured Approvals and Authentication

Modern Open Banking providers allow you to embed approval logic and user authentication into the payout flow:

- Assign roles and permissions

- Capture digital approvals at each step

- Maintain an audit trail that satisfies internal policy and external audit requirements

4. Real-Time Payment Status and Reconciliation

Payments initiated via API can return real-time status updates (success, failure, pending), allowing your finance team to:

- Reconcile transactions as they happen

- Automatically mark invoices as paid

- Flag any failed transactions without manual intervention

5. Built-in Security and Compliance

Open Banking APIs are regulated and use secure authentication protocols (such as Strong Customer Authentication). This ensures:

- Sensitive payment information is never exposed

- Access is permission-based and traceable

- Your processes are compliant with UK financial regulations

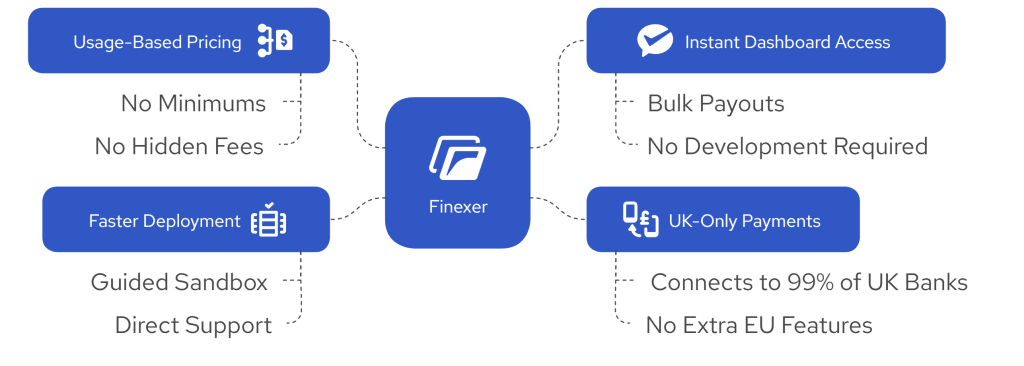

How Finexer Makes Supplier Payout Automation Affordable

For many UK businesses, automating supplier payouts sounds ideal — until they encounter complex pricing models, expensive integrations, or monthly minimums that don’t align with their actual usage. Finexer was built to remove those barriers.

Whether you’re paying 20 vendors a month or managing thousands of disbursements, Finexer gives you the flexibility to start small and scale confidently, without being locked into enterprise-level contracts or high fixed fees.

Here’s how Finexer helps UK teams automate bulk supplier payments with full control over cost and complexity.

Usage-Based Pricing, No Minimums

Finexer’s pricing is straightforward and based entirely on usage. You only pay for what you use — there are:

- No monthly minimums

- No setup or onboarding costs

- No bundled features that inflate your bill unnecessarily

This makes it ideal for early-stage companies, seasonal businesses, or teams trialling supplier payment automation without heavy upfront investment.

Ready-to-Use Dashboard for Bulk Payments

Not every business has an in-house dev team ready to integrate an API on day one. Finexer provides a fully functional dashboard where you can:

- Upload payout files

- Review, approve, and send bulk payments using Open Banking

- Track payout statuses in real time

This lets your team begin automation immediately — and migrate to API-driven workflows later, if and when you’re ready.

Built for the UK

Where many Open Banking providers focus on multi-region coverage or enterprise platforms, Finexer is purpose-built for UK-based businesses. It connects to 99% of UK banks and focuses exclusively on domestic A2A payment flows.

That means faster deployments, more relevant compliance handling, and no extra cost for services you don’t need, especially if your vendor network is UK-only.

Faster Go-Live, Lower Overhead

Most Open Banking integrations take weeks — if not months — to get started. Finexer typically deploys 2 to 3 times faster than other providers, thanks to:

- Guided sandbox environments

- Clear documentation

- Direct access to integration support

Combined with its low-cost model, this gives businesses a faster route to value, without lengthy onboarding or bloated budgets.

Whether you’re running payouts from your accounting platform or want to build custom disbursement workflows, Finexer provides the tools to do it affordably — and on your terms. If you’re looking to automate supplier payouts using Open Banking APIs, Finexer offers the flexibility, speed, and pricing clarity that most UK providers don’t.

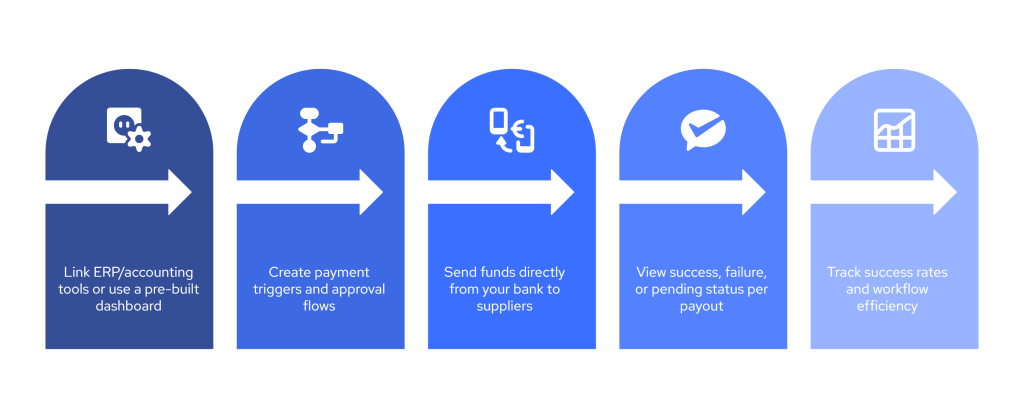

5 Steps to Automate Supplier Payouts Using Open Banking APIs

For UK businesses looking to streamline their accounts payable workflows, Open Banking APIs offer a practical and reliable way to automate supplier payouts. This section outlines a typical implementation process from connecting your systems to executing real-time, secure payments at scale.

1. Connect Your ERP or Accounting Platform

Start by linking your finance system, whether it’s Xero, NetSuite, QuickBooks, or a custom ERP with an Open Banking provider that supports payment initiation APIs for businesses.

If you don’t want to build a full integration immediately, platforms like Finexer also offer a ready-to-use dashboard where you can:

- Upload payment files

- Review and approve supplier payouts

- Trigger bulk payments using Open Banking without leaving the interface

This is ideal for businesses that want to automate supplier disbursements quickly, without committing to a full-scale ERP integration on day one.

2. Configure Supplier Disbursement Workflows

Set up rules that define how and when payments should be triggered. This may include:

- Scheduled payout runs (weekly, bi-weekly, month-end)

- Threshold-based triggers (e.g. payment once invoice exceeds £5,000)

- Approval stages embedded within the system

These workflows form the foundation of your supplier payment automation process.

3. Trigger Payouts via API

Once the workflow is live, your finance team (or system) can use the Open Banking API for payouts to send funds in real time.

Each transaction:

- Is authorised by the appropriate user (via Strong Customer Authentication)

- Moves directly from your business account to the supplier’s account

- Bypasses card networks or BACS, reducing both cost and settlement time

This is especially valuable for UK-based businesses looking to automate supplier disbursements without relying on legacy tools.

4. Receive Real-Time Payment Status Updates

Once a payment is initiated, the system receives a status update:

- Success

- Failure (e.g. invalid account)

- Pending (awaiting bank action)

These updates help your team reconcile transactions immediately, improving accuracy and speeding up financial reporting.

5. Monitor and Optimise

After deploying the API, continue monitoring:

- Supplier payment success rates

- Approval lags

- Reconciliation efficiency

The goal is to continually refine your accounts payable automation process and reduce human intervention wherever possible.

What is the best way to automate supplier payouts for UK businesses?

The most efficient method is to use Open Banking APIs that allow your accounting or ERP system to trigger real-time, account-to-account payments. This eliminates the need for manual BACS uploads and reduces payment delays.

Can Open Banking be used for bulk supplier payments?

Yes. Many UK providers now support bulk payments using Open Banking, allowing finance teams to pay multiple suppliers at once, directly from a dashboard or through an API integration.

Is it secure to use Open Banking for supplier disbursements?

Absolutely. Open Banking in the UK is regulated by the FCA and uses secure authentication methods like Strong Customer Authentication (SCA). Each payment requires explicit user authorisation, making it a safe method for automating supplier disbursements.

How long does it take to go live with Open Banking payout automation?

With platforms like Finexer, you can get started within days. Finexer offers both API access and a ready-made dashboard, so you can begin running automated supplier payouts without needing full development resources upfront.

Does automating payouts help with reconciliation?

Yes. One of the major benefits of supplier payment automation using Open Banking is that each transaction includes a real-time status. This can be pulled into your system to automatically reconcile payments, helping finance teams reduce end-of-month workload.

Do you want to Automate Bulk Payouts? Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂

![Guide:How to Automate Supplier Payouts Using Open Banking APIs 1 Automate Supplier Payouts with UK Open Banking [2025 Guide]](/wp-content/uploads/2025/04/Automate-Supplier-Payouts.jpg)