A bank transfer in the UK is supposed to be fast, simple, and trackable. But for many people, especially those handling business payments, things don’t always go as planned. Sometimes the money doesn’t arrive when expected. Other times, the transaction gets blocked outright with little explanation.

Before jumping into the causes and fixes, it helps to understand the three main types of UK bank transfers:

- Faster Payments: Typically settles within a few minutes but can take up to 2 hours. Most common for personal and business transfers under £1 million.

- BACS Transfers: Takes up to 3 working days. Often used for payroll and recurring business payments.

- CHAPS Payments: Used for high-value transactions. Funds usually arrive the same day if sent before the cutoff time.

All three routes are designed to move money between UK bank accounts, but delays happen more often than most people realise. In many cases, the issue isn’t with the network itself but with how the payment was flagged or processed along the way.

📚 Guide to UK Bank Transfer Modes

How Long Does a Bank Transfer Take in the UK?

If your bank transfer hasn’t arrived yet, the first question to ask is: Was it delayed, or was it blocked outright? Timing plays a big role in figuring that out.

Here’s how long different UK bank transfers typically take:

Faster Payments

- Normal timeframe: Within a few minutes, but can take up to 2 hours

- Limits: Up to £1 million, depending on the bank

- When delays happen: Outside banking hours, flagged for review, or network maintenance

Bacs Transfers

- Normal timeframe: 3 working days

- Used for: Payroll, HMRC payments, supplier invoices

- When delays happen: Public holidays, incorrect submission files

CHAPS Payments

- Normal timeframe: Same day (if submitted before bank cutoff, usually around 3pm)

- Used for: House purchases, high-value transactions

- When delays happen: Submission after cutoff, compliance checks

It’s important to track when the transfer was initiated and which type of payment was used. For example, if you made a Faster Payment on a Saturday night, it may not process until Monday morning, even though it’s technically “instant.”

If your bank transfer delays extend beyond the expected window, that’s often a sign the transaction was paused for manual review. We’ll cover the most common triggers next.

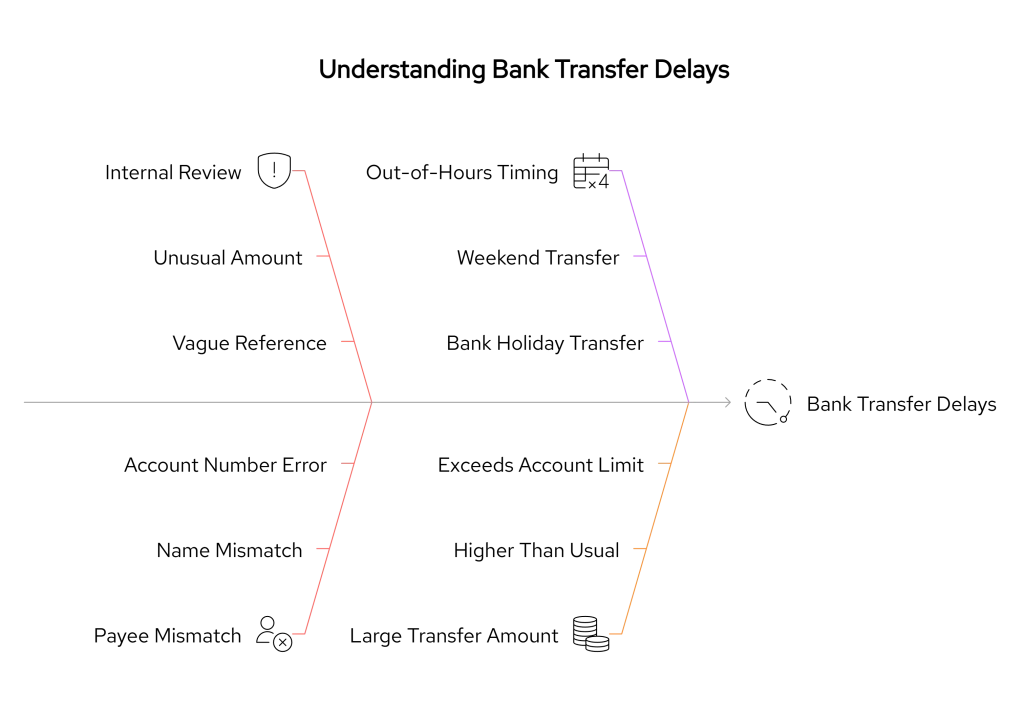

4 Common Reasons a Bank Transfer Gets Blocked or Delayed

A bank transfer might be delayed for reasons that have nothing to do with technical failures. In most cases, the issue comes down to automated compliance checks or missing information. Here are four of the most common causes:

1. The Payment Is Pending Internal Review

If you’re wondering why is my bank transfer is pending, it’s often because the bank’s automated systems flagged it for extra scrutiny. Common triggers include:

- Unusual amounts for your account history

- Payments to newly added recipients

- Vague or suspicious descriptions (e.g. “loan”, “services”, or “gift”)

These triggers cause the transaction to be routed for manual compliance review, especially during non-working hours.

2. Mismatch in Payee Information

If the name on the account doesn’t match the sort code and account number, your bank may pause the transaction. While some banks allow you to proceed despite a mismatch, others may block the payment entirely.

This is especially common when:

- You’re paying someone for the first time

- The account is a business account, but listed as a personal name

- You mis-type one digit in the sort code or account number

3. Out-of-Hours Transfers

Most bank transfers process instantly during working hours, but if you send money late in the evening, over the weekend, or on bank holidays, it may not go through right away, especially with CHAPS or Bacs.

Banks may also batch certain transfers for manual review the next business day, particularly if they involve flagged recipients or large sums.

4. Large or Unusual Amounts

Transferring a much higher amount than usual can trigger anti-fraud alerts. Even if you’re within your payment limit, your bank may temporarily block the transfer for security checks.

This often happens with:

- End-of-month supplier payments

- One-off payouts

- Charity donations

- Transfers to new investment platforms

If the transfer seems out of pattern, it could be delayed or blocked pending review.

What to Do If Your Bank Transfer Is Not Received

If a bank transfer is not received within the expected timeframe, it’s important to act quickly but calmly. Delays don’t always mean the payment failed. Here’s how to check what’s happening and what to do next.

Step 1: Confirm the Payment Was Sent

Log in to your online banking and verify:

- The transaction shows as completed (not pending or queued)

- The date and time it was initiated

- The exact payee name, sort code, and account number used

- The payment type (Faster Payments, Bacs, or CHAPS)

If the transaction still says pending, you may be dealing with an internal review, which leads to further delay.

Step 2: Contact Your Bank’s Customer Support

Have the following details ready:

- Payment reference ID

- Payee account details

- Amount and payment date

- Any messages or error codes from your bank

When speaking to support, ask directly if the transfer is held for compliance checks or flagged by the system. This can speed up escalation.

Step 3: Ask the Recipient to Check Their End

Sometimes, the issue of not receiving the bank transfer is due to delays on the recipient’s side. They should:

- Check for pending inbound payments

- Confirm they shared the correct account details

- Speak with their bank if needed

Note: Some banks delay incoming funds from unfamiliar senders until internal checks are complete.

Step 4: Know When to Escalate

If the issue isn’t resolved within 24–48 hours for Faster Payments (or longer for Bacs), request:

- A payment trace

- Written confirmation that the money has left your account

- A complaint reference if delays continue

📚 Pay by bank vs Card Payments

Use Open Banking to Avoid Wire Transfer Friction

Traditional bank transfers still rely on older rails like Bacs, CHAPS, or even internal manual reviews, and that’s exactly where delays and blocks creep in. Open Banking offers a faster, more transparent alternative for sending money across the UK.

Here’s why it’s gaining traction among finance teams, platforms, and payment processors:

1. Real-Time Bank Authentication

Instead of entering sort codes and account numbers manually, Open Banking uses secure bank authentication to verify the sender and recipient directly through their banks. This reduces the risk of fraud, eliminates typos, and improves approval rates.

2. Instant Confirmation of Payee

Before any money moves, Open Banking verifies that the account details match the intended recipient. No guesswork. No blocked wires due to mismatched names.

3. Fewer Compliance Flags

Because the customer consents to the transaction directly through their bank, the payment is treated as an authorised initiation, not a flagged outbound wire. This cuts down on manual intervention and delays.

4. Transparent Settlement

You get confirmation the moment the payment is initiated and in many cases, it settles instantly. No more wondering if your bank transfer is pending or waiting hours to hear if it landed.

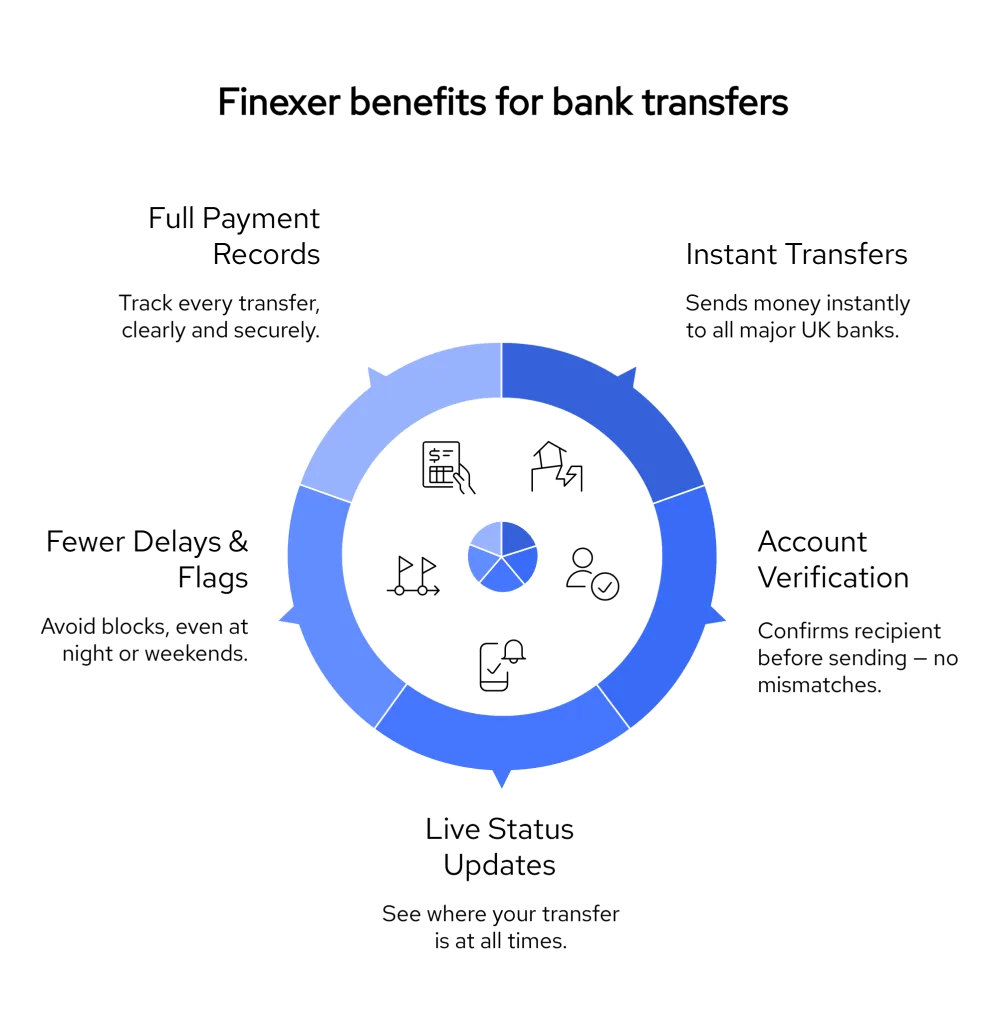

How You Can Do It Better with Finexer

If you’ve dealt with delays, blocked wires, or vague bank support, you’re not alone. Finexer helps you avoid all that by using Open Banking instead of old-school transfer methods like BACS or CHAPS.

Here’s how it makes a difference:

✅ Sends money instantly across all major UK banks

✅ Confirms the recipient’s account before you send, so there’s no mismatch

✅ Gives you real-time status updates, no more wondering if it’s stuck

✅ Reduces payment blocks and flags, even during evenings or weekends

✅ Shows clear payment records for you and your team to track

With Finexer, you don’t have to second-guess where your money is or wait days for it to land. Everything is verified, tracked, and sent in seconds, exactly how a bank transfer should work today.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowHow long does a bank transfer take in the UK?

Faster Payments take up to 2 hours, Bacs takes 3 working days, and CHAPS settles same day if sent before the bank’s cutoff time, while Open banking transfers in near instant time.

Why is my bank transfer pending?

Transfers may show as pending due to fraud checks, large amounts, new payees, or being sent outside business hours.

What should I do if my bank transfer hasn’t arrived?

Check your bank for status, confirm recipient details, then contact support to request a trace if the payment is delayed.

Can a bank block a transfer without notice?

Yes. UK banks may hold or block payments during internal reviews without notifying you immediately.

Tired of waiting on blocked or delayed bank transfers?

With Finexer, you can send payments in seconds!