If you are comparing merchant payment services for a UK business, this guide focuses on four cost-effective providers with transparent pricing, fast payouts, and dependable support. We wrote it for owners and ops teams who want a clear answer without fluff.

In this 2025 update, we look at what the best merchant services UK companies actually offer, how leading UK payment processors price transactions, and which payment gateway in the UK features matter most for real-world use.

What you will get in this guide

- A quick way to judge total cost beyond headline rates

- Comparing the best Payment services for UK Merchants

- When to use cards, when to add Pay by Bank, and how payouts affect cash flow

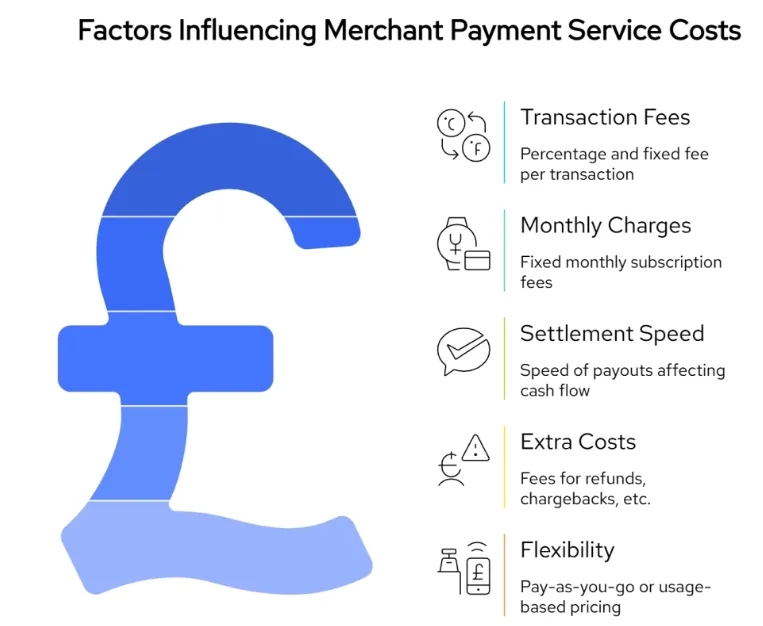

What Makes Merchant Payment Services Cost-Effective?

Before we dive into the four providers, it’s worth setting out the factors that actually make merchant payment services affordable. Many UK businesses look at just the advertised transaction rate, but real savings (or hidden costs) show up in the details.

1. Transaction Fees

This is the percentage + fixed fee per transaction. Lower fees matter most if you process high volumes or lots of small-ticket sales.

2. Monthly Charges

Some providers charge nothing beyond per-transaction fees, while others add a fixed monthly subscription. For smaller businesses, avoiding heavy monthly fees often keeps things cost-effective.

3. Settlement Speed

Fast payouts reduce the need for working capital. If money lands in your account instantly or the next day, you cut the cash flow strain compared to waiting three to five days.

4. Extra Costs

Check for fees on refunds, chargebacks, PCI compliance, or non-UK cards. These can erode savings quickly.

5. Flexibility

Pay-as-you-go or usage-based pricing is often cheaper for SMEs than being locked into long contracts.

Keeping these points in mind will help you decide which UK payment processors and payment gateway UK solutions deliver the best value for your setup.

Comparing Merchant Payment Services in the UK

| Provider | Pricing model | Payout speed | Best for | Notable features |

|---|---|---|---|---|

| Finexer | Usage-based; saves up to 90% on transactional costs | Instant / same-day | SMEs, accounting & payroll, invoicing | Pay by Bank APIs, white-label dashboards, fast deployment |

| SumUp | Flat ~1.69% per transaction | 1–2 days (same-day optional) | Pop-ups, cafés, small shops | Low-cost readers, invoices, payment links |

| Stripe | ~1.5% + £0.20 for UK cards | 2–3 business days | Ecommerce, SaaS, online-first | Subscriptions, multi-currency, fraud protection |

| Worldpay | Negotiable (e.g., ~1.3% + £0.20 at scale) | 3–5 business days | High-volume merchants, established retailers | Omnichannel POS + online, advanced risk tools |

1. Finexer

Best for: Businesses that want to cut card network fees and get faster settlement.

Finexer is a modern UK provider of merchant payment services built on Open Banking. By eliminating card networks, it allows direct bank-to-bank transactions that save businesses up to 90% on transactional costs compared to traditional card payments.

Key Features

- Pay by Bank APIs: Secure account-to-account transfers with Strong Customer Authentication.

- Usage-based pricing: No setup or hidden monthly fees — you only pay for what you process.

- Fast deployment: API integration completes 2–3x quicker than the market average.

- Hands-on support: 3–5 weeks of guided onboarding tailored to UK businesses.

- White-label dashboards: Branded payment experience designed for accountants, payroll providers, and SMEs.

Why It’s Cost-Effective

Traditional UK payment processors pass along card scheme charges, refund costs, and long settlement times. Finexer avoids these altogether, giving businesses faster access to funds and dramatically lower costs.

Best For

- Accounting and payroll platforms issuing high-volume payouts

- SMEs and service firms that want faster settlement

- Businesses invoicing clients and seeking affordable payment gateway alternatives

2. SumUp

Best for: Small retailers, cafés, and mobile businesses that need simple in-person payments.

SumUp is one of the most widely used merchant payment services in the UK because of its simplicity and transparent pricing. Instead of complex contracts, it offers flat transaction fees with no monthly charges, making it appealing to small businesses that prioritise cost control.

Key Features

- Affordable card readers: Low-cost hardware options like the SumUp Air and Solo.

- Flat-rate pricing: Clear fees per transaction, usually around 1.69% in the UK.

- Omnichannel tools: Send payment links, create online invoices, and accept remote payments.

- Fast onboarding: Merchants can start accepting payments the same day.

Why It’s Cost-Effective

SumUp avoids lock-in contracts and heavy monthly fees. For micro and small businesses with limited volumes, this makes it one of the most budget-friendly UK payment processors available.

Best For

- Pop-up shops and market traders

- Local retailers that want a quick setup without hidden charges

- Small firms needing both POS and basic payment gateway features

3. Stripe

Best for: Online businesses, SaaS platforms, and ecommerce brands needing developer flexibility.

Stripe is a global leader in merchant payment services, and it has a strong presence in the UK. It is best known for its developer-friendly APIs, wide integration options, and transparent pricing that appeals to startups and scale-ups.

Key Features

- Developer-first platform: Well-documented APIs and SDKs for custom checkout flows.

- Subscription billing: Built-in tools for recurring payments and dunning management.

- Multi-currency support: Accepts over 135 currencies, suitable for UK businesses selling internationally.

- Fraud protection: Stripe Radar uses machine learning to block suspicious activity.

Why It’s Cost-Effective

Stripe’s pay-as-you-go pricing model (around 1.5% + 20p for domestic UK cards) makes it easy to start without upfront fees. With no setup or monthly charges, it suits SMEs that want scalability without fixed overheads.

Best For

- Ecommerce companies selling across the UK and abroad

- SaaS businesses that rely on recurring billing

- Developers or teams that want control over the checkout experience with a reliable payment gateway in the UK

4. Worldpay

Best for: Established retailers and higher-volume merchants in the UK.

Worldpay is one of the most recognised names in merchant payment services. With decades of experience and a large share of the UK payments market, it provides a mix of online and in-person solutions that scale with business growth.

Key Features

- Omnichannel coverage: Card machines, POS systems, and ecommerce payment gateways.

- Negotiable rates: Larger businesses often secure transaction fees starting from around 1.3% + 20p.

- Advanced fraud tools: Includes 3D Secure and risk management systems.

- Global acceptance: Supports international cards and wallets, making it suitable for UK businesses with overseas customers.

Why It’s Cost-Effective

Worldpay is competitive for higher volumes because rates can be customised. While small merchants may find fees higher than newer entrants, mid-sized firms benefit from negotiated discounts and robust support. For businesses with steady turnover, this balance of reliability and lower effective fees makes it one of the stronger payment processors in the UK.

Best For

- Established retailers and ecommerce brands

- Merchants processing high monthly volumes

- UK businesses need both POS and payment gateway solutions in the UK

Choosing the Right Merchant Payment Services in the UK

The best merchant payment services for your business depend on transaction volume, sales channels, and how fast you need access to funds.

- Finexer stands out for cost savings of up to 90% on transactional costs through Pay by Bank. It is the most cost-effective choice for SMEs, accounting platforms, and service providers that want instant settlement and no card network fees.

- SumUp is ideal for smaller retailers, cafés, and pop-ups that need affordable hardware and flat, simple pricing without monthly charges.

- Stripe works best for online-first companies, SaaS providers, and ecommerce brands that need developer flexibility, subscription billing, and multi-currency support.

- Worldpay is the go-to option for larger merchants who can negotiate lower rates and require omnichannel payment acceptance with advanced fraud protection.

What are merchant payment services?

Merchant payment services are solutions that allow businesses to accept customer payments securely, whether online or in person. They cover card processing, bank-to-bank transfers, digital wallets, and payment gateways.

Which merchant payment service is cheapest in the UK?

Cost depends on your business model. Finexer can save up to 90% on transactional costs with Pay by Bank. For small retail, SumUp is often cheapest due to flat per-transaction rates and no monthly fees, but settlement time can affect cash-flow.

Do I need a merchant account?

Some providers (like Worldpay) require a traditional merchant account, while others (Finexer, Stripe, SumUp) act as payment facilitators so you can start without opening one separately.

Cut your payment costs by up to 90% and get instant access to your funds with Finexer with no setup cost!