Financial accuracy depends heavily on the quality of transaction data. As more accounting firms and financial analysts in the UK adopt automation, the gap between raw and clean transaction data is becoming increasingly visible.

Recent reports indicate a significant shift among UK financial institutions towards adopting categorised APIs over raw bank data, driven by the need for faster reconciliation, improved compliance checks, and reduced manual processing.

This shift isn’t just about saving time. It reflects a broader need to improve reporting precision, reduce human error, and ensure that all financial workflows from forecasting to tax filing start with clean, categorised transaction data.

But what actually distinguishes raw transaction data from clean data? And why does it matter so much to UK financial professionals?

In this guide, we’ll break down:

What Is Raw Transaction Data?

Raw transaction data is the unprocessed information pulled directly from a bank feed. It typically includes just the basics: a timestamp, amount, currency, and a short, often cryptic description. While it may appear complete at a surface level, raw data lacks the structure that financial analysts and accountants need to work efficiently and accurately.

Here’s a typical example of raw transaction data:

| Date | Amount | Description |

|---|---|---|

| 11/04/2025 | £312.00 | POS 49821 – Sainsbury’s LDN 042 |

| 12/04/2025 | £2,500.00 | BACS 82391028 – ABC PAYROLL LTD |

| 13/04/2025 | £85.00 | ATM Withdrawal – HSBC ATM 0031 |

From a data quality perspective, this output poses several issues:

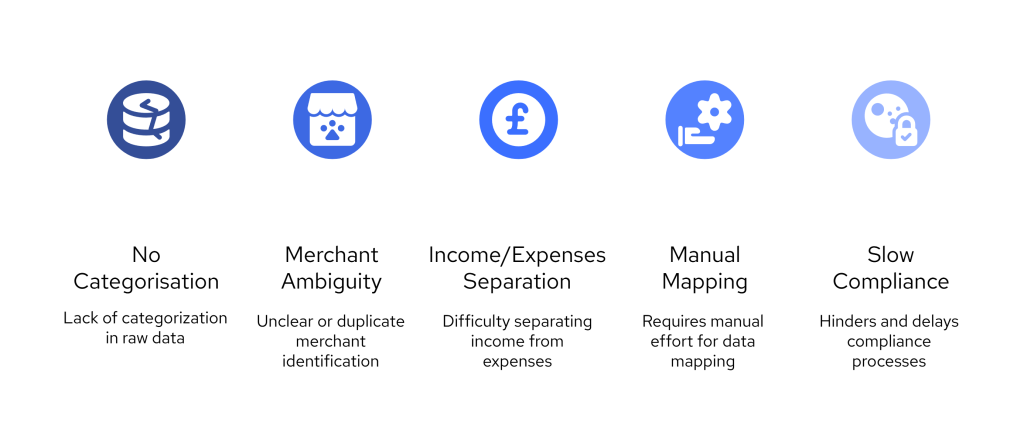

Key Limitations of Raw Transaction Data

- No categorisation

You can’t tell whether a payment was for groceries, rent, travel, or something else. This makes it harder to track expenses or generate meaningful reports. - Merchant ambiguity

Businesses like “Sainsbury’s” might appear in dozens of variations across different banks and feeds, making standardisation nearly impossible without manual cleanup. - No separation between income and expenses

Whether the transaction is a debit or credit isn’t always explicit, and there’s no classification by type (e.g., salary vs. refund). - Manual mapping required

Raw data doesn’t automatically align with a chart of accounts, reconciliation tool, or tax category. Everything has to be reviewed and tagged manually. - Slows down compliance

When it comes to AML audits or financial reviews, raw data lacks the metadata needed to trace and validate a transaction at speed.

These challenges are especially problematic for UK-based firms handling high transaction volumes, where accuracy and turnaround times are critical. Delays in interpreting transaction data can slow down client reporting, disrupt cash flow forecasting, and lead to compliance gaps.

What Is Clean Transaction Data?

Clean transaction data is structured, categorised, and ready for use, without the extra steps. Unlike raw data, which is hard to interpret and time-consuming to process, clean transaction data is enriched with standardised labels, merchant information, categories, and metadata that align with how accountants and analysts work.

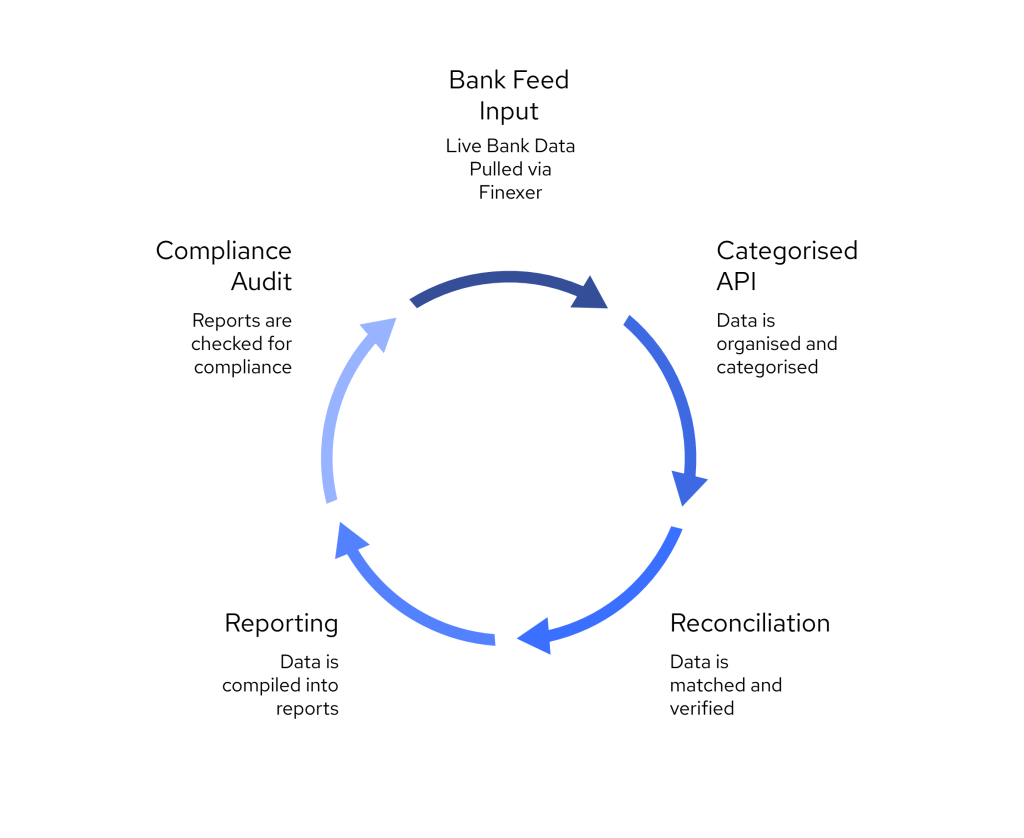

This kind of data is made possible by categorised APIs, such as the one offered by Finexer. Instead of delivering vague descriptions and merchant codes, these APIs return a fully-structured transaction object designed for direct use in reconciliation, reporting, forecasting, and compliance.

Example of clean transaction data:

| Date | Amount | Merchant | Category | Type | Status |

|---|---|---|---|---|---|

| 11/04/2025 | £312.00 | Sainsbury’s | Groceries | Debit | Booked |

| 12/04/2025 | £2,500.00 | ABC Payroll Ltd | Salary Income | Credit | Booked |

| 13/04/2025 | £85.00 | HSBC ATM | Cash Withdrawal | Debit | Booked |

Raw vs. Clean Transaction Data: Comparison

Financial analysts and accountants don’t just need access to data; they need accuracy, clarity, and consistency. Raw transaction data often introduces delays and errors that cost time and create compliance risks. In contrast, clean transaction data delivered through categorised APIs enhances every step of your financial workflow, from daily reconciliations to audit prep.

Here’s how they compare in practice:

| Feature | Raw Transaction Data | Clean Transaction Data (via Finexer) |

|---|---|---|

| Structure | Unformatted text; inconsistent descriptions | Structured object with consistent schema |

| Merchant Clarity | Varied naming across banks (e.g., “TESCO 0123”) | Normalised merchant labels (e.g., “Tesco”) |

| Category Tags | None; must be assigned manually | Auto-tagged (e.g., groceries, payroll, rent) |

| Audit-Readiness | Requires manual annotations and context | Includes metadata, timestamps, and balance tracking |

| Compliance Support | Not suitable for Source of Funds / AML reviews | Includes categorised fields and source references |

| Reconciliation Speed | Slow; depends on analyst interpretation | Fast; categories map directly to ledgers |

| Integration Effort | Needs transformation logic in-house | Developer-ready endpoints with categorised output |

Why UK Firms Are Switching to Categorised APIs

When transaction data is clean, categorised, and enriched, your reporting becomes more accurate by default. You avoid rounding errors, misclassified expenses, and compliance gaps caused by missing metadata.

With Finexer’s categorised APIs, UK firms are able to:

- Automate bank reconciliation

- Reduce manual tagging by over 80%

- Support audit-ready compliance workflows

- Cut costs by avoiding post-processing tools

For analysts who manage high transaction volumes or work across multiple accounts and institutions, switching to structured transaction data isn’t a luxury; it’s a necessity.

The Practical Advantages of Clean Transaction Data

When it comes to reporting, reconciliation, or regulatory reviews, the structure and clarity of financial data make all the difference. Poorly formatted entries slow down workflows, increase the chance of misclassification, and create downstream issues that are harder to fix later.

Clean, well-structured feeds solve that from the start. Instead of needing manual clean-up or guesswork, they provide analysts with labelled fields, recognised merchant names, and standardised categories—ready to use.

Here’s a direct comparison:

| Feature | Raw Data | Clean Data (via Finexer) |

|---|---|---|

| Structure | Unformatted descriptions, variable quality | Organised JSON schema with defined fields |

| Merchant Consistency | Labels change across providers | Standardised naming (e.g. Tesco, BP, Amazon) |

| Expense Classification | Missing or inconsistent | Auto-categorised: travel, payroll, utilities, etc. |

| Readiness for Audit | Requires additional context | Includes timestamps, balances, references |

| Workflow Speed | Slower due to manual tagging | Speeds up matching and reconciliation |

| Integration Cost | Higher due to formatting overhead | Lower with developer-ready outputs |

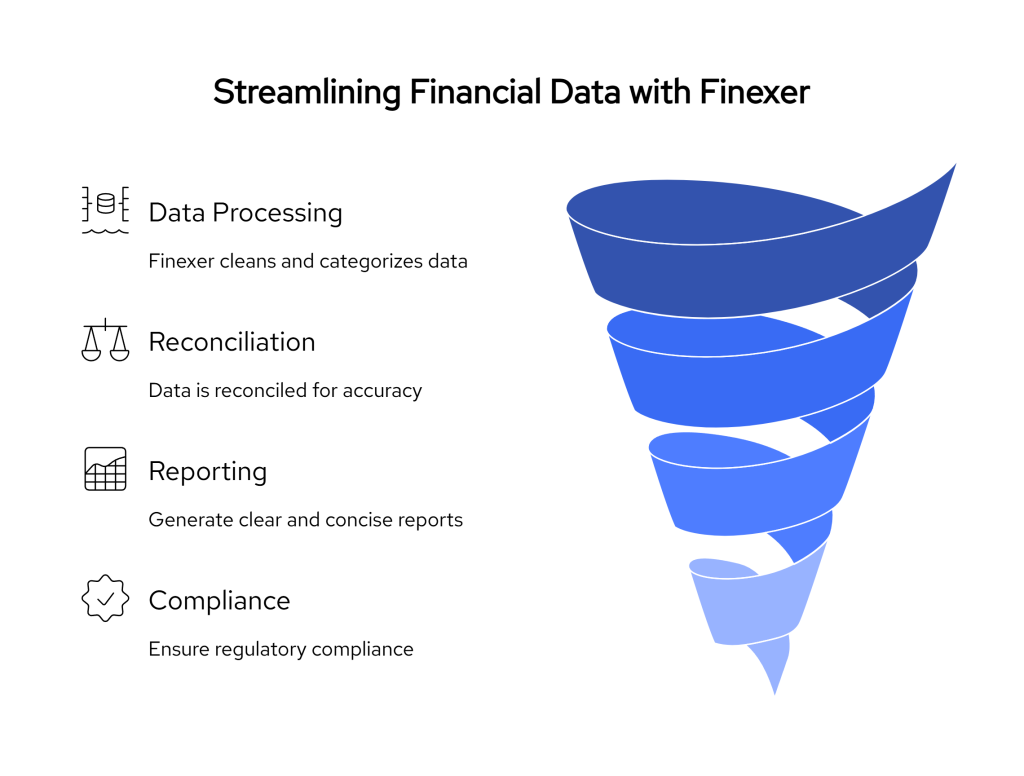

How Finexer Delivers Clean Data Without the Complexity

For financial teams in the UK, the pressure to produce accurate reporting while handling large volumes of bank data is only increasing. Whether it’s reconciliation, forecasting, or compliance, clean, usable data is no longer a luxury. It’s a requirement.

This is where Finexer stands out.

While most providers still return unstructured or loosely formatted records, Finexer delivers fully processed, categorised data that’s ready to plug into your workflows. You don’t need to hire analysts to clean it. You don’t need to build layers of transformation logic to make sense of it. And you don’t need to overpay for it.

Why Financial Teams Prefer Finexer

- Fewer errors during reconciliation and reporting

- Faster turnaround for audits, cash flow updates, and tax prep

- Accurate categorisation of every income and expense item

- Reduced overhead with automation-ready outputs

- UK-first infrastructure, built to align with how local firms operate

Whether you’re a mid-sized accounting firm or a tech-enabled finance team, Finexer helps you move faster without sacrificing accuracy. The enriched data structure works straight out of the box, meaning fewer delays, cleaner records, and higher confidence in every financial output.

And because Finexer offers usage-based pricing with no long-term lock-ins, you’re not forced into expensive plans to access high-quality data.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

What’s the difference between raw and categorised bank data?

Raw data is unstructured. Categorised data is enriched and ready for faster reconciliation, reporting, and automation.

Why is structured bank data important for accountants?

It speeds up reconciliations, reduces manual work, and improves reporting accuracy across all client accounts.

Is Finexer affordable for small and mid-sized firms?

Yes. Finexer offers usage-based pricing with no long-term lock-in, making it cost-effective for firms of all sizes.

No setup delay. No bloated pricing. Just clean financial data that works from day one! Book Now 🙂

![Raw vs Clean Transaction Data: What UK Finance Teams Should Know in 2025 1 Raw vs Clean Transaction Data: Insights for UK Firms[2025]](/wp-content/uploads/2025/05/Transaction-data.jpg)