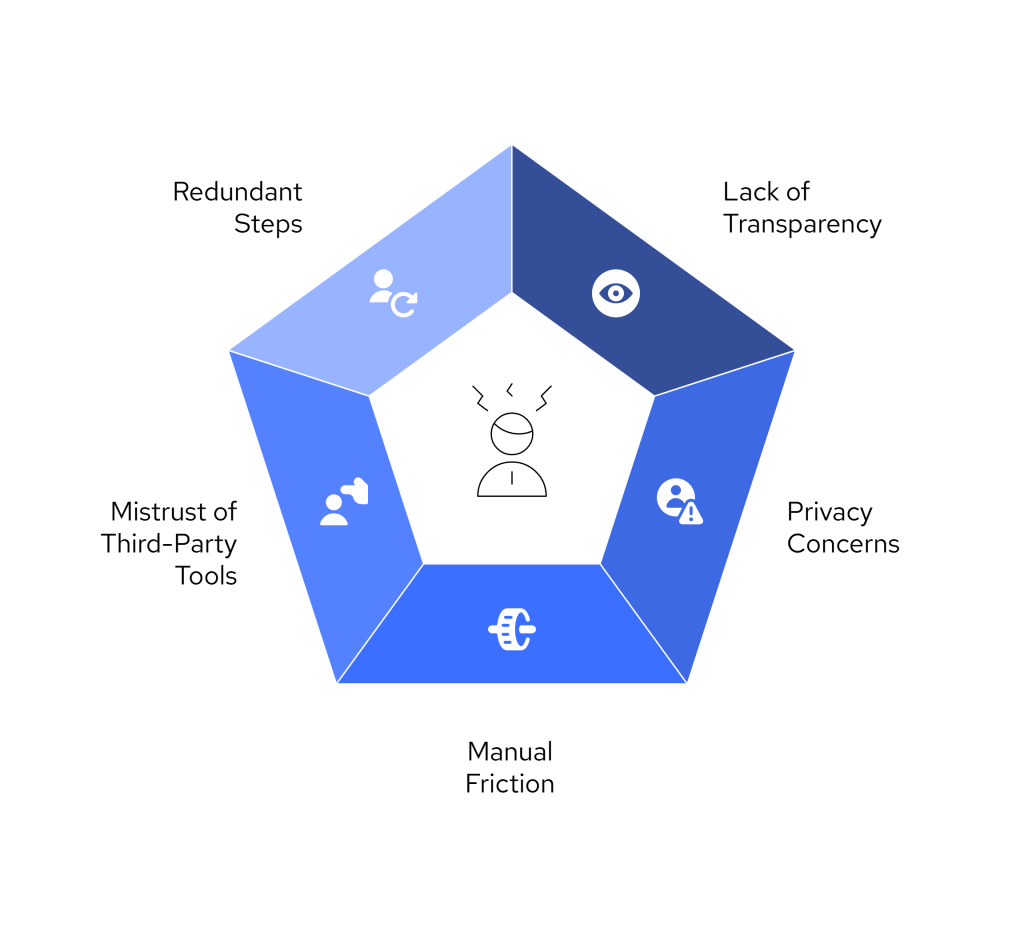

For many clients, the customer KYC process feels intrusive. They’re often unsure why personal documents are being requested, especially when the service they’re signing up for doesn’t seem like it needs them. This disconnect can create hesitation, resistance, or even abandonment.

Common reasons for client pushback:

- Lack of transparency: If it’s not clear why certain information is needed, clients are less likely to cooperate.

- Privacy concerns: Many fear their data may be mishandled or stored insecurely.

- Manual friction: Uploading documents, filling out forms, and waiting for approval creates a poor experience.

- Mistrust of third-party tools: When redirected to unfamiliar portals or apps, clients are more likely to drop off.

- Redundant steps: Clients often feel they’re submitting the same information multiple times across different forms or teams.

For front-desk, compliance, and customer success teams, these moments of friction lead to increased hand-holding, slower onboarding, and lower conversion rates. In sectors like legal, accounting, or financial services, where trust is essential, even small barriers can cost you the client.

The key to solving this is rethinking how the customer KYC process is presented and delivered. When done right, KYC doesn’t have to feel like a regulatory burden. It can become a seamless, secure part of the client journey.

Keep Reading or Jump to the section you’re looking for:

Understanding the KYC Compliance Mandate

To reduce friction in the customer KYC process, you first need to understand what you’re legally required to collect — and what you’re not. Over-complicating the process often stems from outdated workflows, redundant checks, or unclear internal policies.

What KYC typically requires in the UK:

- Proof of identity: e.g., passport, driving licence, or a verified bank login

- Proof of address: e.g., utility bill, bank statement, or council tax notice

- Screening checks: against PEP (Politically Exposed Persons) and sanctions lists

These requirements apply to regulated industries like financial services, law, and accountancy. Depending on the risk profile of the client and the nature of the service, enhanced due diligence (EDD) may also be necessary.

KYC vs KYB: What’s the difference?

- KYC (Know Your Customer) applies to individuals. You verify identity, address, and run compliance checks.

- KYB (Know Your Business) is used when onboarding companies. You’ll need to verify directors, shareholders, company registration, and banking information.

While these requirements are non-negotiable, the way you collect and verify the data is flexible. That’s where white-label tools, real-time bank authentication, and intelligent document extraction come in — they allow you to meet compliance standards without creating extra work for clients.

Modernising the customer KYC process means meeting your legal obligations without falling into the trap of excessive bureaucracy.

5 Ways to Reduce KYC Friction Without Sacrificing Compliance

Improving the customer KYC process doesn’t mean compromising on regulatory standards. It means rethinking how you collect and verify data, not whether you do it.

Here are five practical ways compliance and customer-facing teams can reduce friction, without cutting corners.

1. Use Bank Authentication Instead of Manual Uploads

Rather than asking clients to upload a passport or driving licence, let them verify their identity by logging into their bank account. This method, powered by Open Banking, confirms key details like full legal name, account holder status, and address — all in seconds.

- Reduces document anxiety

- Feels more secure for clients

- Fully compliant when backed by an FCA-authorised provider

This single step can transform the identity verification experience from a chore to a tap.

2. Enable Real-Time Document Extraction and Matching

If clients do need to upload ID or proof of address, make sure the system does the heavy lifting. Use tools that automatically extract name, address, and birthdate from photos of documents and match them against submitted details.

This:

- Eliminates manual typing errors

- Speeds up verification

- Prevents unnecessary back-and-forth

It’s a win for both the compliance teams and client onboarding workflows.

3. Embed KYC Directly Into Your Existing Onboarding Flow

One of the biggest friction points in the customer KYC process is redirection, sending clients to unfamiliar third-party portals kills trust and conversions. Instead, embed verification steps right into your own app or website using white-label tools.

- No login surprises

- Maintains brand trust

- Keeps clients on your platform

4. Offer Friendly, Transparent Explanations

Clients are more willing to cooperate when they understand why you’re asking for certain information. Use plain-language microcopy next to document fields or bank login buttons to explain:

- What’s being collected

- How it’s used

- Why it’s required by law

Simple messaging reduces drop-off and builds trust in the client onboarding process.

5. Let Users Continue While You Verify in the Background

Instead of blocking users until verification is complete, allow them to continue other steps of onboarding. Once KYC is done, simply notify them with an approval or action required message.

This helps:

- Prevent hard drop-offs

- Keep momentum going

- Improve conversion rates for new clients

The result? You maintain compliance while making the customer KYC process feel smooth and respectful.

📚Now Faster Onboarding using bank account validation

How to Implement Client-Friendly KYC With Open Banking

Now that you’ve seen what a low-friction approach looks like, here’s how to actually implement a client-friendly customer KYC process using Open Banking and intelligent verification tools.

This step-by-step guide is designed for compliance and customer onboarding teams looking to reduce friction without adding technical complexity.

Step 1 – Choose an FCA-Authorised KYC Partner

Start by selecting a provider that meets UK compliance standards and offers:

- White-label verification flows

- Bank login authentication

- Real-time identity and address verification

- Secure API or no-code options

Look for providers who understand both compliance obligations and customer experience expectations.

Step 2 – Integrate Bank-Verified Identity Checks

Let clients verify themselves by logging into their bank account through a secure Open Banking flow. This captures:

- Full legal name

- Account ownership

- Sort code and account number

- Address linked to the account

It’s a fast and secure way to handle identity verification with zero document uploads.

Step 3 – Add Document Capture as a Secondary Layer

For clients who can’t complete bank login or require enhanced due diligence, offer a fallback option:

- Let users snap a photo of their ID and proof of address

- Use OCR to extract data

- Cross-match with details from the bank login or form entry

This dual-track approach gives flexibility while keeping the customer’s KYC process smooth.

Step 4 – Review Internally and Notify Clients in Real Time

Use an internal dashboard or webhook system to review results and flag mismatches. Once verified:

- Automatically notify the client via email or in-app update

- Provide next steps or approval message

- Store audit trails securely for compliance

This ensures your client onboarding process is fast and responsive, without compromising on regulatory checks.

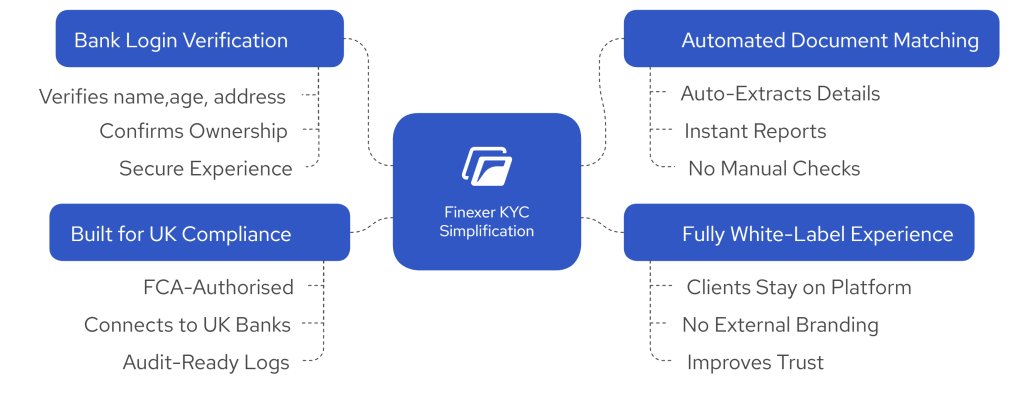

Finexer’s Role in Delivering a Smoother KYC Experience

Finexer is built for UK businesses that want to collect KYC data without frustrating their clients or delaying onboarding. If your team is tired of chasing documents, dealing with drop-offs, or explaining why you need a passport scan, this is where Finexer fits in.

Here’s what you get with Finexer:

1. Clients Log In to Their Bank — That’s It

Instead of uploading documents, clients can verify their identity by logging into their bank account.

- Confirms full name, address, and account ownership

- Feels secure and familiar to clients

- No more passport scans or proof of address uploads in most cases

This turns a high-friction task into a 30-second step, without losing compliance.

2. Still Need Documents? We Handle That Too

If you need an ID or utility bill for extra checks, Finexer supports that, too.

- Clients upload photos of their documents

- We extract the details automatically (name, DOB, address)

- You get a match report showing whether everything lines up

No manual checks. No chasing missing info.

3. Everything Happens in Your Branding

Finexer is fully white-label. Clients see your logo, your colours, and stay on your site or app.

- Keeps the process consistent and trustworthy

- Avoids confusion or suspicion from third-party links

- Designed for a smooth client onboarding experience

4. Always Compliant, Always Auditable

Finexer is FCA-authorised and built to meet UK KYC requirements.

- Works with over 99% of UK banks

- Stores full audit trails and verification logs

- Ready for reporting, inspections, or internal reviews

You stay compliant, without adding admin work for your team.

How VirtualSignature-ID Uses Finexer for Secure, Compliant KYC

VirtualSignature-ID (VSID), a UK government-accredited provider of digital identity and eSignature services, needed a reliable Open Banking partner to support high-value property transactions and AML compliance.

By integrating Finexer, VSID now delivers:

- Bank-based identity and source-of-funds verification for clients in legal and property sectors

- Automated AML checks, including PEPs and sanctions screening

- Frictionless client onboarding via Finexer’s embedded, white-label flows

- Payment initiation capabilities for transferring funds to designated client accounts

David Kern, CEO of VSID, shared:

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package. They’ve proven to be more than a provider — they’re a trusted partner who understands our vision and helps us achieve it.”

Wrapping Up

Getting KYC right is no longer just a regulatory checkbox; it’s part of your client experience. A clunky or confrontational customer KYC process can lead to drop-offs, missed revenue, and unnecessary back-and-forth.

But it doesn’t have to be that way.

With tools like Open Banking, real-time document extraction, and white-label identity flows, you can meet all compliance requirements and keep your clients comfortable. Whether you’re onboarding an individual or a business, reducing friction builds trust, and trust drives growth.

Platforms like Finexer are already helping regulated UK firms deliver faster, safer, and friendlier onboarding experiences. The result? More completed verifications, less manual work, and higher client satisfaction.

What’s the easiest way to verify client identity without documents?

Using Open Banking authentication through a provider like Finexer allows clients to verify their identity by logging into their bank account, no document uploads needed.

Can bank login verification replace passport or utility bill checks?

Yes, for many UK onboarding scenarios, bank-verified identity data meets KYC requirements. For high-risk cases, additional documents can be layered in.

Is a client-friendly KYC process still fully compliant?

Absolutely. As long as your provider is FCA-authorised and supports required checks (ID, PEPs, sanctions, proof of funds), you’re staying within UK regulatory boundaries.

What makes clients drop off during the KYC process?

Complex forms, unclear instructions, being redirected to third-party tools, and repeated document requests are the most common reasons.

Can I embed the KYC process in my own app or website?

Yes. With white-label solutions like Finexer, everything happens in your platform under your branding, so clients never feel like they’re leaving your environment.

Simplify your Client KYC process with secure, customer-friendly verification! Try Finexer today.