The UK has developed its own unique local payment schemes, separate from the SEPA system, to support bank transactions. Traditional schemes such as Bacs manage a large share of the payment volume. Concurrently, the UK is leading the way in creating a real-time payment system, enhancing its core infrastructure. For more detailed insights

What You’ll Discover in This Blog:

🗸 Overview of UK payment schemes including Bacs, Faster Payments, and CHAPS.

🗸 Details on the UK’s real-time payment infrastructure and its future developments.

🗸 Explanation of UK bank account formats and IBAN structure.

🗸 Insights into the Bank of England’s role in payment settlement and clearing.

🗸 How Finexer simplifies payment automation and treasury management in the UK.

Key Facts

Currency:

Pound Sterling (£)

ISO Currency Code:

GBP

ISO Country Code:

GB

IBAN Example:

GB29 MYBK 6026 1431 0379 19

Key Local Payment Schemes:

- Bacs Direct Credit

- Bacs Direct Debit

- Faster Payments

- CHAPS

Settlement Agent:

Bank of England

Payment Infrastructure in the UK

The UK’s interbank payment system is primarily based on domestic schemes, unlike many eurozone countries that utilise SEPA schemes. This is because SEPA does not support the British pound sterling, despite the UK’s participation in SEPA.

For businesses to utilise the UK’s domestic schemes, transfers must be sent in GBP between bank accounts located within the UK. This requires businesses to open a GBP account with a bank that has a UK branch. Contact us for recommendations and introductions to suitable banking partners.

The three main local payment schemes in the UK are Bacs (Direct Credit and Direct Debit), CHAPS, and the relatively new Faster Payments (FPS). These schemes define the transactional capabilities of banks and the primary transfer types available, which are similar to those under SEPA: credit transfers, direct debits, and instant credit transfers. A significant recent trend is the rise of the real-time Faster Payments scheme, leading to a shift away from batch-based systems.

Some elements of this ecosystem have been in place for decades: Bacs was introduced in 1968 and CHAPS in 1984. Currently, each scheme operates independently, but this is set to change with the introduction of the New Payments Architecture (NPA). The NPA aims to consolidate these schemes into a single settlement system within the next decade, representing a major overhaul of UK interbank payments.

Scheme Overview

| Scheme | Use Case | Settlement | Fees |

|---|---|---|---|

| CHAPS | High-value transactions | Same day | £20+ |

| Bacs Direct Credit | Regular bank transfers | 1-3 business days | £0.05+ |

| Faster Payments | Real-time payments | Near-instant | £0.50+ |

| Bacs Direct Debit | Regular, recurring payment collections | 1-3 business days | £0.05+ |

Push-Based Transfers

CHAPS, Bacs Direct Credit, and Faster Payments facilitate push transfers, each with distinct fees, settlement times, and use cases. Bacs Direct Credit (commonly referred to as a ‘bank transfer’) is used for regular payments such as salaries, pensions, and state benefits, processing transfers within approximately three business days.

CHAPS, one of the world’s largest high-value payment systems, is predominantly used for large transactions and corporate treasury operations. Faster Payments, launched in 2008, operates 24/7, 365 days a year, enabling funds to appear immediately in the payee’s bank account. While transfers are free for consumers, businesses may incur higher costs.

Pull-Based Transfers

Bacs Direct Debit is the UK’s primary pull payment method, commonly used by consumers to pay recurring bills and subscriptions. According to UK Finance, around 70% of all regular bill payments in 2022 were made using Direct Debit. Despite its popularity among consumers, businesses tend to use it less due to the lack of control over the amount and timing of outgoing transfers.

Market Data and Trends

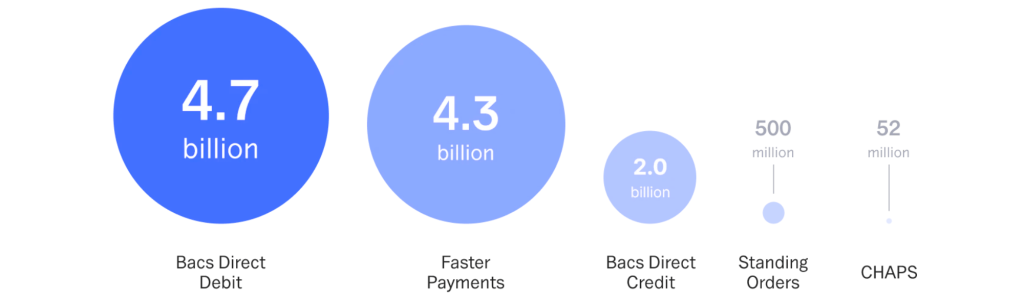

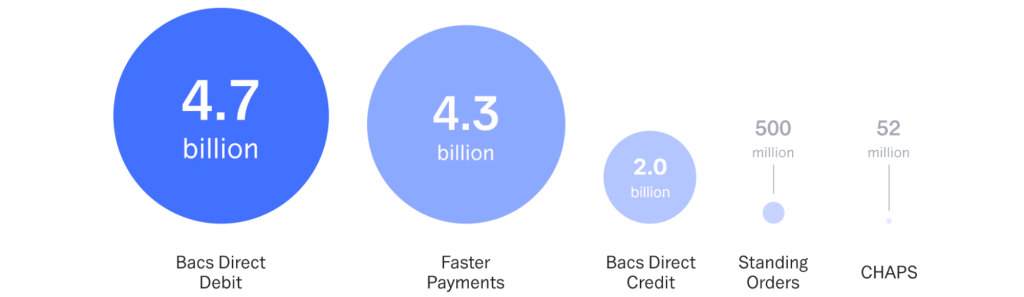

UK bank payments volume by scheme, 2022 (source: UK Finance)

UK Bank Transfers Volume by Scheme

Faster Payments is experiencing significant volume growth. In 2021, Faster Payments overtook Bacs Direct Credit as the most popular method among businesses, accounting for 43% of all transfers. Volumes have surged from 614 million transfers in 2012 to 4.3 billion in 2022, with an annual growth rate of 15-20%.

Total Transaction Value by Scheme (2021-2022)

| Scheme | 2021 Transaction Value | 2022 Transaction Value | Year-on-Year Growth |

|---|---|---|---|

| CHAPS | £86,316 billion | £98,643 billion | 14% |

| Bacs Direct Credit | £3,825 billion | £3,968 billion | 4% |

| Faster Payments | £2,597 billion | £3,243 billion | 25% |

| Bacs Direct Debit | £1,243 billion | £1,331 billion | 8% |

In 2022, CHAPS handled only 0.1% of the payment volume (52 million transactions) but represented 90% of the total value, amounting to £98.6 trillion. This underscores its importance for financial and corporate treasury purposes.

Within the Bacs scheme, Direct Debit accounts for 70% of the volume but only about 25% of the value, indicating that Direct Credit is used for larger transfers, such as government disbursements of state benefits and pensions.

Faster Payments has also seen strong growth in total transaction value, increasing by 25% from 2021 to 2022. The ongoing development of the UK’s open banking sector could further boost the growth of Faster Payments, especially if it gains traction in retail transfers.

UK Bank Account Numbers

| Format | Structure | Example |

|---|---|---|

| BBAN | AAAA XXXX XXYY YYYY YY | MYBK 6026 1431 0379 19 |

| IBAN | GBDD AAAA XXXX XXYY YYYY YY | GB29 MYBK 6026 1431 0379 19 |

Key Elements

| Element | Description | Example |

|---|---|---|

| Country Code | Represents the country | GB |

| Check Digits | Verification digits | 29 |

| Bank Code | Represents the bank | MYBK |

| Sort Code | Indicates the branch | 60-26-14 |

| Account Number | Unique customer account identifier | 3103 7919 |

The UK’s Basic Bank Account Number (BBAN) comprises a four-character bank code, six-digit sort code, and eight-digit account number.

The sort code, unique to the UK and Ireland, acts like a BIC or SWIFT code. Its first two digits identify the bank, while the last four pinpoint the branch. The account number specifies a bank account, typically with eight digits. Some banks use shorter numbers, adding leading zeros to reach eight digits. Account numbers are usually used with sort codes.

BBANs follow the AAAA XXXX XXYY YYYY YY format. A is the bank code, X the sort code, and Y the account number. The bank code matches the first four characters of the bank’s BIC code.

For international transactions, the International Bank Account Number (IBAN) is used. UK IBANs add a four-character header to the BBAN. This includes ‘GB’ (the UK’s ISO 3166 code) and two check digits.

UK IBANs are written as GBDD AAAA XXXX XXYY YYYY YY, where GB is the country code, DD the check digits, followed by the BBAN.

Clearing and Settlement

The Bank of England is the UK’s sole settlement agent, also running CHAPS. This differs from the SEPA region, where various local and pan-European clearing and settlement mechanisms (CSMs) operate.

The Bank of England’s real-time gross settlement (RTGS) system underpins sterling payment settlement. It holds accounts for banks and building societies, transferring funds in real time between account holders. This ensures risk-free, final, and irrevocable settlement.

The Bank of England is upgrading its RTGS service to meet ISO 20022 standards by 2025, alongside the implementation of the New Payments Architecture (NPA) to centralise UK schemes and boost real-time payments.’

Retail bank payment systems in the UK

UK Retail Bank Payment Systems

Bacs Direct Credit

- Introduced: 1968

- Operator: Bacs (now part of Pay.UK)

- Maximum amount: £20 million per payment (may vary by bank)

- Availability: Monday to Friday, 07.00 to 22.30

- Settlement: Up to three business days

- Fee per payment: Approximately 1.85 kr.

Bacs Direct Credit enables businesses of all sizes to pay directly into other bank or payment service provider (PSP) accounts within a three-day settlement period. It’s the most common method for regular payments, with about 8 in 10 Britons receiving their salaries through Direct Credit.

For businesses, Bacs Direct Credit offers significant advantages over cash and cheques. It allows for automated remittance and reconciliation, reduces security requirements, and simplifies cash flow forecasting due to its regular settlement cycle.

Direct Credit transfers can be submitted up to 30 days before the desired payment date, making it ideal for scheduled payments like salaries. Payments can be recalled if the bank or PSP is notified before the cut-off time.

Processing cycle

- Day 1: Payment files sent to Bacs between 07.00 and 22.30

- Day 2: Files delivered to recipient’s bank for processing

- Day 3: Funds credited to recipients’ accounts and debited from payer’s account

Pros and cons

Advantages:

- Cost-effective for bulk payments

- Reliable and widely accepted

- Suitable for regular, scheduled payments

- Allows advance submission of payment files

- Automated reconciliation possible

Drawbacks:

- Three-day settlement period

- Limited to UK bank accounts

- Not suitable for urgent or same-day payments

- Requires advance planning due to processing cycle

- May have transaction limits set by banks

Faster Payments

- Introduced: 2008

- Operator: Pay.UK

- Maximum amount: £1 million per payment

- Availability: 24/7, 365 days a year

- Settlement: Near real-time (typically within seconds)

- Fee per payment: Varies by bank, often free for personal accounts

Faster Payments enables near-instant transfers between UK bank accounts. It’s widely used for online and mobile banking, standing orders, and future-dated payments.

Processing cycle

- Payment initiated by sender

- Sender’s bank validates payment

- Payment sent to Faster Payments central infrastructure

- Recipient’s bank receives and processes payment

- Funds credited to recipient’s account

Pros and cons

Advantages:

- Near-instant transfers

- 24/7 availability

- Suitable for urgent payments

- Widely supported by UK banks

- Can be used for regular payments via standing orders

Drawbacks:

- Transaction limits may apply

- Not all banks support the £1 million limit

- Limited to UK bank accounts

- May incur fees for business users

CHAPS

- Introduced: 1984

- Operator: Bank of England

- Maximum amount: No limit

- Availability: Monday to Friday, 06.00 to 18.00

- Settlement: Same-day, real-time

- Fee per payment: Typically £25-£30, varies by bank

CHAPS (Clearing House Automated Payment System) is used for high-value or time-critical payments. It’s commonly used for property purchases, large corporate transactions, and interbank transfers.

Processing cycle

- Payment initiated by sender

- Sender’s bank processes and sends payment to CHAPS

- CHAPS validates and settles payment in real-time

- Recipient’s bank credits funds to account

Pros and cons

Advantages:

- No transaction limit

- Same-day, real-time settlement

- Highly secure and reliable

- Ideal for high-value transactions

Drawbacks:

- Higher fees compared to other payment methods

- Limited operating hours

- Not suitable for regular, low-value payments

- Requires manual processing by banks

- Pros: Bacs Direct Credit is open to any UK business with a bank account. It’s straightforward to manage, with automated remittance and reconciliation options, and offers relatively low fees per transaction.

- Cons: Due to its three-day settlement period and strict cut-off times, Bacs Direct Credit isn’t suitable for immediate or same-day payments. As a push-based method, it relies on the payer to initiate the transaction (unlike Bacs Direct Debit).

Bacs Direct Debit

- Year introduced: 1968

- Operated by: Bacs (now part of Pay.UK)

- Maximum amount: £250,000 per payment (may vary by bank)

- Availability: Monday to Friday between 07.00 and 22.30

- Settlement: Up to three business days

- Fee per payment: £0.05-0.50

The concept of direct debit emerged in the UK during the 1960s, and today, Bacs Direct Debit is the most prevalent method for recurring payments. A Direct Debit is an instruction from a customer to their bank, authorising an organisation to collect payments directly from the customer’s account.

This instruction takes the form of a Direct Debit mandate, providing advance notice of payment amounts and dates. It can be completed via a paper form or online.

Bacs Direct Debit is commonly used for regular bill payments and subscriptions, but it’s also suitable for invoices and one-off payments. However, its three business day processing cycle makes it unsuitable for same-day settlement, ruling it out for most retail and e-commerce scenarios.

If any changes occur to a Direct Debit’s amount, date, or frequency, the organisation must typically notify the customer at least 10 business days in advance. Under the Direct Debit Guarantee, customers are entitled to a full and immediate refund for erroneous payments.

Customers can cancel a Direct Debit at any time, usually by contacting their bank or building society.

Processing cycle

- Day 1: Payment files are sent to Bacs between 07.00 and 22.30

- Day 2: Files are delivered to the recipient’s bank for processing

- Day 3: Funds are credited to recipients’ accounts and debited from payers’ accounts

Pros and cons

- Pros: Bacs Direct Debit is available to any UK business with a bank account, offering a low-maintenance, long-lasting recurring payment mandate.

- Cons: It’s unsuitable for immediate or same-day payments due to the three-day settlement period. Insufficient funds in the payer’s account may result in the sending bank refusing the direct debit.

Looking ahead

The UK is making significant investments in its real-time infrastructure. A key aim of the New Payments Architecture (NPA) is to enable more real-time payments and gradually phase out the traditional three-day Bacs processing cycle. This shift from batch-based payments has major implications for businesses and platforms relying on manual workflows and legacy systems.

Real-time, 24/7 settlement means continuous payment initiation and receipt, regardless of time or day. This continuous settlement demands greater automation of initiation and reconciliation, live status tracking, and new workflows like automated retries and faster approvals.

Finexer’s platform is designed to support real-time payment flows in the UK and beyond, right out of the box. To learn how we can help your team prepare for real-time payments, contact us here

Variable Recurring Payments

Alongside the NPA and the rise of Faster Payments, the emergence of Variable Recurring Payments (VRPs) is potentially one of the most significant developments in UK bank payments in recent years.

VRPs are a type of open banking API enabling recurring payments similar to direct debits, but with variable amounts and frequencies without requiring reauthorisation from the account holder. Settlement occurs in real time. A potential use case could be paying a variable electricity bill based on actual consumption via a smart meter.

In 2021, the UK’s Competition and Markets Authority (CMA) mandated VRPs for sweeping services (or me-to-me payments) between bank accounts held under the same name. Since then, the UK’s largest banks have developed their own APIs to enable sweeping VRPs. Currently, there’s no equivalent mandate for commercial VRP use cases, such as bill payments.

If UK banks fully adopt commercial VRPs, businesses could benefit from lower transaction costs compared to card payments, while maintaining more control than direct debits. For consumers, VRPs could offer safer, more flexible recurring payments without manual form-filling.

How Finexer Can Help

Finexer provides access to local UK payment schemes through a single API, allowing you to continue using your existing banks. You can automate both credit transfers and direct debits from initiation to reconciliation, with built-in support for Faster Payments and real-time settlement.

Returns are handled automatically, and consolidated data from all your banks is available in the Finexer dashboard or via API, enabling real-time monitoring of transactions and balances.

This could save countless hours otherwise spent on manual payment initiation and tracking, not to mention the resources required to build and maintain direct integrations with UK banks.

UK bank payments are evolving, from real-time migration to potential NPA scheme changes. Finexer’s innovative platform streamlines payment and treasury automation, ensuring swift adaptation to infrastructure shifts. Our solution makes managing cash and automating payments at UK banks effortless, both now and in the future.

Are you a company seeking easier bank cash management or payment automation? We’d love to chat.