The information about Finicity Pricing in this blog was sourced from publicly available materials on 2026. Please note that details may be subject to change.

When businesses look for financial data aggregation and verification services, cost is a major factor in decision-making. Finicity Pricing is structured to serve enterprises that need secure, high-quality financial data solutions—but does it fit the budget of every business?

For companies operating in the UK, especially fintech startups, lending platforms, and accounting firms, evaluating Finicity’s pricing against alternative providers is essential to ensure they’re getting the best value for their investment.

In this blog, we’ll break down Finicity Pricing, highlight the factors influencing its costs, and compare it with a Affordable alternative for UK Businesses

We will guide you through:

What Does Finicity Offer?

Finicity, owned by Mastercard, provides a suite of financial data services, including:

- Data Aggregation & Insights: Secure access to financial data from multiple sources.

- Account Verification: Real-time bank account verification for onboarding and fraud prevention.

- Credit Decisioning: Helping lenders assess borrower risk using transaction history and cash flow insights.

- Open Banking APIs: Compliance-driven API solutions that connect businesses with consumer financial data.

These services are designed for enterprises that require secure, high-volume data processing, but they come with premium pricing, which may not be ideal for all businesses.

How Finicity Pricing Works in 2026

Finicity employs a customized, usage-based pricing model, tailoring costs to the specific needs and scale of each business. While exact pricing details are not publicly disclosed, the structure generally encompasses the following components:

1. API Usage

- Transaction-Based Fees: Businesses incur charges based on the number of API calls made for services such as account verification, transaction data retrieval, and credit decisioning insights. Higher volumes of API requests may qualify for tiered pricing discounts, which are typically negotiated directly with Finicity.

2. Service Bundles

- Solution-Specific Pricing: Finicity offers various solutions, including Finicity Pay™, Finicity Manage™, and Finicity Lend™, each with its own pricing structure that varies by API and usage volume. This allows businesses to select and pay for services that align with their specific requirements.

3. Custom Enterprise Solutions

- Tailored Integrations: For large enterprises requiring advanced security features, customized API integrations, or extensive data access, Finicity provides bespoke pricing options. This flexibility ensures that enterprise clients receive solutions that meet their complex needs, though it may come at a higher cost.

4. Additional Considerations

- Compliance and Support: As regulatory requirements evolve, Finicity may offer enhanced compliance tools and premium support services, which could influence overall pricing. Businesses should assess these factors in relation to their operational needs and budget constraints.

Finicity’s services are designed for large enterprises, but since it is not available in the UK, businesses in the region need a reliable alternative.

Why UK Businesses Need a Finicity Alternative

While Finicity offers a robust and secure financial data platform, there are several key limitations that make it less suitable for companies operating in the UK:

No UK Market Presence

- Unavailable Services: Finicity does not operate in the UK, which means businesses in the region cannot access its financial data aggregation or Open Banking solutions.

- Geographical Restrictions: Without a local presence, UK companies are left without direct support or services tailored to their market.

Lack of Local Regulatory Compliance

- FCA Regulation: Finicity’s services are not FCA-regulated, which is critical for businesses in the UK to ensure adherence to local financial standards.

- Compliance Challenges: Operating without local regulatory oversight can expose UK businesses to compliance risks when managing financial data.

Limited Integration with UK Financial Institutions

- Bank Connectivity Issues: Finicity’s platform does not offer seamless integrations with the majority of UK banks, limiting access to real-time financial data.

- Data Aggregation Limitations: The absence of strong local bank integrations can impede the effective aggregation of financial data needed for business operations.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Businesses Choose Finexer in the UK

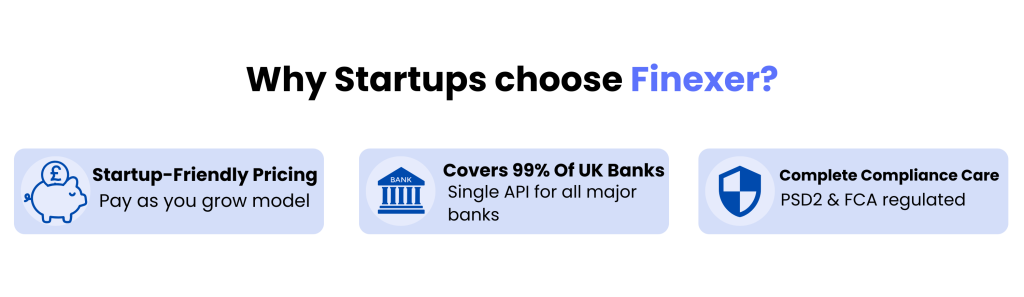

Finexer—a financial data provider specifically designed with the UK market in mind. Finexer delivers many of the core functionalities found in Finicity’s offerings but with a focus on affordability, local expertise, and simplicity.

1. Cost-Effective Pricing:

- Transparent and Predictable: Unlike the custom and usage-based model of Finicity Pricing, Finexer offers straightforward pricing structures that help businesses plan their budgets without unexpected spikes in costs.

- Usage-Aligned Costs: With a consumption-based model, you pay only for the services you use, making it ideal for smaller-scale operations or businesses experiencing rapid growth.

2. Local Market Focus:

- UK-Centric Integrations: Finexer’s services are tailored for the UK market, ensuring seamless integration with local banks and financial institutions. This local focus simplifies compliance with regional regulations such as Open Banking standards and FCA guidelines.

- Enhanced Local Support: With a team that understands the unique challenges of UK businesses, Finexer offers dedicated support to address region-specific issues quickly.

3. Simplified API and Integration:

- Ease of Implementation: Finexer’s developer-friendly APIs are designed for rapid deployment, reducing the complexity and time required to integrate payment and data aggregation solutions into existing systems.

- Streamlined Processes: By focusing on the most essential features, Finexer eliminates the need for extensive customization, enabling a smoother integration process.

4. Robust Security and Compliance:

- Tailored for UK Regulations: While Finicity Pricing includes comprehensive global security measures, Finexer offers targeted compliance and security features that meet UK-specific regulatory requirements without the additional cost burden.

- Built-In Fraud Prevention: With advanced security tools, Finexer ensures that businesses maintain high standards of data protection while keeping costs manageable.

| Service | Category | Description |

|---|---|---|

| Instant Payment | PIS (Payments) | Request to Pay-By-Bank for instant transactions. |

| Payout | PIS (Payments) | Instant refunds and withdrawals. |

| Bulk Payout | PIS (Payments) | Multiple payments in a single click. |

| Recurring Payment | PIS (Payments) | VRP (Variable Recurring Payments) and Sweeping. |

| Transactions Data | AIS (Data) | Real-time bank transaction data retrieval. |

| Balance Check | AIS (Data) | Access income, expenses, and balance information. |

| Authenticate | AIS (Data) | Retrieve account details, sort code, IBAN, and BIC. |

- API Call Volume: Costs increase based on the number of financial data requests made.

- Account Verification Fees: Charges apply per verification request, making it costly for high-volume onboarding.

- Enterprise Customization: Large businesses requiring tailored integrations may incur extra costs.

- Additional Fees: Fraud detection, data retention, and premium support may carry additional charges.

- Finicity: While Finicity offers strong compliance measures, it is not available for UK businesses and does not provide FCA-regulated Open Banking solutions.

- Finexer: Built for UK businesses, ensuring seamless FCA compliance, GDPR adherence, and Open Banking compatibility, all while providing dedicated local support.

Try Open banking with Finexer in 2026 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂