Instant payment systems have completely changed the way money flows between companies, retailers, and consumers in the digital age. Businesses now expect payments to clear in a matter of seconds and are accessible around the clock, eliminating the need for slow settlement cycles. Better cash flow, lower risk, and increased operational efficiency are the results of this change. Instant payment systems support modern commerce by facilitating real-time fund availability, significantly increasing business liquidity, and simplifying financial workflows, according to a recent EY industry report on European and UK payments.

This article examines the fundamental ideas behind instant payment systems, their development in the UK and worldwide markets, their advantages for companies, and how they are changing financial operations on all fronts.

What are instant payment systems?

Bank-to-bank payment infrastructures that enable instantaneous, delay-free money transfers are known as instant payment systems. Unlike consumer digital wallets like PayPal or Apple Pay, which operate on top of banking rails, these systems, which are governed and overseen by central banks or national payment councils, offer real-time settlement even outside of regular business hours.

Launched in 2008, the UK’s Faster Payments Service (FPS) was one of the first widespread instant payment systems in the world, enabling almost instantaneous GBP transfers for both consumers and businesses.

How Instant Payment Systems Help Businesses and Merchants

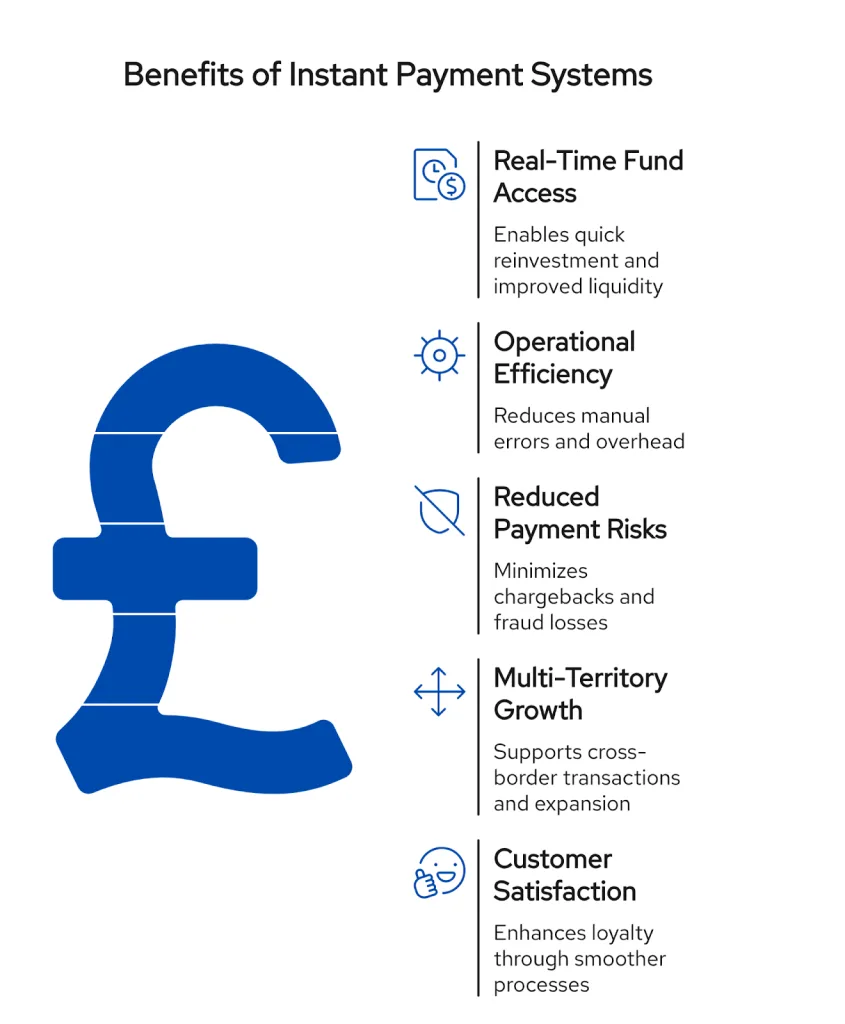

The B2B payment environment is changed by instant payments in the following ways:

- Providing Real-Time Fund Access: Instantaneous payments to businesses allow for improved liquidity and quicker reinvestment in business operations.

- Improving Operational Efficiency: Errors and overhead associated with manual accounting are decreased by automated reconciliation and instant confirmations.

- Reducing Payment Risks: Merchants experience fewer chargebacks and fraud losses when funds are transferred irrevocably.

- Facilitating Multi-Territory Growth: Multi-currency transactions and cross-border expansions are supported by unified payment rails.

- Improving Customer Satisfaction: Client loyalty and repeat business are increased by quicker refunds and smoother payment processes.

In addition to enhancing financial stability, these advantages put businesses in a better position to take advantage of new market opportunities more quickly than in the past.

What are instant payment systems?

Instant payment systems are bank-to-bank infrastructures that enable funds to be transferred and settled in seconds, 24/7, even outside regular banking hours.

Are instant payments secure and reliable?

Yes, instant payments feature strong security measures, including Verification of Payee (VoP), and operate under strict regulatory oversight, such as the UK’s Payment Services Directive.

Global Instant Payment Systems Compared

| Country / Region | System Name | Currency | Key Features / Notes |

|---|---|---|---|

| United Kingdom | Faster Payments Service (FPS) | GBP | In place since 2008; mature infrastructure; 24/7, sub-10 second settlement times. |

| Eurozone | SEPA Instant (SCT Inst) | EUR | Pan-European scheme; banks phased in for mandatory adoption from 2025; real-time euro transfers. |

| Bulgaria | Blink Instant Payments | BGN | Domestic system by BORICA; transfers in under 10 seconds; operates continuously. |

| Czech Republic | CERTIS Instant | CZK | Instant, 24/7 domestic CZK transfers run by the central bank. |

| Hungary | AFR (Azonnali Fizetési Rendszer) | HUF | Instant payments have been mandatory since ~2020 for amounts under set limits; they cover all domestic banks. |

| Poland | Express Elixir | PLN | 24/7 settlement; core rail for many local payment methods. |

| Romania | Transfond Instant | RON | Operates continuously/24/7; real-time domestic transfers. |

| Sweden | RIX-INST | SEK | Central bank-operated; supports high adoption; powers services like Swish. |

| Norway | Straksbetalinger | NOK | Real-time transfers between banks; supports popular wallet apps. |

| Denmark | Straksclearing | DKK | Integrated with services such as MobilePay; a national clearing system that works all the time. |

| Brazil | Pix | BRL | Very rapid adoption; <10 second transfers; uses QR codes, phone numbers, etc.; heavy usage in eCommerce. |

| India | UPI / IMPS | INR | UPI: massive monthly volumes, mobile-first; IMPS: legacy real-time support. |

| China | IBPS (CNAPS2) | CNY | Operated by People’s Bank; supports daily retail instant transfers. |

| Singapore | FAST / PayNow | SGD | FAST for bank transfers; PayNow adds mobile/email touchpoints; increasingly linked cross-border. |

| UAE | IPI / Aani | AED | Central bank systems; mobile/QR-based payments; linking with neighbouring instant rails. |

Key Instant Payment Systems Around the Globe

- UK: Faster Payments Service (FPS) enables GBP payments in seconds, driving real-time transactions domestically.

- Europe: SEPA Instant mandates real-time euro payments across 36 countries from 2025, supporting pan-European commerce.

- Americas: Brazil’s Pix powers instant payments for 40%+ of e-commerce; the US advances FedNow and RTP rails for real-time settlement.

- Asia-Pacific: India’s UPI dominates with billions of monthly transactions; Singapore’s PayNow pushes cross-border real-time capabilities.

The Changing Landscape of the UK Payment Market with Instant Payment Systems

| Aspect | Before FPS and Instant Systems | Current Landscape (2025) | Business Implications |

|---|---|---|---|

| Payment Settlement Time | Several business days | Seconds, 24/7 availability | Improved cash flow and operational agility |

| Annual Transaction Volume | Approx. 1 billion | Over 5 billion FPS transactions | Widespread adoption and trust in instant payments |

| Total Value Processed | Limited by slower rails | £4+ trillion annually across FPS | Supports large-scale commercial payment flows |

| Transaction Fees | Typically 1-3%+ for cards and cheques | As low as 0.1% on instant payment rails | Significant cost reductions for merchants |

| Chargeback and Fraud Incidence | Relatively high, manual dispute resolution | Near zero for instant payments, automated security | Reduced financial risk and dispute overhead |

| Payment Hours | Bank business hours only | Round the clock, including weekends and holidays | Enables global commerce and e-commerce growth |

| Reconciliation Process | Manual, time-consuming | Automated, real-time | Savings in finance team time and faster financial closes |

| Merchant Onboarding | Weeks to months | Hours to days | Faster access to new payment options and revenue streams |

Finexer’s function in the instant payment ecosystem

Although many platforms provide instant payment rail access, Finexer is a UK-based, FCA/PSD2-focused Open Banking provider that exposes a single API for account data and bank-initiated payments across 99% of the UK Banks, this allows companies to:

- Take advantage of extremely low transaction fees, which start as low as 0.1%.

- For digital invoicing and immediate payment approvals, make use of sophisticated features like Request to Pay.

- Give independent contractors and small businesses the ability to quickly collect money through secure payment links without the need for a website.

- Depend on improved fraud prevention and complete regulatory compliance, designed for growing B2B businesses.

Finexer is a prime example of how technology can streamline the intricacies involved in the adoption of instant payments, enabling these state-of-the-art systems to be accessed by parties other than major banks and fintechs.

Get Started

Learn how to integrate instant payment systems in your business and accept payments instantly

Test Us!Why Modern Businesses Need to Embrace Instant Payment Systems

Instant payment systems are now more than just a convenience in today’s rapidly changing financial environment; they are a strategic requirement for companies trying to stay ahead of the competition. Here are some reasons why companies should make implementing instant payments a top priority:

1. Reduce Capital Lock-Up and Enhance Cash Flow

Instead of waiting days for conventional bank transfers to clear, businesses can receive funds instantly thanks to instant payments. This quick access to funds facilitates more flexible reinvestment to support growth, enhances liquidity management, and lessens dependency on expensive credit lines.

2. Lower Transaction and Operational Costs

When compared to cheque processing or legacy card networks, instant payment rails usually have lower transaction fees. Furthermore, automating instant payment processing drastically lowers administrative errors, manual intervention, and reconciliations, which lowers operating costs and frees up finance teams to concentrate on higher-value tasks.

3. Improve Payment Certainty and Reduce Fraud Exposure

Instantaneous and irrevocable payment completion reduces the possibility of chargebacks and disputes. Businesses are further protected by enhanced fraud detection implementations like Verification of Payee (VoP), which ensures that funds are sent only to verified accounts and lowers financial losses from fraud.

4. Accelerate International Trade and Cross-Border Payments

With growing interoperability among instant payment platforms worldwide, businesses can leverage instant payments to execute fast and cost-effective cross-border transactions. This is vital in expanding into new markets and supporting global supply chains without delays or expensive correspondent banking fees.

5. Enhance Customer Experience with Fast, Frictionless Payments

Immediacy and convenience have become more important to consumers. In competitive digital commerce, providing instant payment options not only eases the checkout process but also facilitates quicker refunds and real-time payment confirmations, both of which are essential for boosting customer satisfaction and cultivating loyalty.

Instant payment system adoption is expected to increase significantly as the UK market develops further, thanks to infrastructure improvements, ongoing open banking innovations, and supportive regulatory reforms. Companies that adopt this shift have the potential to turn payments from a bottleneck into a vital source of operational excellence and competitive advantage.

How have instant payment systems impacted business payments in the UK?

The UK’s Faster Payments Service (FPS) has transformed payments by enabling over 5 billion near-instant GBP transactions annually with £4+ trillion value. This evolution has reduced settlement times from days to seconds, improved cash flow, lowered fees, and enabled 24/7 availability.

What benefits do instant payments bring to customer experience?

Instant payments enable frictionless transactions, immediate refunds, and faster payment confirmations, significantly improving customer satisfaction and loyalty.

Conclusion

Instant payment systems are now essential for companies to compete in the fast-paced economy of today, not just a “nice-to-have”. They guarantee seamless customer experiences while eliminating delays, cutting expenses, and giving businesses more control over liquidity.

Instant payments are raising the bar for global trade thanks to initiatives like the UK’s Faster Payments, Europe’s SEPA Instant, and international breakthroughs like Brazil’s Pix and India’s UPI. Every industry’s financial operations are changing due to the ability to transfer money in a matter of seconds.

The message is clear for businesses in the UK and abroad: implementing instant payments is a strategic advantage. Platforms like Finexer, which offer unified API access, compliance, and sophisticated features intended for expansion, make this adoption easier.

Ready to speed up your business payments and improve cash flow?Get started with instant payment systems today!