Getting paid on time is not just ideal, it’s essential for maintaining healthy cash flow. Yet, late payments remain a persistent challenge for UK finance teams. In most cases, the issue isn’t the invoice itself, but the absence of a clearly enforced late fee policy.

According to Open Banking UK’s recent insight, 70% of small businesses using open banking-enabled cloud accounting platforms have seen measurable improvements in handling late payments. These gains come from better payment documentation, smarter tools, and proactive payment terms enforcement.

Many businesses include invoice late fees in their contracts, but these are often vague or inconsistently applied. When clients don’t understand or take the policy seriously, the result is more unpaid invoices and more time wasted on follow-ups.

In this guide, you’ll learn:

- What makes a late fee policy enforceable and respected

- How to build strong payment terms enforcement into every client engagement

- Why digital tools like Finexer help finance teams automate invoice late fees and maintain complete payment documentation

Creating an enforceable late fee policy is about being clear, compliant, and consistent. Let’s break it down.

Why Many Late Fee Policies Fail

On paper, a late fee policy might seem like enough to prevent overdue payments. But in reality, most policies go unenforced or ignored because they lack the three things that make them effective: clarity, consistency, and automation.

Let’s look at the most common reasons your late fee policy may not be working:

1. Vague Payment Terms

When clients aren’t sure what counts as “late,” or how much they’ll be charged, they’re unlikely to take your policy seriously. Strong payment terms enforcement starts with clearly defined timelines, grace periods, and invoice late fees spelt out in every agreement.

2. Poor Communication

A common mistake is assuming clients will read the fine print. Without upfront conversations and visible reminders, even the best late fee policy can fall through the cracks. Your team must make payment documentation easy to understand and impossible to overlook.

3. Manual Follow-Ups

Chasing payments manually drains resources and increases the risk of inconsistency. If some clients are followed up with while others are not, your policy becomes unreliable. Without automation, payment terms enforcement tends to slip through the gaps.

4. Lack of Legal Support

Some policies use fee rates or terms that aren’t enforceable under UK law. If your invoice’s late fees aren’t legally sound, clients can dispute or ignore them. A well-documented late fee policy, backed by proper contracts and compliant payment documentation, is critical.

Businesses that rely on guesswork or informal agreements often struggle the most. An effective late fee policy should be as solid and repeatable as your billing process.

📚 Guide to Cashflow Monitoring

The Core Elements of an Enforceable Late Fee Policy

If your goal is to reduce late payments without damaging client relationships, your late fee policy needs more than just a line item in a contract. It should be structured, legally sound, and supported by clear payment documentation.

Here are the four core elements every enforceable late fee policy must include:

1. Clear Payment Terms

Effective payment terms enforcement begins with total clarity. Your invoice should answer three questions upfront:

- When is the payment due?

- Is there a grace period?

- What fee applies if the deadline is missed?

State exact dates, not vague timeframes. For example, “Payment due within 30 days” is less enforceable than “Payment due by 15 July 2025.” Similarly, a clear invoice late fee clause such as “A 2% monthly fee will apply to unpaid balances” makes expectations transparent.

2. Legally Compliant Fee Structures

To make your late fee policy enforceable in the UK, the terms must comply with applicable laws. This includes:

- Keeping late fee rates within reasonable legal bounds

- Clearly stating those terms in signed agreements

- Applying fees fairly and consistently

If you’re unsure whether your invoice late fees align with legal limits, it’s worth seeking advice. A legally compliant policy makes payment terms enforcement more credible and less likely to be challenged.

3. Transparent Client Communication

Most clients aren’t trying to avoid payment. They’re just more likely to delay if the consequences aren’t clear. This is where communication matters.

- Include late fee policy summaries in your onboarding material

- Reiterate payment terms when sending invoices

- Use polite reminders that reference the documented terms

Clients are far more likely to act on time when they understand both the timeline and the cost of delay. Good payment documentation turns your terms into a professional standard rather than a personal request.

4. Consistent Enforcement Through Automation

Even the best late fee policy can fail if it’s enforced inconsistently. Manually tracking overdue invoices or sending reminders leads to errors and delays.

Using an automated system ensures:

- Every client receives the same reminder sequence

- Invoice late fees are applied automatically after the due date

- You have a complete payment documentation trail in case of disputes

This is where platforms like Finexer provide a major advantage, helping finance teams manage and enforce policies with minimal effort.

Automating Late Fee Enforcement with Finexer

Even the most carefully written late fee policy won’t have much impact unless it’s backed by real-time enforcement. That’s where Finexer’s Open Banking API offers a significant advantage. Instead of relying on manual tracking, reminders, or spreadsheet alerts, Finexer gives you the tools to enforce payment terms automatically and with precision.

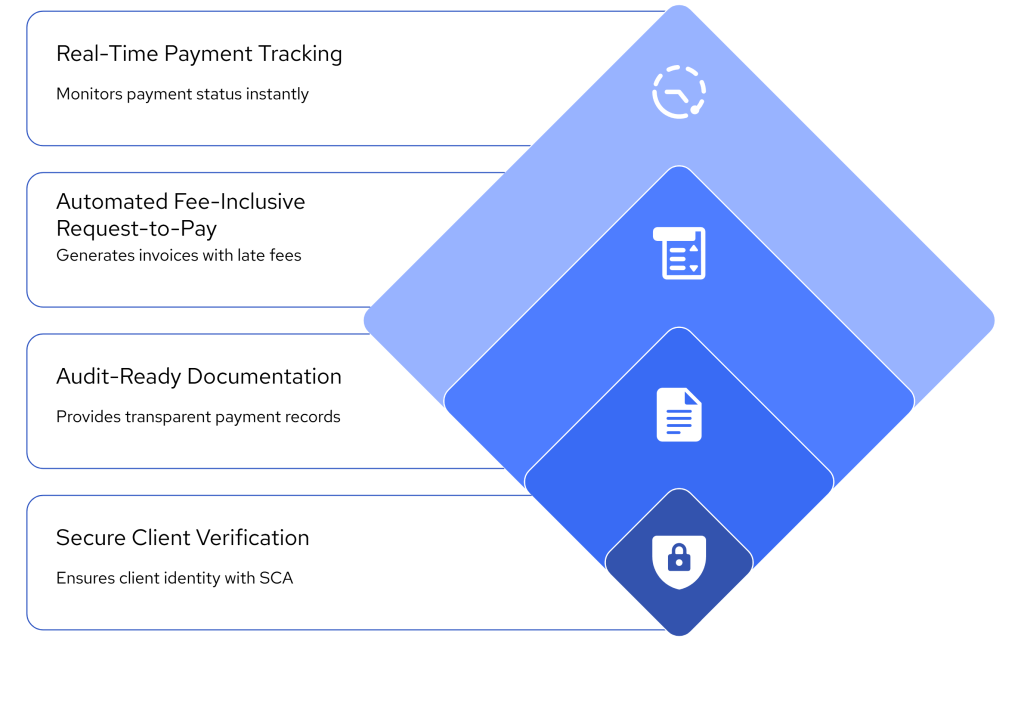

Here’s how Finexer helps you put your late fee policy into action:

1. Real-Time Visibility for Every Invoice

Finexer connects directly with 99% of UK bank accounts, allowing you to track incoming payments in real time. This makes it easy to spot when a payment is overdue and apply your invoice late fees without delay.

With real-time visibility:

- You always know which payments are late

- Your team can act instantly without guesswork

- Payment documentation is always up to date

2. Automated Payment Requests That Include Late Fees

Using Finexer’s Request-to-Pay feature, you can send payment reminders that automatically include any applicable late fees. Clients receive a clear, secure payment link showing the updated amount — no manual editing or awkward follow-ups needed.

This creates a consistent and professional approach to payment terms enforcement, while removing friction from the process.

📚 Guide to Enterprise Payment Terms

3. Strong Customer Authentication (SCA) Built In

Every payment made through Finexer is authenticated at the client’s bank using SCA. This protects against fraud and ensures a secure, verified transaction record, key for supporting your late fee policy and avoiding disputes.

4. Audit-Ready Payment Records

Every action, from sending the initial request to confirming payment, is logged and time-stamped. This provides a clear audit trail, strengthening your payment documentation and making your invoice late fees far more defensible in case of any challenge.

5. Fast Setup Without Developer Involvement

Finexer’s API and ready-to-use tools can be deployed quickly, even without a full tech team. For busy finance teams, this means you can start enforcing your late fee policy and automating your payment terms in days, not months.

When your late fee policy is tied directly to real-time banking data and automated follow-ups, it moves from being a theoretical deterrent to a working system that protects your cash flow.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Conclusion: From Policy to Payment

Creating a late fee policy isn’t just about protecting your bottom line, it’s about setting clear expectations and ensuring accountability. When clients know what’s expected, when it’s due, and what happens if they miss a deadline, payment behaviours change.

But policy alone isn’t enough. Without consistent payment terms enforcement and reliable payment documentation, your efforts can fall apart. That’s why more finance professionals are moving to automated, bank-connected systems that make invoice late fees easier to manage and harder to ignore.

Finexer helps you bridge that gap by combining real-time bank data, secure client communication, and automatic enforcement tools into one simple platform.

What is a late fee policy and why do I need one?

A policy defines when an invoice is late, the fee owed, and how it is applied, keeping payment terms enforceable and cash flow steady.

Is it legal to add invoice late fees in the United Kingdom?

Yes, if the fee is reasonable, disclosed before work starts, and noted in signed agreements, it is legal and enforceable.

How much can I charge in invoice late fees?

Most firms choose a flat fee or about two per cent per month; confirm the exact rate with legal counsel to stay within UK rules.

How do I enforce a late fee policy without harming relationships?

Set clear terms, put them on every invoice, and send polite automated reminders so enforcement feels professional, not personal.

Late fee policy built? Automate the follow-up with Finexer. Book a quick demo and see real-time tracking, instant reminders, and Request to Pay Works!