Note: This article’s information about Modulr’s pricing and services is based on research as of 2026.

What You Will Discover:

Introduction

The financial services sector in the United Kingdom continues to undergo substantial changes in 2026. Once dominated by traditional banking methods, business payments now incorporate new technologies that prioritise speed, security, and cost reduction. This evolution particularly affects UK businesses seeking reliable payment processing solutions.

Companies face pressure to reduce transaction costs and increase payment speed, so the market has developed two distinct approaches. Traditional payment providers maintain established infrastructure focused on enterprise clients, while open banking solutions offer direct bank-to-bank connections that reduce intermediary involvement.

Recent UK financial data indicates that businesses processing payments through traditional methods often face higher transaction fees and longer settlement periods. In contrast, open banking payments have demonstrated the ability to reduce costs through direct bank connections, with settlement times measured in minutes rather than days.

New to Open Banking? Let Our Experts Show You How It Works: Book Your Personalised Demo and Strategy Session → Click here

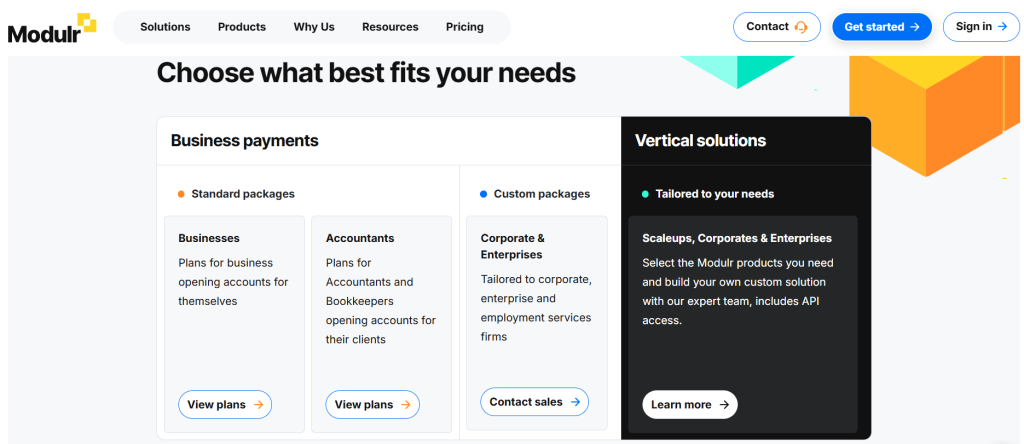

Modulr’s Comprehensive Service Structure

Modulr has established itself in the UK market with a service architecture designed to address various business payment needs. Their approach divides services into three distinct categories, each targeting specific business requirements and operational scales.

Standard Business Package: Core Payment Processing

Modulr’s standard business solution focuses on companies managing their own financial operations. This package serves as the foundation of their service offering, providing essential tools for business account management.

The standard package demonstrates careful consideration of basic business payment needs. Companies using this tier receive access to account opening services and fundamental payment processing capabilities. This level suits businesses that handle their financial operations internally and need reliable payment processing systems.

Professional Services Solution: Accountant-Specific Features

The accountant-focused tier reveals Modulr’s understanding of professional service requirements. This package extends beyond basic payment processing to address the specific needs of accounting professionals and bookkeepers who manage multiple client relationships.

Through this service level, accountants receive tools designed for client account management. The system allows professional service providers to maintain separate financial records for each client while processing transactions through a unified platform. This approach particularly benefits accounting practices that must maintain a clear separation between client accounts while managing multiple financial relationships.

Enterprise-Level Offerings: Custom Corporate Solutions

Modulr’s corporate and enterprise services represent their most sophisticated offering. This tier moves beyond standardised solutions to provide tailored systems developed with their expert team. The service specifically addresses the needs of larger organisations, particularly those in corporate environments and employment services.

The enterprise-level demonstrates particular attention to complex payment requirements. This tier’s organisations can work with Modulr’s team to develop payment solutions that match their specific operational needs. This collaboration ensures that larger organisations receive systems aligned with their particular industry requirements while maintaining necessary compliance standards.

This comprehensive service structure indicates Modulr’s focus on serving various business scales and types. Each tier builds upon the previous level, adding features and capabilities designed to match increasing operational complexity.

Understanding Modulr’s Standard Business Package

1.Bronze Package: Starting Point for Growing Businesses

The Bronze package serves as an entry point for businesses beginning to structure their payment operations. This tier provides:

Payment Processing:

- 200 monthly payments included in the base package

- Additional payments cost £0.35 each

- CHAPS payments available at £17.50 per transaction

- Free account transfers between Modulr accounts

- 3 connected integrations for linking with business tools

Account Management:

- 10 total accounts for business operations

- 10 users can access the system

- Built-in notifications and reporting tools

- Mobile app approval system for payment security

2.Silver Package: Mid-Scale Business Operations

The Silver tier suits businesses with growing transaction needs and more complex operations:

Payment Processing:

- 500 monthly payments in the base package

- Reduced cost of £0.29 for each additional payment

- Same CHAPS payment rate at £17.50

- Free account transfers maintained

- 5 connected integrations available

Account Management:

- 20 accounts for broader business operations

- 20 user access points

- Enhanced notification and reporting systems

- Mobile approvals with additional security features

3.Platinum Package: Full-Scale Business Solutions

The Platinum tier provides comprehensive support for businesses with substantial payment volumes:

Payment Processing:

- 2,500 monthly payments included

- Lowest additional payment rate at £0.24 per transaction

- Standard CHAPS rate maintained at £17.50

- Unlimited free account transfers

- Unlimited integration connections

Account Management:

- Unlimited account creation capability

- Unlimited user access

- Premium notification and reporting tools

- Advanced mobile approval systems

Selecting the Right Package for Small Businesses

Bronze Package:

- Lower initial commitment with 200 monthly payments

- Manageable number of user accounts (10) for small teams

- Essential features included:

- Batch payment submissions

- Basic reporting tools

- Mobile app approvals

- Three integration connections sufficient for core business tools

Stop Overpaying on Payment Processing: Book a Free Strategy Session with Our Open Banking Specialists to See How Much You Could Save → Click here

Understanding Modulr’s Accountant-Specific Packages

Let’s examine how Modulr structures its services for accounting professionals, analysing what each tier offers and how it serves different practice sizes. This understanding helps accountants select the most suitable package for their client base and transaction needs.

📚 Learn more about Open banking Use Cases for Accountants

1.Bronze Package: Foundation for Growing Practices

The Bronze tier serves as an entry point for accounting practices beginning to digitise their payment operations. This package includes:

Payment Processing Capabilities: The system allows for 200 monthly transactions, with each additional payment costing £0.35. For a practice handling client payments, this translates to approximately 8-10 transactions per business day. CHAPS payments remain accessible at £17.50 per transaction, while account-to-account transfers within Modulr come at no additional cost.

Practice Management Features: Accounting firms can manage up to 10 client accounts, suitable for smaller practices or those transitioning to digital payments. The system accommodates 10 team members, allowing for essential staff access while maintaining security. Three connected integrations enable linking with common accounting software and business tools.

Client Service Tools: The Bronze package includes the Delegate Dashboard, allowing practices to access and manage all client accounts from a central location. The mobile app approval system adds security to payment processes, while notifications and reporting tools help maintain oversight of all transactions.

2.Silver Package: Supporting Growing Practices

The Silver tier addresses the needs of established practices with a growing client base:

Enhanced Payment Capacity: With 500 monthly transactions included and additional payments at £0.29 each, this tier supports practices handling around 20-25 transactions per business day. The reduced per-transaction cost becomes particularly valuable as payment volumes grow.

Expanded Practice Operations: Practices can manage up to 20 client accounts and grant access to 20 team members. Five connected integrations allow for more comprehensive software connectivity, supporting diverse client needs and internal processes.

Advanced Management Tools: The package maintains all core features of the Bronze tier while accommodating higher volumes and more complex operations. The increased user access supports growing teams while maintaining security and oversight.

3.Platinum Package: Comprehensive Solution for Larger Practices

The Platinum tier provides full-scale support for established practices with substantial client bases:

Substantial Transaction Volume: Including 2,500 monthly transactions with additional payments at £0.24 each, this tier suits practices processing over 100 transactions daily. The reduced per-transaction cost significantly benefits high-volume operations.

Unlimited Operational Capacity: Practices can manage unlimited client accounts and user access, supporting large-scale operations. Unlimited integration connections allow for comprehensive software ecosystem development.

Premium Features: Exclusive access to premium client onboarding tools enhances the practice’s ability to manage new client relationships efficiently. The unlimited capacity for accounts and users removes any constraints on practice growth.

Selecting the Right Package for New Accounting Practice

The Bronze package provides 200 monthly transactions, translating to approximately 8-10 transactions per business day. This volume comfortably supports initial operations for a new accounting practice typically starting with 3-5 clients. The £0.35 cost for additional transactions allows for flexible growth without substantial upfront costs.

Download Open Banking USP for Startups in the UK

Finexer: A Modern Open Banking Alternative for UK Startups

As we examine the payment processing landscape for UK startups, Finexer emerges as a compelling alternative to traditional payment providers like Modulr. Let’s explore how Finexer addresses common startup challenges through its innovative approach to financial technology.

Understanding Finexer’s Startup-Focused Approach

Where traditional payment providers often create services for established enterprises, Finexer has developed its platform specifically for startups and growing businesses. This fundamental difference shapes every aspect of their service delivery, from pricing to technical implementation.

Cost-Effective Payment Processing

Finexer’s pricing model stands out through its consumption-based structure. The system allows companies to pay based on actual usage rather than requiring businesses to commit to rigid payment tiers. This approach is particularly valuable for startups, where transaction volumes may vary significantly during early growth.

For new businesses, this flexible pricing means:

- No upfront commitment to high monthly minimums

- Payment costs that scale naturally with business growth

- Reduced financial pressure during quiet periods

- Clear, predictable costs for financial planning

Technical Implementation Advantages

Finexer’s platform connects to 99% of UK banks through a single integration point. This technical architecture delivers several key benefits for startups:

Implementation speed increases significantly, with deployment typically happening 2-3 times faster than traditional solutions. The platform’s single-app approach simplifies daily operations, which is particularly beneficial for startups with limited technical resources.

Growth-Supporting Infrastructure

The platform’s infrastructure supports business growth from 100 to 100,000 transactions while maintaining 98% uptime. This scalability eliminates the need for additional technical investment as your business expands, allowing startups to focus resources on core business development.

Comprehensive Compliance Management

Finexer’s FCA-authorised infrastructure automatically handles compliance requirements for startups navigating the complex UK financial regulations. This built-in compliance management reduces operational overhead and risk, which is particularly valuable for new businesses establishing their market presence.

Strategic Partnership Approach

Beyond basic payment processing, Finexer positions itself as a strategic growth partner. Their team provides dedicated support and guidance, helping startups optimise their payment operations and plan for growth. This consultative approach proves especially valuable for businesses new to the financial technology sector.

Practical Advantages for UK Scaleups

The real-world impact of choosing Finexer becomes clear when examining specific startup scenarios. A new business processing 1,000 monthly transactions might save up to 90% on processing fees compared to traditional providers. This cost reduction directly impacts cash flow and profitability during crucial early growth stages.

Ready for a more personal approach? Our payment specialists are here to help you! Book a Demo Now 🙂