If you are still managing your VAT returns through Excel spreadsheets, you are not alone. Thousands of UK businesses prefer using Excel due to its flexibility and familiarity. However, with HMRC’s Making Tax Digital (MTD) rules now mandatory for VAT-registered businesses, staying compliant requires a bit more than just good record-keeping.

This is where MTD bridging software plays a crucial role. It allows businesses using Making Tax Digital spreadsheets to continue working in Excel while still meeting HMRC’s digital submission requirements.

By connecting your spreadsheet directly to HMRC systems, bridging software ensures that you can submit VAT returns digitally without switching to full accounting software.

In this guide, we’ll explain exactly how MTD bridging software for Excel works, what HMRC expects when it comes to digital links, and how to choose the best solution, even if you’re looking for free Excel bridging software for MTD options.

Keep Reading or Jump to the section you’re Looking for:

What is MTD Bridging Software?

Making Tax Digital bridging software is a tool that connects your Excel spreadsheets to HMRC’s systems. Instead of manually entering figures into the HMRC portal, bridging software picks up the data directly from your spreadsheet and submits it digitally, as required by MTD rules.

Many businesses still rely on Excel because of its flexibility for calculations, record-keeping, and tracking VAT. However, HMRC now demands that VAT returns be submitted through digital links — manual copy-pasting is no longer allowed. This is where MTD bridging software for Excel becomes essential.

By using bridging software, you can continue working in familiar making tax digital spreadsheets without having to move everything into a full accounting program. It acts like a bridge between your existing Excel setup and HMRC’s Making Tax Digital platform.

If you’re running VAT reports manually today, switching to a trusted bridging software for MTD Excel solution ensures you meet the legal requirements without disrupting your processes.

Can You Still Use Excel for MTD Compliance?

Yes, you can still use Excel to manage your VAT records — but only if you meet certain conditions set by HMRC.

Simply filling in an Excel spreadsheet is not enough; to stay compliant under Making Tax Digital, your spreadsheet must connect to HMRC through approved digital links.

This is where making tax digital spreadsheets combined with bridging software come into play. The spreadsheet must store your VAT calculations digitally and transfer the data automatically to your bridging software, without any manual copying or pasting.

For example, you might maintain your Excel VAT records by calculating sales and purchase totals using formulas. As long as those totals feed directly into your MTD bridging software via a digital link, such as cell references or automated macros, your process remains compliant.

However, if you manually re-type or copy values from one document to another, you risk breaking HMRC’s digital link rules. Digital links are designed to create a clear audit trail, ensuring that your VAT submission flows directly from your original data without any manual interference.

In short:

- Allowed: Formulas, cell references, macros, API integrations.

- Not Allowed: Manual copying, cutting, or retyping figures.

If you want to keep using Excel for VAT tracking, you must use either a standalone MTD bridging software for Excel or a spreadsheet solution that supports compliant digital links.

Digital Link Requirements Explained

A key rule under Making Tax Digital is the use of digital links. If you want to continue using Excel spreadsheets, understanding what qualifies as a digital link is crucial.

HMRC defines a digital link as any electronic or automated transfer of data between software programs, systems, or spreadsheets, without the need for manual intervention. In simple terms, once your figures are entered into your making tax digital spreadsheets, they must flow automatically through to your submission software.

Here’s what counts as a digital link:

- Cell references across worksheets

- Formulas pulling totals from transaction logs

- Macros that automate movement of data

- APIs connecting Excel to a bridging software system

- XML or CSV exports/imports (without manual editing)

Here’s what does NOT count:

- Manual copying and pasting figures from Excel to another file

- Typing numbers manually into a separate form or software

- Editing data after exporting/importing

To stay compliant, businesses using Excel need to ensure that their spreadsheet totals are linked directly into a bridging software for MTD Excel solution.

The digital journey must be seamless from your original transaction records to your final VAT submission.

If you break the digital link — for example, by retyping totals — you risk non-compliance and possible penalties.

Maintaining proper digital links not only keeps you within the law but also reduces errors and improves the accuracy of your VAT filings.

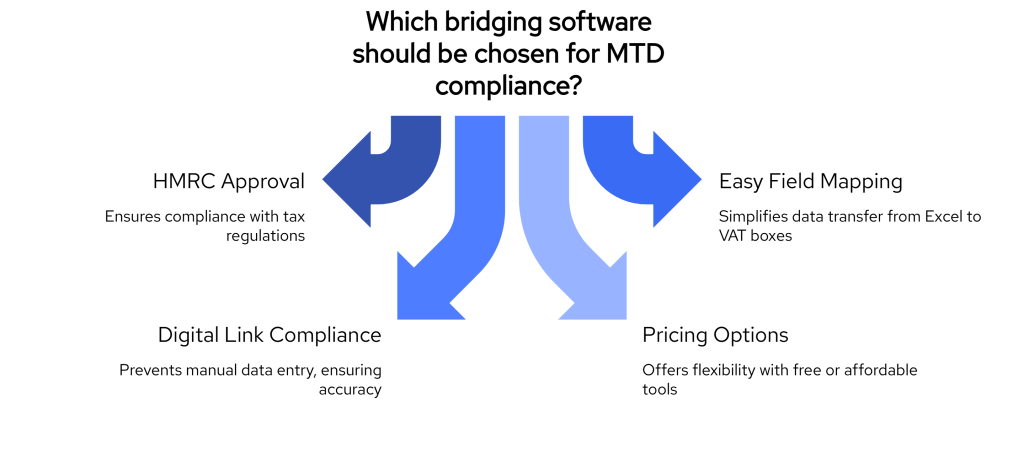

Choosing the Right Bridging Software for Excel

Selecting the right MTD bridging software for Excel can make the difference between a smooth VAT return process and a stressful last-minute rush. With so many options available, it’s important to know what features to look for when deciding.

Here are some key factors to consider:

1. HMRC Recognition

Always ensure the software you choose is listed on HMRC’s official list of approved MTD suppliers.

This guarantees that your VAT returns will be accepted without any technical issues.

2. Easy Mapping from Excel

Good bridging software should allow you to map your spreadsheet fields directly to the required VAT return boxes.

The simpler the mapping, the faster your submission process will be.

3. Digital Link Support

The tool must maintain digital links between your making tax digital spreadsheets and the VAT submission file, ensuring full MTD compliance without manual copying.

4. Flexible Pricing Options

If you are a small business or only submit VAT returns a few times a year, you might benefit from free Excel bridging software for MTD or pay-per-use options.

Several bridging software providers offer affordable or even free plans depending on your needs.

5. Multi-Client Handling (for Agents)

If you manage VAT submissions for multiple businesses, choose a solution that can handle multiple clients easily from one dashboard.

Choosing a well-designed MTD bridging software for Excel ensures that you stay compliant while continuing to use the spreadsheet systems you already know.

Whether you go for a premium tool or a free Excel bridging software for MTD, always prioritise ease of use, compliance, and reliability.

Popular Bridging Software Options for MTD

Below is a quick, neutral look at some of the most widely used Making Tax Digital bridging software tools for Excel users. Each option supports digital links and direct VAT submissions, and some even provide a free Excel bridging software for MTD tier so small firms can test them without risk.

1.TaxCalc Excel VAT Filer

- Summary: A desktop application that pulls VAT boxes straight from your spreadsheet and sends them to HMRC.

- Key Features: Simple cell-mapping wizard, built-in error checks, multi-client dashboard for agents.

- Pricing: One-off licence fee; no recurring subscription for standard edition.

2.BTCSoftware MTD VAT Solution

- Summary: Cloud-connected tool aimed at accountants handling multiple entities.

- Key Features: Supports group VAT, bulk submissions, and keeps an audit trail for each client.

- Pricing: Annual subscription based on number of companies; 14-day free trial available.

3.Absolute Excel VAT Filer

- Summary: Lightweight add-in that sits inside Excel, ideal for businesses that want to avoid extra log-ins.

- Key Features: Uses macros to create the digital link, auto-validates figures before submission, minimal setup.

- Pricing: Low one-off cost per user; discounted bundles for accountancy firms.

4.QuickBooks Bridging Module (Excel)

- Summary: For users already on QuickBooks but still collecting data in spreadsheets.

- Key Features: Drag-and-drop upload, secure transfer into QuickBooks, consolidated VAT history in one place.

- Pricing: Included in select QuickBooks plans; no extra charge if you have an active subscription.

5.MTDfVAT (Free Option)

- Summary: A no-cost desktop tool maintained by a small UK software house, suitable for very small businesses.

- Key Features: Basic VAT return submission from Excel, supports single company, digital link compliant.

- Pricing: Completely free; donations accepted for ongoing development.

Choosing the right bridging software for MTD Excel comes down to volume of returns, budget, and how much automation you need. Test any shortlisted tool in advance and confirm it appears on HMRC’s recognised supplier list before filing a live VAT return.

How Finexer Helps Businesses Using Excel Stay MTD-Compliant

If you’re using spreadsheets to manage VAT returns under Making Tax Digital (MTD), having accurate, up-to-date financial data is just as important as having compliant bridging software. This is where Finexer supports businesses and accountants working in Excel environments.

With Finexer, you can connect directly to 99% of UK banks and pull real-time transaction data into your spreadsheet or bookkeeping system, helping you maintain complete, digital VAT records without relying on manual entry or missing bank statements.

Why Finexer Works Well Alongside Excel Bridging Software

| Feature | Benefit for Your VAT Process |

|---|---|

| 99% UK bank coverage | Instantly access bank transactions across nearly all UK institutions |

| Real-time feeds | Keep your Excel records updated ahead of VAT deadlines |

| No monthly minimums | Flexible for small businesses, seasonal firms, and growing practices |

| Fast client onboarding | Connect a business bank account and start syncing in days, not months |

| FCA-authorised and UK-hosted | Meets strict security, data protection, and compliance standards |

| Scales with your needs | Start with one VAT client and expand easily as your client base grows |

How Finexer Fits Into Your MTD Workflow

- Use Excel spreadsheets to track and calculate VAT figures as usual.

- Connect your clients’ bank accounts through Finexer to automatically pull live transaction data.

- Maintain secure digital records without chasing statements manually.

- Map your VAT totals into your bridging software for seamless, compliant submission to HMRC.

Finexer makes it easier for businesses and accounting firms to keep their making tax digital spreadsheets complete, accurate, and audit-ready, ensuring a smoother MTD compliance process when using Excel.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Wrapping Up

Staying compliant with Making Tax Digital doesn’t mean abandoning the spreadsheets you already know. By pairing Excel with a trusted MTD bridging software, you can keep your familiar workflow while satisfying HMRC’s digital-link rules. Choose an HMRC-recognised tool that maps your VAT boxes automatically, maintain secure formulas instead of copy-and-paste shortcuts, and save an audit trail after every submission. Follow the best practices outlined above and your next MTD bridging software Excel filing will feel just as straightforward as any regular spreadsheet task only now it’s fully compliant, error-resistant, and ready for HMRC in a few clicks.

What is MTD bridging software and why do I need it?

MTD bridging software sends VAT totals from Excel straight to HMRC. Manual VAT entry is banned, so Excel users need it to stay compliant.

Can I still use Excel spreadsheets for MTD VAT returns?

Yes—pair Excel with HMRC-listed bridging software and formula links; copying or retyping figures breaks MTD rules.

What counts as a digital link for MTD compliance?

Any data move with no manual input: cell refs, formulas, macros, APIs, untouched CSV/XML. Copy-paste or later edits violate rules.

Is there any free MTD bridging software for Excel?

Yes. Tools like MTDfVAT are free for single firms, but check they’re on HMRC’s list and note feature limits.

How do I choose the right MTD bridging software for Excel?

Pick an HMRC-approved tool with easy cell mapping, solid digital links, pricing that fits your filing pace, and multi-client features.

Do I need to keep digital records if I use bridging software?

Yes. Record all sales and purchases digitally in Excel with formulas and keep the files for six years.

What’s the difference between bridging software and full accounting software?

Bridging files VAT from Excel. Full suites run invoicing, banking, reports and ditch sheets. Bridging stays cheaper for Excel fans.

Get Instant Bank Data with Finexer! Schedule your free demo and get a 14-day Free Trial 🙂

![How to Stay MTD Compliant Using Excel: Bridging Software & Digital Links Explained 1 MTD Bridging Software [2025]: Excel VAT Guide](/wp-content/uploads/2025/04/Finexer-Blog-2025.jpg)