The April 2026 rollout of Making Tax Digital Self Assessment (MTD ITSA) means accounting firms need to adopt digital tools that fit their workflows and client profiles. But not all tools are priced equally, and not all savings are obvious up front. From cloud-based tax software to bridging tools and bank-feed APIs, this guide explores the true cost of MTD compliance and how to calculate the return on your investment.

If you’re preparing your clients for MTD ITSA, the right mix of tools can help you reduce admin time, avoid penalties, and scale client reporting profitably. Here’s how to make an informed decision.

Keep reading or Jump to the section you’re looking for:

Tool Categories and Typical Cost Models

There are three main categories of MTD self assessment tools that firms typically evaluate:

| Tool Type | Up-Front Fee | Ongoing Fee | Typical Extras |

|---|---|---|---|

| Cloud tax software | Licence per user | Monthly per client | Training, onboarding, support |

| Bridging tools (Excel-based) | Low one-time fee | Annual subscription | Additional dashboards or agents |

| Bank-feed APIs (e.g., Finexer) | None | Usage-based | White-label options, premium support |

1. Cloud Tax Software

Examples: QuickBooks, Xero, FreeAgent, Sage

How it helps:

- These platforms provide an all-in-one solution for clients who are comfortable working digitally.

- They allow clients to record income and expenses, submit quarterly updates, and file the final declaration directly to HMRC.

- Ideal for tech-savvy sole traders or landlords who want full visibility and self-management.

2. Bridging Tools (Excel-based)

Examples: 123 Sheets, Absolute Excel Income Tax Filer

How it helps:

- Designed for accountants or clients who still use spreadsheets to track finances.

- Bridging tools link the spreadsheet totals to HMRC’s MTD system so you can submit data without changing your workflow.

- Great for firms who want to stay compliant without replacing existing systems.

3. Bank-Feed APIs (e.g., Finexer)

Examples: Finexer, Codat (API layer)

How it helps:

- These tools connect directly to clients’ bank accounts and pull live transaction data.

- They help keep records accurate and up to date across spreadsheets or software, ensuring a compliant digital trail.

- Best for firms that want flexibility, especially when working with clients using hybrid or manual processes.

Each tool solves a different problem. Full cloud platforms are best for firms ready to move all clients online. Bridging tools offer minimal disruption for spreadsheet workflows. Bank feeds improve the accuracy of source data without changing existing tools.

Direct Costs vs Hidden Costs

When evaluating Making Tax Digital Self Assessment tools, most firms focus on licence fees and subscription costs. But in practice, several other factors affect the total cost of ownership. Here’s what to consider beyond the software’s price tag:

Direct Costs

These are the obvious, budgeted items:

- Licence or subscription fees (monthly, annual, or per-client)

- Bridging tool access fees (usually lower-cost, often annually billed)

- API or bank-feed usage fees (based on transaction volume or connected accounts)

Hidden Costs

These are often underestimated, yet they add up quickly:

- Migration and setup time – Staff need to move data, configure user roles, and test the system.

- Training and onboarding – Internal time spent getting teams comfortable with the interface or workflows.

- Support requests – Time lost waiting on customer service or resolving platform bugs.

- Quarterly update preparation – Tools that don’t offer live data feeds may require clients to submit CSVs or manual entries, adding hours per submission.

- Risk of non-compliance – HMRC may issue fines (e.g., £200 per missed update) if submissions are late or data is inaccurate due to poor setup.

While some costs are predictable, others only become clear after implementation. When comparing MTD self assessment tools, it’s important to look at both time and money over a 12-month period.

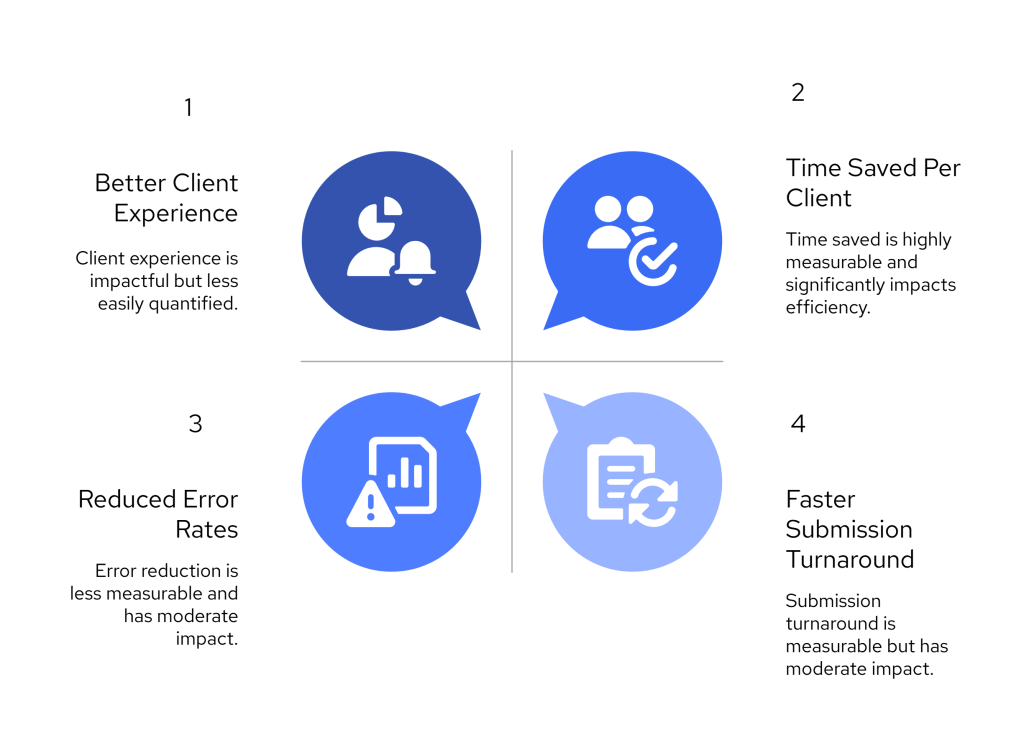

Quantifiable Benefits of MTD Self Assessment Tools

Although the upfront cost of adopting Making Tax Digital Self Assessment software may seem like an extra burden, most firms can recover that investment within the first year, often much sooner. The key is to track time saved, errors reduced, and long-term gains in efficiency and service delivery.

Here are the core benefits you can measure when using the right MTD self assessment tools:

1. Time Saved Per Client

Automated systems and integrated bank feeds can reduce repetitive admin by 2 to 4 hours per client per quarter. Tasks like chasing client statements, fixing formula errors in spreadsheets, and formatting records manually all fade into the background.

If your firm manages 50 MTD-eligible clients, that’s over 400 hours saved each year — time that could be reallocated to advisory work, new client onboarding, or simply reducing burnout in your team.

2. Reduced Error Rates

Manual entry is still one of the most common causes of late or inaccurate tax updates. Tools that sync directly with bank accounts or accounting systems ensure better data quality, fewer misclassifications, and lower risk of HMRC penalties.

Improved accuracy helps maintain compliance with Making Tax Digital Self Assessment obligations while building trust with clients who rely on you to get things right the first time.

3. Faster Submission Turnaround

When data is live, clean, and centralised, you can spend less time preparing for quarterly updates and more time reviewing them. This streamlined workflow improves your team’s ability to meet deadlines consistently — without the chaos that often surrounds MTD reporting periods.

4. Better Client Experience

Clients benefit too. Those who receive real-time summaries of their financial position or automated reminders before key deadlines are more engaged and less stressed. Offering a modern, digital-first service helps retain clients and build loyalty, especially among digitally aware sole traders and landlords.

5. Higher Profit Margins

When core compliance work becomes more efficient, your firm gains the capacity to scale, either by taking on more clients or by redirecting time into higher-margin services like forecasting or tax planning.

The best MTD self assessment tools support this shift by reducing your baseline workload and increasing the value of each client relationship over time.

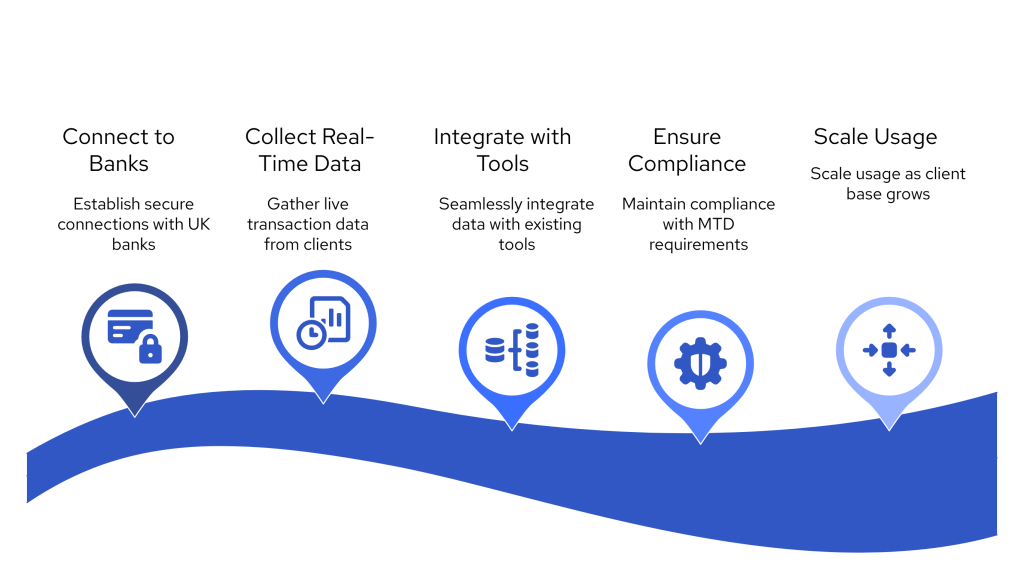

How Finexer Helps Firms Prepare for MTD Self-Assessment

Finexer helps accounting firms collect accurate, real-time bank data from their clients without relying on CSV uploads, PDFs, or outdated systems. By connecting to 99% of UK banks, Finexer feeds live transaction data directly into the tools you already use — including spreadsheets, bridging software, and cloud platforms.

This allows you to maintain digital records for Making Tax Digital Self Assessment without forcing clients onto expensive or complex accounting software. For firms managing landlords, sole traders, or mixed portfolios, Finexer offers a low-cost and flexible way to meet HMRC’s digital record-keeping requirements.

Here’s how Finexer helps reduce total cost, speed up preparation, and future-proof your MTD workflow.

1. No Setup Fees or Upfront Costs to Get Started

You don’t need to purchase licences, commit to long-term contracts, or pay onboarding fees. With Finexer, you can test the system with just a few clients and expand only when you’re ready. This is especially helpful if you’re rolling out MTD in phases, starting with higher-income clients in 2026 and continuing through to 2028.

2. Flexible, Usage-Based Pricing for Active Clients Only

Unlike software that charges for every client whether you use it or not, Finexer bills only for active transaction feeds. If a client skips a quarter or does not need ongoing support, you are not charged. This pricing structure is ideal for firms working with seasonal landlords or irregular self-employed clients.

3. Eliminate Manual Uploads with Live Bank Feeds

Finexer connects directly to nearly every UK bank. This means you no longer need to chase bank statements or import CSV files. Clients authorise a secure feed, and their transactions flow into your system automatically.

This real-time visibility helps you stay compliant with MTD Self Assessment requirements while reducing time spent on data prep and error correction.

4. Works with Excel, Bridging Tools, and Cloud Software

Finexer does not require you to change your existing software. Whether you use spreadsheets, bridging tools, or simple MTD-compatible platforms, Finexer fits in as the data layer that keeps everything up to date. Your team can continue using the tools they know, while gaining access to reliable, compliant bank data.

5. Built for Security, Compliance, and Scale

Finexer is powered by FCA-authorised infrastructure and stores all data securely within the UK. As your client base grows, you can scale your usage without increasing your risk. You meet HMRC’s digital record requirements without needing separate compliance tools or third-party connectors.

By using Finexer, accounting firms can control MTD costs, avoid software fatigue, and offer a digital-first experience to clients without disrupting internal workflows. It’s a practical choice for firms that want more flexibility, lower spend, and better data — all while staying ready for Making Tax Digital Self Assessment.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Wrapping Up

Making Tax Digital Self Assessment is not just a compliance milestone. It’s also an opportunity to rethink how your firm collects, reviews, and submits client data in a way that protects your time and profit margins.

The right MTD tools should give you more control, not more overhead. Cloud platforms may suit some clients, while others are better served with spreadsheets and bridging tools. But no matter which path you take, having accurate, real-time bank data remains essential.

Finexer helps firms meet MTD Self Assessment requirements without the high costs or rigid systems that come with most software. With usage-based pricing, no setup fees, and compatibility with both Excel and cloud platforms, Finexer is built for firms that want flexibility, affordability, and control throughout the 2026 to 2028 transition.

Start small, test what works, and build an MTD process that pays for itself.

What is Making Tax Digital Self Assessment?

Making Tax Digital Self Assessment is HMRC’s requirement for landlords and self-employed individuals earning over £50,000 to keep digital records and submit quarterly income tax updates through compatible software starting in April 2026.

How much do MTD Self Assessment tools cost?

Costs vary. Cloud platforms often charge monthly per client, bridging tools usually require a low annual fee, and bank-feed solutions like Finexer operate on usage-based pricing. It’s important to also consider hidden costs like training, data migration, and support.

Why choose Finexer for MTD Self Assessment?

Finexer provides real-time bank data from 99% of UK banks, helping you automate record keeping while using your existing tools. There are no setup fees or contracts, and you only pay for active usage, making it ideal for firms managing clients in phases.

MTD made affordable with Finexer! Schedule your free demo and get a 14-day Free Trial 🙂