Getting new customers signed up should be simple in 2025. But for many businesses, it’s anything but. Long forms, manual document checks, and waiting for approvals can frustrate users before they even get started. Some give up halfway, others turn to competitors with easier processes.

At the same time, businesses need to be careful—verifying identities, preventing fraud, and following strict KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. Balancing security with a smooth experience isn’t easy, and outdated methods only make things worse.

What if there was a way to verify customers instantly using data they already trust? Instead of slow, manual checks, businesses can confirm identities directly through a customer’s bank account—a faster, more secure, and reliable method.

In this blog, we’ll explore:

Identifying Customer Onboarding Challenges

Before updating your onboarding system or adopting new technologies, it’s essential to understand the main obstacles that hinder a smooth customer integration process. Recognising these challenges can help pinpoint exactly where improvements are needed, ensuring that your onboarding experience is as efficient and engaging as possible. Here are the three major challenges that many businesses face today:

1. Lengthy Processes

A fast and efficient onboarding experience is key to attracting and retaining customers. Unfortunately, many companies still rely on complex, multi-step procedures that slow everything down. Consider the following common issues:

- Excessive Forms and Documentation:

Customers are often required to fill out numerous forms and provide a variety of documents. Each additional step increases the likelihood that a potential customer will lose interest before completing the process. - Manual Verifications:

When processes involve manual checks and approvals, the time required to onboard a customer can increase dramatically. This delay not only frustrates users but also creates a bottleneck for your team. - Redundant Steps:

Multiple screens, repeated information entry, or unclear instructions can make the process feel overwhelming. In today’s fast-paced digital world, every extra minute spent on onboarding risks losing the customer’s interest.

📚 Open banking verification explained

2. Lack of Personalisation

Every customer is unique, and a one-size-fits-all onboarding approach can leave users feeling undervalued and disconnected. Personalisation in onboarding isn’t just a nice-to-have; it’s a key driver of engagement. Here’s why:

- Generic Experience:

When the onboarding process feels the same for every user, it fails to resonate with individual needs. Customers might feel like they’re just another number rather than a valued partner. - Unmet Individual Needs:

Without tailored guidance, customers may struggle to understand how to use a product or service in a way that benefits them personally. This can lead to confusion and a lack of confidence in the value you offer. - Missed Opportunity for Engagement:

Personalised onboarding can set the stage for a long-term relationship. When users see that the process is designed with their specific needs in mind, they are more likely to stick around, explore further, and eventually become loyal customers.

3. Compliance Issues

For businesses in regulated industries, compliance isn’t optional—it’s a necessity. However, the measures required to meet legal standards, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, can complicate the onboarding process considerably:

- Rigorous Verification Requirements:

To ensure that every customer is properly vetted, companies must carry out thorough identity checks. While these steps are critical for security, they often slow down the overall process. - Additional Documentation and Checks:

Compliance often means collecting extra data and undergoing multiple verification steps. This can extend the time it takes to complete onboarding and increase the burden on both the customer and your team. - Balancing Security with User Experience:

While it’s essential to meet regulatory requirements, doing so without compromising the customer experience is challenging. Overly strict or prolonged compliance checks can lead to frustration and deter customers from completing the process.

A Single Solution for all these Challenges

In today’s competitive digital landscape, overcoming the challenges of lengthy processes, lack of personalisation, and complex compliance is essential for a successful onboarding strategy. Onboarding using bank account validation offers a modern, streamlined approach that tackles these obstacles head-on, transforming the customer journey from frustrating to frictionless.

Streamlining Lengthy Processes

Traditional onboarding methods often involve multiple forms, redundant data entry, and manual verifications—all of which contribute to lengthy and cumbersome processes. Onboarding using bank account validation addresses this by:

- Automating Data Collection: Direct access to verified bank data eliminates the need for customers to manually enter their details, reducing both time and potential errors.

- Reducing Steps: With a single secure login to the customer’s bank account, the verification process becomes swift and efficient, significantly lowering the chance of customer drop-off.

- Enhancing Efficiency: Faster onboarding means that customers can access services almost immediately, helping businesses capture more leads and improve overall conversion rates.

Enhancing Personalisation

A generic onboarding experience can leave customers feeling undervalued. By leveraging the trusted and up-to-date information provided by their banks, onboarding using bank account validation creates a more tailored experience:

- Pre-Filled Information: Automatically retrieved bank data allows companies to personalise the onboarding experience, ensuring that customers see relevant and accurate information right from the start.

- Tailored Journeys: With verified data in hand, businesses can customise their messaging and services to better meet each customer’s unique needs, setting the stage for higher engagement and loyalty.

- User-Centric Experience: A personalised onboarding process makes customers feel recognised and valued, laying the groundwork for a stronger long-term relationship.

Ensuring Compliance with Ease

For companies in regulated industries, compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements is critical yet challenging. Onboarding using bank account validation simplifies this aspect by:

- Leveraging Trusted Data: Using data directly from banks ensures that the information is current and accurate, inherently supporting regulatory requirements.

- Automated Verification: The validation process seamlessly integrates robust compliance checks without slowing down the customer experience.

- Reduced Risk: By automating compliance measures, businesses reduce the likelihood of errors and delays, ensuring that all necessary verifications are performed efficiently and securely.

What Is Onboarding Using Bank Account Validation?

Onboarding using bank account validation is a modern approach to customer verification that streamlines the onboarding process by leveraging real-time data directly from a user’s bank account. Powered by Open Banking and its secure APIs, this method replaces traditional manual checks with an automated system that pulls accurate financial information and verifies identities quickly.

This solution integrates advanced technologies such as data extraction and facial recognition to ensure that the identity documents and provided details are authentic and up-to-date. Rather than relying solely on forms and manual document submissions, the system retrieves verified data from banks and government-issued IDs, ensuring a high level of accuracy and security throughout the process.

Key Features:

- Open Banking Integration: Uses secure APIs to access real-time financial data from various banks.

- Automated Data Extraction: Pulls essential details from identity documents like passports and driving licenses.

- Facial Recognition: Compares selfie images with the photo on the identity document to generate a similarity score, confirming authenticity.

- Real-Time Verification: Matches customer-supplied information (e.g., name) with data from the bank instantly.

- High Security and Compliance: Adheres to strict regulatory standards (such as KYC and AML) while providing bank-grade security.

By adopting onboarding using bank account validation, businesses create a seamless, efficient, and secure onboarding experience that builds trust and enhances customer satisfaction.

How It Works

The process of onboarding using bank account validation is designed to be simple, fast, and secure. Here’s a step-by-step breakdown of how the solution works:

Initiation:

- The customer chooses to verify their identity by opting to use their bank account during the sign-up process.

- They are prompted to upload an identity document (such as a passport or driver’s license) and a selfie image.

Data Extraction and Facial Recognition:

- Data Extraction: The system automatically extracts key details from the uploaded identity document.

- Facial Recognition: A facial recognition algorithm compares the selfie with the picture on the identity document, generating a similarity score in real time. This step confirms that the document belongs to the person providing the selfie.

Financial Data Verification:

- The customer authorises access to their bank account via Open Banking.

- The system retrieves the customer’s financial data, such as their full name and account status, directly from the bank.

- The supplied name is cross-verified with the bank’s records to ensure it matches, providing an additional layer of validation.

Unified Verification Report:

- All the collected data—from the identity document, facial recognition, and bank account verification—is compiled into a comprehensive verification report.

- This report includes a similarity score that indicates the accuracy of the match between the submitted information and the bank data.

Seamless Onboarding Completion:

Once the verification report confirms the customer’s identity, the onboarding process is completed.

The business can then securely create an account, knowing that the customer’s identity has been thoroughly and automatically validated.

Advantages of This Approach:

- Automation: Eliminates manual data entry and reduces the risk of human error.

- Enhanced Security: Combines facial recognition and bank-grade security protocols to protect against identity fraud.

- Increased Efficiency: Accelerates the onboarding process by verifying data in real time.

- Cost-Effective: Reduces operational expenses by minimising manual verification efforts.

- Improved User Experience: Provides a smooth and hassle-free onboarding process that builds customer trust from the start.

Real World Impact: Transforming Digital Identity Verification with Finexer

In today’s rapidly evolving digital landscape, where efficiency, security, and compliance are critical, VirtualSignature-ID (VSID) recognised the need to revolutionise its customer onboarding process. Specialising in certified document management, KYC, AML, and Source of Funds solutions for professional organisations in the legal and accountancy sectors, VSID faced challenges integrating compliant, secure open banking technology into its services.

To address these challenges, VSID turned to Finexer—a leader in open banking solutions—to implement a modern, streamlined approach. By adopting onboarding using bank account validation, VSID was able to leverage Finexer’s secure open banking API to transform its digital identity verification process. This innovative solution automates the extraction of data from identity documents, uses real-time facial recognition for robust security, and seamlessly verifies customer details against trusted bank records.

David Kern, CEO of VirtualSignature-ID, explains the value of this partnership:

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package. Finexer has proven to be more than a provider—they’re a trusted partner who understands our vision and helps us achieve it.”

Before partnering with Finexer, VSID grappled with inefficient processes that slowed down customer onboarding and created compliance bottlenecks. Finexer’s FCA-compliant open banking technology provided an immediate solution, integrating effortlessly with VSID’s existing systems. This enabled VSID to not only meet strict KYC and AML requirements but also enhance overall operational efficiency—allowing for faster, more secure onboarding of new customers.

Key benefits realised through this collaboration include:

- Cost and Time Savings: Automation and streamlined data extraction reduced the need for manual intervention, cutting down both time and operational expenses.

- Enhanced Efficiency: The integrated solution improved workflows, enabling VSID to serve its legal and accountancy sector clients more effectively.

- Improved Customer Satisfaction: A seamless, secure onboarding process resulted in higher customer engagement and trust, setting a new standard in digital identity verification.

Looking ahead, VSID remains committed to its partnership with Finexer. As David Kern notes, the collaboration is not just about meeting current needs but also about anticipating future growth:

“We aim to continue our partnership with Finexer as we improve our services and expand the business further.”

This shared vision of innovation and excellence underscores the transformative power of onboarding using bank account validation. By harnessing Finexer’s Open banking Api, VSID has set a new benchmark in digital identity verification—demonstrating that with the right partner, businesses can overcome traditional challenges and drive long-term success.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Choose Finexer for Faster Onboarding

When it comes to bringing new customers on board quickly and safely, Finexer stands out as a trusted partner. Here are a few simple reasons to choose Finexer:

- Quick Verification: Finexer uses bank account validation to check customer details in real time. This means less waiting and a faster setup for new users.

- Easy Integration: The system is designed to fit into your existing setup with minimal fuss. It works well with your current tools and does not require extensive changes.

- Strong Security: Finexer relies on secure access to bank data. This helps protect against fraud and keeps customer information safe.

- Less Manual Work: By automatically retrieving and verifying customer data, Finexer reduces the need for manual checks. This saves time and lowers the chance of errors.

- Reliable Support: The team at Finexer is known for being responsive and helpful, making it easier for your business to manage any issues that arise.

Choosing Finexer means you can offer new customers a fast, secure, and straightforward onboarding experience with minimal hassle. This simple, practical approach helps your business move forward and lets customers start using your services without delay.

Stats mentioned above & Sources to read

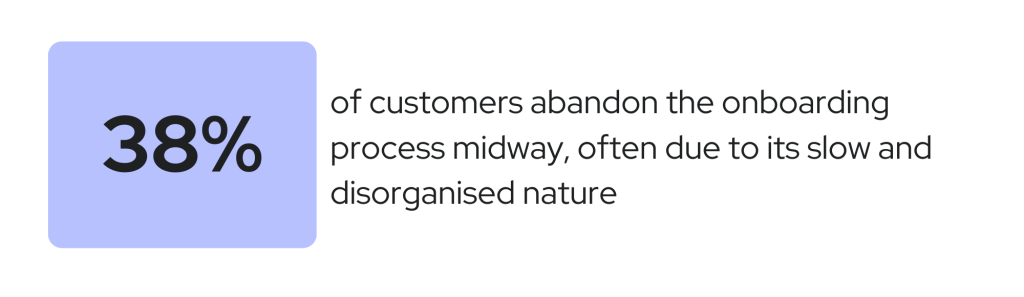

- 38% of customers abandon onboarding midway because of long, disorganised procedures. (ZignSec)

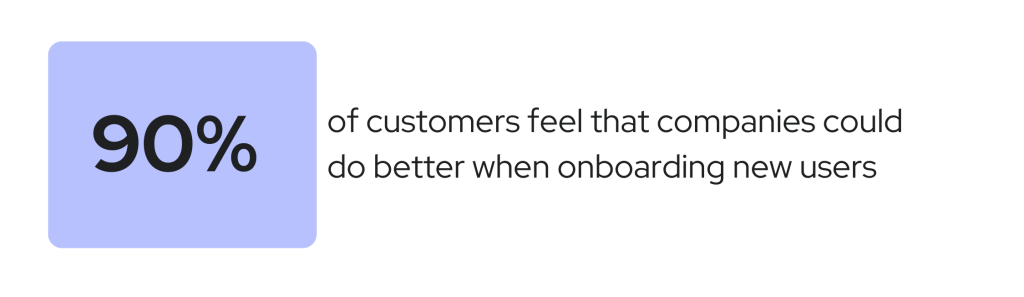

- 90% of customers feel that companies could do better when onboarding new users. (Userpilot)

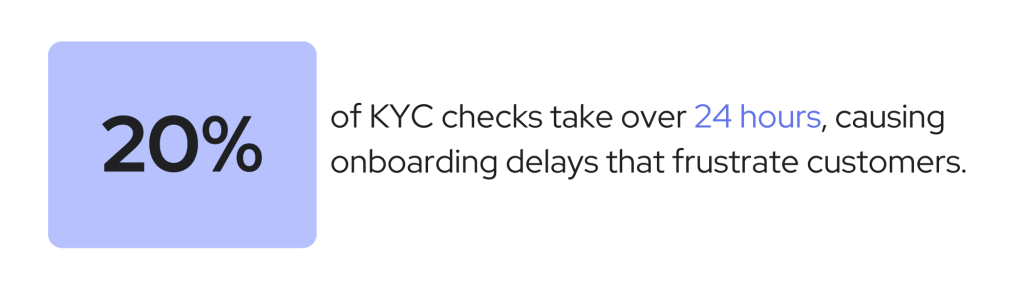

- 20% of KYC checks take over 24 hours to complete, creating onboarding delays that frustrate customers. (NorthRow)

What is onboarding using bank account validation?

It is a method that verifies new customers by directly accessing their bank account data through Open Banking APIs, allowing businesses to confirm identities quickly and accurately.

How does onboarding using bank account validation work?

Customers sign up by choosing to verify their identity with their bank account; they securely log in via their bank’s portal, and the system automatically retrieves and verifies essential details such as name, address, and account status.

What benefits does this method offer over traditional onboarding?

This approach reduces the time and effort needed for manual checks, improves data accuracy, increases security by using trusted bank data, and helps meet regulatory requirements like KYC and AML.

Is the process secure and compliant with industry regulations?

Yes, onboarding using bank account validation is built with strong security measures and adheres to strict KYC/AML regulations, ensuring that customer data is protected while verifying identities reliably.

Try Onboarding using bank account validation with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂