Table of Contents

UK platforms cannot build financial features when open banking AIS access depends on unreliable connections or manual data collection. Account information services require infrastructure that delivers consistent bank data without operational overhead.

Key Takeaways

What problem does this solve?

Platforms cannot access bank account data reliably when AIS banking connections break frequently or require manual fallback processes.

Why does infrastructure quality matter?

Unreliable open banking AIS connectivity creates operational overhead. Platforms need verified account data without constant troubleshooting.

What breaks with poor providers?

Consent management fails. Bank connections disconnect. Transaction data arrives incomplete. Features requiring account information become unreliable.

What should platforms evaluate before integration?

FCA authorisation status, UK bank coverage, connection reliability, consent lifecycle management, data format consistency, historical data depth.

Where does Finexer fit operationally?

Finexer provides FCA-authorised AIS banking infrastructure. Platforms integrate once and receive account data through APIs. Platforms build verification, reconciliation, and reporting features on top.

Why does open banking AIS connectivity fail?

Platforms promise automated reconciliation, instant verification, and real-time financial reporting. These features require continuous access to account information through reliable AIS banking connections.

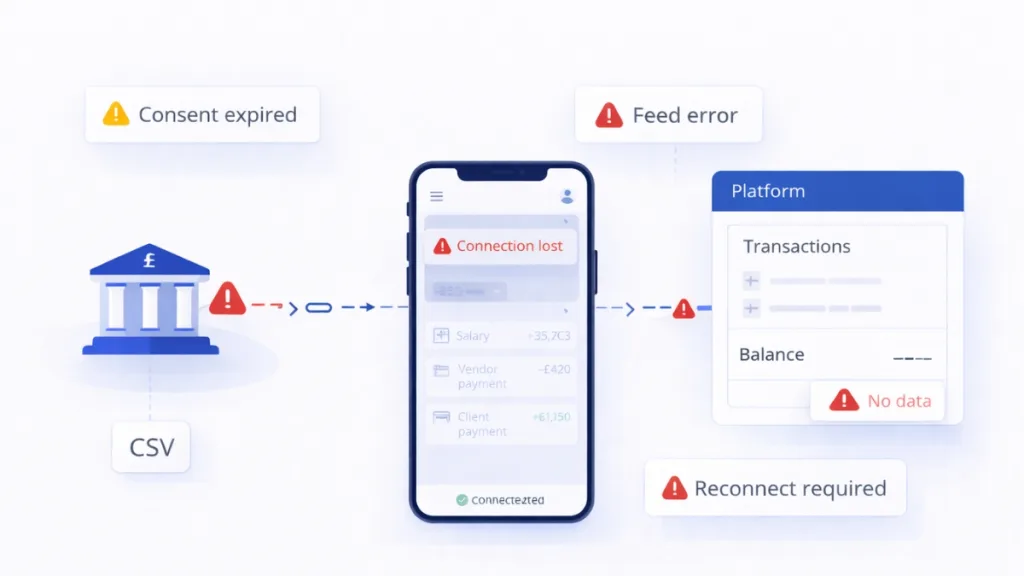

Bank connections break without warning. Consent expiry disrupts data access unexpectedly. Transaction feeds deliver incomplete data. Account balance updates arrive delayed. Manual re-authentication becomes necessary.

When platforms rely on unreliable providers, users experience feature breakage. Reconciliation stops working. Verification processes fail. Financial reporting shows outdated information.

Screen scraping creates fragile connections that break during bank updates. Authentication methods change. Connection logic requires constant maintenance. Support teams spend time fixing broken feeds instead of building features.

Manual fallback processes defeat automation purpose. When open banking AIS fails, platforms cannot ask users to download bank statements manually without destroying user experience.

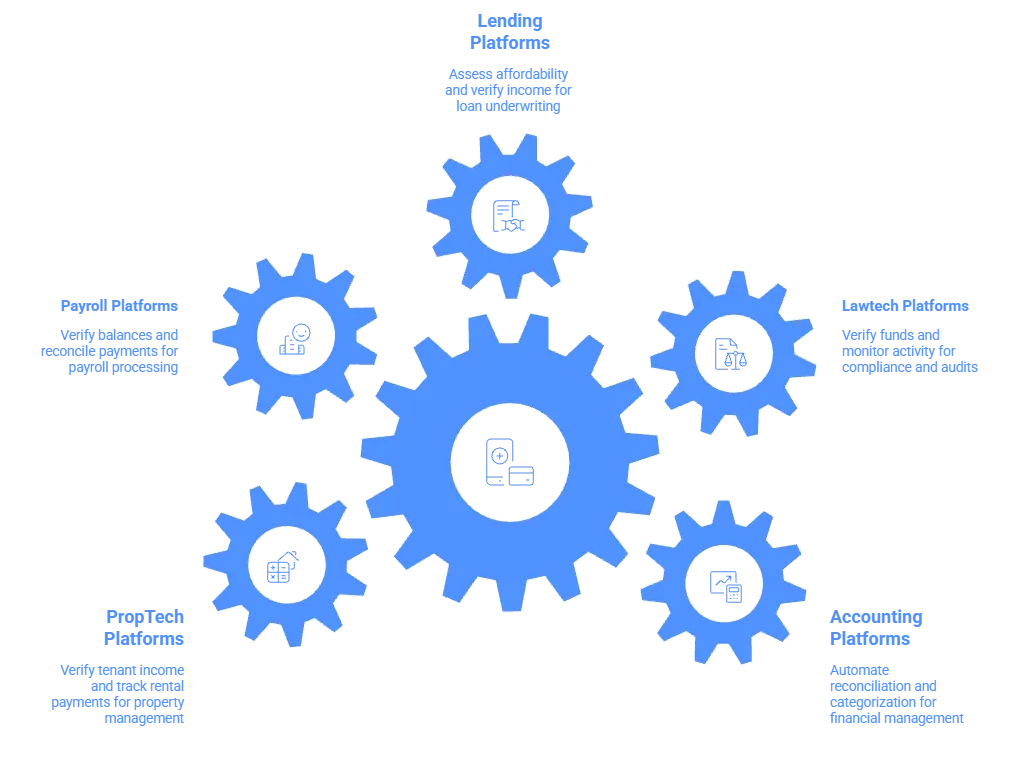

Who needs reliable AIS banking infrastructure?

Accounting software platforms access client bank accounts for reconciliation. They retrieve transaction data for categorisation. Cash flow reporting requires monitoring account balances. Automated bank feed connections eliminate manual uploads.

Lawtech platforms verify source of funds for compliance. They access account history for client verification. Transaction records provide audit trails. Financial positions must be confirmed for client accounts.

Lending platforms assess affordability through transaction analysis. Income patterns get verified from account data. Historical transactions inform underwriting decisions. Repayment account balances require monitoring.

Payroll platforms verify company account balances before payroll runs. Salary payments get reconciled against bank records. Account activity monitoring confirms payment execution. Transaction history supports audit purposes.

PropTech platforms verify tenant income through account data. Payment reliability gets assessed from transaction history. Rental payment accounts require monitoring. Account balances determine affordability for tenancy applications.

What happens when AIS connectivity fails?

Reconciliation features stop working unexpectedly. Verification processes fail without warning. Financial reporting shows stale data. Users lose trust in platform capabilities.

Support teams troubleshoot broken connections constantly. Engineers maintain bank-specific connection logic. Manual processes become necessary fallbacks. Product development slows significantly.

Features requiring bank data become unreliable. Unexpected re-authentication requests appear. Account connections break without explanation. Competitive platforms offer better reliability.

Audit trails contain data gaps. Verification processes lack complete information. Regulatory reporting shows incomplete records. Client money handling lacks proper oversight.

Connection failures increase with user volume. Support costs grow faster than revenue. Operational margins compress. Platform reliability decreases.

What must platforms evaluate before integration?

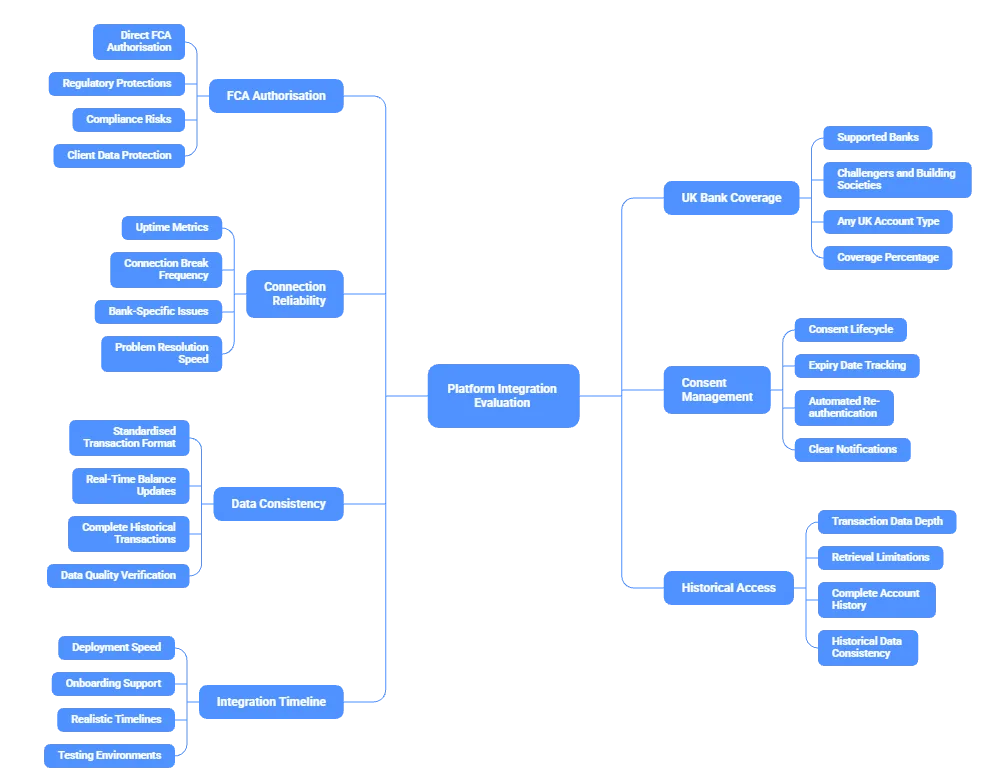

- FCA authorisation: Is the provider directly FCA-authorised for AIS? What regulatory protections exist? Are there compliance risks for platforms? How is client data protected?

- UK bank coverage: Which banks are supported currently? Are challengers and building societies included? Can users connect any UK account type? What coverage percentage is guaranteed?

- Connection reliability: What uptime metrics are available? How frequently do connections break? Are there bank-specific reliability issues? How quickly are problems resolved?

- Consent management: How is consent lifecycle handled? Can platforms track expiry dates? Is re-authentication automated? Do users receive clear notifications?

- Data consistency: Is transaction format standardised across banks? Do account balances update in real-time? Are historical transactions complete? How is data quality verified?

- Historical access: How far back does transaction data extend? Are there retrieval limitations? Can platforms access complete account history? Is historical data consistent with recent feeds?

- Integration timeline: How quickly can platforms deploy? What support is provided during onboarding? Are timelines realistic for production? What testing environments exist?

How does Finexer enable reliable AIS connectivity?

Finexer provides FCA-authorised open banking AIS infrastructure for UK platforms.

Key capabilities:

- 99% UK bank coverage

- FCA-authorised infrastructure

- Real-time webhooks

- Up to 7 years historical data

- Usage-based pricing

- White-label ready

- 2-3x faster integration

- 3-5 weeks onboarding support

- Saves up to 90% on transaction costs

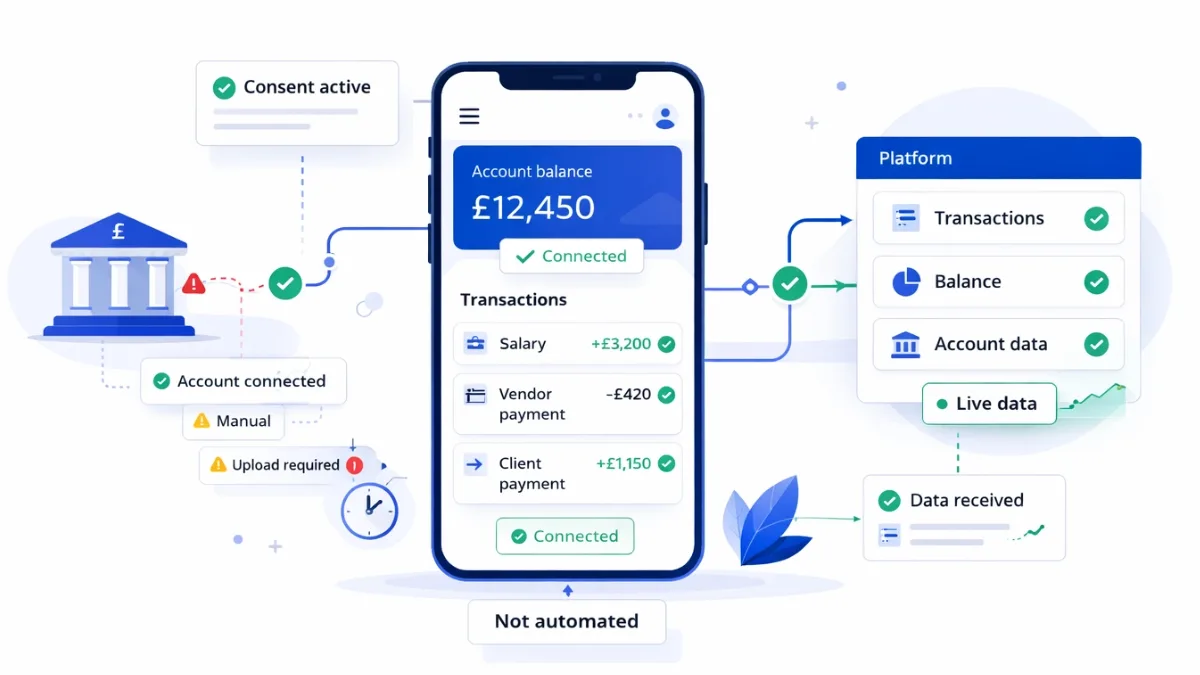

Platforms integrate AIS APIs once through standard endpoints. Users authenticate bank accounts through secure open banking flows. Platforms receive account data automatically without managing bank-specific connections.

Transaction data arrives in consistent JSON format regardless of source bank. Platforms write processing logic once and apply across all UK banking institutions.

Real-time webhooks notify platforms when account activity occurs. Balance updates arrive immediately. Transaction data flows continuously without polling.

Consent lifecycle management is automated. Platforms track permission status programmatically. Users receive clear notifications before expiry. Re-authentication happens smoothly without disrupting features.

Historical transaction access extends up to seven years depending on bank support. Platforms retrieve complete account history without manual statement collection.

For platforms requiring AIS API connectivity, reliable infrastructure removes operational bottlenecks.

AIS infrastructure evaluation checklist

| Evaluation Criteria | Why It Matters | What to Look For |

|---|---|---|

| FCA authorisation | Unauthorised providers create compliance risk | Direct FCA authorisation for account information services |

| Bank coverage | Users cannot connect unsupported accounts | 99% UK coverage including challengers and building societies |

| Connection reliability | Frequent failures create support overhead | Proven uptime metrics with real-time monitoring |

| Consent management | Manual processes create user friction | Automated tracking with proactive expiry notifications |

| Data format | Inconsistent structure requires custom parsing | Standardised JSON across all banking institutions |

| Historical depth | Limited access prevents complete analysis | 7-year transaction retrieval capability |

Platforms building AISP infrastructure should confirm providers support their specific use cases.

What we see in practice

Most platforms underestimate the maintenance burden of AIS banking connections. Initial integration appears simple but operational reality emerges months later.

Bank authentication methods change without notice. Consent expiry creates unexpected user friction. Transaction data quality varies significantly by institution. Connection failures increase during high-volume periods. Support overhead grows faster than anticipated.

The mistake we see most often is choosing providers based on initial integration speed. Platforms discover reliability problems when user volumes grow and edge cases appear.

Consent management becomes critical at scale. Platforms lacking proper expiry tracking face user complaints about unexpected re-authentication requests.

Data format inconsistencies create ongoing engineering work. Platforms must maintain bank-specific parsing logic when providers deliver unstandardised data.

For platforms requiring real-time bank data, infrastructure reliability determines feature quality.

Common use cases for AIS infrastructure

Accounting platforms:

- Access client accounts for automated reconciliation

- Retrieve transactions for categorisation features

- Monitor balances for cash flow dashboards

- Enable bank feed connections for bookkeeping

Lawtech platforms:

- Verify source of funds through account history

- Access transaction records for compliance checks

- Monitor client account activity for audit trails

- Retrieve account data for verification workflows

Lending platforms:

- Assess affordability through transaction analysis

- Verify income patterns from account data

- Retrieve complete financial history for underwriting

- Monitor account activity during loan lifecycle

Payroll platforms:

- Verify company account balances before payroll

- Reconcile executed payments against bank records

- Access transaction history for audit purposes

- Monitor accounts for payment confirmations

PropTech platforms:

- Verify tenant income through account access

- Assess payment reliability from transaction history

- Monitor rental accounts for payment tracking

- Retrieve balances for affordability verification

What is open banking AIS?

Open banking AIS (Account Information Services) enables FCA-authorised providers to access bank account data through secure APIs. Platforms use AIS banking infrastructure to retrieve transactions, balances, and account details.

What is open banking in the UK?

Open banking in the UK allows FCA-authorised providers to access customer bank data through secure APIs with explicit consent. This enables platforms to build features requiring account information.

What is AIS banking for platforms?

AIS banking infrastructure provides platforms with API access to UK bank accounts. Platforms retrieve transaction data, account balances, and financial information for verification and reconciliation features.

Can I refuse to use open banking?

Users control consent for open banking AIS access. Platforms cannot access account data without explicit user authentication through secure banking flows.

Why do platforms need reliable AIS infrastructure?

Features requiring bank data fail when connectivity is unreliable. Platforms need consistent open banking AIS access to deliver automated workflows without operational overhead.