Introduction

The way businesses access financial data and process payments is changing. With traditional banking systems, companies often rely on manual processes, card networks, or outdated integrations to access account information or accept payments. But in the UK, Open Banking APIs provide a faster, secure, and direct alternative.

Through an Open Banking API, businesses can retrieve bank account data, initiate payments, and automate financial processes without relying on third-party intermediaries. Whether you’re a fintech startup, merchant, lender, or accounting provider, Open Banking APIs offer a direct connection to banks, enabling smarter, cost-effective financial operations.

This guide will explain how Open Banking APIs work, what makes them different from traditional banking systems, and why they are becoming a must-have for businesses in the UK.

Let us guide you through:

What is an Open Banking API?

An Open Banking API is a software interface that enables businesses, fintechs, and financial institutions to securely access customer banking data and initiate payments—with customer consent.

In simple terms, it acts as a bridge between banks and third-party service providers, allowing them to retrieve real-time financial information or facilitate direct bank transfers without using cards or manual processes.

| Feature | Traditional Banking Methods | Open Banking API |

|---|---|---|

| Data Access | Manual bank statements, screen scraping | Direct, real-time API access |

| Payments | Card networks, bank transfers | Direct bank-to-bank transactions |

| Security | Requires login sharing (screen scraping) | Regulated, customer-consented access |

| Processing Speed | Delayed, batch processing | Instant or near-instant transactions |

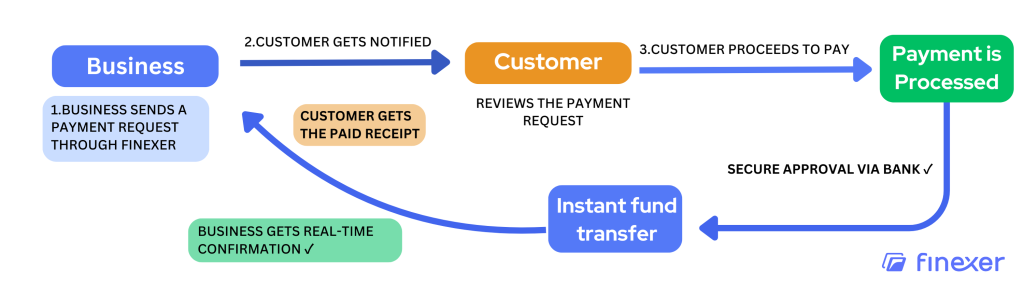

How Does an Open Banking API Work?

Understanding how an Open Banking API functions can help businesses determine whether it’s the right fit for their needs.

1.User Authorisation: A customer grants permission to a third-party provider (TPP) to access their banking data or initiate a payment.

2.API Request to the Bank: The API sends a request to the customer’s bank for the required information or transaction approval.

3.Bank Response & Execution: If authorised, the bank provides the requested data or processes the payment.

Example Scenario:

A lending platform uses an Open Banking API to retrieve a borrower’s financial history in real time, allowing for instant affordability checks without requiring document uploads.

Why Open Banking APIs Are Gaining Adoption in the UK

- Regulated & Secure: Open Banking APIs are designed with strict security measures under FCA regulations.

- Lower Payment Costs: Bank-to-bank transfers reduce card processing fees for merchants.

- Real-Time Data Access: Businesses get up-to-date financial insights without waiting for manual uploads.

By integrating an Open Banking API, companies can improve payment efficiency, automate financial processes, and offer better services to customers

| Service | Category | Description |

|---|---|---|

| Instant Payment | PIS (Payments) | Request to Pay-By-Bank for instant transactions. |

| Payout | PIS (Payments) | Instant refunds and withdrawals. |

| Bulk Payout | PIS (Payments) | Multiple payments in a single click. |

| Recurring Payment | PIS (Payments) | VRP (Variable Recurring Payments) and Sweeping. |

| Transactions Data | AIS (Data) | Real-time bank transaction data retrieval. |

| Balance Check | AIS (Data) | Access income, expenses, and balance information. |

| Authenticate | AIS (Data) | Retrieve account details, sort code, IBAN, and BIC. |

Key Benefits & Use Cases of Open Banking APIs

1. Secure and Direct Access to Banking Data

Traditionally, businesses relied on screen scraping or manual bank statement uploads to access financial data. These methods were inefficient and carried security risks.

Open Banking APIs solve this problem by providing:

- Real-time access to banking data with customer consent

- A regulated and secure alternative to screen scraping

- Stronger authentication via Open Banking protocols, reducing fraud risks

Use Case Example:

A lending platform can instantly retrieve a borrower’s bank account transaction history using an Open Banking API, helping them perform real-time affordability checks instead of requiring users to upload PDFs of their bank statements.

2. Faster and Cost-Effective Bank Payments

For businesses, traditional payment methods such as card payments, BACS, and direct debits often come with high processing fees and slow settlement times.

How Open Banking APIs improve payments:

- Direct bank-to-bank transfers without relying on card networks

- Lower transaction costs compared to credit/debit card processing fees

- Instant or near-instant settlements, compared to two to three days for traditional bank transfers

Use Case Example:

An e-commerce business can integrate an Open Banking API to offer instant account-to-account payments at checkout. This reduces reliance on card networks, lowers transaction fees, and speeds up cash flow.

Open Banking Payment Growth

In the UK, Open Banking-powered payments saw a 68 percent increase in 2024, with over 12.6 million payments processed in a single month. Source

3. Real-Time Financial Insights and Automation

Businesses that handle accounting, lending, and financial management require up-to-date banking data for accurate decision-making.

Open Banking APIs provide:

- Live financial data instead of relying on outdated bank statements

- Automated categorisation of transactions for accounting and reconciliation

- Improved credit decision-making for lenders using real-time affordability checks

Use Case Example:

A financial management app can use an Open Banking API to sync a user’s latest bank transactions, categorise spending patterns, and provide automated budgeting recommendations.

Open Banking for Personal Finance

Over 3.5 million UK consumers now use Open Banking to manage personal finances, benefiting from real-time insights and automation. Source

4. Improved Customer Experience and Payment Flows

Consumers expect faster, more efficient payment experiences. Open Banking APIs reduce the need for card details or lengthy bank transfers by directly connecting user accounts for transactions.

Advantages for businesses and customers:

- Fewer payment failures, reducing declined transactions due to expired cards

- Faster checkout processes, as customers authenticate directly with their bank

- More control over payments, as users approve each transaction securely

Use Case Example:

A subscription-based business can use an Open Banking API to allow customers to set up recurring payments directly from their bank accounts, eliminating the risk of card expirations and failed transactions.

SMEs Adopting Open Banking

Forty-five percent of UK SMEs now use Open Banking APIs to streamline payments and reduce reliance on costly card transactions. Source

What to look for in an Open Banking API Provider

Choosing an Open Banking API is a critical decision for businesses integrating financial data or payments. The provider you select will determine the functionality, reliability, and security of your Open Banking implementation. Before deciding, consider these key factors:

Coverage

The more banks and financial institutions an API connects with, the broader your service reach. Limited coverage can reduce the effectiveness of your solution.

If your target market includes UK businesses, ensure the provider covers all major banks. A strong API should offer at least 85-90% bank coverage in your desired region.

Payment Capabilities

Not all Open Banking APIs support payments. Some only offer account information services (AISP), while others also provide payment initiation services (PISP).

Consider:

- Does it support single and recurring payments?

- Is Variable Recurring Payments (VRP) available?

- Are bulk payments an option?

A business offering payroll solutions, for example, will need an API that can initiate high-volume transactions efficiently.

API Performance and Reliability

Downtime and slow response times can impact transactions. A high-quality Open Banking API should provide:

- 99.9% uptime to ensure continuous availability

- Low latency for faster response times

- Scalability to handle high transaction volumes

For businesses processing thousands of transactions daily, reliability is key to maintaining a smooth user experience.

Data Quality and Enrichment

Financial data is only useful if it is structured and clear. Some APIs provide only raw transaction data, while others enrich it with spending categorisation and additional insights.

For fintechs handling credit scoring or expense management, an API with detailed transaction categorisation will improve accuracy and efficiency.

Security and Compliance

Since Open Banking APIs handle sensitive financial data, security is non-negotiable. Always verify:

- FCA (Financial Conduct Authority) approval for UK providers

- Strong encryption and authentication to protect data

- Fraud prevention mechanisms to minimise risk

A provider compliant with PSD2 regulations ensures your business stays within legal and security standards.

Integration and Developer Support

A well-documented API speeds up implementation. Look for:

- Comprehensive API documentation and SDKs

- Testing sandbox environments

- Developer support in case of integration issues

Fintechs launching fast-moving products benefit from APIs with clear documentation and strong technical support.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Use Finexer’s Open Banking API?

Businesses integrating Open Banking require a provider that offers broad bank coverage, secure transactions, and seamless integration with existing financial systems. Finexer delivers a solution tailored for fintechs, enterprises, and businesses looking for reliable financial data access and payment capabilities.

Beyond technology, Finexer focuses on collaboration, flexibility, and business-specific solutions, as demonstrated through real-world partnerships.

Comprehensive Coverage and Business-Focused Solutions

Finexer connects with 99% of the UK banks, providing businesses with seamless access to financial data and payments. Whether companies require consumer, business, or corporate account integration, Finexer’s API is designed to meet their needs.

For businesses requiring tailored Open Banking solutions, Finexer provides a collaborative approach rather than a one-size-fits-all model.

“We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

– Penny Phillips, Chief Commercial Officer at Sysynkt

By working with Finexer, Sysynkt, a B2B SaaS provider, integrated Open Banking to enhance its business automation platform. Finexer’s flexibility ensured seamless financial automation for its high-profile clients.

Seamless Payments and Identity Verification

For businesses in highly regulated sectors such as legal, finance, and accounting, Open Banking must be compliant, secure, and easy to integrate.

VirtualSignature-ID, a UK Government-accredited digital identity provider, chose Finexer for its FCA-compliant technology and smooth implementation.

“Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.”

– David Kern, CEO of VirtualSignature-ID

With Finexer’s Open Banking API, VirtualSignature-ID streamlined digital identity verification while ensuring compliance with KYC and AML regulations.

A Trusted Partner for Long-Term Growth

Finexer prioritises long-term collaboration, ensuring businesses have the support they need to scale.

“Finexer is more than a provider—they’re a partner who aligns with our mission to deliver world-class services.”

– Penny Phillips, Chief Commercial Officer at Sysynkt

For businesses seeking an Open Banking API provider that prioritises flexibility, security, and ease of integration, Finexer stands out as a trusted choice.

Try Open Banking Verification API today! Schedule your demo and get a 14 days free Trial by Finexer 🙂