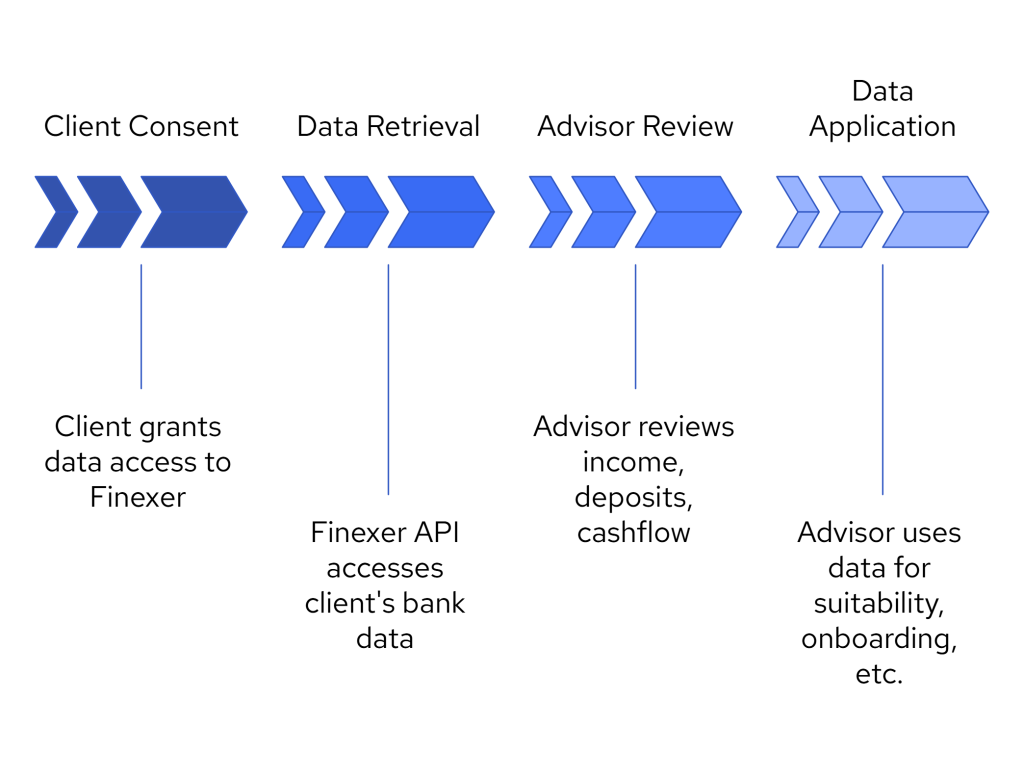

Open banking for financial advisors is helping UK firms get a clearer view of their clients’ financial positions. Instead of collecting bank statements, scanning PDFs, or chasing clients for updates, advisors can now access bank account data directly, with the client’s consent.

This approach supports better investment planning, quicker onboarding, and more accurate Source of Funds checks. Adoption continues to rise: as of March 2025, there are 13.3 million active open banking users in the UK, a 40% increase from the previous year.

Keep Reading or Jump to the section you are looking for:

1. Access to Current Account Data

Most advisors work with information that’s already out of date by the time they receive it. Open banking changes that offer access to live account data across 99% of UK banks.

This includes:

- Current account balances

- Income sources (salary, dividends, pensions)

- Investment-related transactions or contributions

Having access to verified, up-to-date financial data makes it easier to discuss affordability, understand a client’s risk profile, and prepare for regular investment reviews, without depending on paperwork.

2. Supporting Source of Funds Checks

Source of Funds checks are required under UK AML regulations, especially when large sums are being invested. Traditionally, this meant chasing down documentation or waiting for clients to submit scanned statements.

With open banking, advisors can request consent-based access to a client’s account and immediately see the origin of funds, whether it’s from income, asset sales, or transfers from other accounts.

This process helps:

- Confirm income and cash flow stability

- Identify large deposits with traceable origins

- Reduce onboarding time for high-net-worth clients

In March 2025 alone, over 31 million open banking payments were made in the UK, indicating both adoption and trust in the system

3. Reviewing Cashflow and Investment Suitability

Knowing how much a client earns, spends, and saves is essential when making investment recommendations. But relying on rough estimates or manually shared spreadsheets often leads to incomplete or outdated information.

With open banking, advisors can access accurate, up-to-date records of a client’s income and spending habits. This makes it easier to:

- Understand monthly cash inflows and outflows

- Identify regular commitments such as mortgage payments or subscriptions

- Determine how much is realistically available to invest

This approach allows advisors to build more suitable investment plans, backed by real financial behaviour rather than assumptions.

4. Simplifying Ongoing Reviews and Reporting

Annual or quarterly investment reviews often require clients to resend documents or update advisors manually. This can delay conversations and limit the depth of advice.

With open banking in place, advisors can maintain continuous access to client-approved financial data. This allows for:

- Timely insights into changes in income or spending

- Easier preparation for review meetings

- A more accurate picture of progress against financial goals

Instead of starting from scratch each time, advisors can base their reviews on data that’s already current, structured, and easy to reference.

5. Getting Started with Open Banking as an Advisor

Open banking doesn’t require a full technology rebuild. Most platforms offering access to live bank data provide developer-ready APIs or advisor tools that can be integrated into your existing systems.

To get started:

- Choose a provider that covers UK banks and supports consent-based data access

- Confirm that the API or platform is FCA-regulated

- Define how you’ll use the data (e.g. onboarding, cashflow tracking, Source of Funds checks)

- Work with your compliance team to ensure proper consent and data handling procedures are in place

For advisors working with regulated clients or high-net-worth individuals, real-time access to financial data can simplify day-to-day operations without adding overhead.

Finexer: A Practical API for Advisory and Compliance Needs

Finexer provides an FCA-regulated Open Banking API built to support advisory, onboarding, and compliance workflows in the UK. For financial advisors, this means gaining access to accurate, client-permissioned data without adding operational overhead.

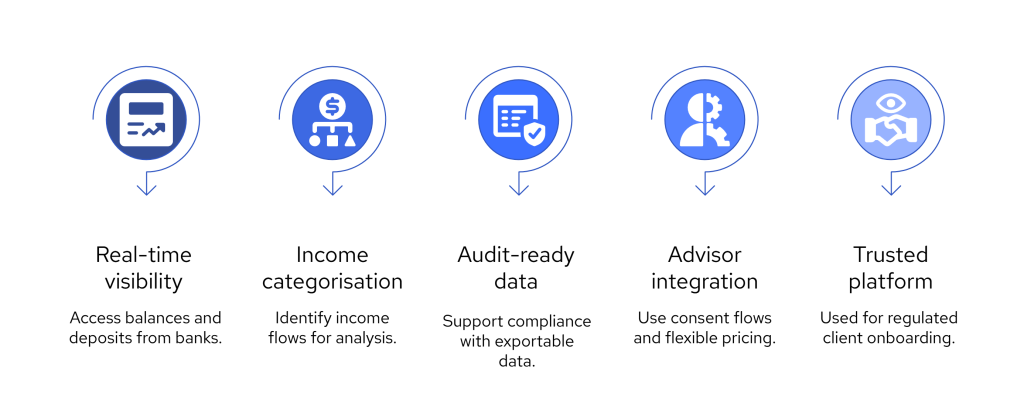

Here’s what makes Finexer especially relevant for advisory work:

- Real-time financial visibility

View current account balances, income patterns, and recent deposits across 99% of UK banks. This is especially useful during onboarding, annual reviews, or when reassessing investment suitability. - Income and deposit categorisation

Identify sources of funds, including salary, pensions, and dividends — all categorised and structured for easier analysis. This reduces reliance on paper statements and helps advisors prepare informed recommendations. - Audit-ready data for compliance

Finexer supports Source of Funds and KYC/AML checks with transaction-level visibility and exportable data structures that meet UK regulatory expectations. - Advisor-friendly integration

Finexer offers branded consent flows, webhook-based updates, and usage-based pricing, making it easy to implement without rebuilding existing systems or taking on unnecessary cost. - Trusted by professional services

Platforms like VirtualSignature-ID use Finexer to support client verification across legal and financial services, showing its credibility in regulated environments.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

What does open banking mean for financial advisors?

It allows advisors to access live client account data with consent. This helps with onboarding, income checks, and regular investment reviews.

Is open banking data accurate enough for investment advice?

Yes. Advisors can view verified income, deposits, and transactions directly from client accounts, avoiding outdated or incomplete records.

Can open banking be used for Source of Funds checks?

Yes. Open banking provides transaction-level data that helps advisors confirm where funds have come from, with less reliance on manual documents.

Is client consent required for open banking?

Always. Clients must approve access to their account data through a secure consent journey. Access can be revoked at any time.

Does Finexer offer tools for financial advisors?

Yes. Finexer provides an FCA-regulated Open Banking API with income categorisation, Source of Funds visibility, and advisor-ready features.

If your firm is looking for a clear, compliant way to use Open Banking in your advisory process, Finexer is ready to support you! Book now 🙂