Open Banking in the UK just hit a major milestone.

As of March 2025, 1 in 5 consumers and small businesses are now active users.

This record-high adoption signals more than just growth. It reflects a shift toward a digital-first, data-powered economy. Here’s what the numbers tell us, and what it could mean for businesses, fintechs, and policymakers.

1. Open Banking UK: State of Adoption in 2025

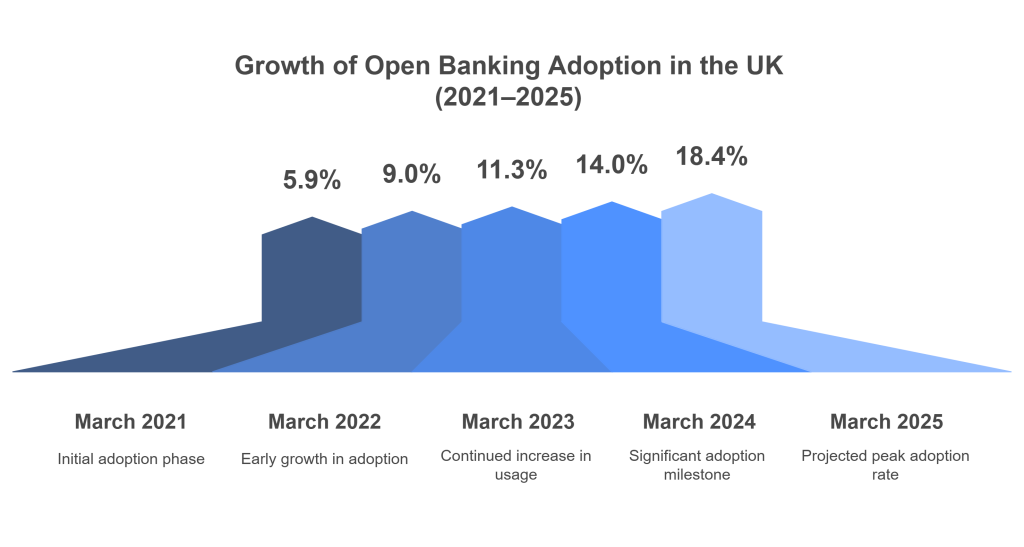

The number of active Open Banking users in the UK reached 13.3 million in March 2025, marking an 18.4% penetration rate among those with online bank access.

While small businesses initially led the way, consumer adoption is now catching up fast. Both groups are showing similar usage rates, driven by better payment experiences, improved financial tools, and wider awareness.

Growth Trends:

- 40–50% year-on-year adoption growth

- Projected to reach 1 in 4 users by early 2026

2. Payments Now Lead the Way

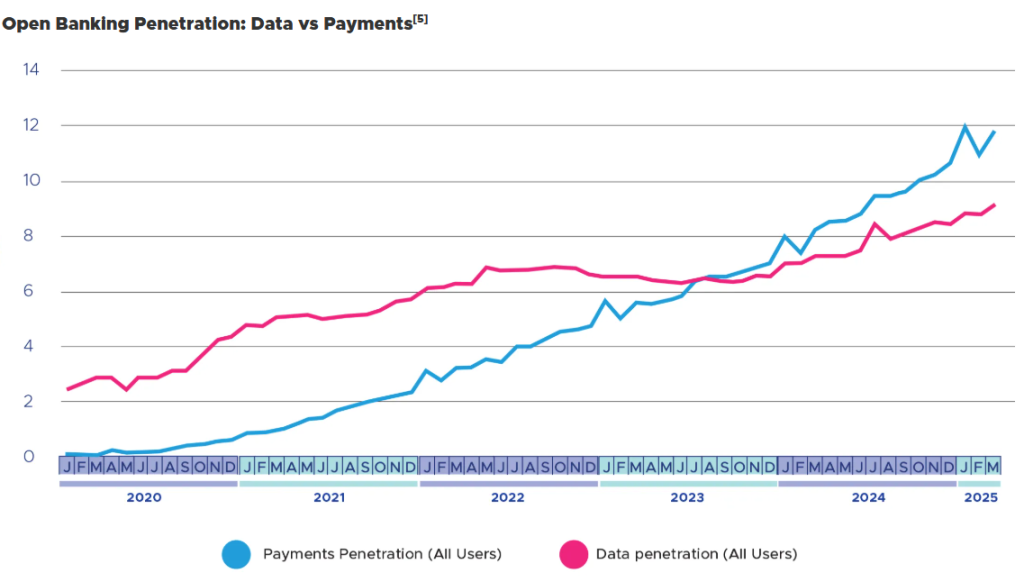

It began with data access, but in 2025, it is the payments side that is leading adoption.

In March alone, the UK processed an estimated 31 million Open Banking payments, making up 8% of all Faster Payments. This marks a 67% increase compared to the same time last year.

Notable Peak:

- January 2025: Over 1.3 million HMRC self-assessment payments were made through Open Banking, with a total value of £4.7 billion

- VRPs (Variable Recurring Payments): These now represent 13% of Open Banking payments, showing strong traction in subscriptions, rent collection, and recurring invoices

3. Ecosystem Update: Who’s Building With Open Banking?

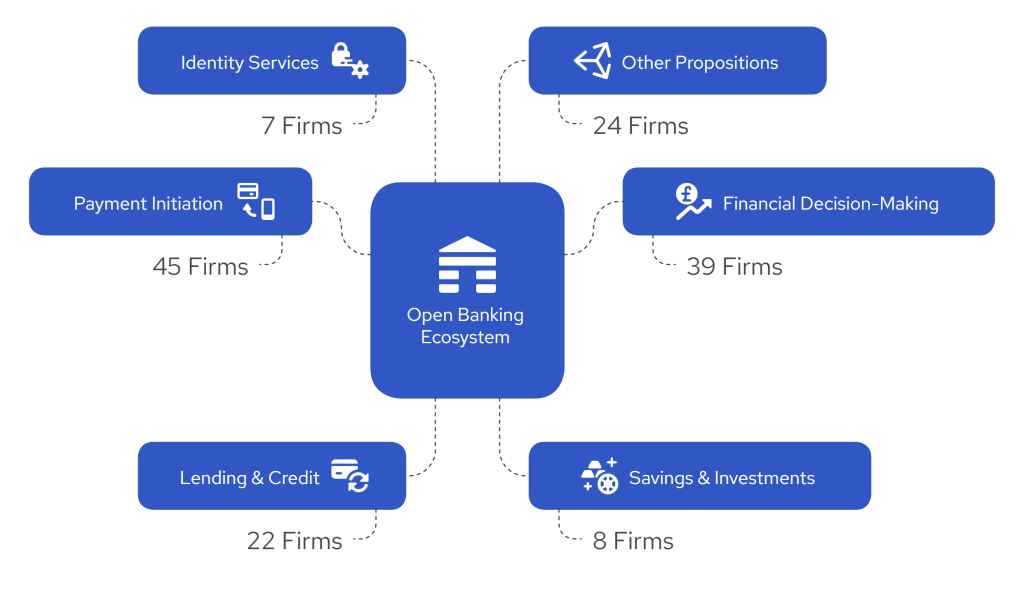

As of March 2025, there are 145 regulated Third-Party Providers (TPPs) with live market propositions, supported by 406 agents.

Breakdown by Proposition Type:

- 45 focused on payment initiation

- 39 on financial decision-making

- 22 on lending and credit

- 8 on savings and investments

- 7 in identity services

- Others offer hybrid or niche solutions

The ecosystem continues to mature with new players entering to solve real financial problems through Open Banking.

📚 How Finexer made Open Banking Affordable

4. A Push for Policy and Sector-Wide Innovation

To mark the release of the Impact Report, OBL gathered policymakers, regulators, and industry leaders. The discussion focused on expanding Open Banking beyond financial services into areas like insurance, energy, and lending.

A major area of attention is the Data (Use and Access) Bill, which aims to set up a long-term regulatory framework. This would support:

- Open Finance initiatives

- Smart Data sharing across sectors

- Fair and secure access to user-permissioned financial data

The goal is to encourage safe, consent-based data usage to fuel cross-sector innovation.

5. Why This Matters for the UK Economy

The impact of Open Banking goes beyond fintech. It helps reduce payment costs, enhances competition, and improves access to digital financial services for individuals and businesses.

By improving the way money and financial data flow, Open Banking:

- Enables real-time cash visibility

- Powers automated finance workflows

- Supports digital SME growth

- Helps establish Open Finance foundations for the future

📚 How Finexer Helps SMB’s in the UK

What UK Consumers Gain from Open Banking?

The 2025 Open Banking Impact Report reveals a pivotal shift. For the first time since Open Banking launched in 2018, consumer adoption has nearly matched small business usage. With 18.4% of digitally active users engaging in Open Banking services in March 2025, the platform is now supporting real, everyday experiences for millions of people.

Here’s what this means for individual users.

1. Safer and More Convenient Payments

One of the clearest benefits for consumers is the ability to make secure, direct payments from their bank account without needing to enter card details. All transactions are authorised through the user’s mobile banking app, reducing the risk of fraud and phishing.

Example:

More than 1.3 million people paid their self-assessment tax bills to HMRC via Open Banking in January 2025, settling over £4.7 billion securely and instantly.

This model is now expanding into retail, gaming, travel, and even credit card repayment. Brands like Just Eat, Ryanair, Tesco, and William Hill have already integrated Open Banking into their payment flows.

2. Control Over Financial Data

Open Banking puts users in charge of their data. With explicit, time-bound consent, consumers can securely share account information with budgeting apps, lenders, or identity verification services.

While data-sharing adoption had plateaued during 2022–2023, it is now growing again, partly driven by innovations like Apple’s balance check feature, which uses Open Banking to show account balances in Apple Wallet.

This return to data usage highlights a renewed interest in smart, user-driven financial tools.

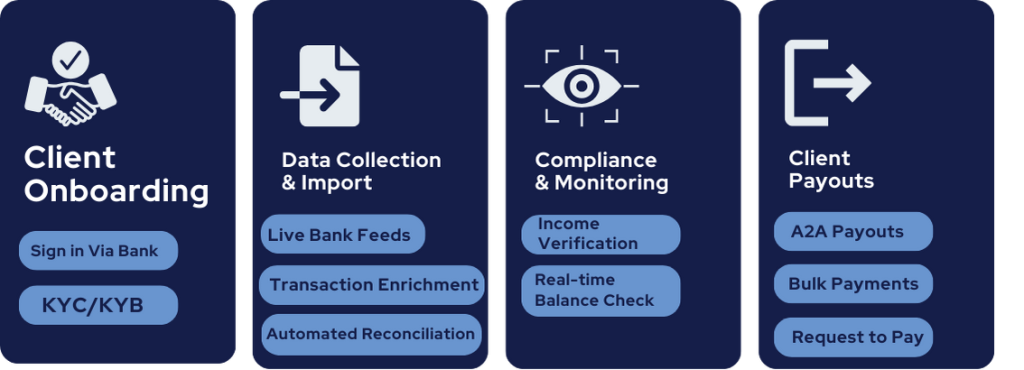

3. Faster Access to Services

Open Banking allows consumers to verify identity, share income history, or confirm account ownership in seconds. This makes it easier to:

- Open a bank account

- Apply for a loan or credit product

- Pass KYC or affordability checks

- Onboard with utility or telecom providers

Users no longer need to upload bank statements or submit manual documents, saving time and reducing friction.

4. Better Financial Products and Recommendations

By granting temporary access to their transaction history, consumers can receive:

- Personalised loan or mortgage quotes

- Spending insights and budgeting help

- Credit-building opportunities based on real activity

This opens the door to a more inclusive financial ecosystem, especially for users without extensive credit histories.

5. Expanding Use Cases Across Industries

Open Banking is no longer limited to banking apps. The 2025 Impact Report notes its adoption in sectors such as:

- Travel (230% growth in usage via Trustly with airlines and booking platforms)

- eCommerce (500% growth reported by TrueLayer)

- Investments (30% of Hargreaves Lansdown payments now processed via Open Banking)

This wider reach increases consumer exposure and makes Open Banking a more familiar part of the digital economy.

Success Stories: How Finexer Helped UK Businesses with Open Banking Integration

Digital Identity & AML Verification (VirtualSignature-ID)

“Finexer is easy to work with and flexible in their approach. They provided the bespoke services we required, along with a commercial model that made sense for us.”

— David Kern, CEO, VirtualSignature-ID

A government-accredited eSignature and identity provider, VirtualSignature-ID needed real-time bank data to power AML, proof-of-funds, and identity checks for legal sector clients.

With Finexer:

- Automated AML and PEP checks using account information APIs

- Verified source of funds through live bank feeds

- Faster onboarding for high-value property transactions

“Finexer helps us deliver secure, compliant, and seamless verification workflows to legal and accountancy firms every day.”

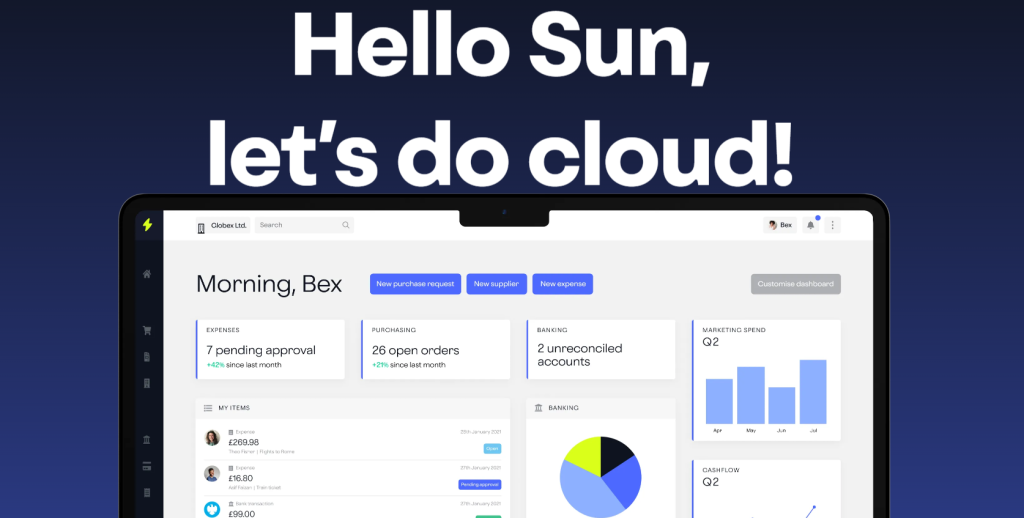

B2B Payments & Reconciliation (Sysynkt)

“Finexer’s willingness to adapt to our needs rather than offering a one-size-fits-all solution made a real difference.”

— Penny Phillips, Chief Commercial Officer, Sysynkt

Sysynkt, a leading business automation platform, integrates Finexer’s APIs into its cloud accounting portal to streamline:

- Bank reconciliations via AIS

- Bulk supplier and expense payments using PIS

- Finance office automation across procurement, invoicing, and payroll

With Finexer:

- Delivered real-time connectivity to UK business accounts

- Enabled secure, same-day disbursements

- Achieved fast integration with minimal developer lift

These partnerships reflect how Finexer supports both regulated identity platforms and large-scale finance automation providers by offering flexible, FCA-compliant Open Banking APIs built for real business outcomes.

“We’re excited to grow further with Finexer. Their team is responsive, technically sound, and easy to work with.”

— Penny Phillips, Sysynkt

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How Finexer Makes Open Banking Accessible for UK Businesses

- Faster Deployment, Minimal Engineering Lift

Go live in days, not months, using our developer-friendly APIs and support. No legacy system dependencies or complex bank certifications needed. - Instant Access to 99% of UK Banks

Secure, regulated connectivity with major UK banks using Open Banking APIs, without needing to build from scratch. - Real-Time Bank Feeds for Better Visibility

Receive cleared transactions, balances, and payer data directly into your system, with no lag or daily export delays. - Payment Initiation APIs Built for Business Workflows

Initiate one-time or recurring payments directly from your platform. Support for payroll, supplier disbursements, tax payments, and refunds. - Built-In Affordability for Growing Teams

Transparent, usage-based pricing that allows startups, accounting firms, and SaaS platforms to get started without upfront cost burdens.

Final Thoughts

The 2025 Impact Report makes one thing clear. Open Banking has moved from early adoption into mainstream usage. It is now a key part of the UK’s financial infrastructure, reaching millions of users and enabling innovation across sectors.

If you are considering how to tap into this growth, now is the time to act.

All insights and data in this blog are sourced from the Open Banking Impact Report 2025 by Open Banking Limited (OBL).

Is Open Banking more commonly used for payments or data access?

Open Banking payments now lead adoption. As of 2025, payments account for the majority of usage, surpassing data-sharing for the first time. Payment volumes reached 31 million in March alone.

What are Variable Recurring Payments (VRPs) in Open Banking?

Variable Recurring Payments (VRPs) allow users to authorise flexible, ongoing payments via Open Banking. They’re commonly used for subscriptions, invoices, and utility bills, offering an alternative to direct debit.

How do small businesses benefit from Open Banking in the UK?

Small businesses benefit from faster payments, real-time cash visibility, reduced card fees, and easier reconciliation. Open Banking helps automate financial workflows using secure API integrations.

Finexer helps UK businesses tap into Open Banking with real-time payment initiation, account data access, and instant bank connectivity, without the usual technical overhead!