Insurance processes often involve delays at critical points, such as onboarding, claim validation, and payouts. Manual checks, scanned statements, and back-and-forth emails increase costs and slow resolution times.

Open Banking allows insurance providers to collect financial data directly from a customer’s bank account, with consent. This gives insurers access to verified transaction records, identity information, and account details without relying on PDFs or phone-based confirmations.

As a result, insurers are now:

- Verifying claims in less time

- Detecting inconsistencies early in the process

- Paying out approved claims without using BACS or cheques

This guide explains how Open Banking is being used in day-to-day insurance workflows, covering:

- Claims validation using transaction data

- KYC and AML reviews without paper documents

- Payouts are processed instantly to the correct account

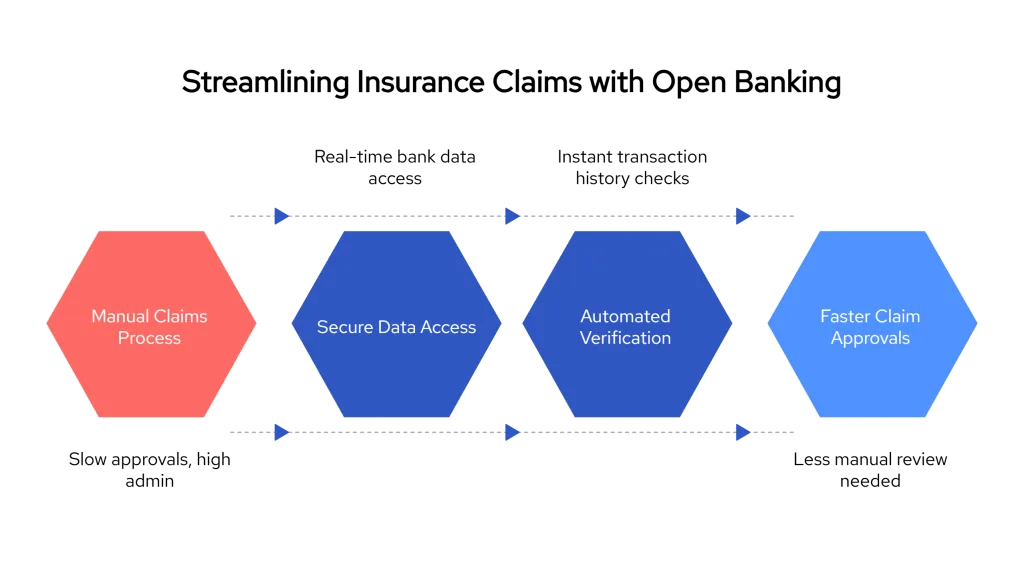

1. Using Open Banking to Speed Up Insurance Claims

The insurance sector still depends on uploaded receipts, bank statements, and policyholder declarations to approve claims. This increases the workload for claims handlers and introduces unnecessary delays.

With Open Banking, insurers can connect to a customer’s bank account and pull recent transaction history in real time, all done with explicit consent and no paper documents.

Use Case: Verifying Travel Insurance Claims

- A claimant says their trip was cancelled due to an emergency

- Instead of requesting flight invoices and hotel bookings, the insurer checks for relevant transactions directly via bank data

- If no travel-related payments appear in the expected timeframe, the claim is flagged for further review

Use Case: Supporting Health or Dental Claims

- Insurance teams often request invoices from clinics or pharmacies

- With Open Banking, recent payments to verified providers can be confirmed through the customer’s transaction history

- This removes the need for scanned receipts or manual document uploads

Results for Insurance Operations

- Fewer delays in assessing simple, verifiable claims

- Reduced manual effort for handlers

- Consistent evidence trails for compliance teams

- Faster response times for policyholders

Open Banking also ensures data access is permission-based, with all activity logged for auditing. That makes it suitable for high-volume claim categories like health, travel, and personal cover.

2. KYC for Insurers: Identity, Account Ownership, and AML Checks

Traditional KYC in insurance often involves customers uploading documents like utility bills, bank statements, or passports, all of which must be manually verified. These checks create friction for new policyholders, delay underwriting, and leave gaps in fraud detection.

Open Banking offers a direct alternative. With customer consent, insurers can access verified data straight from the applicant’s bank account. This includes:

- Full account holder name

- Account number and sort code

- Transaction history

- Available balance and incoming funds

These details enable KYC teams to verify identity, ownership, and affordability, all without relying on scanned documents or third-party databases.

Use Case: Verifying Identity and Account Ownership

A customer applies for an income protection policy. Instead of asking them to upload bank documents:

- The insurer presents a secure Open Banking consent screen

- The customer selects their bank and grants access

- The insurer receives verified details (e.g. John Smith, Barclays UK, account number ending in 9021)

- Cross-checking with application data takes seconds, not days

This approach reduces errors and protects against fraudulent identity use.

Use Case: Source of Funds and Risk Assessment

Some insurance products, particularly high-value life or business policies, require enhanced due diligence.

- By reviewing income patterns, insurers can confirm the legitimacy of income sources (salary vs. unexplained transfers)

- Categorised transaction data helps underwriters spot anomalies or potential risk behaviours

- This supports AML requirements and can be retained for audit evidence

Outcome for Insurance KYC Teams

- Faster onboarding, most verifications happen in under a minute

- Fewer support tickets and re-requests for better documents

- Stronger fraud protection using verified, real-time data

- Built-in evidence for FCA compliance and internal audit trails

Unlike screen scraping or data brokers, Open Banking offers consented access, limited by scope, with all interactions logged. That makes it suitable for insurers handling regulated products or working under tighter FCA expectations.

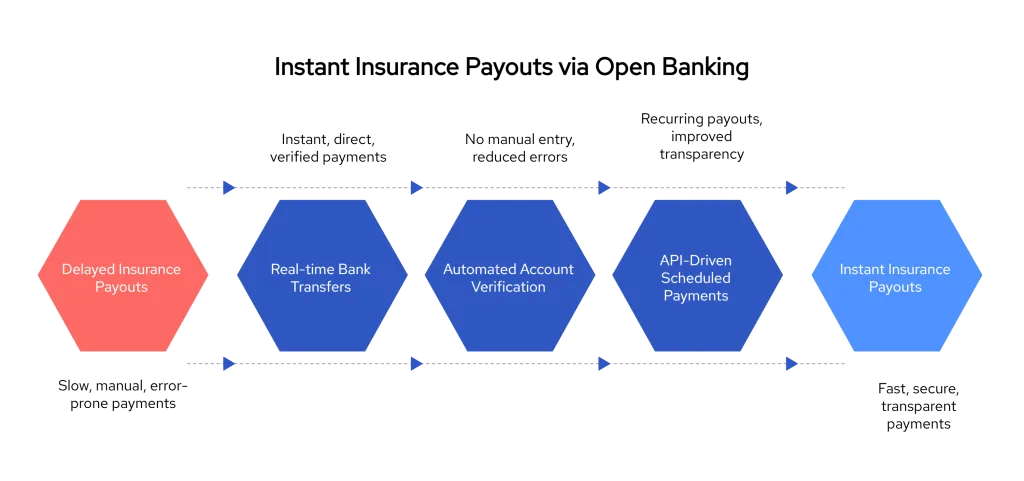

3. Real-Time Payouts to Customers: No BACS, No Cheques

Once a claim is approved, many insurance teams still rely on legacy payment methods: BACS transfers that take days to settle, manual entry of account details, or even printed cheques sent through the post. These methods increase payout delays and introduce unnecessary friction, especially when customers expect near-instant resolution.

With Open Banking, insurers can initiate real-time account-to-account payments directly to the policyholder’s verified bank account. This removes the need for manual data entry or reliance on outdated rails.

Use Case: Motor Insurance Reimbursements

A policyholder has a claim approved for vehicle damage.

Instead of:

- Asking the customer to confirm bank details via email

- Scheduling a BACS transfer that takes two to three business days

- Following up with the customer for payment status

The insurer:

- Uses a verified bank account (already captured via Open Banking)

- Initiates a real-time payment using Pay by Bank infrastructure

- Logs confirmation of the payout instantly within the claim record

This ensures faster customer resolution and fewer post-claim follow-ups.

Use Case: Income Protection or Personal Injury Claims

Where time-sensitive or ongoing payments are involved, Open Banking payouts reduce reliance on recurring manual processing.

- Payments can be issued on a schedule using programmable APIs

- Each disbursement can be linked to a verified account

- Settlement confirmation is immediate, improving transparency for both insurer and policyholder

Benefits for Insurance Payout Operations

- Eliminate delays associated with BACS and cheque processing

- Reduce risk of payout errors or fraud due to incorrect account details

- Confirm payment status in real time, no need for customer service follow-ups

- Improve customer satisfaction by meeting expectations for faster resolution

In high-volume claim categories such as travel, health, home contents, or temporary income loss, this shift saves time for both teams and policyholders.

Open Banking also ensures that payouts are made only to accounts that the policyholder owns and has verified, reducing the risk of fraud or misdirection.

How It Works in Practice: Consent, Compliance, and Control

Open Banking isn’t just a data access method, it’s a regulated, standards-based system designed to give users full control over what data is shared, who accesses it, and for how long.

For insurance teams, this means every interaction, whether for identity checks, claims validation, or payout setu,p is built around customer permission and audit-ready access.

How Consent Is Captured

Before any data is accessed, the customer:

- Is presented with a secure screen from an authorised provider

- Reviews what data the insurer is requesting (e.g. transactions, account name)

- Grants permission using their online banking credentials via their bank’s own interface

- Can revoke access at any time

No credentials are shared with the insurer, and the consent process is protected under UK Open Banking and PSD2 regulations.

What Data Can Be Accessed and For How Long

Insurers can request access to:

- Account ownership details

- Sort code and account number

- Transaction history (with limits set by the consent)

- Balance or incoming payments (if needed for affordability checks)

The access is typically read-only and time-limited, for example, 90 days, ensuring that only relevant information is collected, and only with approval.

FCA-Ready Controls for Insurance Teams

Each data pull via Open Banking is:

- Logged with a timestamp and consent record

- Scoped to only the necessary fields (supporting data minimisation)

- Linked to a traceable audit trail, useful for compliance reviews or internal QA

- Revocable at the customer’s discretion, in line with privacy regulations

This makes Open Banking suitable for insurers who are subject to FCA oversight, internal compliance policies, or third-party audits.

Why This Matters for Insurance Operations

Insurers are expected to maintain clear records of data collection, reduce unnecessary processing, and protect customer privacy even when using third-party tools. Open Banking meets these requirements out of the box:

- No manual handling of sensitive data

- Fully digital, permission-based access

- Clear scope and expiry of every data session

This reduces compliance risk while simplifying verification processes, something that traditional methods rarely achieve at scale.

How Finexer Supports Insurance Teams

Finexer provides a set of Open Banking APIs built specifically to reduce delays in insurance workflows from onboarding and claim verification to real-time payouts. Our tools help insurance teams access bank-verified data in seconds, without relying on PDFs, manual checks, or back-office follow-ups.

Here’s how insurers are using Finexer in practice:

1. Instant KYC and Account Verification

Insurance onboarding doesn’t need to wait for uploaded statements or customer follow-up. With Finexer:

- Customers verify their identity and account details in under 90 seconds

- You receive live bank account holder names, sort codes, and numbers

- Data is matched automatically to the application, no manual review needed

- All consent is securely captured and audit-ready

This helps insurers reduce onboarding drop-off, avoid document errors, and meet KYC obligations with minimal effort.

2. Faster Claims Validation with Transaction Data

Instead of asking for receipts or proof of spend, Finexer lets you fetch relevant transaction categories directly from a policyholder’s bank account:

- Travel, dental, retail, or service payments can be confirmed in seconds

- Claims that meet automated rules can be fast-tracked

- Others can be flagged if transactions don’t match the claimed event

This speeds up genuine claims and reduces time wasted reviewing incomplete or suspicious files.

3. Real-Time Insurance Payouts

Once a claim is approved, Finexer enables instant bank payments with no BACS delays or manual data entry:

- Funds are sent directly to the verified account the customer used during onboarding

- Payout confirmation is available instantly via webhook or dashboard

- There’s no need to re-collect or re-check payout details

For categories like car damage, lost baggage, or income protection, this reduces wait times and customer complaints.

4. Built for Compliance and Control

Every interaction through Finexer is logged and built to support insurance compliance:

- Customer consent is captured via regulated interfaces

- Only the requested data is accessed, nothing more

- Access is time-limited, revocable, and permission-based

- All data flows meet UK Open Banking and FCA expectations

This gives Compliance Leads confidence without creating new internal processes.

5. Fast Deployment, Real Support

Finexer is designed for teams who don’t want long implementations. We offer:

- Clean Developer friendly SDKs

- Sandbox access for realistic testing

- 3-5 weeks of hands-on Support from UK-based onboarding team

- Deployment up to 2–3x faster than most market providers

You can start with just one workflow like account verification or payouts, and expand based on results.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWhat is open banking used for in insurance?

Open banking in insurance is used for customer identity verification (KYC), account ownership checks, claims validation, and fast payouts. It allows insurers to access verified bank data directly, reducing paperwork and speeding up policy decisions.

Can open banking help detect fraud in insurance claims?

Yes. Open banking lets insurers check live transaction data against claim details. If a customer claims travel expenses without matching transactions, the system can flag it for review, reducing fraud risk and improving accuracy.

How fast are insurance payouts using open banking?

Insurers can issue payouts in seconds using open banking APIs. Once a claim is approved, funds are sent directly to the policyholder’s verified bank account, without BACS delays or manual bank detail entry.

See how Finexer helps insurers verify accounts, validate claims, and issue payouts, all using live bank data.