Handling accounts for a single business is challenging. But when your client manages multiple entities such as subsidiaries, branches, or franchises, the complexity increases quickly. Each entity often has its own bank account, ledger, and reporting needs. This results in more spreadsheets, more reconciliation tasks, and higher chances of error.

Traditional methods like uploading CSV files or manually entering transactions are not sustainable. They slow down reporting and increase the risk of inconsistencies. This is where Open Banking Integration becomes a practical solution for accountants.

By securely connecting directly to client bank accounts through Open Banking, accountants can:

- Access real-time transaction data across all entities

- Automate bank feed imports

- Reduce reconciliation delays

- Bring all financial data together in one place

For firms supporting multi-entity clients, Open Banking Integration is no longer a nice-to-have feature. It is a core part of a scalable accounting process.

What Is Open Banking Integration and How It Works for Accountants

Open Banking Integration refers to the secure connection between bank accounts and accounting systems through APIs. Instead of waiting for clients to send bank statements or uploading files manually, you can pull live bank transaction data directly into your accounting platform.

For accountants working with multi-entity clients, this means no more switching between banking portals, requesting missing statements, or relying on outdated records. Each entity’s bank data is available in real time, within a single view.

How It Works:

- Client authorises access to their bank

Through a secure consent-based process, clients grant access to their bank accounts using Open Banking protocols. - Transactions are pulled via API

Once access is granted, the integration automatically fetches bank transactions and feeds them into your chosen accounting or reconciliation system. - Data is categorised and mapped

Transactions are enriched with merchant names, categories, and payment types. This helps speed up coding and matching across multiple ledgers. - You view and reconcile

Accountants can view all transactions by entity, apply filters, and begin reconciliation immediately without waiting for documents.

This process significantly improves bank feed automation, reduces the risk of data entry errors, and gives you faster access to cash flow insights across each entity.

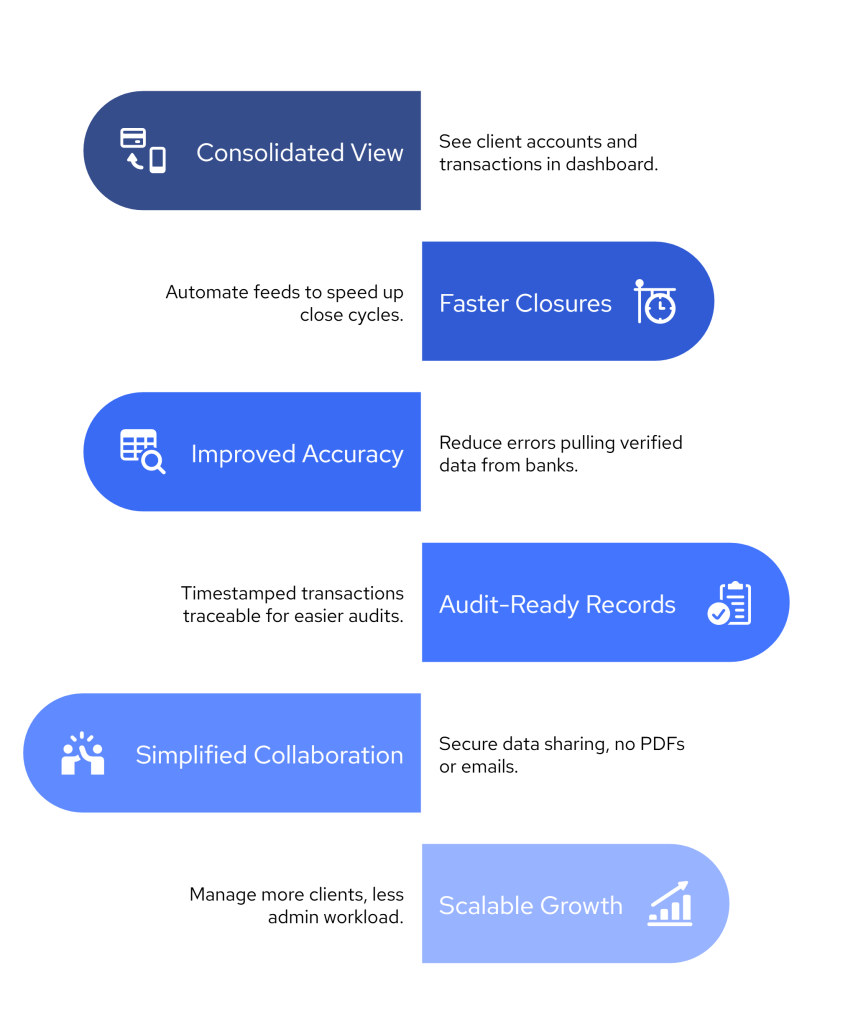

Key Benefits of Open Banking Integration for Multi-Entity Clients

When managing clients with multiple business units or subsidiaries, efficiency and accuracy are everything. Open Banking Integration helps accounting firms achieve both without increasing admin overhead.

Here are the top benefits:

1. Consolidated View Across All Entities

With real-time bank feeds pulled into one platform, accountants can monitor balances and transactions across all client entities. No need to chase separate bank logins or juggle multiple files. This simplifies multi-entity accounting and reduces risk.

2. Faster Month-End Closures

Automated transaction feeds reduce the time spent waiting for statements or importing CSV files. This allows accountants to close books faster, even when working with complex organisational structures.

3. Improved Data Accuracy

Manual processes are prone to errors. Open Banking Integration eliminates duplication, missing entries, and version mismatches by fetching verified data directly from banks.

4. Better Audit Trails

Each transaction retrieved through Open Banking is timestamped and traceable to its source account. This makes it easier to justify balances and respond to audit queries with minimal delay.

5. Streamlined Client Collaboration

Clients no longer need to email PDFs or upload bank statements. They simply connect their bank accounts once, and their data flows securely into your system on an ongoing basis.

6. Scalable Workflows for Growing Firms

As your client base grows, the admin burden does not. Whether you manage five entities or fifty, Open Banking Integration ensures your systems scale with demand, not your headcount.

Choosing the Right Open Banking Integration for Your Accounting Practice

Not all Open Banking tools are designed with accountants in mind. If you manage multi-entity clients, you need more than just access to bank data — you need features that fit into your workflow and make client management easier.

Here’s what to look for:

1. Coverage Across UK Banks

Choose a provider that connects with at least the Major UK banks. This ensures you can serve clients regardless of which institutions they use, avoiding delays caused by limited coverage.

2. Multi-Entity Dashboard Support

A good Open Banking Integration should allow you to manage multiple client accounts from one interface. Look for solutions that let you tag or group transactions by entity, making it easier to keep ledgers separate and accurate.

3. Transaction Enrichment and Categorisation

Raw bank data isn’t always easy to interpret. The right tool should enhance transactions with merchant details, descriptions, and categories. This supports faster coding and clearer reporting.

4. Compatibility with Existing Software

Whether you use Excel, bridging tools, or cloud accounting platforms, make sure the integration complements your current stack. You shouldn’t have to change your whole system just to enable bank feeds.

5. Security and FCA Authorisation

Ensure your provider follows all Open Banking regulations and is authorised by the FCA. You’ll be handling sensitive financial data, so full compliance and bank-grade security are essential.

6. Flexible Pricing for Varying Client Needs

Avoid fixed pricing plans that penalise you for serving small or seasonal clients. Look for usage-based models that align with how you actually work.

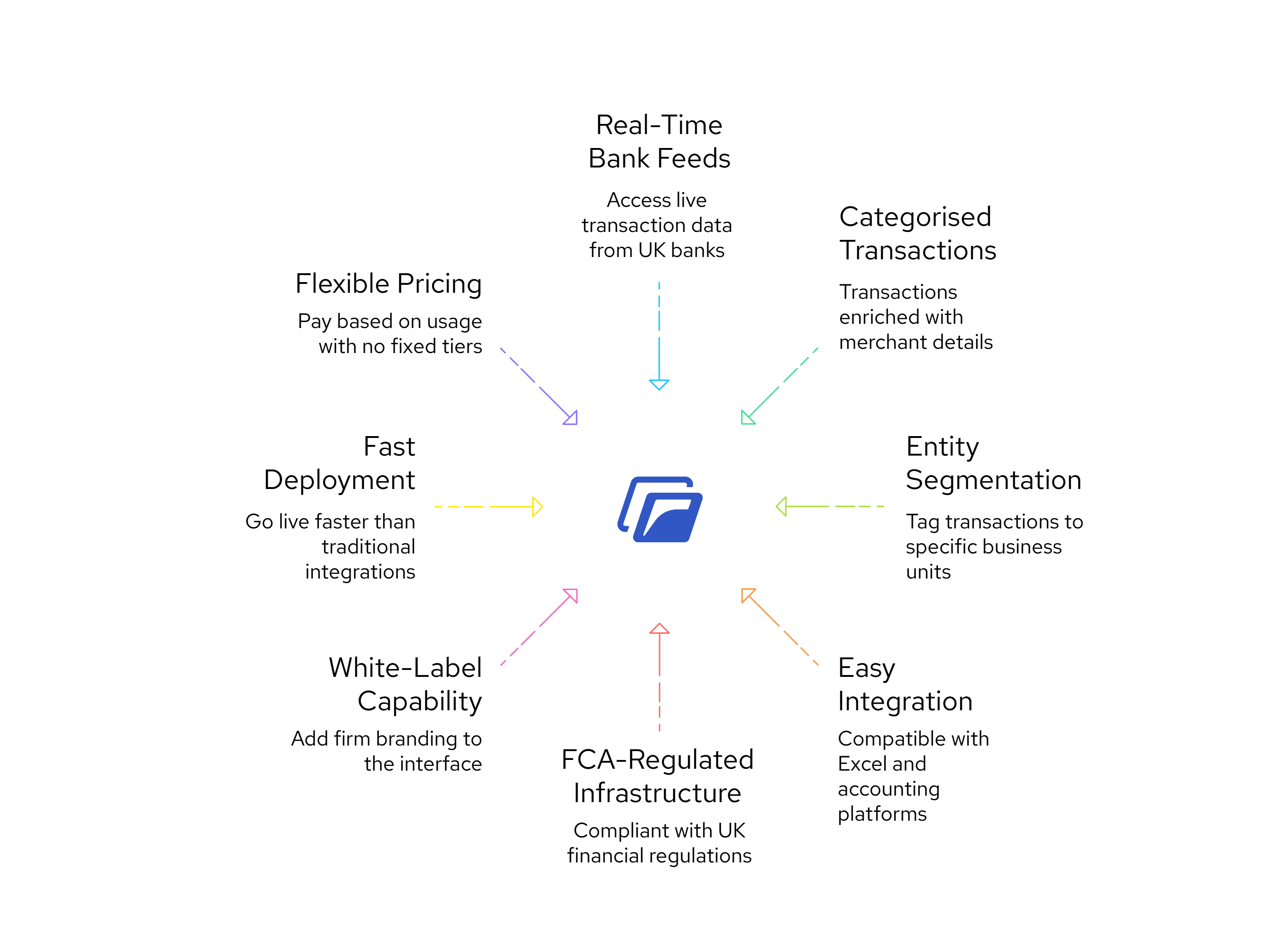

How Finexer Supports Complex Multi-Entity Accounting Workflows

Finexer has been purpose-built for accounting firms managing layered client structures from subsidiaries and trading arms to holding companies and trusts. If your practice supports multiple entities under one client group, Finexer offers a robust, reliable foundation to simplify your bank data workflows using secure Open Banking Integration.

Here’s what makes Finexer suitable for multi-entity accounting at scale:

1. Real-Time Bank Feed Access Across All Entities

Finexer connects to 99% of UK banks, enabling your firm to sync live transaction data from multiple bank accounts into one secure platform. You no longer have to chase clients for PDF statements or reconcile data that’s days out of date.

Each transaction is automatically pulled through Open Banking APIs, timestamped, and assigned to the correct account, allowing you to monitor entity-specific activity from a unified dashboard.

2. Transaction-Level Data with Categorisation and Enrichment

Multi-entity accounting becomes much easier when transactions are categorised correctly from the start. Finexer enriches transaction data with merchant names, payment types, and categories, giving your team cleaner inputs to work with during reconciliation.

This allows you to:

- Match receipts and payments without back-and-forth validation

- Reduce manual data entry and exception handling

- Speed up both monthly and year-end close

3. Entity Segmentation and Ledger Mapping

Finexer allows you to tag transactions by business unit or entity, so you can keep financial records segmented without needing separate systems. Whether your client operates five bank accounts or fifteen, you can assign each to the relevant legal entity or ledger in your workflow.

This reduces the chance of posting errors and ensures accurate reporting for compliance, forecasting, or audit preparation.

4. Easy Integration with Existing Accounting Tools

Your firm does not need to overhaul its software stack. Finexer’s Open Banking Integration fits alongside Excel-based workflows, MTD bridging tools, and popular accounting platforms. During onboarding, Finexer works with your team to test the integration setup, resolving any compatibility issues before deployment.

This makes it a practical choice for firms using mixed systems across different clients or departments.

📚 How to Stay MTD Compliant with Finexer

5. FCA-Authorised Infrastructure with Full Compliance Support

Finexer operates under an FCA-regulated framework, ensuring all data access and storage meets the highest compliance standards. Every bank feed pulled through the platform includes a secure audit trail, helping your firm stay aligned with HMRC’s Making Tax Digital requirements and future-proofed for regulatory checks.

6. White-Label Capability for Client-Facing Workflows

If your firm wants to maintain a branded client experience, Finexer allows full white-labelling. Clients see your firm’s name and branding on their bank connection interface, giving you control over how your services are presented while retaining the technical capabilities in the background.

7. Fast Deployment for Rapid Onboarding

With Finexer, your firm can go live in days, not months. The integration dashboard is designed for accountants, with minimal learning curve and clear controls over entity-specific feeds. Compared to many competitors, Finexer deploys 2 to 3 times faster, without compromising on reliability.

8. Flexible Pricing That Reflects Usage

Finexer’s pricing adjusts based on your usage. You are not locked into fixed tiers or minimums that force you to overpay for smaller clients or part-time engagements. Whether you manage high-volume books or just need segmented feeds for a few key clients, the platform adapts to your needs.

What is Open Banking Integration in accounting?

Open Banking Integration securely connects bank accounts to accounting software for real-time data syncing and automation.

How does Open Banking help with multi-entity clients?

It allows you to manage multiple bank accounts across entities from one dashboard, reducing manual work and improving accuracy.

Is Open Banking Integration secure?

Yes. FCA-authorised providers follow strict standards with encrypted connections and audit trails to protect client financial data.

Can I use Open Banking with Excel or MTD bridging tools?

Yes. Many providers support Excel-based workflows and MTD tools without needing to switch your accounting system.

Do I need to install software for Open Banking Integration?

No. Most tools are cloud-based and integrate directly with your existing systems without requiring new installations.

Stop juggling spreadsheets and disconnected bank feeds! Switch to Finexer and simplify multi-entity accounting across all your clients 🙂