Mid-size and scaling accounting firms face a daily challenge: keeping financial data accurate, up to date, and easy to access without slowing down client work. Chasing bank statements, waiting for CSV files, and cross-checking transactions eat into billable hours and delay reporting.

Open banking providers for accounting firms have changed that. By connecting directly to client bank accounts with their consent, these platforms deliver secure, real-time transaction data and, in some cases, payment initiation capabilities. The right provider can remove manual admin, improve reconciliation speed, and help your firm offer more value to clients.

But with multiple options in the UK market, the question is no longer ‘if you should use open banking’; it’s which provider fits your accounting workflows best.’

What to Look For in an Open Banking Provider

When evaluating open banking providers for accounting firms, it’s worth looking beyond a basic feature checklist. The right choice should align with how your firm works today and where you plan to grow. Key factors to consider include:

- UK Bank Coverage

The more banks your provider connects to, the fewer gaps you’ll face. For mid-size firms serving a diverse client base, high bank coverage ensures you rarely chase missing statements. - Data Refresh Speed and Reliability

Real-time or frequent refreshes keep reconciliations accurate. Look for providers with a proven track record in delivering stable, error-handled feeds. - FCA Authorisation and Security

Compliance is non-negotiable. FCA regulation means the provider meets UK standards for handling sensitive financial data. - Integration with Your Accounting Software

Direct compatibility with platforms like Xero, QuickBooks, or Sage saves hours in manual imports and reduces error risk. - Data Enrichment Capabilities

Beyond raw transactions, enriched data, like categorised expenses, recurring income detection, and merchant identification, supports better client advisory and reporting. - Payment Initiation Support (Optional)

If you manage payroll, supplier payouts, or client collections, having payment initiation alongside data access reduces reliance on multiple systems.

Comparison: Open Banking Providers for Accounting Firms

| Feature / Criteria | Finexer | Crezco | Salt Edge | Volt | Bud |

|---|---|---|---|---|---|

| UK Bank Coverage | 99% UK Banks | Major UK banks | UK + global banks | UK + EU coverage | 90%+ UK coverage |

| Real-Time Payments | Yes | Yes | ⚠ Optional (via partners) | Yes | No |

| Financial Data Access | Yes | ⚠ Limited | Yes | No | Yes |

| Data Enrichment | Yes | No | Advanced | No | Advanced |

| White-Label Support | Yes | Limited | Yes | Limited | Limited |

| FCA Authorised | Yes | Yes | Yes | Yes | Yes |

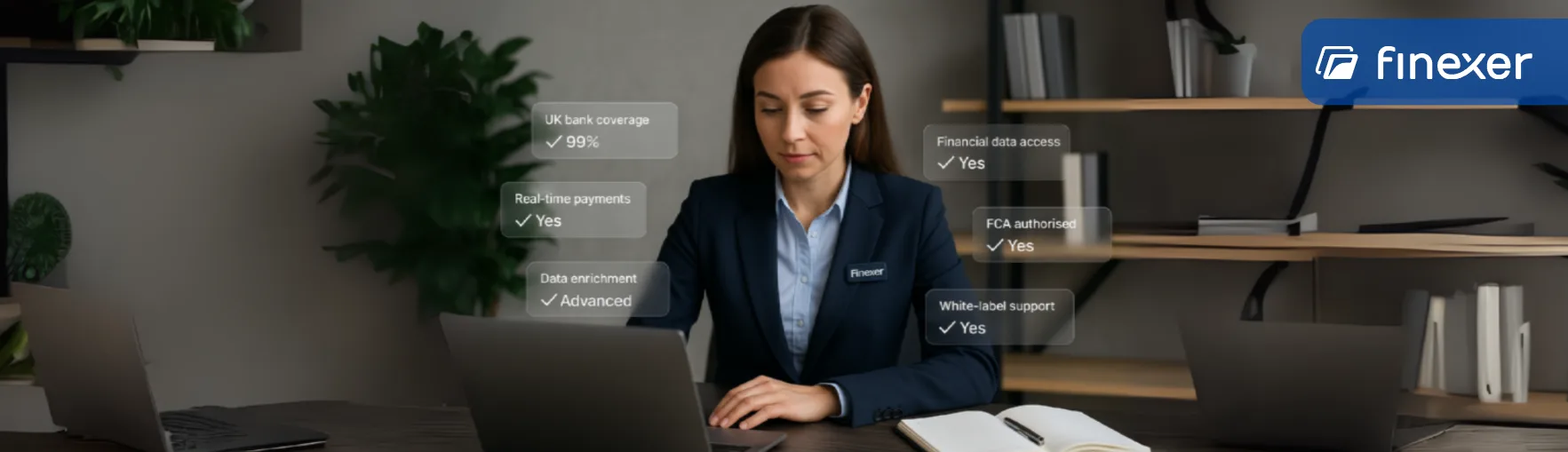

1. Finexer

For mid-size and scaling accounting firms, operational delays caused by missing bank statements or unreliable data feeds are more than just an inconvenience; they slow down reporting, impact client relationships, and cut into profitability. Finexer was built to solve exactly that.

As one of the most UK-focused open banking providers for accounting firms, Finexer delivers both real-time bank data access and payment initiation tools through a single, easy-to-deploy API. With 99% coverage of UK banks, FCA authorisation, and infrastructure designed around Faster Payments, it’s tailored for firms that need speed, compliance, and flexibility without the complexity of managing multiple vendors.

Where many providers split their focus across multiple markets, Finexer is dedicated to the UK, which means integrations, support, and compliance are aligned with the exact needs of UK accounting professionals. For scaling firms, that translates into faster onboarding, fewer client delays, and the option to white-label services for a seamless client experience.

Key Highlights:

- Full AIS + PIS access via one integration

- 99% UK bank coverage with real-time data refresh

- FCA-authorised and UK compliance-ready

- White-label capability for branded client portals

- Flexible usage-based pricing, no setup fees or hidden charges

Why Mid-Size & Scaling Firms Choose Finexer:

Finexer helps accounting teams handle high client volumes without sacrificing accuracy or compliance. By combining real-time data feeds with account-to-account payment functionality, firms can manage reconciliation, payroll, and supplier payouts from the same platform.

For mid-size practices aiming to grow, Finexer’s onboarding support (three to five weeks of hands-on assistance) ensures your team can deploy and start delivering value quickly.

Best Fit For:

- UK-based mid-size and scaling accounting firms

- Firms managing multi-client reconciliation and payments

- Practices seeking a single provider for both data and payment capabilities

Get Started

Finexer helps you reconcile faster, serve more clients, and scale without extra admin.

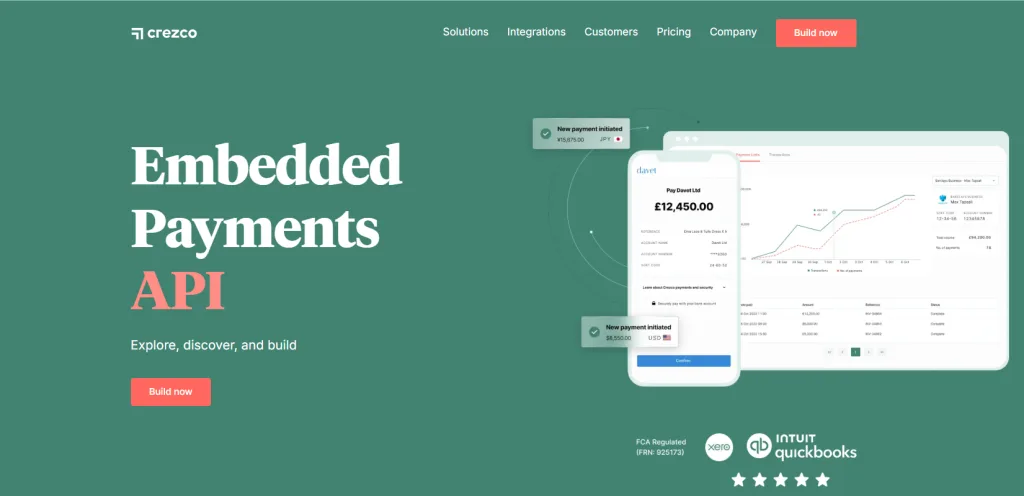

Try Now2. Crezco

For accounting firms that spend too much time chasing unpaid invoices, Crezco focuses on removing the friction between sending a bill and receiving cleared funds. Instead of relying on card payments or manual transfers, it turns invoices into secure pay-by-bank requests, allowing clients to settle directly from their bank account.

Built in the UK and fully FCA-authorised, Crezco connects directly to tools like Xero and QuickBooks, so once a payment is made, the invoice is automatically marked as paid, cutting out the reconciliation step. This makes it particularly attractive for firms supporting small businesses that experience frequent payment delays.

While Crezco doesn’t offer broad financial data aggregation, its focus on invoice-to-payment workflows makes it a practical choice for firms whose primary need is speeding up receivables and keeping client cash flow healthy.

Core Benefits:

- Real-time account-to-account payments via open banking

- Automatic reconciliation when payments are received

- Direct integration with Xero and QuickBooks

- FCA-authorised for UK payments

Best Fit For:

- Firms managing invoicing and cash flow for small business clients

- Practices looking to reduce late payments without adding manual work

What is the role of open banking in accounting firms?

Open banking lets accounting firms securely access client bank data in real time. This reduces manual statement chasing, speeds up reconciliation, and improves reporting accuracy, making it easier to deliver timely, accurate financial services.

Which features should accounting firms prioritise when choosing an open banking provider?

Key factors include UK bank coverage, FCA authorisation, accounting software integration, data enrichment, and payment initiation. Mid-size and scaling firms should also consider white-label support and flexible, usage-based pricing for long-term scalability.

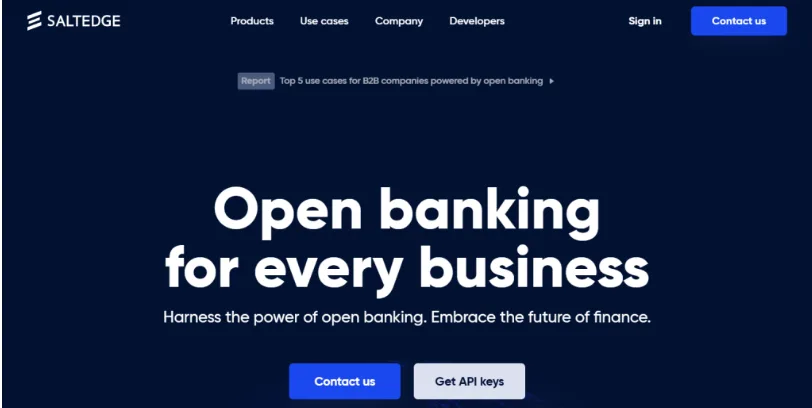

3. Salt Edge

For accounting firms where deep financial insight is as important as raw transaction access, Salt Edge offers one of the most comprehensive data aggregation and enrichment platforms in the market. With connectivity to more than 5,000 banks worldwide, including full coverage of major UK institutions, it allows firms to access client financial data in real time and transform it into meaningful reports.

Its enrichment tools go beyond simple categorisation. Salt Edge identifies merchants, detects recurring income or expenses, and provides additional financial insights that can support advisory work, affordability checks, and more informed client conversations. For firms handling complex portfolios or clients with multiple accounts across different banks, this depth can significantly reduce manual analysis.

Salt Edge is fully FCA-authorised in the UK (FRN: 822499) and ISO 27001 certified, ensuring data security and compliance remain at the highest standard.

Core Benefits:

- Connectivity to 5,000+ banks worldwide, including UK-wide coverage

- Advanced transaction categorisation and merchant identification

- Real-time account information and financial insights

- FCA-authorised and ISO 27001 certified

Best Fit For:

- Firms that need high-quality financial data aggregation and analysis

- Practices offering advisory services based on transaction trends and behaviour

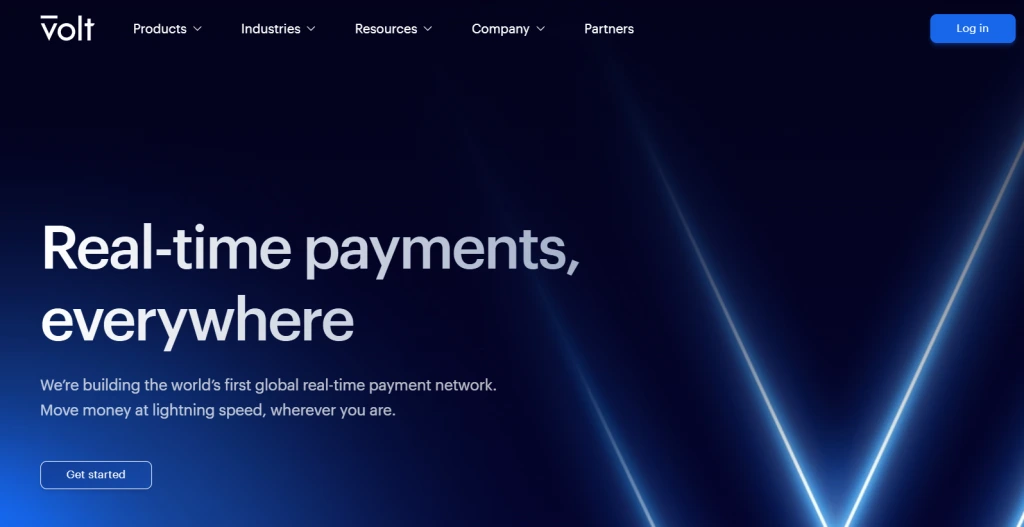

4. Volt

When an accounting firm’s role extends beyond reconciliation into handling high-volume or high-frequency payouts, payment reliability becomes critical. Volt is built specifically for that purpose, enabling real-time account-to-account transfers designed to move funds quickly and consistently.

Its standout feature is a smart routing engine that automatically selects the most reliable banking path for each payment, reducing the chance of delays or failures. This is particularly valuable for firms managing supplier payments, payroll runs, or marketplace settlements on behalf of clients.

While Volt does not provide financial data aggregation or transaction enrichment, its focus on speed and payment success rates makes it a strong choice for firms that require dependable payment flows at scale.

Core Benefits:

- Real-time A2A payments via open banking

- Smart routing engine to reduce failed transactions

- Developer-first API infrastructure for tailored workflows

- FCA-regulated in the UK

Best Fit For:

- Firms managing high-volume or high-frequency payouts

- Accounting practices supporting e-commerce or marketplace clients with regular disbursements

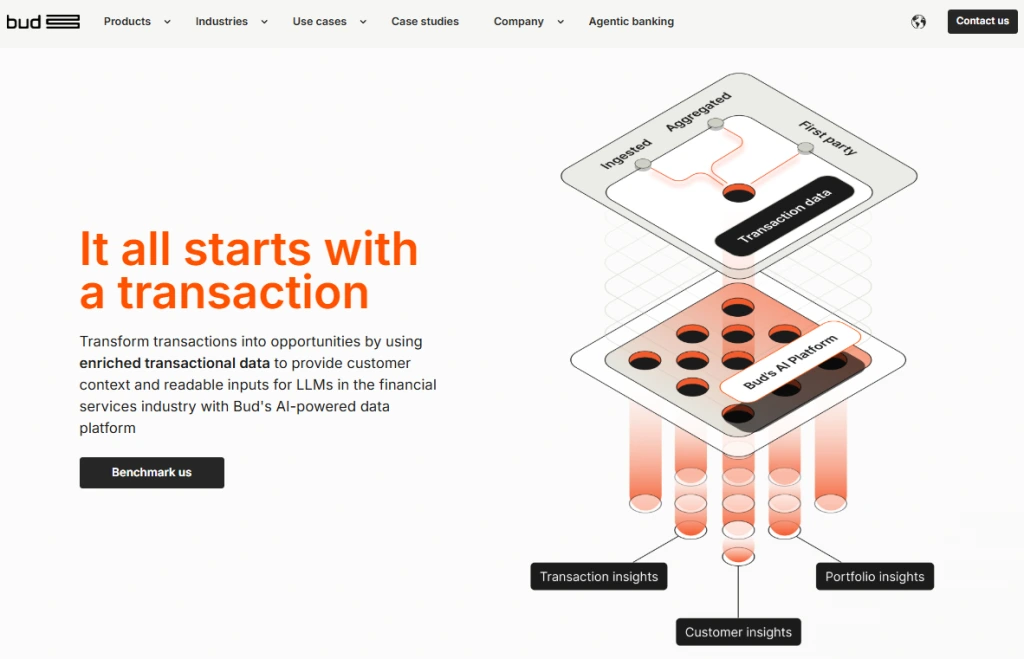

5. Bud

For accounting firms that want to move beyond compliance into delivering data-driven advisory services, Bud focuses on turning raw bank transactions into meaningful client insights. Its platform offers advanced categorisation, income trend analysis, and behavioural mapping, giving accountants a clearer view of their clients’ financial health without the need for manual data processing.

Bud’s tools are particularly valuable for firms involved in affordability checks, financial planning, or cash flow advisory services. By detecting recurring income, identifying spending patterns, and segmenting transaction categories, it enables accountants to have more informed, strategic conversations with clients.

While Bud does not process payments, it offers real-time banking data with UK bank coverage and supports white-label deployment for firms that want to deliver these insights under their own brand.

Core Benefits:

- Advanced transaction categorisation and income analysis

- Real-time bank data access with UK coverage

- Behavioural insights for better client advisory

- FCA-regulated with white-label options available

Best Fit For:

- Firms providing financial advice or affordability assessments

- Practices looking to personalise services using enriched bank data

Final Thoughts

The shift to open banking is no longer optional for UK accounting firms; it’s an essential step toward faster reconciliations, fewer client delays, and better financial insight. With the right provider, you can connect directly to client bank accounts, pull enriched transaction data in real time, and even initiate payments without leaving your existing workflow.

While each provider in this guide has its strengths, the decision comes down to your firm’s priorities. Invoice-heavy practices may lean toward Crezco, data-led firms may prefer Salt Edge or Bud, and those handling high-volume payouts could see value in Volt.

But for mid-size and scaling firms that want a UK-focused, FCA-authorised platform combining real-time bank feeds, enriched transaction data, and payment initiation all in one integration, Finexer offers the most complete solution. It’s built for firms ready to cut manual admin, serve more clients with less effort, and scale without sacrificing compliance or branding.

Which is the best open banking provider for accounting firms in the UK?

For a UK-focused, FCA-authorised platform with real-time feeds, enriched data, and payment initiation in one solution, Finexer is a leading choice for mid-size and scaling accounting firms.

Can open banking providers integrate with accounting software like Xero or QuickBooks?

Yes. Many open banking providers for accounting firms integrate directly with platforms like Xero, QuickBooks, and Sage to sync transactions and speed up reconciliation.

Are open banking providers in the UK regulated?

Yes. Legitimate open banking providers are authorised by the Financial Conduct Authority (FCA) to ensure secure handling of financial data and payments in the UK.

Mid-size and scaling accounting firms trust Finexer to combine data access, payments, and compliance in one simple integration.