What You Will Discover:

Picture Sarah, a senior accountant at a growing firm in London. She spent hours downloading bank statements, matching transactions, and updating client records every Monday morning. Her team would dedicate weekends to reconciliation, often missing their children’s football matches. Today, Sarah enters her office, opens her laptop, and finds all weekend transactions automatically processed, categorised, and reconciled. Her team now provides strategic advice to clients instead of manual data entry.

This transformation isn’t futuristic – it’s happening in accounting firms across the UK. But here’s the challenge: while UK businesses lose £8.5 billion annually to manual accounting processes, many firms struggle to understand how open banking can transform their practice. Let’s explore this revolution together, breaking down complex concepts into practical, actionable insights.

Understanding Open Banking

Imagine your local coffee shop. Every morning, dozens of customers order their favourite drinks. The barista takes orders, makes coffee, handles payments, and updates inventory – all tasks that need coordination. Now, picture a modern point-of-sale system that automatically tracks orders, updates inventory, and reconciles payments. That’s similar to what open banking does for accounting, but on a much larger scale.

Open banking creates secure, automated connections between banks, accounting systems, and financial data. Think of it as building a smart city for financial information, where data flows automatically through secure channels, replacing the old system of manually carrying information between different places.

Why Does This Matter for Your Practice?

Consider these questions:

- How many hours does your team spend on manual data entry each week?

- What percentage of your client billing is delayed due to reconciliation issues?

- How quickly can you provide clients with accurate cash flow forecasts?

For most firms, the answers reveal significant inefficiencies. Let’s look at a typical week in numbers:

| Task | Traditional Process (Time Spent) | Open Banking Solution (Time Saved) |

|---|---|---|

| Bank reconciliation | 15 hours | Automated matching (14.5 hours) |

| Transaction categorisation | 20 hours | Finexer’s categorisation (19 hours) |

| Payment processing | 5 hours | Instant processing (4.5 hours) |

| Audit preparation | 10 hours | Continuous audit trail (9 hours) |

The Building Blocks of Modern Accounting

Understanding open banking in accounting is like understanding how a modern smart home works. Just as a smart home has different systems working together (security, heating, lighting), open banking brings together various financial services that transform your practice.

This comprehensive guide explores how open banking use cases are fundamentally changing financial services, focusing on their impact on accounting firms in the UK market. Whether you’re a financial director exploring new technological possibilities or a software developer seeking to integrate banking capabilities, this guide will provide you with actionable insights and practical understanding.

Open Banking Services

Understanding the foundational elements that support modern open banking use cases is crucial for organisations looking to harness their potential. These services form the backbone of modern financial technology integration and enable the creation of innovative solutions that enhance business operations.

Account Information Services (AIS)

Account Information Services represent a fundamental shift in how businesses access and manage financial data. At its core, AIS enables secure access to account information across multiple banking institutions through standardised APIs. This capability transforms how organisations handle financial data and make decisions.

Consider a medium-sized enterprise managing relationships with multiple banking partners. Traditionally, their finance team would need to log into several banking portals, download statements, and manually compile information. Through AIS, this enterprise can now access real-time account information from all their banks through a single interface, saving considerable time and reducing the risk of manual errors.

The technical framework supporting AIS operates through secure protocols that ensure data protection while maintaining accessibility. When a business connects through an AIS provider, it establishes secure channels that comply with the UK’s Open Banking Security Profile, incorporating multiple layers of authentication and encryption.

For implementation, organisations must consider several key aspects:

Firstly, data access permissions must be explicitly granted and regularly renewed, typically every 90 days, in accordance with UK regulations. This ensures ongoing security and user control over their financial information.

Secondly, the scope of accessible data needs careful consideration. While AIS can access transaction history, balance information, and account details, organisations should determine which data points are essential for their use cases to maintain efficiency and data minimisation principles.

Thirdly, proper error handling and data validation processes must be established to ensure reliable operation, particularly when dealing with multiple banking interfaces with varying response formats or availability patterns.

📚 Learn more about Data aggregation for Accounting Firms

Payment Initiation Services (PIS)

Payment Initiation Services introduces a new paradigm for how businesses handle financial transactions. This service enables third-party providers to initiate payments directly from user accounts, creating opportunities for streamlined payment processes and enhanced user experiences.

To understand the practical impact of PIS, consider a property management company handling rent collections from hundreds of tenants. Rather than managing direct debits or waiting for manual bank transfers, they can implement a PIS solution that allows tenants to authorise payments directly through their property management portal, with funds moving straight from the tenant’s account to the property manager’s account. The technical architecture of PIS incorporates several crucial elements that ensure secure and reliable payment processing:

Strong Customer Authentication (SCA) forms the cornerstone of PIS security, requiring multi-factor authentication for payment authorisation. This typically involves combining something the user knows (like a password) with something they have (such as a mobile device for receiving confirmation codes). The Payment is successfully authorised once the user gives the correct information and proves he is the bank account holder through SCA

The payment flow begins with payment initiation, where the PIS provider sends a structured payment request to the user’s bank. Upon successful authentication, the bank processes the payment through the UK’s Faster Payments network or other appropriate payment schemes, providing near-immediate settlement in many cases.

Success and failure scenarios require careful handling, with robust notification systems ensuring all parties remain informed of payment status. This includes immediate confirmation of payment initiation and subsequent updates as the payment progresses through the banking system.

📚 Guide to Low Payment Processing Fee for Accountants

Open Banking Verification

Building upon the foundation of open banking services, Verification API represents a sophisticated approach to identity verification and customer authentication. This service combines traditional banking data with modern technological capabilities to create a comprehensive verification system that serves multiple critical functions in modern financial operations.

The verification process encompasses several interconnected components that establish identity confidently. When a business needs to verify a customer’s identity, the system employs multiple verification methods working in concert. For instance, a financial institution might need to verify a new client’s identity during onboarding. The verification system would first extract data from official identity documents such as passports or driving licences, creating a foundational layer of verification.

This document verification works alongside facial recognition technology. The system compares a customer’s real-time selfie with their identity document photograph. The process generates a similarity score, giving organisations a quantifiable measure of confidence in the identity match. This multi-layered approach significantly reduces the risk of identity fraud while maintaining a smooth user experience.

The system’s capabilities extend beyond simple document verification. Through open banking connections, the verification process can cross-reference customer-provided information against their bank account data. This creates an additional layer of verification by confirming that the provided name matches the name registered with their financial institution. This bank-grade verification occurs in real-time, streamlining the process while maintaining high-security standards.

Businesses implementing verification systems get benefits beyond simple identity confirmation. The extracted data can automate subsequent processes, reducing manual data entry and associated errors. The combination of document verification, facial recognition, and bank data validation provides a robust foundation for fraud prevention whilst streamlining customer onboarding processes.

📚5 Reasons to Adopt Open Banking KYC & Compliance

Open banking use cases for Accounting practices

Bank Feed integration

Bank feed integration has revolutionised how businesses handle financial data. Accounting systems automatically collect and process transaction data from multiple banking institutions through secure API connections in real-time. This advancement eliminates the traditional practice of manually downloading and processing bank statements.

Consider a retail business operating with multiple bank accounts. Instead of individually downloading statements from each bank, their system automatically consolidates all financial information instantly. The system’s robust categorisation capabilities learn from historical patterns, automatically assigning recurring transactions to appropriate expense categories without human intervention.

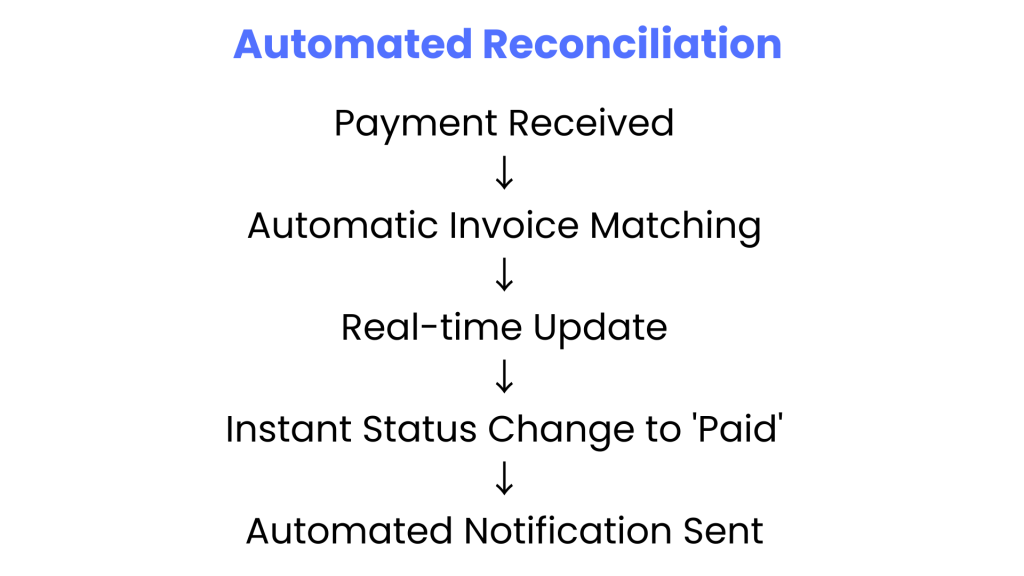

Automated Reconciliation

The transformation from manual to automated reconciliation addresses a fundamental challenge in financial management. Traditional manual matching processes, requiring meticulous attention from financial teams, consume significant time and remain prone to human error. The manual reconciliation burden can translate to numerous hours spent matching payments with invoices for a mid-sized firm processing thousands of monthly transactions.

Automated reconciliation through open banking integration offers a straightforward yet powerful solution. Payments are automatically reconciled through the system using accounting software such as Xero. This direct integration eliminates the need for manual matching between payments and invoices, a process that traditionally consumes substantial time and carries inherent error risks.

The system’s real-time reconciliation capability means that as soon as a payment is received, it is automatically matched to its corresponding invoice in the accounting system. This immediate reconciliation clarifies the business’s financial position and eliminates the traditional delay between payment receipt and transaction recording. For financial controllers who previously spent their weekends manually matching transactions, this automation transforms their workflow, reducing processing time from 15 hours to approximately 30 minutes.

📚Manual Vs Automated Reconciliation by Finexer

As open banking continues to reshape financial services, its practical applications in accounting have emerged as particularly transformative. These open banking use cases demonstrate how financial professionals are revolutionising their approach to managing and processing business information, delivering enhanced efficiency and accuracy across essential accounting services.

Automated Bookkeeping

Among the most impactful open banking use cases, automated bookkeeping addresses a fundamental challenge in accounting. Traditional bookkeeping typically consumes up to 20 hours per week for accounting teams, with approximately 1,040 hours spent annually on manual data entry and reconciliation. This process has been transformed into a streamlined, automated workflow through open banking integration.

Implementing open banking APIs creates a digital bridge between banking institutions and accounting software, enabling real-time transaction processing and categorisation. When a business makes regular supplier payments, the system automatically categorises these transactions based on learned patterns, eliminating manual intervention. This open banking use case extends beyond simple time savings, allowing financial controllers and accountants to focus on strategic financial planning rather than spending weekends managing transaction entries.

Advanced Cashflow Forecasting

Another significant open banking use case is transforming cash flow forecasting. Traditional finance teams spend excessive time consolidating data from multiple banking platforms, with studies showing that 70% of financial leaders dedicate more time to data gathering than strategic analysis. Open banking integration has fundamentally altered this situation.

Implementing open banking APIs enables unprecedented accuracy in cash flow forecasting through real-time visibility across banking relationships. This consolidated view provides immediate access to current financial positions through a unified dashboard, with organisations reporting a 40% reduction in forecasting variance and saving approximately 15 hours weekly on manual data consolidation.

📚Accurate Cashflow forecasting

Enhanced Auditing

Applying open banking use cases in auditing has created a paradigm shift in financial verification and compliance management. With 84% of banks planning to invest in API-driven solutions by 2025, this transformation reflects the growing importance of open banking in modern auditing methodologies.

This particular use case enables real-time data integration for auditing purposes, allowing auditors to access transaction data instantly. The standardisation of data processing ensures consistent formatting across various financial institutions, significantly reducing preparation time and eliminating manual reformatting tasks.

Financial Advisory

Open banking allows financial institutions to securely share their clients’ financial data with third-party providers, such as financial advisors, through application programming interfaces (APIs). This system provides financial advisors with real-time access to a client’s bank account and transaction data, eliminating the need for manual data entry or statement collection. Advisors can access a comprehensive, up-to-date view of their client’s financial situation, enabling them to offer more personalised and proactive advice.

One of the primary challenges financial advisory firms face is the time-consuming gathering of client data. Advisors often spend hours collecting bank statements, investment reports, and other documents from clients, which delays decision-making and reduces client engagement. With open banking, this process becomes automated. Financial advisors can instantly access their clients’ financial data in one secure, centralised place, allowing for quicker analysis and more informed advice.

Furthermore, open banking helps financial advisory firms scale their operations without adding additional staff. Automating data collection and reconciliation frees advisors to focus on high-value tasks, such as developing customised financial strategies and building stronger relationships with clients. This not only improves operational efficiency but also enhances client satisfaction.

Incorporating open banking into financial advisory practices allows firms to stay ahead of the curve, providing timely, accurate, and personalised advice, all while reducing operational costs and increasing scalability.

Payment Processing and Accounts Receivable Management

Open banking use cases have particularly impacted payment processing and accounts receivable management. Traditional manual AR processes, costing UK businesses approximately £8.5 billion annually, have been transformed through automated solutions and real-time payment integration.

Accounting firms can now manage payment collections more efficiently through features like Request to Pay (RTP) technology and smart payment links. These implementations have led to remarkable improvements, including a 43% reduction in Days Sales Outstanding (DSO) and an 82% improvement in first-time payment rates.

Accounting Software Integration with Finexer

Integrating Xero with Finexer’s API is a straightforward process that can be completed in just a few simple steps:

- Sign up for a Finexer account: Visit Finexer’s website and provide the necessary business information to create an account. Sign-up is quick and easy, and you’ll be up and running quickly.

- Connect Finexer to Xero: Use Finexer’s secure connection process to link your Xero account with your Finexer account. This involves granting Finexer permission to access your Xero data, ensuring a seamless flow of information between the two platforms.

- Configure payment settings: Within the Finexer platform, you can set up your preferred payment methods, notification preferences, and other settings. This allows you to customise the integration to suit your business needs and preferences.

- Start accepting payments: Once the integration is complete, you can start accepting payments through Finexer, and the data will automatically sync with Xero. Your clients can make payments using faster payment rails, and you’ll receive instant notifications and automated reconciliation.

When choosing a payment integration partner, consider factors such as cost savings, ease of use, and customer support. Finexer excels in all these areas, making it an ideal choice for accounting professionals looking to streamline their payment processes and reduce transaction costs.

📚Download Finexer’s Success Guidebook for Business Leaders

| Service Category | Feature | Technical Specifications | Business Impact |

|---|---|---|---|

| Bank Feed Integration | Account Information Services (AIS) | – Real-time data collection from 99% of UK banks – Automated transaction categorisation – Instant bank statement processing – Multi-bank account consolidation | – Eliminates manual statement downloads – Reduces data entry time by up to 90% – Provides real-time financial visibility – Enables automated bookkeeping |

| Automated Reconciliation | Payment Integration API | – Automatic payment-invoice matching – Real-time transaction verification – Bulk reconciliation processing | – Reduces reconciliation time from 15 hours to 30 minutes – Eliminates weekend manual matching – Provides accurate cash position visibility – Minimises human error |

| Automated Bookkeeping | Transaction Processing | – Smart transaction categorisation – Pattern recognition for recurring entries – Automated data entry | – Saves up to 1,040 hours annually – Reduces manual data entry by 95% – Improves accuracy of financial records – Enables focus on strategic tasks |

| Cashflow Forecasting | Advanced Analytics Suite | – Real-time banking data integration – Historical pattern analysis – Multi-account aggregation | – Reduces forecasting variance by 40% – Saves 15 hours weekly on data consolidation – Improves strategic decision-making – Enables proactive financial planning |

| Payment Processing | Payment Initiation Services (PIS) | – Direct bank payment initiation – Bulk payment processing – Variable Recurring Payments (VRP) – Instant payment confirmation | – Reduces transaction costs by up to 90% – Improves Days Sales Outstanding (DSO) by 43% – Increases first-time payment rates by 82% – Streamlines accounts receivable |

| Software Integration | Comprehensive integration with any accounting software | – One-click setup – Automated data sync – Custom field mapping – Real-time updates | – Rapid deployment (3x faster) – Seamless data flow – Reduced integration costs – Immediate operational benefits |

| Security & Compliance | Complete Compliance Care | – FCA-authorised infrastructure – Automated regulatory handling – Bank-grade security protocols – Regular compliance updates | – Ensures regulatory compliance – Reduces compliance overhead – Minimises risk exposure – Maintains data security |

| White-Label Solutions | Customisation Suite | – Brand-matched interface – Custom API endpoints | – Tailored user experience – Increases customer engagement – Streamlines client onboarding – Differentiates service offerings |

| Real-time Audit Trail | Transaction Monitoring System | – Instant transaction verification – Comprehensive audit logging – Digital trail maintenance – Automated data validation | – Reduces audit preparation time by 60% – Enhances audit accuracy – Provides instant verification capabilities – Streamlines compliance checks |

| Financial Verification | Open Banking Verification API | – Bank-grade data verification – Automated balance confirmation – Real-time account validation – Multi-source data cross-referencing | – Eliminates manual verification steps – Reduces verification errors by 85% – Accelerates audit completion – Enhances data reliability |

| Compliance Monitoring | Regulatory Compliance Suite | – FCA compliance automation – Real-time regulatory checks – Automated reporting – Risk assessment tools | – Ensures continuous compliance – Reduces compliance risk – Automates regulatory reporting – Maintains audit readiness |

Choose Finexer for Your Accounting Practice

As accounting firms navigate the evolving financial technology landscape, choosing the right open banking partner becomes crucial for sustainable growth and efficiency. Finexer emerges as the ideal solution for accounting practices, offering a comprehensive suite of services tailored specifically for financial professionals.

Understanding the unique challenges accounting firms face, Finexer provides a single-platform solution that seamlessly integrates with your existing accounting software. Our API-first approach enables instant connectivity to 99% of UK banks, while our automated reconciliation and payment processing capabilities can reduce transaction costs by up to 90%.

What sets Finexer apart is our commitment to accounting firms’ success. Our platform deploys up to three times faster than competitors, featuring an intuitive integration dashboard that simplifies the technical aspects of open banking. This means your practice can begin benefiting from automated workflows and real-time financial data processing within days, not months.

Security and compliance remain paramount in financial services. As an FCA-authorised provider, Finexer handles all regulatory requirements automatically, allowing your firm to focus on delivering value to clients. Our infrastructure maintains 98% uptime reliability, ensuring your practice operates smoothly even as you scale from hundreds to thousands of transactions.

For accounting firms ready to transform their practice through open banking, Finexer offers transparent, consumption-based pricing that grows with your business. Experience the future of accounting technology with a partner who understands your needs. Schedule a demonstration today to discover how Finexer can enhance your practice’s efficiency and client service capabilities.

FAQ’s

1. How does open banking integration actually benefit my accounting practice?

Open banking automates bank feeds and reconciliation, reducing manual work by 60+ hours monthly. It provides real-time financial data access and cuts transaction costs by 90%, letting you focus on advisory services.

2. Will this work with my existing accounting software?

Yes! Finexer seamlessly integrates with any accounting platform like Xero, Quickbooks, etc. When clients make payments, transactions automatically sync and reconcile in your system in real-time.

3. What security measures protect sensitive financial data?

As an FCA-authorised provider, Finexer uses bank-grade encryption and advanced fraud detection. Continuous security monitoring ensures that all data transfers maintain regulatory compliance.

4. How long does the integration process take?

Integration typically completes within days, 3x faster than competitors. Our four-step process includes quick setup, secure connection, configuration, and activation, with full support.

5. What ROI can I expect from implementing open banking?

Most firms see ROI within 3-4 months through 90% reduced transaction costs, 10 hours weekly time savings on reconciliation, and 25% increase in payment conversions.

Looking to scale your accounting practice without scaling operational complexity? Book Your Demo Now 🙂