For most UK accounting firms, a huge chunk of the workweek still goes into things that should have been solved years ago: chasing clients for missing bank statements, manually tagging transactions, or cleaning up reconciliation errors at month-end.

These aren’t strategic problems, they’re time drains. And with more clients expecting real-time support, it’s becoming harder to justify manual processes.

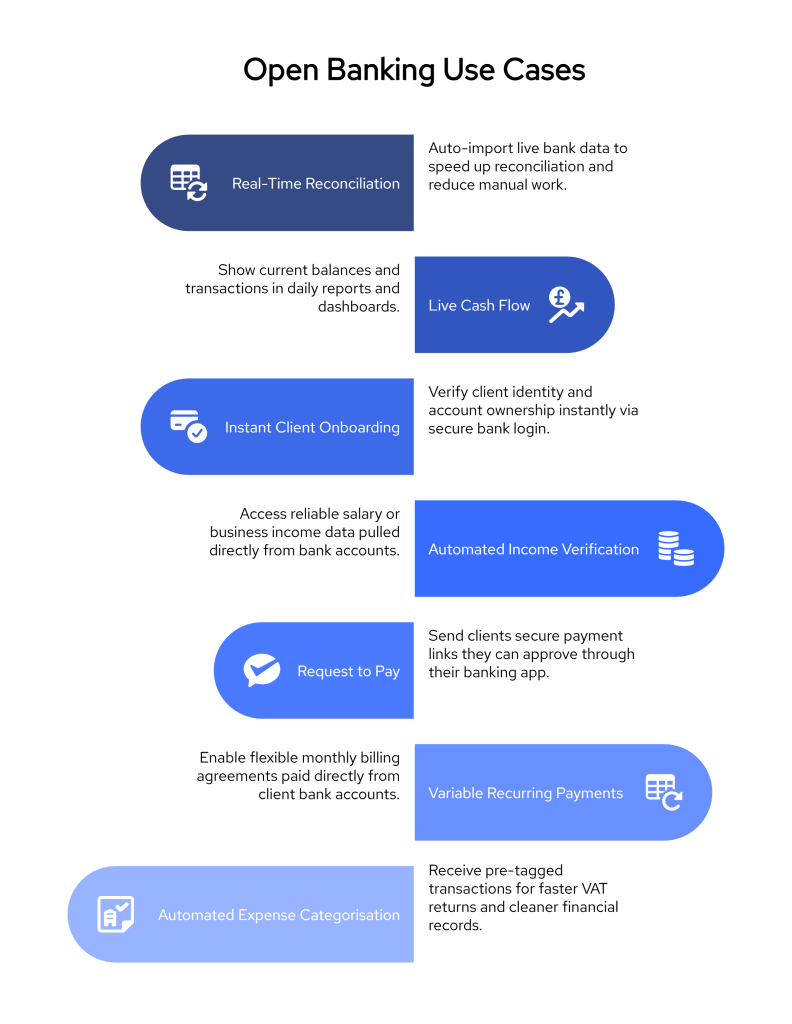

In this blog, we’ll walk you through seven open banking use cases that are actually working for UK accounting firms today.

Keep Reading or Jump to the Section you’re Looking for:

At Finexer, we work directly with accountants, bookkeepers, and finance teams across the UK. Our FCA-authorised open banking platform connects to 99% of UK banks, and our tools are built for firms that want to move away from spreadsheets and emails, without taking on another bloated software stack.

If you’re looking for practical ways to cut down on admin and deliver better service to your clients, this is a good place to start.

1. Real-Time Bank Feeds & Reconciliation

What it solves

Manual uploads. Outdated statements. Errors that only show up when it’s already too late.

Most accounting firms still rely on clients to download and send CSV bank statements, sometimes days or weeks after transactions occur. This slows down reconciliation, increases the chance of missing items, and makes real-time reporting nearly impossible.

How open banking helps

With a real-time bank feed connection to client bank accounts, transactions are pulled automatically as they happen. There’s no need to email statements, reformat files, or deal with version issues. Every time the client spends, the feed updates.

Why it matters

A direct bank feed doesn’t just speed up reconciliation — it helps you spot issues earlier, close the books faster, and improve the quality of your reporting. For many firms, this one change can save up to 15 hours per team member each week.

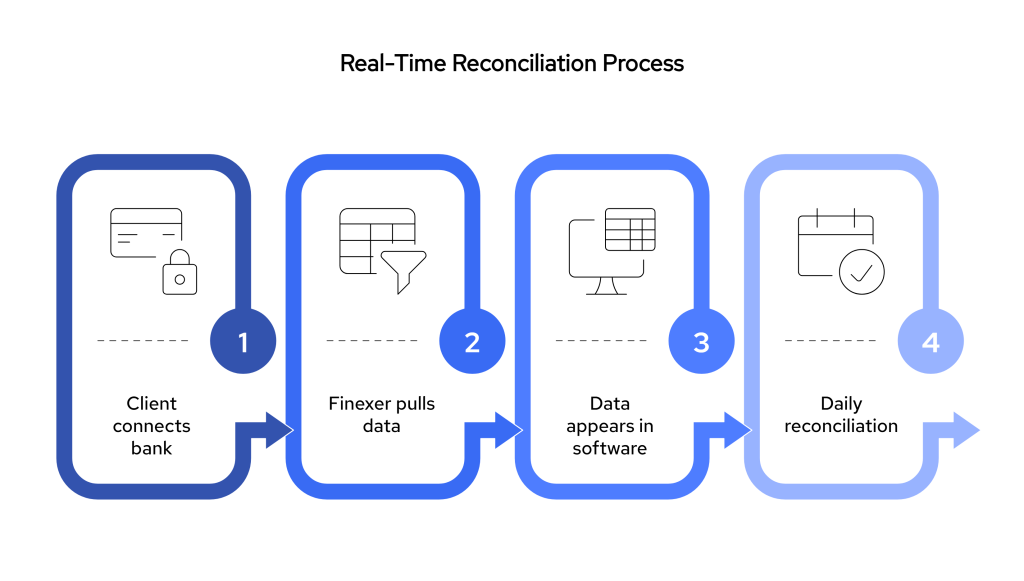

Example workflow

- Your client approves bank access via a secure redirect.

- Finexer pulls transaction and balance data using AIS (Account Information Services).

- The data appears in your accounting software, already categorised with merchant details.

- You reconcile daily — not just at month-end.

Quick Tip

With Finexer, you get coverage for 99% of UK banks. That means even clients with multiple accounts at different banks can be managed from one feed.

2. Live Cash Flow Dashboards

What it solves

Accountants often rely on end-of-month reports to understand a client’s financial position. But that delay makes it harder to support decisions in real time, especially when clients ask for up-to-date figures on short notice.

How open banking helps

By connecting directly to a client’s bank account, you can pull their available balance and most recent transactions automatically. That data can feed into dashboards built with accounting software, spreadsheets, or tools like Power BI.

Why it matters

You no longer have to guess or ask the client to “check their app.” You can see their live bank position as of this morning, not last week. This makes it easier to support cash flow planning, tax prep, or short-term funding discussions.

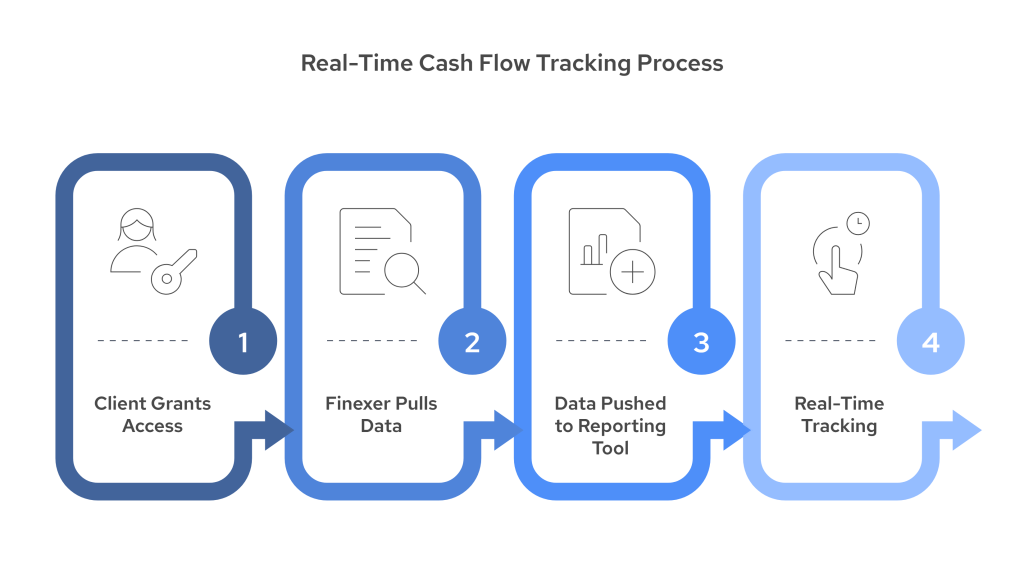

Example workflow

- Client approves one-time access to their account.

- Finexer’s Balance Check API pulls their available and cleared balances.

- The data updates your custom dashboard — either inside your client portal or linked from reporting tools.

- You review daily cash positions without needing to call or wait on spreadsheets.

Quick Tip

Because Finexer categorises transactions as they come in, your dashboard reflects not just totals, but spending behaviour, supplier trends, and account activity patterns.

3. Instant Client Onboarding & KYC

What it solves

Getting a new client set up often involves back-and-forth emails, scanned documents, and delays that can stretch onboarding out over days. You may be waiting on ID proofs, bank statements, or ownership verification, especially for business accounts.

How open banking helps

With open banking, clients can verify their identity and confirm account ownership in one step by logging into their bank. This process also supports biometric verification if needed.

Finexer combines account access with optional KYC/KYB checks, meaning your client’s identity and bank account are verified instantly, without needing to upload PDFs or wait for manual review.

Why it matters

Faster onboarding = fewer drop-offs. You don’t lose momentum after a strong sales call, and clients don’t get stuck in admin before you even start the work. For busy firms, this also means you can start processing accounts or running checks the same day.

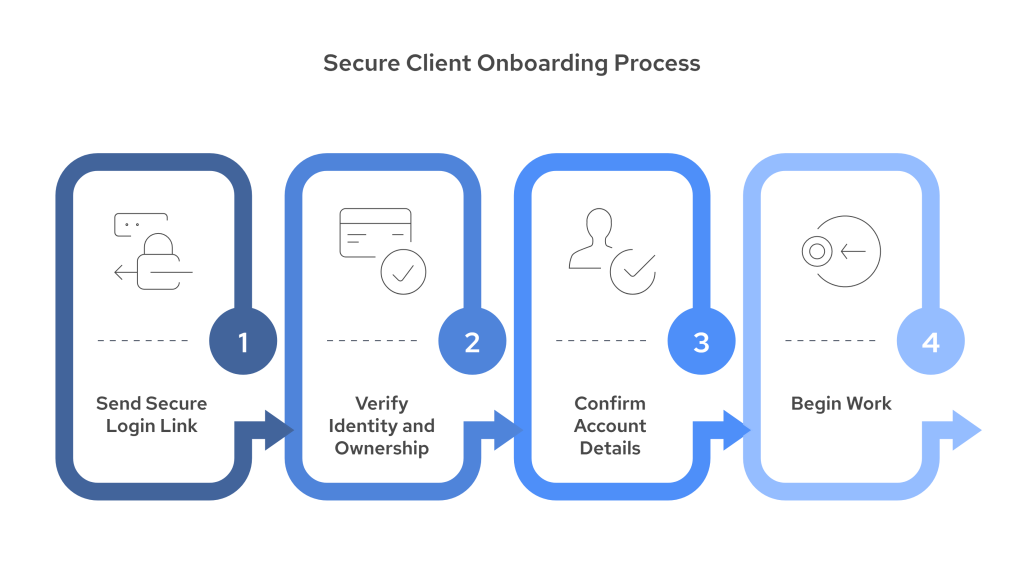

Example workflow

- You send the client a secure link to verify via bank login.

- They complete consent, and Finexer verifies identity, sort code, account number, and account name.

- Optionally, a biometric selfie is added for extra assurance (if needed).

- You receive confirmation that the account is verified and proceed with onboarding.

Quick Tip

If you onboard multiple directors or UBOs (Ultimate Beneficial Owners), you can collect their data individually — no messy group paperwork or follow-up calls.

4. Automated Income Verification

What it solves

When a client applies for a loan or credit facility — or even just needs a letter for proof of income — accountants are often asked to dig through historical bank statements and manually calculate salary flows, irregular income, or business earnings.

This takes time, opens the door for mistakes, and often delays the approval process for both you and your client.

How open banking helps

Finexer’s Income Check tool uses transaction data pulled directly from a client’s bank to identify income sources, frequency, and stability. It can flag regular salary deposits, self-employment income, and other relevant patterns, all in seconds.

No paperwork, no guesswork — just a fast, bank-backed summary.

Why it matters

Instead of scanning PDF statements and highlighting salary lines, you get a ready-to-use report. Whether your client is applying for a mortgage or confirming income for a visa, you can deliver the required documents faster and more accurately.

It also helps reduce risk: you’re using verified data from the bank, not client-supplied figures.

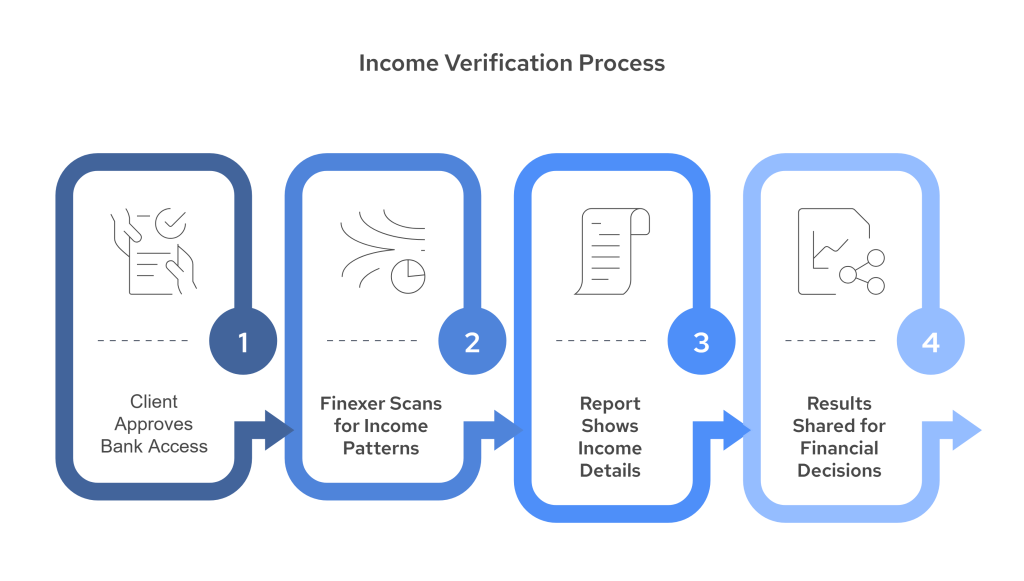

Example workflow

- The client grants access to their bank account for the past 3–12 months.

- Finexer pulls the relevant data via AIS and runs the Income Check process.

- You receive a structured output showing source, regularity, and average income over time.

- Use this data for internal assessment or include it in client documentation.

5. Request to Pay for Invoice Collection

What it solves

Getting clients to pay on time often means sending multiple reminders, dealing with lost invoices, or waiting days for payments to land, especially if they’re making manual bank transfers.

Traditional card payments add their own problems: higher fees, settlement delays, and occasional disputes. These issues slow cash flow and add extra admin.

How open banking helps

Request to Pay lets you send a payment request directly to your client via email, SMS, or inside your platform. The client approves the request through their banking app, and the payment is sent straight from their bank account to yours.

There’s no need to enter account details, download invoices, or leave the page.

Why it matters

Firms using Request to Pay can reduce payment delays, improve cash flow, and avoid the processing fees linked to card payments. Because the process is digital from start to finish, it’s also easier to track who paid, when, and for what.

This approach works especially well for recurring invoices, one-off payments, or remote clients who prefer mobile-friendly options.

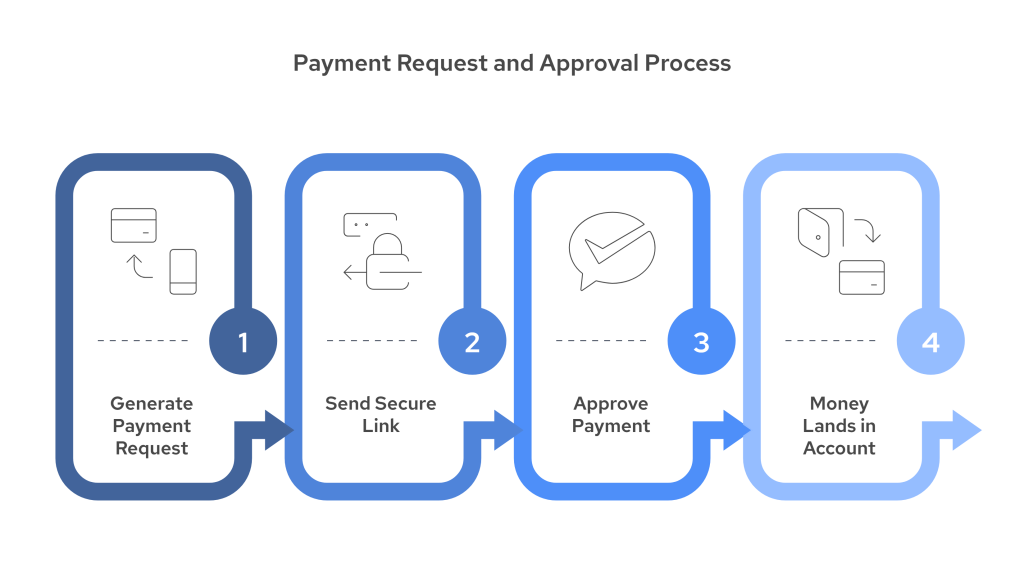

Example workflow

- You generate a payment request from Finexer’s dashboard or API.

- The client receives a secure link to approve payment through their banking app.

- The payment is settled in your account almost immediately.

- The invoice is automatically marked as paid in your system — no manual updates required.

Quick tip

You can add a reference (like an invoice number or client code) to every request. This ensures each payment is easy to match and reduces back-and-forth with clients or your internal team.

6. Variable Recurring Payments for Monthly Billing

What it solves

Direct debits work — but they aren’t flexible. They often take days to set up, require paperwork, and fail if a card expires or a client switches banks. On the other end, manual invoicing every month drains your team’s time and increases the chance of delays.

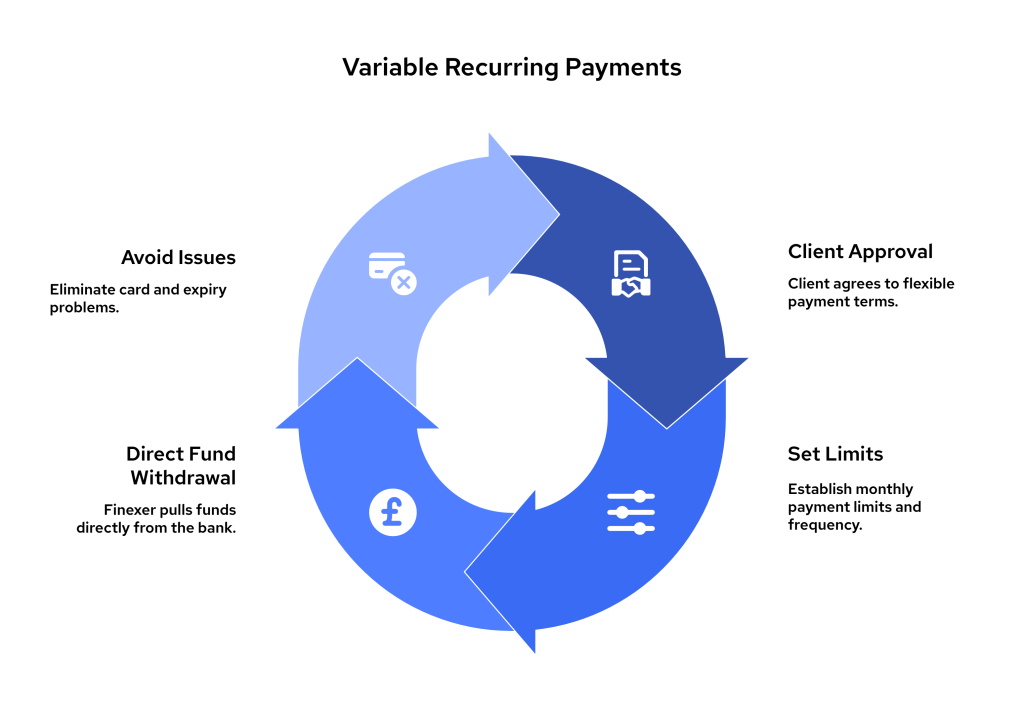

How open banking helps

Variable Recurring Payments (VRP) allow your clients to authorise a flexible payment agreement through their banking app. Once approved, you can collect payments automatically, as long as they stay within the agreed limit and schedule.

No cards, no expiry dates, no re-authorisations.

Why it matters

This is ideal for firms billing on a fixed monthly retainer or usage-based pricing. You get paid on time, without chasing. Your client stays in control and can adjust limits when needed. And unlike card payments or traditional standing orders, the process doesn’t break when something changes.

Example workflow

- You offer the client a secure link to set up a VRP mandate.

- They approve the payment agreement from their bank account, including limits and duration.

- You collect fees each month, without needing to send a manual invoice or payment reminder.

- The client can review or cancel the mandate anytime from their bank app.

Quick tip

If you manage multiple clients under retainers, VRP can reduce billing time dramatically. Just set it once and you no longer have to follow up every billing cycle.

7. Automated Expense Categorisation for MTD & Tax Returns

What it solves

Sorting through hundreds of client transactions to code expenses manually, especially during VAT periods or self-assessment deadlines, is time-consuming and error-prone. One wrong category and you’re left fixing reports after submission.

It also slows down MTD filings, especially for clients who use multiple accounts or submit paperwork late.

How open banking helps

With live transaction feeds pulled through AIS, Finexer automatically applies categories and merchant tags as data comes in. This means expenses are already labelled by the time you or your software receives them.

Instead of cleaning up messy data at month-end, you’re reviewing pre-tagged entries with consistent naming, date formats, and amounts.

Why it matters

You can spend less time cleaning data and more time reviewing what matters. It also speeds up VAT prep, helps clients understand spending patterns, and cuts back on last-minute questions around “What was this charge for?”

For firms handling MTD submissions, having cleaner records upfront reduces filing stress and supports more confident submissions.

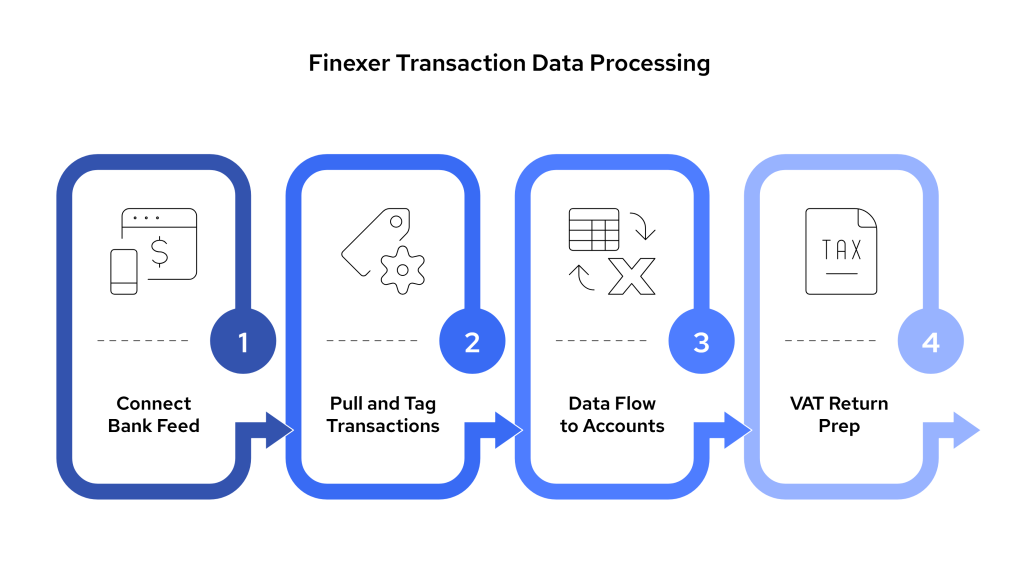

Example workflow

- Client connects their bank account once via secure consent.

- Finexer pulls transactions with embedded category tags (e.g. travel, software, meals).

- The data flows into your accounting software, mapped to relevant expense lines.

- You review and adjust only where needed, not from scratch.

Quick tip

If you use different expense labels across clients, you can build simple rules inside your software to auto-map Finexer’s categories to your firm’s preferred chart of accounts.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

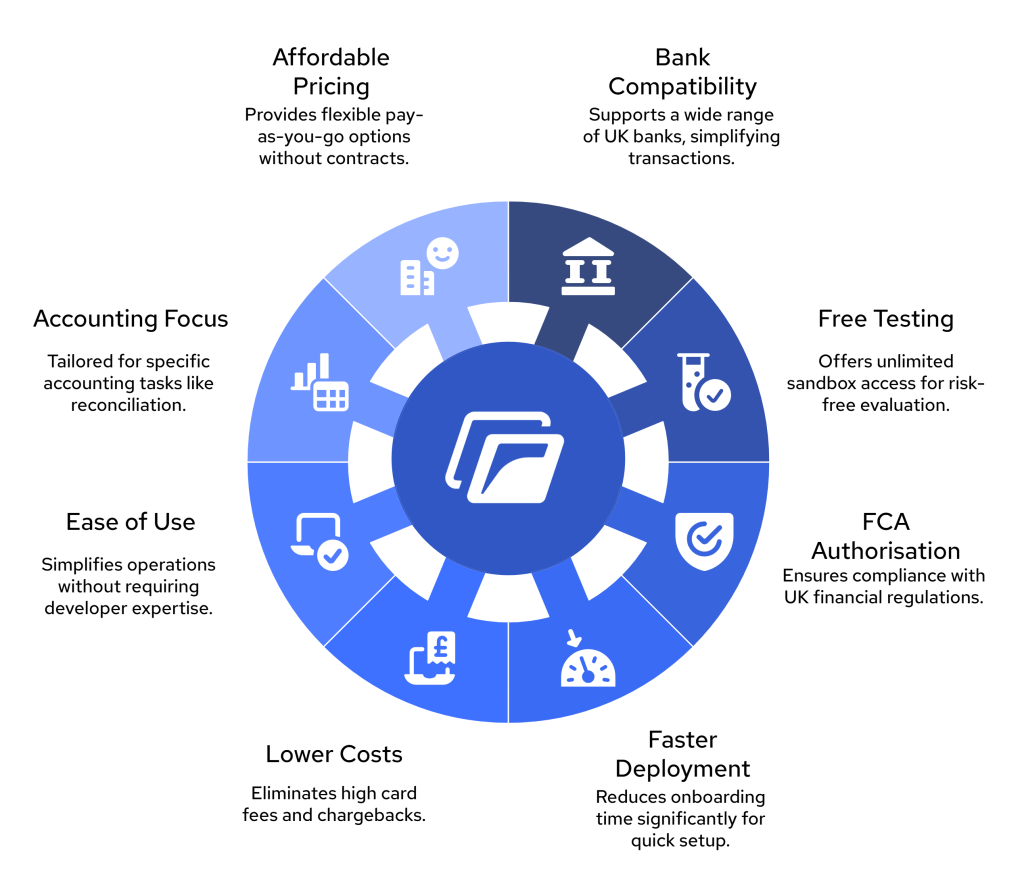

Why UK Accounting Firms Choose Finexer

Finexer is built specifically for accounting firms in the UK. No confusing setups, no unnecessary features — just the tools that help you do your job faster and with less back-and-forth.

1. Works with almost every UK bank

Finexer connects to 99% of UK banks, including high street banks and new digital ones. You don’t need to worry about whether your client’s account is supported.

2. Free testing — no limits

You can try every feature using Finexer’s sandbox (test environment) without paying anything. There’s no limit on how much you test, and no time restriction.

3. Registered and approved in the UK

Finexer is FCA-authorised, which means we’re legally approved to provide secure access to bank data and payments. You don’t need to apply for your own licence — we’ve already handled that.

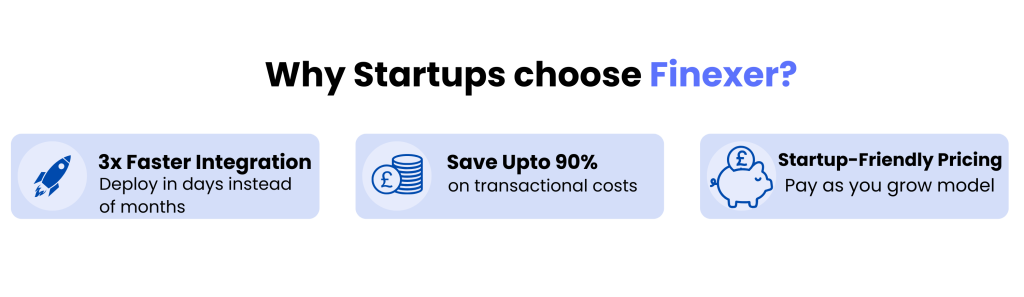

4. Upto 3x Faster Deployment

Most firms are fully set up and testing live use cases within weeks, not months. There’s no long onboarding, no complex build, and no back-and-forth with third parties.

5. Lower cost than card payments

Collecting payments with Finexer is cheaper than using cards. There are no chargebacks, and the money arrives fast with the correct reference every time.

6. Easy to use

You don’t need to be a developer to use Finexer. Everything is built to be simple to follow. If you do have questions, our UK team is here to support you.

7. Designed for accounting firms

Every feature is made with real accounting tasks in mind — from collecting fees, to checking bank balances, to pulling data for VAT or MTD.

8. Affordable pricing for growing firms

Finexer offers clear, usage-based pricing. You only pay for what you use — no monthly minimums, no surprise fees, and no long-term lock-ins.

Is open banking secure for client data?

Yes. Finexer is authorised by the FCA and uses encrypted, bank-level connections. Clients approve access directly through their bank — no passwords or sensitive data are stored.

Do I need a developer to use Finexer?

No. You can use most features, including payments and bank feeds, through our dashboard. If you want to integrate it into your platform, developer tools are available — but not required for day-to-day use.

Can I test Finexer before going live?

Yes. You get full access to Finexer’s sandbox for free. You can test payment requests, data flows, and account connections as much as you like before using it with real clients.

What accounting software does Finexer work with?

Finexer works alongside tools like Xero, QuickBooks, Excel, and cloud-based reporting systems. You can export data, run checks, or build your own workflows using the output.

How much does Finexer cost?

Finexer uses usage-based pricing — you only pay when you use it. There are no monthly minimums or setup fees. For most firms, it’s much cheaper than card payments or manual processing costs.

Need Accurate Bank Data? Try Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂