For many UK businesses, running payroll still feels unnecessarily slow and manual. Between downloading BACS files, logging into multiple bank portals, and manually reconciling payments, payroll teams spend hours on what should be instant, automated processes.

But that’s starting to shift, thanks to a growing number of payroll platforms that use Open Banking.

Instead of relying on outdated payment rails and clunky reconciliation workflows, modern payroll systems are now integrating Open Banking to:

- Trigger secure, account-to-account salary payments

- Pull live bank data to match disbursements

- Automate reimbursement payouts and financial reporting

- Reduce fraud risk and meet regulatory compliance

Whether you’re a business using payroll software or a provider offering HR tools, understanding how Open Banking fits into payroll workflows is now essential.

In this blog, we’ve reviewed six payroll platforms that use Open Banking in different ways, from streamlining pay runs to improving visibility across accounts.

Keep Reading or Jump to the section you are looking for:

1. Sage Payroll

How They Use Open Banking

Sage is one of the most established payroll and accounting platforms in the UK. Through its “Bank Feeds” and e-Banking services, Sage connects directly to UK banks using regulated Open Banking APIs.

While Sage Payroll itself doesn’t initiate payments via Open Banking, it allows finance teams to link their bank accounts securely to automate the flow of transaction data. This helps simplify the reconciliation of salary disbursements and other payroll-related payments.

Among payroll platforms that use Open Banking, Sage stands out for combining robust accounting tools with banking integrations that support smoother finance operations, especially when Sage Accounting and Sage Payroll are used together.

Best For

UK SMEs that want to match payroll payments against real-time bank data without relying on manual exports or third-party tools.

Key Features Enabled by Open Banking

- Secure bank account connections

- Real-time bank feed imports

- Faster reconciliation of payroll runs

- Streamlined tracking for direct debits, salary payments, and HMRC transactions

Integrations

- Sage Accounting

- Sage Payroll

- Compatible with all major UK banks (via Open Banking)

2. Xero Payroll

How They Use Open Banking

Xero is widely known for its cloud-based accounting software, but its payroll module also benefits from Open Banking, particularly through its real-time bank feed connections. These feeds are powered by regulated APIs that allow businesses to automatically sync transaction data with Xero, helping teams reconcile salary payments as soon as they land.

Among payroll platforms that use Open Banking, Xero focuses on enhancing visibility and simplifying back-office workflows, rather than initiating the payments themselves. Payroll admins can instantly match pay runs with bank statements, track whether salary transfers have cleared, and close out payroll periods with greater confidence.

This not only saves time but also reduces errors, especially for businesses managing high volumes of recurring payroll transactions.

Best For

Small to mid-sized businesses using Xero for both accounting and payroll, and seeking more automation in bank reconciliation.

Key Features Enabled by Open Banking

- Real-time bank feed integration

- Faster payment matching for payroll transactions

- Secure authentication without manual file imports

- Improved visibility for finance teams during each payroll cycle

Integrations

- Xero Payroll

- Xero Accounting

- Direct bank connections with most major UK banks via Open Banking

3. Papaya Global

How They Use Open Banking

Papaya Global is a comprehensive workforce management platform that integrates Open Banking to streamline global payroll and cross-border payments. By leveraging Open Banking APIs, Papaya Global facilitates real-time, secure transactions, ensuring accurate and timely salary disbursements across 160+ countries .

Their Payments Connector creates a secure bridge between workforce systems and global payments, standardising and converting payroll data into ready-to-execute transactions. This integration allows for seamless data flow, reducing manual interventions and enhancing compliance with local regulations.

Best For

Multinational corporations seeking a unified platform for managing global payroll, ensuring compliance, and executing cross-border payments efficiently.

Key Features Enabled by Open Banking

- Real-time payment processing with guaranteed landing dates

- Secure API integrations for seamless data exchange

- Automated compliance with local tax and employment regulations

- Centralised management of workforce funds through dedicated wallets

Integrations

- Works with major HCM platforms like SAP SuccessFactors

- Utilises payment rails from partners like J.P. Morgan to ensure secure and efficient transactions

4. Staffology

How They Use Open Banking

Staffology is a UK-based cloud payroll platform designed for automation and integration. While it doesn’t natively offer Open Banking features, Staffology’s comprehensive REST API allows seamless integration with Open Banking-enabled payment providers like Telleroo. This setup enables businesses to automate payroll payments, ensuring faster and more secure transactions.

By leveraging these integrations, Staffology users can:

- Automate the distribution of payroll payments directly from Staffology to employees’ bank accounts.

- Enhance payment accuracy and reduce manual errors through real-time data synchronisation.

- Streamline reconciliation processes by syncing payment data with accounting software like Xero.

Best For

UK businesses seeking a flexible payroll solution that can integrate with Open Banking-enabled payment services to automate and streamline their payroll processes.

Key Features Enabled by Open Banking Integration

- Automated payroll payment processing through integrated payment providers.

- Real-time synchronisation of payment data with accounting systems.

- Enhanced security and compliance through regulated payment services.

- Customisable workflows to fit unique business needs.

Integrations

- Payment services: Telleroo

- Accounting software: Xero, Sage, QuickBooks

- HR systems: Staffology HR, and other third-party HR software via API

5. Employment Hero Payroll (via Comma Integration)

How They Use Open Banking

Employment Hero Payroll, a UK-based payroll and HR platform, has partnered with Comma to introduce an Open Banking-enabled payroll system. This integration allows businesses to automate payroll payments directly from their bank accounts, eliminating the need for manual processes. By leveraging Open Banking APIs, the platform facilitates secure, real-time transactions, ensuring employees are paid accurately and on time.

This collaboration streamlines the payroll process by connecting payslip information with the business’s bank account, reducing errors and enhancing efficiency. The integration also supports secure payment authorisation, allowing accountants and bookkeepers to send payment links for approval, further simplifying payroll management.

Best For

Small to medium-sized UK businesses seeking an integrated payroll solution that offers automated, secure, and efficient payment processing through Open Banking.

Key Features Enabled by Open Banking

- Automated payroll payment processing

- Real-time synchronisation of payment data

- Secure payment authorisation workflows

- Reduced manual data entry and errors

Integrations

- Comma (Open Banking payment provider)

- Major UK banks supporting Open Banking

6. PayFit

How They Use Open Banking

PayFit is a modern payroll and HR platform designed to simplify compliance and day-to-day operations for UK businesses. What sets it apart is its focus on developer-first flexibility, and that includes how it handles Open Banking integrations.

Rather than locking users into rigid workflows, PayFit recently launched an Open API that enables teams to connect their own Open Banking solutions to automate salary payments, expense reimbursements, and payment status tracking. This means customers can work with trusted third-party providers (like Finexer) to plug in Payment Initiation or Account Information Services based on their internal setup.

Among payroll platforms that use Open Banking, PayFit’s approach is less about out-of-the-box features and more about providing the tools to build custom flows, ideal for tech-forward businesses.

Best For

Startups and mid-sized tech companies that want flexibility to integrate their own Open Banking partner into payroll processes.

Key Features Enabled by Open Banking

- Open API for custom integrations

- Connect third-party PIS/AIS providers

- Automate salary disbursements and reimbursement payouts

- Enhanced audit readiness through data syncing

Integrations

- Native integration with HMRC

- Customisable API endpoints to connect Open Banking providers

- Compatible with Open Banking-enabled payment and data platforms

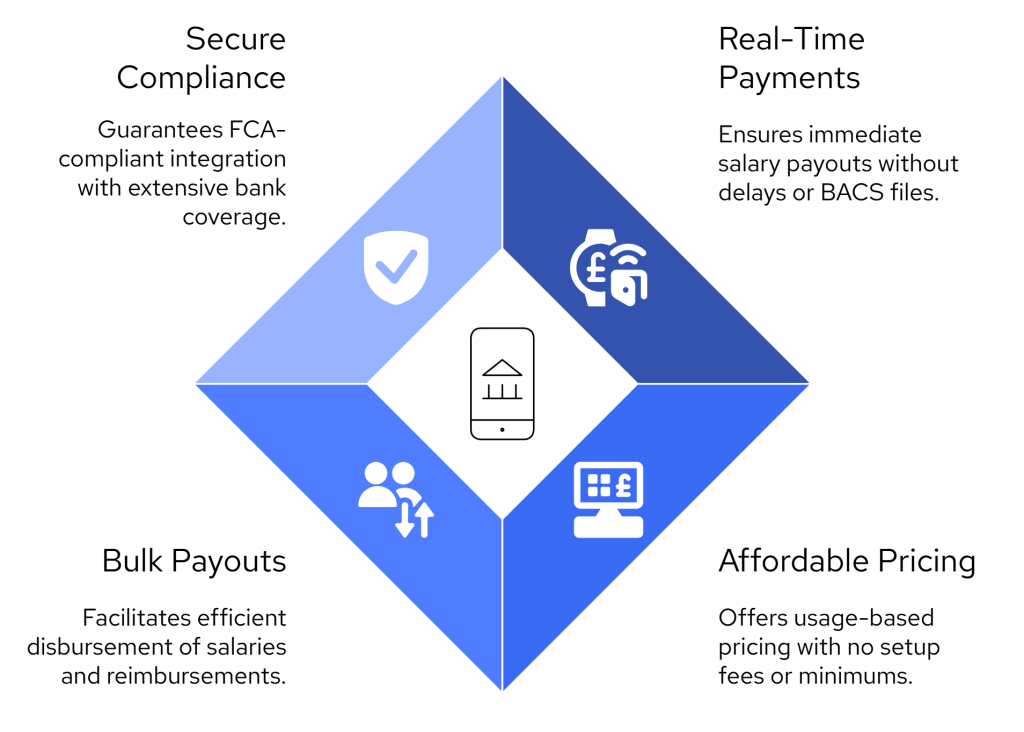

Finexer: Making Open Banking Affordable for Payroll Systems

While many payroll platforms are beginning to integrate Open Banking to enhance their services, Finexer stands out by offering a dedicated solution that makes this technology accessible and cost-effective for businesses of all sizes.

Why Finexer?

Finexer is an FCA-authorised Open Banking platform that provides businesses with the tools to streamline their payroll processes through secure, real-time financial data access and instant payments. By leveraging Finexer’s APIs, companies can:

- Automate Payroll Payments: Initiate instant, account-to-account salary disbursements, reducing reliance on traditional banking methods and minimising delays.

- Enhance Data Accuracy: Access real-time bank transaction data to ensure accurate payroll calculations and reduce errors.

- Simplify Compliance: Utilise built-in tools for KYC/KYB verification and stay compliant with evolving financial regulations.

- Reduce Costs: Cut down on transaction fees associated with traditional payment methods, making payroll processing more economical.

Key Features for Payroll Integration

- Instant Payments: Facilitate immediate salary payments, improving employee satisfaction and cash flow management.

- Bulk Payouts: Process multiple payments simultaneously, saving time and reducing administrative workload.

- Real-Time Data Access: Gain insights into financial transactions as they occur, aiding in accurate payroll processing and financial planning.

- Secure Authentication: Verify bank account details securely, ensuring that payments are made to the correct recipients.

Integration and Support

Finexer’s platform is designed for seamless integration with existing payroll and accounting systems. With comprehensive API documentation and dedicated support, businesses can quickly implement Finexer’s solutions without significant technical hurdles.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

What does it mean for a payroll platform to use Open Banking?

It means the platform integrates directly with UK bank accounts via regulated APIs. This allows real-time access to transaction data (AIS) and enables account-to-account salary payments (PIS), reducing manual processes and improving payment speed.

Is Open Banking secure for payroll-related payments?

Yes. Payroll platforms that use Open Banking operate under strict FCA regulations. Payments and data are processed securely via bank authentication flows, without storing sensitive credentials.

Do I need to switch my payroll system to use Open Banking?

Not necessarily. Many businesses integrate Open Banking APIs into their existing payroll stack using platforms like Finexer, enabling faster payouts and reconciliation without replacing current systems.

Can Open Banking help with expense reimbursements?

Absolutely. With Payment Initiation, you can send one-off reimbursements directly to employee accounts. With Account Information Services, you can verify spending and match payments automatically.

Which types of businesses benefit most from these integrations?

UK-based SMEs, HR tech platforms, finance teams handling bulk salary disbursements, and any business looking to reduce payroll admin and settlement delays.

Looking to integrate open banking into Payroll? Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂

![Top 6 Payroll Platforms That Use Open Banking 1 Top 6 UK Payroll Platforms With Open Banking Integration [2025]](/wp-content/uploads/2025/04/Payroll-Platforms-using-Open-Banking.jpg)