As an accountant, you’re not just balancing books, you’re juggling deadlines, chasing client documents, assigning tasks, managing a team, and trying to keep everyone on the same page. Spreadsheets and scattered email threads might have worked when your firm was smaller, but as things grow, they quickly start to fall apart. Missed follow-ups, unclear handovers, and duplicated effort become part of the daily grind.

That’s where practice management platforms come in.

In this blog, we’ll walk you through five of the best tools built specifically for accounting firms. These platforms help you manage workflows, automate reminders, assign responsibilities, and give clients a central place to communicate and upload documents. Whether you’re a solo practitioner or leading a 20-person firm, the right setup can reduce admin and give you back control over your time.

We’ve reviewed these tools from a firm’s perspective, not just based on features, but how well they actually support the way accountants work. If you’re looking to make your day-to-day smoother, more structured, and easier to manage as your client list grows, this is the shortlist worth reviewing.

we will guide you through:

What Is Practice Management Software for Accountants?

Practice management software is a centralised system that helps accounting firms run their day-to-day operations more efficiently. It’s not just about tracking jobs, it’s about managing your entire workflow from client onboarding to file delivery, while keeping your team aligned and accountable.

A good practice management platform gives you a clear view of who’s doing what, what’s due when, and which clients need attention. It can help reduce miscommunication, prevent deadlines from being missed, and save time by automating recurring tasks.

What it typically includes:

- Task assignment and tracking

- Built-in calendars and deadline reminders

- Centralised client records and communication history

- Document sharing and client portals

- Time tracking and billing support

- Integration with accounting software like Xero, QuickBooks, or Sage

For growing firms, relying on emails, spreadsheets, or multiple disjointed apps often leads to delays and duplication. Practice management platforms are built to fix that by bringing everything into one place, so your firm stays organised even during your busiest periods.

What to Look for in a Practice Management Tool

Choosing the right practice management platform isn’t just about ticking off features; it’s about finding a tool that fits the way your firm actually works. Whether you’re focused on monthly bookkeeping cycles, year-end accounts, or ongoing advisory services, the software should support your workflow, not force you to change it.

Here are the key things to look for when comparing accounting practice management software:

1. Task and Workflow Management

You need to know who’s doing what, what’s overdue, and what’s coming up next. A strong platform will let you assign tasks, set recurring schedules, and build templates for common jobs like VAT returns, payroll, or client onboarding.

2. Shared Client Records

Every message, document, and file request should live in one place. A good practice management system keeps your team and clients aligned by storing emails, notes, and files under a shared timeline.

3. Deadline Tracking and Reminders

Missing deadlines damages client trust. Look for tools that alert you (and your team) before due dates arrive—especially during busy periods like year-end or self-assessment season.

4. Simple, Secure Client Communication

Clients shouldn’t have to dig through email chains to find what they need. A platform with a built-in client portal or secure messaging keeps everything accessible and trackable.

5. Time Tracking and Billing (Optional, but Helpful)

If you bill by the hour or track time for internal planning, built-in timers or manual logging features can be helpful. Some platforms also support direct invoicing or integrate with billing software.

6. Integration with Accounting Software

It’s a major plus if the tool connects with platforms like Xero, QuickBooks, or Sage, especially for syncing client lists, job status, or financial documents.

1. Karbon

Karbon is a well-established practice management platform designed for growing accounting firms that need structured workflows and visibility across teams. It brings together email, tasks, and client collaboration in one central place—ideal for practices that are moving beyond spreadsheets and siloed communication.

Best For

- Firms with 5+ team members needing shared visibility

- Managers who want to automate recurring jobs and reminders

- Practices juggling tax, bookkeeping, and compliance workflows

Key Features

- Central inbox with task assignment directly from emails

- Shared client timelines showing every message and update

- Workflow templates and recurring job schedules

- Time tracking and team capacity reports

- Integrates with Xero Practice Manager, QuickBooks, and Zapier

Pros

- Strong collaboration tools for remote and hybrid teams

- Great visibility over deadlines and bottlenecks

- Powerful reporting to track productivity and job status

- Helps reduce email overload by turning conversations into tasks

Cons

- May feel too complex for solo accountants or small firms

- Learning curve during setup if migrating from manual tools

Pricing

- Team Plan: $59/user/month

- Business Plan: $79/user/month (adds automations and reporting)

- Enterprise: Custom pricing for large or multi-office firms

- Free demo and onboarding support available

Where This Platform Fits Best

Karbon is ideal for firms that need structure and visibility across multiple team members and clients. If your practice is scaling or already managing dozens of open jobs at once, Karbon helps turn chaos into trackable progress, without relying on separate email, calendar, and task systems.

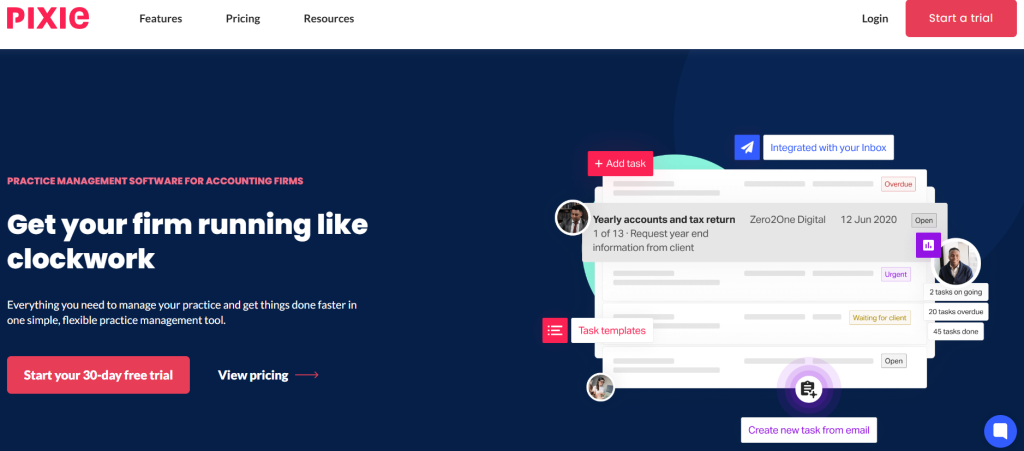

2. Pixie

Pixie is a lightweight yet capable practice management platform built specifically for small to mid-sized accounting and bookkeeping firms. It focuses on simplicity and automation, helping practices manage client tasks, emails, documents, and workflows in one easy-to-navigate system, without unnecessary complexity.

Best For

- Small accounting firms and solo practitioners

- Firms are just moving away from spreadsheets or email-based task tracking

- Bookkeepers and virtual finance teams looking for an affordable structure

Key Features

- Customisable workflows with recurring task automation

- Integrated email with task conversion

- Built-in client CRM with document storage

- Deadline reminders and job timelines

- Simple reporting to track what’s on and overdue

Pros

- Easy to learn and quick to set up

- Affordable entry pricing, ideal for small teams

- Pre-loaded templates for common accounting workflows

- Centralises all client information and work in one place

Cons

- Lacks advanced reporting and capacity planning features

- Not built for large or complex firm structures

Pricing

- Pixie offers a flat-fee pricing model based on the number of clients, not users.

- Up to 250 clients: £99/month

- 251–500 clients: £149/month

- 501–750 clients: £199/month

- 751–1000 clients: £249/month

- Over 1000 clients: Contact Pixie for pricing

- All plans include unlimited users.

Where This Platform Fits Best

Pixie is a great choice for small firms that need more structure but don’t want to overcomplicate things. If you’re still relying on email folders and spreadsheets to keep track of client work, Pixie helps bring everything together, without a steep learning curve or heavy admin setup.

3. Client Hub

Client Hub is a client-focused practice management platform designed for accounting firms that want to simplify client collaboration while keeping internal workflows organised. Unlike other tools that focus mostly on internal task management, Client Hub brings your clients into the picture with a secure portal that makes it easy to share files, request information, and manage communication.

Best For

- Firms that struggle with client follow-ups and file requests

- Accountants who want to centralise all client communication

- Teams managing a high volume of monthly recurring tasks

Key Features

- Shared client workspaces with task checklists and messaging

- “Client tasks” with due dates, reminders, and automatic nudges

- Internal workflow tracking with visibility across the team

- File sharing and document versioning

- Direct integration with QuickBooks Online

Pros

- Makes client communication easier and more organised

- Reduces the need for email follow-ups and back-and-forth

- Keeps both sides (your team and the client) on the same page

- Designed specifically for accounting and bookkeeping workflows

Cons

- May not be ideal for firms that need complex reporting or time tracking

- Integrations are limited compared to larger platforms

Pricing

- Monthly Billing: $69/user/month

- Annual Billing: $49/user/month

- Free trial available

Where This Platform Fits Best

Client Hub is a smart pick for firms that feel buried in client emails and file requests. If you often chase missing documents or need a clearer way to manage client communication, this platform gives both you and your clients one place to stay organised and on task.

4. AccountancyManager (now part of Bright)

AccountancyManager, now integrated into the Bright software suite, is a comprehensive practice management platform built specifically for UK-based accountants and bookkeepers. It covers everything from onboarding and task scheduling to automated reminders, client document requests, and AML compliance, making it a strong all-rounder for firms managing ongoing compliance and admin-heavy processes.

Best For

- UK accounting and bookkeeping firms with recurring workflows

- Practices offering compliance-heavy services like tax, payroll, and VAT

- Teams looking for a tool that covers onboarding, task tracking, and client comms

Key Features

- Automated client onboarding with custom checklists

- Task scheduling based on deadlines and service dates

- Document request automation with due dates and follow-ups

- Time tracking, notes, and internal team collaboration

- AML checks and client file management

- Integration with Xero, Companies House, and more

Pros

- Built specifically for the UK accounting workflow

- Automates admin-heavy work like document chasing and deadline reminders

- Strong features for firms with high compliance workloads

- Scales well from solo practitioners to larger teams

Cons

- Interface can feel busy for new users

- Less flexibility compared to lighter tools like Pixie or Client Hub

Pricing

- Monthly Billing: £42 + VAT/user/month

- Annual Billing: £33.60 + VAT/user/month

- Enterprise Plan: Custom pricing for firms with 12+ users

Where This Platform Fits Best

AccountancyManager is best for firms that need to manage recurring compliance work and want a system that automates deadlines, document requests, and client follow-ups. If your practice juggles VAT returns, payroll schedules, and onboarding admin, this tool is built to take the load off.

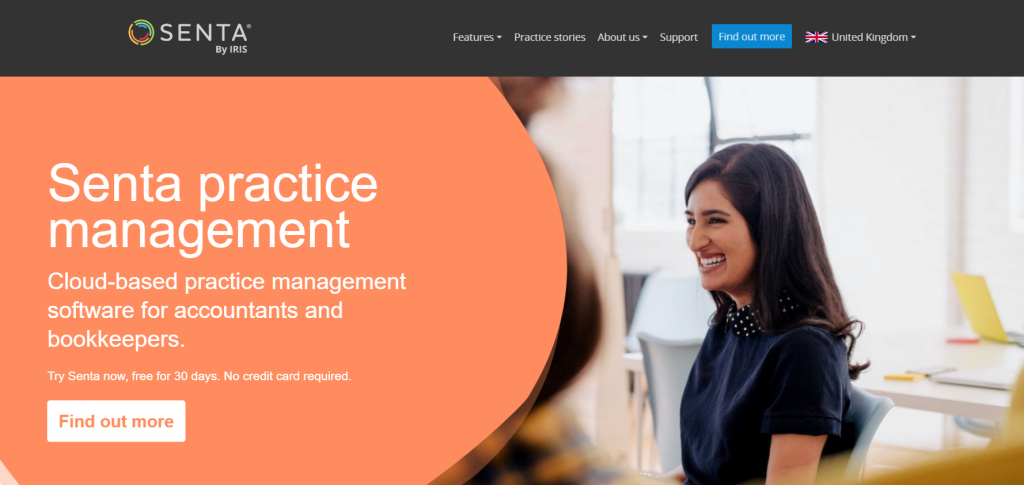

5. Senta (by Iris)

Senta, now part of the Iris family, is a flexible and powerful practice management platform for accounting firms that want to build workflows around their unique processes. It combines task management, CRM, and automated communication into one tool—built specifically for accountants and bookkeepers.

Senta is known for its flexibility. Whether you’re onboarding clients, managing payroll cycles, or sending engagement letters, it can be tailored to match how your firm already works.

Best For

- Firms that need customisable workflows

- Practices offering a mix of compliance and advisory services

- Teams wanting integrated task management and CRM in one place

Key Features

- Workflow automation with triggers and client-specific actions

- Full CRM to manage contacts, tasks, emails, and timelines

- Secure document sharing and client messaging

- Automated emails for onboarding, deadlines, or reminders

- Pre-built templates for UK accounting workflows (e.g. VAT, CIS, tax returns)

Pros

- Customisable to suit your firm’s exact process

- Saves time through automation and email follow-ups

- Combines job tracking with client management

- Used by both small and mid-sized UK practices

Cons

- Interface can take time to fully customise

- Some reporting features are more basic than enterprise tools

Pricing

- Monthly Billing: £32 + VAT/user/month

- Annual Billing: £25.60 + VAT/user/month

- Volume discounts and Iris Practice Suite bundles available

- UK-based onboarding and support included

Where This Platform Fits Best

Senta is a strong fit for firms that want to tailor their practice management system around how they already work. If you’ve built out your own processes but lack a tool that can keep pace, Senta gives you the flexibility to systemise your firm, without forcing you to change how you operate.

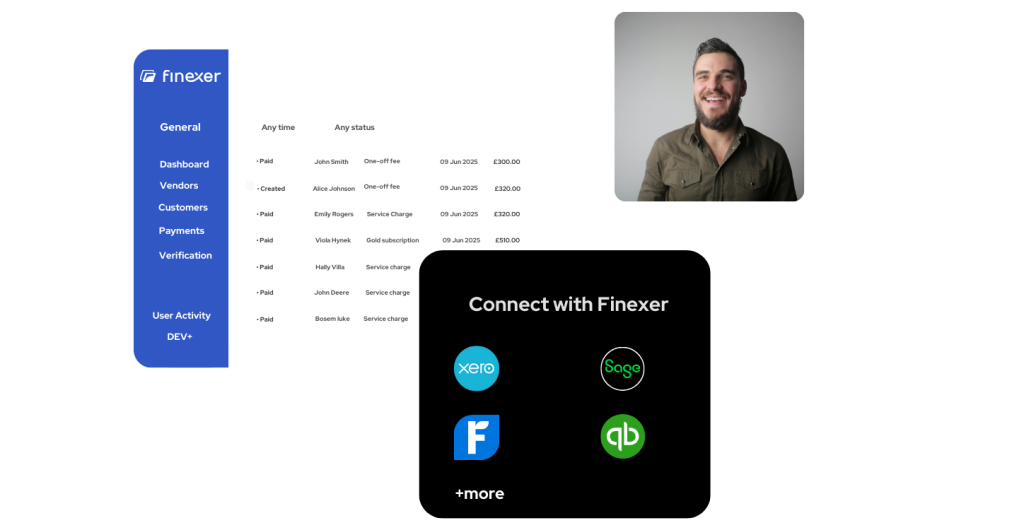

How Finexer Helps Accounting Firms

Finexer isn’t a practice management platform; it’s the infrastructure behind better financial data and faster workflows. As a UK-based Open Banking provider, Finexer gives accounting firms secure access to real-time banking data, KYC tools, and payment capabilities that plug directly into your existing systems.

Whether you’re onboarding clients, preparing reports, verifying accounts, or supporting advisory services, Finexer helps you get it done faster and more accurately, without the manual admin.

1. Real-Time Bank Data with AIS

Finexer connects to 99% of UK banks through Account Information Services (AIS), giving you access to live transactions and balances. This means no more waiting for bank statements or requesting spreadsheets—your team gets the data instantly and securely.

2. Faster KYC and Onboarding

Verify client bank accounts, identity details, and ownership with our integrated KYC tools. Finexer lets you streamline compliance by pulling data directly from clients’ accounts, reducing the time and effort it takes to meet regulatory requirements.

3. Categorised Financial Feeds

Transactions pulled through Finexer are automatically enriched and categorised—so your team doesn’t waste time sorting them manually. This helps during bookkeeping, reporting, or when setting up automation rules in your accounting software.

4. Payouts and Open Banking Payments

In addition to data, Finexer also supports Open Banking payments, which means your firm can help clients send or receive money faster, whether it’s for supplier payments, payroll, or one-off transfers. No card fees, no settlement delays.

5. Compatible with Your Existing Stack

Finexer is designed to work alongside your current tools—whether it’s Karbon, Pixie, Xero, QuickBooks, or Excel. You don’t have to overhaul your systems to start using better data. It simply integrates into your workflow and gives your team cleaner, more reliable information.

Why It Matters

When your data is up to date, your advice is more useful. When your onboarding is faster, your firm is more professional. And when your payments run through Open Banking, your clients stay in control.

That’s how Finexer helps accounting firms do more with less friction.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How to Choose the Right Practice Management Software?

Choosing the right practice management platform can make a major difference in how your accounting firm runs day to day. Whether you’re tracking hundreds of tasks across a growing team or just looking to tidy up your workflows, there’s a tool on this list that fits the way you work.

- Karbon is built for firms that need team-wide visibility and structured processes.

- Pixie suits smaller firms looking for simplicity and automation.

- Client Hub keeps client collaboration front and centre.

- AccountancyManager is ideal for UK firms juggling recurring compliance work.

- Senta offers the flexibility to build workflows around your firm’s own systems.

Each of these practice management platforms helps reduce admin, improve client communication, and keep your work on track, even during the busiest times of year.

When paired with a data-first tool like Finexer, you can also ensure that the financial information powering your workflows is always current, accurate, and easy to access—whether it’s for onboarding, reconciliation, or reporting.

The tools you choose can either add friction or remove it. The good ones do their job in the background, so your firm can focus on delivering great work, not chasing it.

What does practice management software do?

It helps accounting firms manage tasks, clients, deadlines, and files in one place—reducing manual work and improving visibility.

Is practice management software worth it for small firms?

Yes. Even small firms benefit from having clearer workflows, fewer missed tasks, and faster onboarding when using the right tool.

Can I manage both tasks and emails in one platform?

Yes. Tools like Karbon and Client Hub let you turn emails into tasks and keep everything linked to the right client file.

Do these platforms work with Xero or QuickBooks?

Most tools support direct integration with Xero, QuickBooks, and Sage, making it easier to sync contacts, documents, and deadlines.

How do I pick the right tool for my firm?

Start with your size and workflow needs. Karbon suits larger teams; Pixie and Client Hub are better for smaller, growing firms.

Get Instant Payments & Data in 2025! Schedule your free demo and get 14-days Free Trial by Finexer 🙂