Reducing month-end closing time has become a priority for many UK accounting firms. Whether you’re managing one client or fifty, delays caused by manual data entry, disconnected bank feeds, and late statements continue to slow down the close process.

Common issues include:

- Chasing clients for bank statements

- Importing CSV files into ledgers

- Manually reconciling transactions

- Dealing with errors, duplicates, and data gaps

All of this leads to longer workdays, reporting delays, and less time for advisory work. Often, the real problem isn’t the accounting software itself, but the lack of direct, real-time access to client bank data.

This is where Open Banking APIs are making a real difference by connecting accounting tools directly to UK bank accounts, they help automate reconciliation, reduce friction, and improve accuracy. APIs allow accountants to access transaction data as it happens. This cuts down manual work and helps with reducing month-end closing time across the board.

Keep reading or Jump to the section you’re looking for:

Open Banking APIs: The Transformation Engine

Open Banking APIs are not just a new technology layer. For accounting firms, they serve as the missing link between real-time financial activity and fast, accurate month-end reporting. Instead of working around disconnected data, firms can now build workflows where transactions flow directly from client bank accounts into their accounting platforms.

Banking-to-Ledger Synchronisation: Eliminating Manual Data Entry

Traditionally, firms spend hours importing CSVs or manually typing in transactions from bank statements. Open Banking APIs replace this step entirely. Once clients grant access, their banking data is pulled automatically and mapped into the ledger i.e no downloads, no imports, and no data duplication.

This direct connection not only reduces data entry time but also improves accuracy. Accountants no longer have to cross-check balances or fix entry errors that stem from outdated or inconsistent uploads.

Exception-Based Processing: Focusing Only on What Needs Attention

In legacy systems, accountants are forced to review every transaction, even if it matches correctly. Open Banking APIs enable exception-based workflows where reconciled items are automatically cleared, allowing teams to focus only on transactions that need further review.

This shift plays a big role in reducing month-end closing time. Firms no longer need to process clean data manually, which frees up hours that can be redirected to more valuable work like advisory, forecasting, or audit preparation.

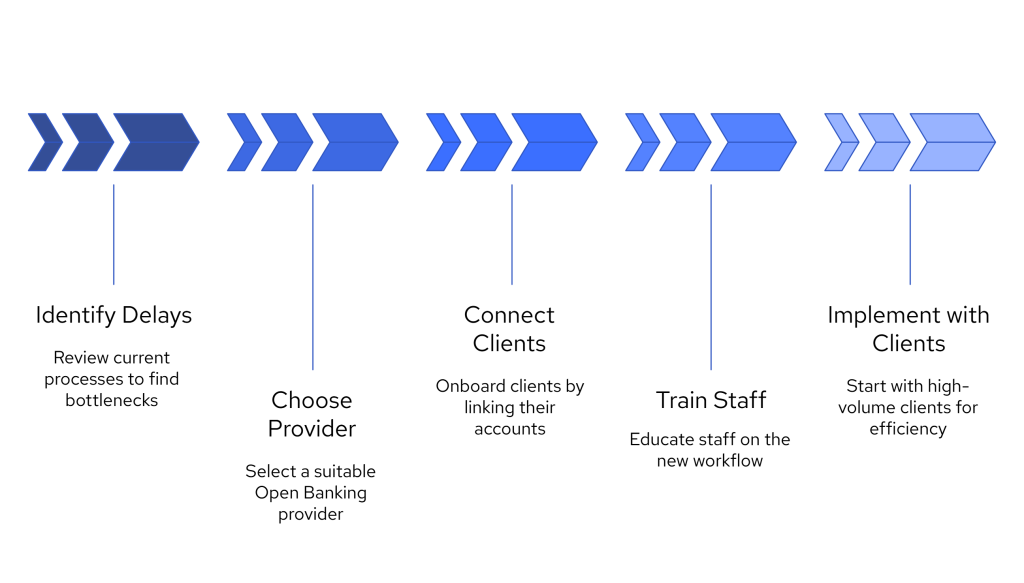

3 Steps Implementation Blueprint

You don’t need to rebuild your systems to start reducing month-end closing time. Many UK accounting firms begin by adding Open Banking connections to their existing tools. The process can be phased in without disrupting your current workflows.

Step 1: Identify the Delays

Start by reviewing where time is lost in your current month-end accounting process. Common delays include:

- Waiting for client bank statements

- Uploading CSV files

- Manually reconciling transactions

Highlight the areas where automation would have the most impact.

Step 2: Choose an Open Banking Provider

Look for a provider that supports bank feed integration, is FCA-regulated, and works well with your current accounting tools like Xero, FreeAgent, or Sage. Platforms like Finexer are designed to plug into your existing software without requiring a full system change.

The goal is to connect directly to client bank accounts using secure APIs, so you can work with accurate, real-time transaction data.

Step 3: Connect Clients and Train Staff

Once you’ve chosen a provider, onboard clients by asking them to securely link their accounts. The connection process usually takes just a few minutes.

Your team may need brief training to understand the new workflow. Most of the change involves reviewing live data feeds instead of manually importing files. For many firms, this change simplifies the process.

Start with a few high-volume clients or those with multi-entity structures, where time savings are easiest to measure. As the process proves itself, roll it out across more accounts.

Measured Impact: Time and Value Reclaimed

Once Open Banking APIs are integrated into your accounting workflow, the results become clear quickly. What used to take days can often be completed in hours, especially when it comes to transaction reconciliation and finalising reports.

Quantifiable Benefits for Accounting Practices

- UK businesses using Open Banking saved an average of 150 hours per year on financial tasks such as reconciliation, payment processing, and invoice handling equivalent to nearly four working weeks annually.

- Instead of handling transactions one by one, accountants can now review bulk-synced data and focus only on exceptions.

- In many cases, month-end closing time is reduced by 10–15 hours per month, freeing up time for client communication, advisory, or tax planning.

These improvements are even more noticeable for firms handling multi-entity clients, where each entity previously required its own reconciliation workflow. With automated data feeds in place, these can be reviewed in one platform with consistent formatting and full traceability.

Client Experience Improvements

Faster month-end processes benefit clients too. Instead of waiting a week or more for monthly reports, they receive timely updates that help them make better business decisions.

It also improves trust. When clients see that their data is handled accurately and securely without constant email reminders or follow-ups, it positions your firm as a tech-forward, reliable partner.

Case Study: How Finexer Helped Sysynkt in Reducing Friction in Financial Operations

Sysynkt, a B2B cloud accounting platform, is known for unifying web services into a single finance portal. Their system supports functions like procurement, bank reconciliation, purchase invoicing, and employee expense processing. But like many platforms, Sysynkt needed a way to integrate real-time banking data and payment initiation more efficiently — especially for high-volume business clients managing complex month-end processes.

The Challenge

Sysynkt found that most major Open Banking providers focused on consumer-grade solutions. They lacked the flexibility, business focus, and technical adaptability needed to serve large enterprises or automate month-end closing at scale.

“We needed a partner who understood the importance of providing business-focused solutions,” said Penny Phillips, Chief Commercial Officer at Sysynkt.

The Solution: Partnering with Finexer

Sysynkt partnered with Finexer based on a recommendation from the Open Banking community — and the collaboration quickly proved to be a strong match.

Finexer provided:

- Account Information Services (AIS) for seamless, live bank feeds to automate bank reconciliations within Sysynkt’s accounting software.

- Payment Initiation Services (PIS) to enable bulk supplier payouts and employee expense reimbursements directly from the platform.

- A flexible integration model, making it easy for Sysynkt to deploy Open Banking features without disrupting their existing infrastructure.

“Finexer’s willingness to work closely with us, rather than treating us as just another customer, was truly refreshing,” Penny noted.

Results and Impact

By embedding Finexer’s APIs, Sysynkt has:

- Enabled real-time bank data access across clients, cutting delays in reconciliation

- Automated key components of the month-end accounting process, reducing time spent on data collection and transaction processing

- Improved satisfaction among enterprise clients who now rely on faster, more reliable financial automation

This transformation directly supports Sysynkt’s mission to streamline finance office functions and reinforces the impact Open Banking APIs can have in reducing month-end closing time for business users.

“We’re happy with where we are and look forward to growing alongside Finexer,” Penny concluded.

Wrapping Up

For UK accounting firms, reducing month-end closing time is no longer a nice-to-have — it’s becoming essential. Whether you’re managing small business clients or complex, multi-entity groups, delays in closing books directly impact reporting, advisory, and cash flow planning.

Open Banking APIs help accounting teams move from reactive month-end sprints to a workflow that’s continuous, accurate, and less dependent on manual intervention. From automatic bank feeds to exception-based reconciliation, firms are saving time, reducing errors, and offering a better experience for clients.

The shift doesn’t require a full system rebuild. It starts with adding a secure, flexible banking layer to the tools you already use. That’s where Finexer fits in — enabling firms like Sysynkt to modernise their workflows with real-time banking data and payment capabilities tailored for business use.

How does Open Banking API reduce month-end closing time for accountants?

Open Banking APIs connect directly to client bank accounts, eliminating manual data collection and entry. Instead of chasing statements and importing CSVs, transaction data flows automatically into your accounting platform in real-time. This direct banking-to-ledger synchronisation cuts hours from reconciliation tasks and improves accuracy across the board.

What are the biggest time-wasters in traditional month-end closing?

The primary time drains include chasing clients for bank statements, manually importing transaction data, line-by-line reconciliation, and correcting errors from outdated information. These manual processes don’t just consume hours – they delay client insights and decision-making while increasing the risk of inaccuracies.

How much time can accounting firms save with Open Banking APIs?

UK accounting firms typically reduce month-end closing time by up to 25% after implementing Open Banking APIs. This translates to approximately 10–15 hours saved monthly, with even greater efficiency gains for practices handling multi-entity clients or high-volume transaction businesses.

Do accounting firms need to replace existing software to use Open Banking APIs?

No – Open Banking APIs work alongside your current accounting tools. Most UK firms simply add banking connections to platforms like Xero, FreeAgent, or Sage without disrupting established workflows. This layered approach enhances your existing systems rather than replacing them.

Stop letting manual bank feeds and CSV uploads hold back your team! Try Finexer and Save extra hours every month 🙂