Running a business means juggling a lot—managing finances, tracking inventory, handling payroll, and keeping customers happy. The bigger the business gets, the harder it becomes to keep everything in check. This is where Enterprise Resource Planning (ERP) software comes in.

But here’s the problem:

- Too many options. There are dozens of ERP solutions, each claiming to be the best.

- Complex pricing. Some providers charge based on users, while others price per module, making it hard to compare costs.

- Hidden limitations. Many ERPs offer great features but lack flexibility, forcing businesses to pay extra for add-ons or custom development.

With so many choices, how do you find the right ERP for your business?

What You’ll Get in This Guide

This blog will break down 10 of the top ERP software options in the UK, covering their:

✅ Core features

✅ Best use cases (small business, mid-sized, or enterprise)

✅ Pricing (where available)

✅ Potential drawbacks

We’ll also explore how Open Banking integrations can help ERPs manage real-time financial data and payments more effectively.

1. SAP Business One

SAP Business One is ERP software designed for small and mid-sized businesses that need a system to manage finances, inventory, and customer relationships. It offers a centralised platform to track operations without the complexity of larger ERP solutions.

Key Features:

- Integrated financial management, including accounts payable and receivable

- Inventory tracking with real-time stock updates

- Sales and customer relationship management (CRM)

- Customisable reporting for financial analysis

Who Should Use It?

Businesses that need a single system to handle accounting, inventory, and sales without investing in enterprise-level ERP software. It is particularly useful for companies that manage stock or supply chains.

Limitations:

- Costs increase with additional modules or users

- Requires some technical setup, which may be a challenge for businesses without IT support

Pricing:

SAP Business One operates on a per-user pricing model. Costs typically range from £50 to £100 per user per month, depending on deployment and licensing.

2. Microsoft Dynamics 365

Microsoft Dynamics 365 is ERP software that integrates seamlessly with Microsoft products such as Office 365, Teams, and Outlook. It is designed for businesses that need flexibility and scalability.

Key Features:

- Financial and supply chain management

- Built-in AI-driven insights for forecasting

- Integration with Microsoft 365 tools

- Industry-specific modules for retail, finance, and manufacturing

Who Should Use It?

Businesses that already use Microsoft products and want ERP software that integrates with their existing tools. It is suitable for companies planning to scale.

Limitations:

- Some features require additional licensing fees

- A learning curve for businesses unfamiliar with Microsoft’s ecosystem

Pricing:

Pricing depends on the module selected. The Finance and Operations module starts at around £140 per user per month.

3. Oracle NetSuite

Oracle NetSuite is ERP software built for businesses that need strong financial and accounting management. It is widely used by companies that require detailed reporting and automation for financial processes.

Key Features:

- Real-time financial reporting

- Automated invoicing and revenue tracking

- Inventory and supply chain management

- Multi-currency support for businesses operating globally

Who Should Use It?

Companies with complex financial needs that require ERP software with strong accounting and reporting features. It is ideal for finance teams handling multiple revenue streams.

Limitations:

- Customisation requires technical support

- Pricing is not transparent, and costs can add up with additional users and features

Pricing:

NetSuite follows a subscription-based model. Pricing typically starts at £750 per month, plus £75 per user per month.

4. Sage Intacct

Sage Intacct is ERP software designed for businesses that require advanced financial management. It automates financial reporting, compliance tracking, and multi-entity accounting, making it ideal for finance teams handling complex transactions and cash flow management.

Key Features

- Automated financial reporting and compliance tracking

- Advanced cash flow management tools

- Multi-entity accounting for businesses with multiple locations

- Customisable dashboards for financial insights

Who Should Use It?

Businesses that need strong financial and accounting tools in their ERP software. It is particularly useful for finance teams that require automated reporting and compliance tracking.

Limitations

- Focuses heavily on finance, so businesses needing broader ERP features may need additional integrations

- Pricing is higher compared to some small business ERP software

Pricing

Sage Intacct does not offer public pricing, but businesses should expect costs to start from £400 per month, depending on user count and features.

5. Odoo

Odoo is a modular ERP software that allows businesses to select only the features they need, covering CRM, accounting, HR, inventory, and project management. With both cloud-based and open-source options, it’s a flexible choice for companies looking for customisation and affordability.

Key Features

- Modular system where businesses can choose only the features they need

- Covers CRM, accounting, inventory, HR, and project management

- Cloud-based or self-hosted deployment options

- Open-source, allowing custom development for unique business needs

Who Should Use It?

Companies looking for flexible ERP software that can be customised to fit their business model. It is ideal for businesses that want an affordable, modular approach to ERP.

Limitations

- Open-source version requires technical expertise for setup and maintenance

- Some essential features require paid modules

Pricing

Odoo has a free community version, but paid plans start at £19 per user per month, with additional costs for premium modules.

6. Workday ERP

Workday ERP is built for enterprises needing a strong HR and finance management solution. It offers payroll, employee benefits, financial planning, and AI-driven workforce insights. Workday is cloud-based, ensuring real-time updates and seamless scalability for large organisations.

Key Features

- Comprehensive HR management, including payroll and employee benefits

- Financial planning and budgeting tools

- AI-powered analytics for workforce insights

- Cloud-based system with regular updates

Who Should Use It?

Large businesses and enterprises that need ERP software with a strong HR and finance focus. Workday ERP is widely used by organisations that manage a large workforce.

Limitations

- Primarily designed for larger companies, so it may not be ideal for small businesses

- Customisation is limited compared to other ERP software

Pricing

Workday ERP does not provide public pricing, but it typically follows an annual subscription model starting at around £500 per user per year.

7. Infor CloudSuite

Infor CloudSuite is an industry-specific ERP solution tailored for sectors such as manufacturing, healthcare, and retail. It provides advanced supply chain management, AI-powered analytics, and multi-tenant cloud deployment, making it ideal for businesses with specialised operational needs.

Key Features

- Tailored ERP solutions for industries such as manufacturing, healthcare, and retail

- Advanced supply chain and inventory management

- AI-powered analytics for business insights

- Cloud-based with multi-tenant deployment options

Who Should Use It?

Businesses that require ERP software designed for their specific industry rather than a one-size-fits-all approach. Infor CloudSuite is widely used in manufacturing, distribution, and retail sectors.

Limitations

- Industry-specific customisations can increase implementation time

- May require additional training due to its specialised modules

Pricing

Infor CloudSuite does not provide public pricing, but businesses should expect a custom pricing model based on industry needs, user count, and selected modules.

8. Xero with ERP Integrations

Xero is a cloud-based accounting software that integrates with ERP systems for seamless financial management. It offers automated bank feeds, real-time financial reporting, and Open Banking integration, making it a cost-effective choice for small businesses needing strong accounting features.

Key Features

- Cloud-based accounting software with ERP integrations

- Automated bank feeds and financial reporting

- Invoice management and expense tracking

- Open Banking integration for real-time financial data sync

Who Should Use It?

Small businesses that do not need a full ERP system but require financial management software that integrates with ERP solutions. Xero works well for startups and SMEs looking for a simple and cost-effective way to manage accounts while connecting to larger ERP platforms.

Limitations

- Not a full ERP software; requires third-party integrations for broader functionality

- Limited inventory and supply chain management features

Pricing

Xero offers different pricing plans based on business size. Plans start from £15 per month, with higher-tier options available for advanced features.

9.SAP S/4HANA – Best for Large Enterprises

SAP S/4HANA is an enterprise-grade ERP solution designed for large businesses requiring advanced financial planning, AI-driven automation, and real-time supply chain management. Its high-performance cloud and on-premise options make it suitable for industries like finance, logistics, and manufacturing.

Key Features

- Advanced financial planning and risk management

- AI-driven automation for business processes

- Integrated supply chain and procurement management

- Real-time data processing with cloud deployment options

Who Should Use It?

Large enterprises that require a high-performance ERP solution capable of handling complex operations across multiple departments. It is widely used in industries such as manufacturing, logistics, and finance.

Limitations

- High implementation and licensing costs

- Requires a dedicated IT team for management and maintenance

Pricing

SAP S/4HANA follows an enterprise pricing model, with costs starting at around £1,500 per month, depending on the deployment and selected modules.

10.Epicor ERP

Epicor ERP is built for manufacturers, distributors, and supply chain businesses, offering advanced production tracking, real-time inventory management, and cloud-based or on-premise deployment. It is ideal for businesses looking for industry-specific ERP solutions with deep operational insights.

Key Features

- Advanced manufacturing execution system (MES) for production tracking

- Supply chain and inventory management with real-time data updates

- Cloud-based and on-premise deployment options

- Customisable dashboards for monitoring business operations

Who Should Use It?

Manufacturers, distributors, and businesses in the supply chain sector that need ERP software focused on production tracking, logistics, and inventory management.

Limitations

- Complex setup and requires industry expertise for proper configuration

- Higher upfront costs compared to general-purpose ERP software

Pricing

Epicor ERP pricing varies based on business size and requirements. Businesses can expect custom pricing, with costs typically starting at £500 per user per month, depending on features and deployment.

How Open Banking Enhances ERP Software Functionality

ERP software helps businesses manage finances, inventory, and operations, but traditional systems often struggle with real-time financial data. Many still rely on manual bank feeds, delayed updates, and complex payment processes. Open Banking solves these issues by connecting ERP software directly to bank accounts, enabling instant financial data access and automation.

Automated Bank Reconciliation

Matching transactions manually is time-consuming. Open Banking speeds up reconciliation by:

- Automatically matching invoices with bank transactions

- Identifying missing or duplicate entries, reducing errors

- Saving time for finance teams, allowing them to focus on strategy

Faster and Cost-Effective Payments

Most ERP systems require third-party payment processors, leading to higher fees and delays. Open Banking allows:

- Direct bank-to-bank payments, cutting out middlemen

- Faster settlements, improving cash flow

- Secure transactions, reducing fraud risks

Better Cash Flow Management

ERP software helps businesses plan finances, but plans can fail without accurate data. Open Banking enables:

- Live balance updates, helping businesses stay on top of finances

- Accurate cash flow forecasts, reducing the risk of overdrafts

- Automated alerts for incoming and outgoing payments, keeping finances in check

Instant Bank Verification

Ensuring payments go to the right accounts is crucial for security. Open Banking:

- Verifies bank accounts instantly, reducing fraud risk

- Confirms customer and supplier details, preventing errors

- Supports compliance requirements, making financial audits easier

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

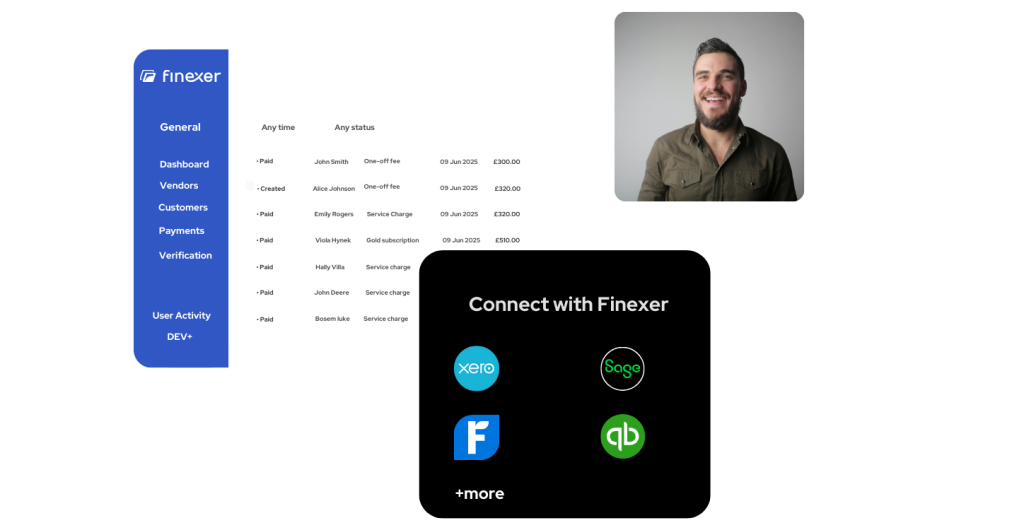

Why Choose Finexer for ERP Automation

Finexer connects ERP software to Open Banking, helping businesses manage payments and financial data with fewer manual tasks and delays. Here are some reasons to consider Finexer:

- Real-time data updates: Transactions and balances sync with ERP software immediately, keeping financial records accurate.

- Secure and compliant: Bank-grade authentication and data protection standards help reduce fraud risks and meet regulatory requirements.

- Simple integration: Finexer’s API connects to popular ERP software, minimising setup time and technical hurdles.

- Flexible pricing: Finexer offers plans that fit different business sises and transaction volumes, avoiding unexpected costs.

- Dedicated support: A team of experts is available to guide businesses through setup and troubleshooting.

By choosing Finexer, businesses can save time on manual processes and focus on more important tasks within their ERP software.

What is ERP software?

RP software stands for Enterprise Resource Planning software. It brings together key business functions such as finance, inventory, human resources, and customer management into one system. By using ERP software, companies can keep all their data centralized, reduce manual data entry, and make decisions based on real-time information.

How does ERP software improve operations?

By consolidating data from different departments, ERP software reduces errors and manual reconciliation. It supports efficient tracking of finances, inventory, and customer interactions, which leads to smoother business operations.

How does Open Banking integration enhance ERP software?

Open Banking integration connects ERP software directly to bank accounts, providing real-time updates on transactions and balances. This feature automates bank reconciliation and speeds up payment processes, improving cash flow management.

What benefits does Finexer offer for ERP automation?

Finexer offers a secure API that links ERP software with Open Banking. This integration delivers live financial data, automated reconciliation, direct bank payments, and instant account verification, helping to reduce manual errors.

How do I choose the right ERP software for my business?

To choose the right ERP software, consider your business size, industry needs, and key functionalities. Look for systems that integrate easily with existing tools, offer clear pricing, and have a user-friendly interface.

Now ERP Process Simplified with Finexer! Schedule your free demo and get a 14 days Trial by Finexer 🙂