What You Will Discover:

How Open Banking Powers Fintech Startups?

The United Kingdom stands at the forefront of financial innovation. Open banking has fundamentally changed how financial technology companies operate and serve customers. According to the Competition and Markets Authority’s 2023 report, the UK has surpassed 7 million active open banking users, marking a significant shift in how consumers and businesses interact with financial services.

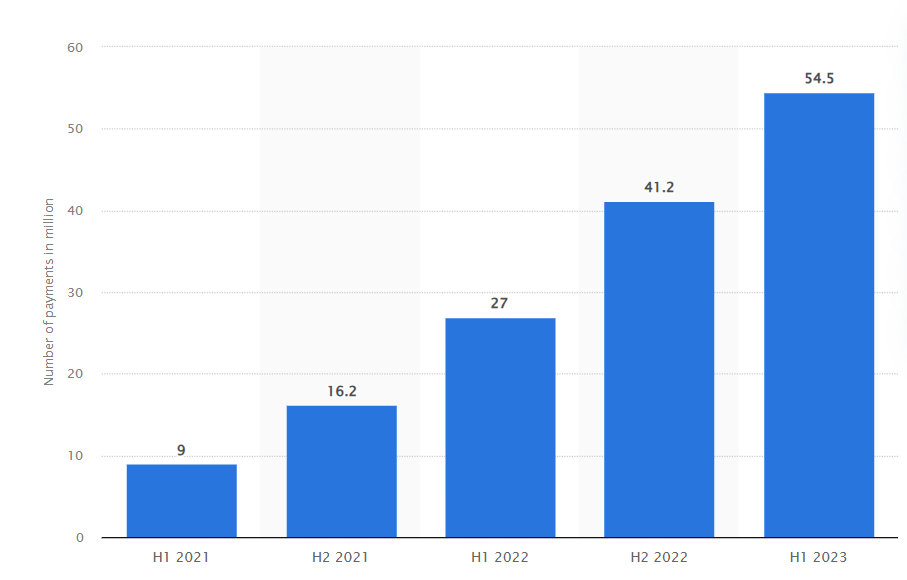

This transformation is particularly evident in the volume of open banking payments, which saw a remarkable 110% increase in 2023. This growth demonstrates not just the technical evolution of financial services, but a fundamental change in how customers expect to interact with their financial data and services.

(Published by Statista Research Department, Nov 13, 2024)

The number of successful open banking payments reported by the nine largest banks and building societies in the UK increased significantly between the first half of 2021 and the first half of 2023. In the first half of 2023, open banking payments were 54.5 million, up from nine million two years earlier.

The Impact on Fintech Operations

Direct Financial Data Access

The introduction of open banking has eliminated traditional barriers to financial data access. Fintech companies now receive standardised, real-time financial information directly from banks through secure APIs. This direct access transforms lending operations, where companies can analyse years of transaction history within moments, leading to more accurate risk assessments and faster decision-making processes.

Consider a lending platform examining a small business loan application. Previously, this process required weeks of manual document collection and verification. Now, with open banking integration, the platform can instantly access and analyse the business’s financial history, cash flow patterns, and payment behaviours, reducing the decision-making process to minutes while improving accuracy.

Cost Structure Transformation

The financial impact of open banking implementation extends beyond operational improvements. Recent studies by the Financial Conduct Authority reveal that companies implementing open banking solutions have experienced a reduction of up to 70% in customer onboarding costs. This dramatic decrease stems from the automation of previously manual processes, such as identity verification and financial history assessment.

Transaction processing has become notably more economical, with costs decreasing by approximately 25%. This reduction comes from eliminating intermediaries and enabling direct account-to-account transactions, creating a more sustainable operational model for fintech companies.

Advanced Payment Architecture

Open banking has introduced sophisticated payment capabilities that extend far beyond traditional banking infrastructure. Through direct account-to-account payments, fintech companies can now process transactions with improved speed and reliability. The system enables instant account ownership verification, continuous transaction monitoring, and the implementation of Variable Recurring Payments (VRP).

The payment architecture supports complex transaction patterns while maintaining high security standards. For instance, when processing business-to-business payments, the system can handle multi-step authorisations, batch processing, and real-time reconciliation, all while maintaining a clear audit trail.

Risk Management Evolution

The advancement in risk management capabilities through open banking represents a significant leap forward for fintech companies. Access to real-time financial data enables continuous monitoring of financial health indicators, allowing for proactive risk management rather than reactive measures.

For example, in the context of business lending, lenders can monitor borrowers’ financial health in real-time, identifying potential issues before they become critical. This capability extends to detecting unusual transaction patterns, verifying income sources, and maintaining ongoing affordability assessments, creating a more robust risk management framework.

Product Innovation Opportunities

Open banking has created new possibilities for financial product development. Financial management platforms can now offer comprehensive views of customers’ financial positions across multiple institutions. Investment platforms can provide personalised recommendations based on actual spending patterns and financial behaviors. Business banking solutions can integrate directly with accounting systems, creating seamless financial management experiences.

Building a fintech startup? Let’s map your journey! Chat with our Open banking experts and get your personalised roadmap.

1.Finexer

Company Background and Focus

Finexer began its journey in London in 2018, creating open banking systems for fintech startups. Their approach comes from understanding the unique challenges that new fintech companies face in the UK market. Unlike traditional banking solution providers who typically build for large enterprises, Finexer designed their entire system thinking about what startups need most: quick setup, easy integration, and room to grow. Their development mirrors the evolution of the UK’s open banking sector, making them particularly attuned to the local market’s requirements and regulations. This focused approach helps new fintech companies launch and scale their services without getting bogged down by complex banking infrastructure.

How Finexer Handles Financial Data

At the core of Finexer’s system is their Open Banking Data API, which connects directly to UK banks to get financial information in its purest form. When startups use this API, they receive exactly what the banks provide without any pre-processing or alterations that might limit their options. This means that if a startup is building a personal finance app, they can organise and analyse the data in ways that make sense for their specific users and business goals. The system delivers this information quickly while keeping it secure, allowing startups to build unique features without worrying about data integrity or speed issues. This approach is especially valuable when startups want to create specialised financial products needing specific data handling methods.

Payment Processing Capabilities

The payment system handles all kinds of money movements through one unified platform. Whether it’s a single payment or thousands of transactions, the system processes everything smoothly and keeps track of all the details. This becomes particularly useful for startups handling services like payroll or managing payments for multiple businesses simultaneously. The system automatically matches payments with records and provides detailed tracking information, making it easier to manage complex payment operations. For startups dealing with various payment types, they can offer sophisticated payment services to their customers without building complicated systems themselves.

Security and Protection

The security system uses advanced encryption (AES-256) to protect all financial data, meeting the highest banking security standards. What makes this system particularly helpful for startups is its ability to automatically update when regulations change, meaning startups don’t need to worry about staying compliant. The system watches transactions in real-time for suspicious activity, requires multiple steps to verify user identity, automatically detects potential fraud, and regularly checks for security issues. This comprehensive security approach helps startups build trust with their customers while avoiding the complexity of managing security systems themselves.

📚 Learn more about PSD2 & Security

Bank Connections and Coverage

Finexer connects to nearly every bank in the UK, covering 99% of the banking sector. This extensive network means startups can serve their customers regardless of which bank they use without setting up multiple bank connections. The system handles everything in real time, from checking account balances to processing payments and verifying accounts. This wide coverage, combined with instant processing capabilities, allows startups to offer reliable services across the entire UK market from day one, removing a significant barrier to market entry and growth.

Managing Financial Operations

The platform gives startups complete visibility into their financial operations as they happen. When transactions occur, startups can see them instantly, track their status, and generate reports without delay. The system automatically matches transactions across different accounts and payment systems, reducing the need for manual checking and record-keeping. This level of automation and real-time monitoring is particularly valuable for startups offering financial management tools or lending services, as it allows them to make quick decisions based on accurate, current information.

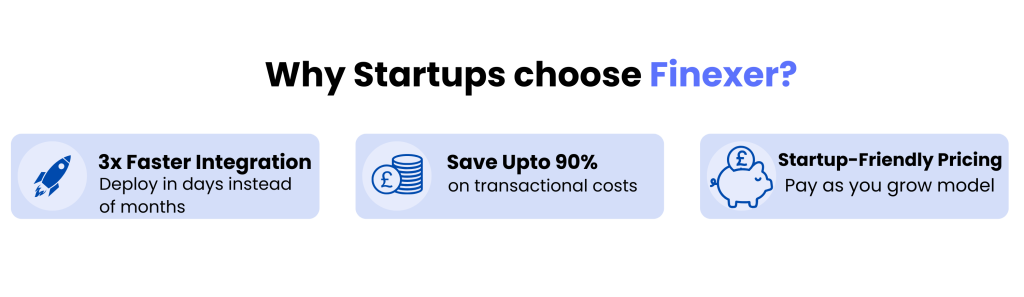

Cost and Pricing Structure

Understanding that startups need flexible pricing as they grow, Finexer uses a consumption-based pricing model. This means startups only pay for what they use, without large upfront costs or long-term commitments that could strain their resources. All fees are clearly explained with no hidden charges, making it easier for startups to predict their costs as they scale. The pricing structure adapts to each startup’s growth pattern, ensuring that operational costs remain manageable throughout their development stages.

Want to see how fast you can launch your fintech product? → Book a demo, and we’ll show you

Alternative Solutions in the Market

The UK’s open banking landscape includes several established platforms alongside Finexer. Understanding their characteristics helps provide context about the available options in the market.

2. Plaid

Plaid entered the UK market with a decade of experience from its operations in the United States, where it has processed billions of transactions since its founding in 2013 in San Francisco. Their system emphasises enterprise-grade reliability and data aggregation capabilities, particularly in North America, where they maintain market leadership. The platform’s integration process follows a structured approach characteristic of enterprise solutions, with their European coverage still developing compared to their North American presence. Their pricing structure reflects their enterprise origin, positioning them in a premium bracket with a comprehensive feature set that includes sophisticated real-time account information services developed through years of refinement across multiple markets.

3. Tink

Tink has established its presence in the European open banking sector, demonstrating growth by tripling revenue to £12 million in 2022. Their platform specialises in payment initiation services across European markets, incorporating real-time transaction capabilities and data enrichment features that extend beyond standard PSD2 requirements. Through their European-focused strategy, their system includes merchant name identification and transaction categorisation. The platform maintains partial branding throughout the customer journey, which affects complete customisation options.

These platforms operate within the larger context of the UK’s open banking ecosystem, where market requirements and regulatory frameworks continue to evolve. Each brings distinct characteristics shaped by their origins and primary market focus.

📚 Tink Pricing Analysis for Startups in 2025

Competitor Analysis

| Feature | Finexer | Plaid | Tink |

|---|---|---|---|

| Coverage | Covers 99% of the UK banks | Broad coverage in the US, with some coverage in the EU and UK | Strong connections in 18 European countries |

| Data (AIS) / Payments (PIS) | Both | Both | Both |

| Data Enrichment | ✔️ | ✔️ | ✔️ |

| Bulk Payments | ✔️ | ❌ | ✔️ |

| Variable Recurring Payments | ✔️ | ✔️ | ✔️ |

| Real-time Account Balances | ✔️ | ✔️ | ✔️ |

| Financial Data Aggregation | ✔️ | ✔️ | ✔️ |

| White-label API | ✔️ | ❌ | ✔️ |

| PSD2 Compliance | ✔️ | ✔️ | ✔️ |

| Webhooks | ✔️ | ✔️ | ✔️ |

Still Confused? Why not Talk to our Open banking Expert

Winding Up

As the UK’s open banking ecosystem evolves, choosing an infrastructure partner becomes increasingly crucial for fintech startups. Our analysis reveals that while global platforms like Plaid offer extensive international experience and Tink provides European market coverage, Finexer is the most suitable choice for UK-based fintech startups, particularly those focused on rapid growth and market entry.

The platform’s consumption-based pricing model aligns perfectly with startup economics, starting at startup-friendly rates without enterprise-level commitments. This pricing structure allows new companies to scale their costs naturally with growth, eliminating the burden of large upfront investments common with other providers. The infrastructure handles growth from 100 to 100,000 transactions with 98% uptime, requiring no additional technical investment.

What truly sets Finexer apart is its complete focus on the UK market’s specific needs. While other platforms divide their attention between multiple regions or enterprise clients, Finexer’s infrastructure was built from the ground up for UK startups. Their FCA-authorised system automatically handles all regulatory requirements, providing peace of mind for startups navigating complex compliance landscapes.

Finexer provides the ideal combination of technical capability, market access, and growth support for fintech startups aiming to establish a strong presence in the UK market. Their white-label platform ensures complete brand control, while their dedicated team offers strategic guidance and optimisation insights throughout the growth journey. With startup-friendly pricing and rapid deployment capabilities, this comprehensive approach makes Finexer the most practical choice for ambitious startups in the UK market.

Transform your fintech vision into reality – Schedule a consultation with our experts today 🙂