Open banking apps have transformed how people manage their finances by allowing them to connect multiple bank accounts in one place. These apps provide better visibility into spending, automate savings, and offer financial insights—all while keeping data secure.

With more people looking for digital tools to take control of their money, open banking apps continue to grow in popularity. Whether you’re tracking expenses, setting savings goals, or looking for smarter ways to manage your finances, the right app can make all the difference.

In this blog, we’ll explore five open banking apps that stand out for their features, accessibility, and how they help users get the most out of their money.

we will guide you through:

What Makes an Open Banking App?

Open banking is a regulatory framework that lets third-party providers access bank data—like transactions and balances—with a user’s permission. Apps built on this concept use open banking APIs to securely connect to banks, giving users real-time data and, in some cases, the ability to initiate payments.

Below are some key aspects that define an open banking app:

Secure Data Sharing

- Apps need user consent to access any banking information.

- Strong encryption and regulatory safeguards protect sensitive details.

Regulatory Compliance

- Providers must be licensed or registered under relevant authorities.

- Many follow KYC (Know Your Customer) rules and anti-fraud measures.

Use of Open Banking APIs

- Account Information Services (AIS): Gather account balances and transactions in one dashboard.

- Payment Initiation Services (PIS): Allow direct transfers or payments from linked accounts.

- Verification & Identity: Include checks to prevent unauthorised access.

Multi-Account Insights

- Users can track multiple bank accounts, credit cards, or loan balances in a single place.

- Automated categorisation of transactions can help with budgeting and goal-setting.

Expanded Features

- Some apps add savings, spending notifications, or investments on top of real-time account data.

- This allows a more complete view of personal finances without juggling multiple platforms.

Top 5 Open banking apps for finance management in 2026

1. Emma

Emma is designed for users who want a complete view of their finances in one place. By securely connecting to multiple bank accounts and credit cards, it provides insights into spending patterns and helps track financial goals.

Key Features

- Spending Insights: Transactions are automatically categorised, giving a clear picture of expenses.

- Subscription Tracking: The app detects recurring payments to help users manage subscriptions effectively.

- Open Banking Integration: Uses AIS (Account Information Services) to pull real-time bank data securely.

Why It Stands Out

Emma simplifies financial tracking by consolidating all account details in one app, making it easier to manage money without switching between banking platforms.

2. Plum

Plum is a smart savings tool that uses open banking to analyse spending habits and automatically set aside money. It’s ideal for those who struggle to save manually or want to invest small amounts over time.

Key Features

- Automated Savings: The app calculates how much users can afford to save and transfers small amounts into a savings pot.

- Investment Options: Users can invest their savings into funds or stocks, though investments carry risk.

- Open Banking Integration: Uses AIS to monitor financial behavior and determine safe saving amounts.

Why It Stands Out

Unlike budgeting apps, Plum takes a proactive approach by automating savings based on real-time financial data.

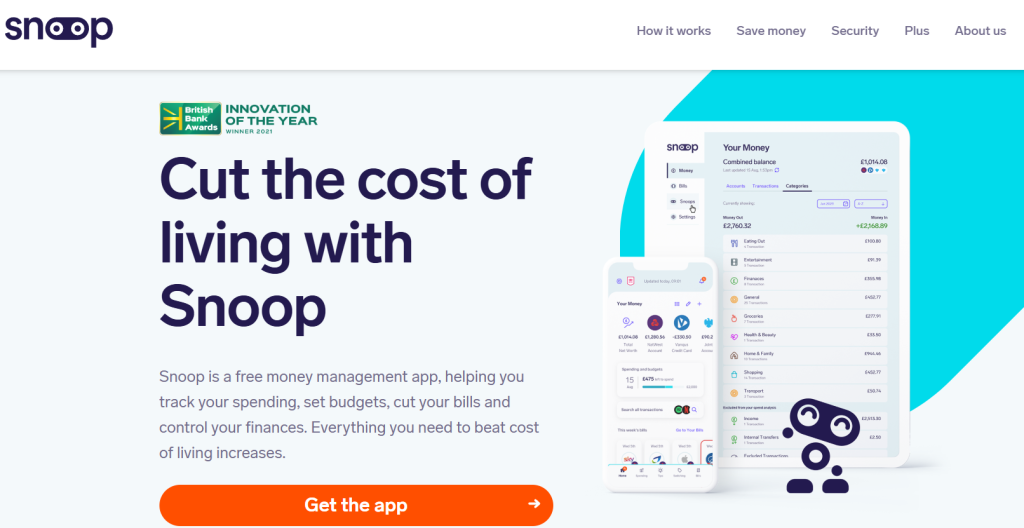

3.Snoop

Snoop is a leading open banking app that helps users gain a clear view of their financial lives. By securely connecting to your bank accounts, Snoop analyses your spending patterns, identifies recurring payments, and uncovers potential savings. Its user-friendly dashboard presents actionable insights to help you make informed decisions about your money.

Key Features

- Personalised Spending Analysis

Snoop automatically categorises your transactions and provides an easy-to-understand overview of your spending. This allows you to quickly see where your money goes each month, helping you identify areas where you can cut back or optimise your budget. - Subscription Management

One standout feature is Snoop’s ability to detect recurring subscriptions. The app notifies you of subscriptions you might have forgotten about, offering suggestions on how to manage or cancel those that are no longer beneficial. - Actionable Savings Tips

Snoop not only shows you your spending habits but also suggests ways to save money. It highlights areas where you could reduce expenses, such as cheaper alternatives for recurring bills, making it easier to achieve your savings goals. - Secure Data Handling

Using robust open banking APIs, Snoop ensures that your data is accessed securely and only with your explicit permission. This focus on security and privacy makes it a trusted tool for managing your finances. - User-Friendly Interface

The app’s intuitive design makes it accessible even for users who aren’t tech-savvy. Whether you’re tracking day-to-day spending or planning for long-term financial goals, Snoop presents information in a clear, visually appealing format.

Why Snoop Stands Out

Snoop is popular among users who want more than just a basic overview of their bank accounts. It leverages the power of open banking to deliver personalised insights and actionable advice, making it easier for you to take control of your finances. By combining advanced data analysis with a focus on usability and security, Snoop has become a trusted tool for smart money management.

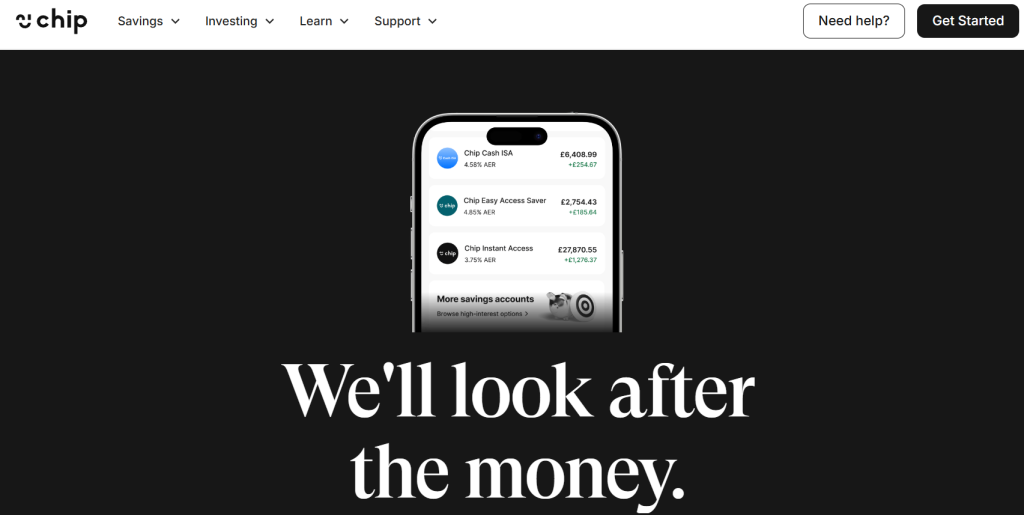

4. Chip

Chip is a savings app that helps users earn higher interest rates on their deposits while also offering open banking-powered direct payments. Unlike traditional savings accounts, Chip moves money into accounts that offer competitive returns, helping users grow their funds more efficiently.

Key Features

- Automated Saving: Chip analyses spending patterns and moves small amounts into a savings pot automatically.

- High-Interest Accounts: Users can access market-leading interest rates without needing to switch banks.

- Open Banking Integration:

- Uses AIS to monitor financial activity and determine safe saving amounts.

- Supports PIS (Payment Initiation Services) for instant deposits without using card networks.

Why It Stands Out

Chip is one of the few apps that combines automated saving with direct bank payments, making it easier to move money between accounts without card fees.

5.Zopa

Zopa is a well-known digital lender and bank in the UK that leverages open banking data to offer more accurate, transparent lending solutions. Originally established as a peer-to-peer lending platform, Zopa now uses real-time financial insights from open banking to assess creditworthiness and provide tailored loan products.

Key Features

- Data-Driven Credit Assessment

Zopa integrates open banking data to evaluate your income, spending habits, and overall financial behavior. This real-time analysis helps generate a clearer picture of your financial health, enabling fairer and more personalised credit assessments. - Personalised Loan Offers

By using detailed financial data, Zopa can offer loan products that match your unique circumstances. Whether you’re looking for a personal loan or refinancing options, the insights from open banking help tailor competitive interest rates and flexible repayment terms. - Secure and Transparent Processes

Zopa prioritises your data security. With robust encryption and strict regulatory compliance, your financial information is handled with care and used only with your explicit consent, ensuring a safe and transparent lending experience.

Why Zopa Stands Out

Zopa’s approach moves beyond traditional credit scoring by harnessing the power of open banking. This allows for:

- A More Inclusive Lending Model:

Customers with limited or non-traditional credit histories can access loans based on a broader view of their financial behavior. - Improved Decision Making:

Real-time data means faster, more accurate credit decisions, reducing wait times and enhancing customer experience. - Greater Transparency:

With a clear understanding of how your data influences lending decisions, Zopa builds trust and empowers you to make informed financial choices.

Get an Open Banking API for Your Business

If your business needs a dependable solution to process payments, access up-to-date financial data, and verify customer identities quickly, Finexer’s Open Banking API is designed for you. With Finexer, you can seamlessly integrate secure financial services into your applications, empowering you to deliver a smoother, more efficient experience to your customers.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try Finexer’s Open banking API

Direct Bank Payments

Finexer enables bank-to-bank transfers without the additional costs and delays of traditional card networks. This streamlined process reduces transaction fees and accelerates payment processing, allowing you to offer faster services to your customers.

Real-Time Financial Data

Access the latest account information and transaction details to drive informed decisions. Whether you’re building budgeting tools, personalised financial dashboards, or automated lending systems, Finexer’s API delivers the data you need in real time.

Secure Customer Verification

Speed up your onboarding process with fast and reliable customer identity verification. Finexer’s API checks account details securely, ensuring compliance with regulatory requirements while minimising friction for your customers.

Build Your Own Open Banking Apps

Finexer’s Open Banking API gives you the power to create open banking apps that deliver:

- Fast and Secure Payments: Offer direct bank transfers that are both cost-effective and speedy.

- Real-Time Financial Insights: Enable dynamic tools that provide users with up-to-date financial information.

- Reliable Customer Identity Verification: Streamline onboarding and ensure secure, compliant verification processes.

By choosing Finexer, you’re partnering with an API provider that delivers secure, scalable, and fully compliant solutions. Our platform is engineered to help you build innovative financial services that meet your customers’ needs today and grow with your business tomorrow.

Try Finexer’s Open banking API in 2026 ! Schedule your free demo and get started with Finexer 🙂