Reconciling bank transactions is one of the most repetitive and error-prone tasks in accounting. Whether you’re working with small businesses or larger firms, the process often feels more manual than it should. Accountants across the UK are still spending hours matching records, correcting inconsistencies, and trying to stay ahead of compliance requirements.

The problems firms face every day:

- Time lost manually comparing transactions with bank statements

- Delayed or missing bank data from clients

- Multi-currency records that don’t balance

- Compliance pressure, especially around Making Tax Digital (MTD)

- Lack of clear audit trails when it matters most

These challenges don’t just slow you down. They increase the risk of inaccurate reporting, missed deadlines, and added back-and-forth with clients.

This blog focuses on bank reconciliation software that helps firms reduce manual effort, stay compliant, and work more confidently with real-time financial data. Every tool listed here has been reviewed based on what actually matters to UK accounting practices.

What Makes a Good Bank Reconciliation Software?

Not every solution that claims to help with reconciliation is built for real accounting work. UK firms need software that is reliable, fast to use, and able to handle a wide range of clients and transactions.

Here are the six key factors we used to evaluate each bank reconciliation software in this guide.

1. Automation Level

Manually matching transactions takes time and increases the chance of error. Good bank reconciliation software should:

- Automatically import and match transactions

- Use rules to handle repeating entries

- Highlight anything that doesn’t match for easy review

2. Real-Time Bank Feeds

Up-to-date bank data helps you work faster and spot problems early. The best software:

- Connects to UK banks directly

- Updates transactions daily or in real time

- Reduces the need to upload bank statements manually

3. Multi-Currency Support

If your clients operate across borders, you need software that handles more than just GBP. Useful features include:

- Automatic currency conversion

- Reconciliation of foreign transactions

- Clear breakdowns by currency

4. UK Tax Compliance (MTD)

Making Tax Digital (MTD) is now a legal requirement for VAT-registered businesses in the UK. Your software must:

- Be compatible with MTD rules

- Connect to HMRC systems or integrate with MTD-compliant platforms

- Keep records in a format ready for digital submission

5. Reporting and Audit Trail

Clean reports and detailed histories save time during reviews or audits. Look for software that offers:

- Downloadable reports for reconciled and unreconciled transactions

- A full log of changes and matched entries

- Filters and summaries to make data easier to review

6. Learning Curve and User Experience

Accountants are busy. Software should be easy to learn and quick to navigate. A good user experience includes:

- Clear menus and labels

- Helpful prompts and tooltips

- No long setup or confusing dashboards

7 Best Bank Reconciliation Software for UK Accounting Firms

1. Xero

Overview:

Xero is a cloud-based accounting platform widely adopted by UK accounting firms for its comprehensive features and user-friendly interface. It offers robust bank reconciliation capabilities, facilitating efficient financial management.

Best for:

Small to medium-sized UK accounting firms seeking a comprehensive, cloud-based accounting solution with strong bank reconciliation features.

Features:

- Connects directly with over 21,000 banks globally, including major UK banks, to automatically import transactions

- Suggests matches between imported bank transactions and existing accounting records, reducing manual work

- Recognised by HMRC and compliant with Making Tax Digital (MTD) for VAT submissions

- Supports multi-currency transactions with automatic exchange rate updates

- Offers a wide range of financial reports including profit and loss, balance sheet, and audit trail exports

Pros:

- Intuitive dashboard with a clear view of financial activity

- Connects with over 800 third-party apps, including CRMs, payment gateways, and payroll services

- Regular updates ensure the platform stays aligned with UK tax requirements

Cons:

- Subscription costs are higher than some alternatives, especially for multi-currency support

- Customer support can be slow to respond at peak times

Integrations:

- Hubdoc: Automates data capture by fetching bills and receipts, which are then matched with transactions in Xero.

- Syft: Provides advanced financial reporting and analytics to enhance decision-making.

- Planday: Simplifies staff scheduling and integrates payroll data directly into Xero.

Xero integrates with a large number of tools used by accounting firms and small businesses — including payment processors like PayPal and Stripe, CRM platforms, payroll systems, and inventory apps.

Pricing:

- Starter: £12/month – best for sole traders or freelancers

- Standard: £26/month – suitable for most small businesses

- Premium: £33/month – includes multi-currency support

Bank reconciliation tools are included in all plans, though multi-currency support requires the Premium tier., and £33 per month for the Premium plan. Multi-currency support is available in the Premium plan.

📚 Get Paid Faster with XERO + Finexer

2. QuickBooks Online

Overview:

QuickBooks Online is one of the most widely used accounting platforms in the UK, trusted by small and medium-sized businesses as well as accounting professionals. It offers built-in bank reconciliation features, HMRC-recognised MTD tools, and a scalable interface that supports everything from invoicing to payroll.

Best for:

Accounting firms and small businesses in the UK looking for reliable, HMRC-compliant bank reconciliation software that scales with business needs.

Features:

- Automatically imports transactions from most UK banks via Open Banking

- Recommends and auto-matches transactions with existing records based on amount, date, and payment reference

- Recognised by HMRC and fully compliant with Making Tax Digital for VAT submissions

- Multi-currency support for international clients and suppliers (available on Essentials and Plus plans)

- Offers bank reconciliation reports, account history, VAT summaries, and detailed audit trails

- Includes mobile app access to reconciliation tools for managing transactions on the go

Pros:

- Designed for ease of use with minimal onboarding needed

- Cloud-based with mobile-friendly access

- Includes project tracking, bill payments, and payroll integration in higher plans

- Wide range of integrations suitable for ecommerce, inventory, payments, and CRM systems

Cons:

- Multi-currency support and key reconciliation features only available in Essentials and above

- Report customisation is limited compared to some alternatives

- Some users report periodic changes to interface without notice, which may cause confusion for existing users

Integrations:

- Amazon Business: Syncs purchase data, allowing for streamlined expense tracking and management.

- Shopify: Connects e-commerce sales data directly into QuickBooks for accurate financial reporting.

- Mailchimp: Integrates marketing campaigns with customer data to analyse ROI effectively.

QuickBooks integrates with PayPal, Shopify, Stripe, Amazon, Square, and many other apps for ecommerce, time tracking, expense management, and CRM. Also connects with UK banks like Barclays, HSBC, NatWest, Lloyds, and more.

Pricing:

- Simple Start: £12/month – covers basic VAT returns, invoicing, and expenses

- Essentials: £20/month – adds multi-currency, bill tracking, and more users

- Plus: £30/month – includes inventory and project tracking features

Bank reconciliation and Open Banking feeds are included from the base plan, but most accounting firms will benefit from starting at the Essentials tier. plans.

3. Sage Business Cloud Accounting

Overview:

Sage Business Cloud Accounting is tailored for UK businesses, offering a range of accounting features, including efficient bank reconciliation tools. It’s designed to support small to medium-sized firms in managing their finances effectively.

Best For:

Small to medium-sized UK accounting firms seeking a reliable accounting solution with strong bank reconciliation features.

Features:

- Automated Bank Feeds: Connects with major UK banks to import transactions automatically.

- Transaction Matching: Facilitates easy matching of bank transactions with accounting entries.

- MTD Compliance: Ensures compliance with Making Tax Digital regulations.

- Comprehensive Reporting: Provides detailed financial reports and audit trails.

- Cloud Accessibility: Access your accounts from anywhere with an internet connection.

Pros:

- Specifically designed to meet UK accounting standards.

- User-friendly interface with straightforward navigation.

- Affordable pricing plans suitable for small businesses.

Cons:

- Limited integration options compared to some competitors.

- Advanced features may be lacking for larger firms with complex needs.

Integrations:

- AutoEntry

Captures data from receipts, invoices, and bank statements, then pushes it into Sage automatically — saving time on manual entry. - Syft Analytics

Offers enhanced financial reporting, dashboards, and forecasting features by syncing real-time data from Sage Accounting. - Capitalise

Helps accounting firms and SMEs find funding options, manage credit, and support clients with business finance — integrated directly into Sage.

Pricing:

Sage Business Cloud Accounting offers two main pricing tiers designed for small and growing businesses in the UK:

- Start – £14/month

Suitable for sole traders or very small businesses. Includes basic invoicing, expense tracking, and bank reconciliation. - Standard – £28/month

Best for small to mid-sized businesses. Includes everything in Start, plus quotes and estimates, cash flow forecasts, advanced reporting, and full compliance with Making Tax Digital (MTD).

Both plans include cloud access, free onboarding support, and integration with HMRC for VAT submissions. Pricing is exclusive of VAT and billed monthly. A 30-day free trial is available without requiring payment details.

4. Zoho Books

Overview:

Zoho Books is a cloud-based accounting tool that provides everything from invoicing and expense tracking to built-in bank reconciliation software features. It’s tailored to support small to medium-sized businesses, including those in the UK looking for MTD-compliant solutions.

Best for:

UK firms that need affordable, all-in-one accounting and bank reconciliation software with solid automation and compliance features.

Features:

- Connects with UK banks to import transactions automatically via Open Banking

- Matches entries with invoices, expenses, or manual adjustments

- MTD-compliant and listed on HMRC’s approved software page

- Multi-currency support with automatic exchange rates

- Offers reconciliation history, downloadable reports, and full audit trail exports

Pros:

- Easy to use, even for firms transitioning from spreadsheets

- Affordable pricing plans, including a free tier for businesses under £35,000 revenue

- Strong integrations with the Zoho ecosystem and third-party tools

Cons:

- Some features (like advanced automation or workflow rules) may require a learning curve

- Reporting is more limited than enterprise-focused platforms

Integrations:

- Dext: Facilitates the capture and processing of receipts and invoices, pushing data into Zoho Books.

- KeyPay: Automates payroll processing and syncs payroll data with Zoho Books for accurate accounting

Works well with Zoho’s CRM, Projects, Inventory, as well as external tools like Stripe, Razorpay, PayPal, Slack, and Google Workspace.

Pricing:

- Free Plan: For UK businesses with under £35,000 in annual revenue

- Standard: £12/month (billed annually)

- Professional: £24/month

- Premium: £36/month

Bank reconciliation is available in all paid plans, with MTD filing included from Standard and up.

5. FreeAgent

Overview:

FreeAgent is a UK-based cloud accounting tool designed specifically for small businesses, freelancers, and the accountants who work with them. It includes easy-to-use bank reconciliation software that simplifies tracking client transactions and staying VAT compliant.

Best for:

Freelancers, contractors, and small UK firms that want simple, HMRC-recognised bank reconciliation software built around the needs of local businesses.

Features:

- Direct bank feed connections with most UK banks via Open Banking

- Automatically matches bank transactions with invoices, expenses, and payments

- MTD-compliant for VAT filing, with direct submission to HMRC

- Supports multi-currency accounts and international invoicing

- Provides reconciliation reports, VAT summaries, and full transaction history

Pros:

- Built for the UK market with a strong focus on tax and banking rules

- Simple interface and onboarding process — ideal for non-accountants

- Free if your business uses NatWest, RBS, or Ulster Bank for banking

Cons:

- Reporting is more limited than other software aimed at larger practices

- Fewer integration options compared to platforms like Xero or QuickBooks

- Not ideal for firms needing in-depth customisation or multi-user workflows

Integrations:

- Taxfiler: Imports trial balance information to assist in preparing statutory accounts and tax returns.

- Receipt Bank: Simplifies expense management by allowing users to upload receipts, which are then processed into accounting data.

FreeAgent connects with PayPal, Stripe, HMRC, and a number of time-tracking, CRM, and productivity apps commonly used by small business owners.

Pricing:

- £29/month + VAT — includes all core features

- First 6 months discounted at £14.50/month + VAT

- Free for eligible users with business current accounts at NatWest, RBS, or Ulster Bank

All bank reconciliation software features are included in the standard plan.

6. ClearBooks

Overview:

ClearBooks is a UK-based accounting software platform built for small businesses and accountants. It offers built-in bank reconciliation tools and is designed to meet the specific needs of UK tax and reporting standards.

Best for:

UK small businesses and accounting firms that want straightforward accounting software with strong local compliance features.

Features:

- Automatic bank feeds from UK banks through Open Banking

- Easy transaction matching and reconciliation summaries

- Multi-currency invoicing and account tracking

- MTD-compliant and HMRC-recognised for VAT submissions

- Offers reports for reconciled accounts, VAT, and profit and loss

Pros:

- Built specifically for UK compliance and workflows

- Simple dashboard that’s easy to navigate

- Strong support for small firms and non-accountants

Cons:

- Limited integrations compared to larger platforms

- Some advanced features only available on higher plans

- May not suit firms with more complex client needs

Integrations:

- Dext: Enables quick import of scanned invoices and receipts, reducing manual data entry.

- Stripe: Allows businesses to accept card payments and keeps track of income within ClearBooks

ClearBooks integrates with HMRC, PayPal, and a limited number of third-party tools focused on payments and banking.

Pricing:

- Starter: £13/month — basic features, including bank feeds

- Small: £28/month — adds MTD filing and advanced reports

- Large: £34/month — includes multi-currency and payroll integration

Most reconciliation features are available from the Small plan upwards.

7. KashFlow

Overview:

KashFlow is a UK-focused accounting software built for small businesses and accounting professionals. It includes tools for automated bank reconciliation, VAT submissions, and day-to-day bookkeeping, all with UK compliance in mind.

Best for:

Small businesses and accountants looking for affordable, UK-ready accounting software with simple reconciliation features.

Features:

- Connects to UK banks for automatic transaction imports

- Matches bank transactions with invoices, expenses, and payments

- Multi-currency support for international transactions

- MTD-compliant with direct VAT filing to HMRC

- Downloadable reconciliation and audit-ready reports

Pros:

- Designed specifically for UK businesses and tax rules

- Interface is clean and beginner-friendly

- No need to install anything — runs fully in the cloud

Cons:

- Fewer integrations than some competitors

- Mobile functionality is limited

- Some users report occasional delays in bank feed updates

Integrations:

- Commusoft: Integrates field service management with KashFlow, streamlining invoicing and customer management.

- Staffology: Automates payroll journal entries by connecting payroll data with KashFlow accounts.

KashFlow integrates with HMRC, PayPal, and basic payroll tools. It also supports a small range of business software, including CRM and stock systems.

Pricing:

- Starter: £10.50/month — ideal for sole traders

- Business: £22/month — includes full VAT and bank reconciliation features

- Business + Payroll: £29/month — adds payroll functionality

Bank reconciliation is available from the Business plan and above.

How Finexer Helps Sysynkt Deliver Accurate Bank Data for Finance Automation

Sysynkt is a cloud-based automation platform built to extend the functionality of Infor SunSystems. It brings together key finance operations like banking, procurement, employee expenses, and invoice management into a single portal. For Sysynkt’s clients, having access to up-to-date and accurate bank data is essential for automating bank reconciliations and improving financial workflows.

To power this, Sysynkt partnered with Finexer, choosing them for their strong focus on business needs and their ability to deliver clean, real-time bank data that fits complex accounting environments. Unlike other providers that focus on consumer tools, Finexer works closely with B2B platforms to ensure the data supports reconciliation, audit, and decision-making across teams.

Key Benefits Sysynkt Gains from Finexer:

- Direct access to bank data from 99 percent of UK banks

- Real-time transaction feeds that support accurate reconciliation inside SunSystems

- Clean and structured data that reduces manual work for finance teams

- Support for high-volume enterprise users and complex business accounts

- A collaborative integration approach tailored to Sysynkt’s financial automation goals

- Reliable, FCA-compliant infrastructure to meet UK regulatory standards

“We realised we had a lot in common with Finexer in how we approach services for our customers. This made it a highly collaborative partnership from the start.”

— Penny Phillips, Chief Commercial Officer, Sysynkt

With Finexer providing the foundation for accurate bank data, Sysynkt is able to offer a smarter and more responsive automation experience to businesses of all sizes.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

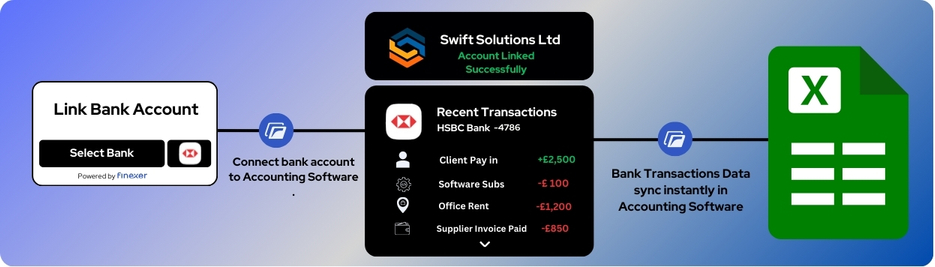

Why Accounting Firms Choose Finexer

Accounting firms across the UK are under pressure to work faster, stay compliant, and reduce manual processes around bank reconciliation and payments. Finexer helps them do just that by providing bank connectivity and payment infrastructure designed for business needs — not repurposed from consumer tools.

Unlike providers that focus on volume and standardisation, Finexer works closely with firms to deliver precise, reliable, and fully compliant bank data and payment solutions that fit into existing workflows. Whether it’s helping a firm automate reconciliations or support client onboarding, Finexer focuses on what matters most to the practice.

What Sets Finexer Apart:

- Access to 99% of UK banks, including direct feeds for real-time transaction syncing

- FCA-authorised platform, built to meet UK regulatory requirements

- Supports reconciliation, payments, and onboarding, all through a single API

- Start Small, Scale Smart pricing model, ideal for smaller and growing firms

- Fast setup and white-label ready, so firms can offer value to clients quickly

- Built for accountants, not just software developers or payment providers

With Finexer, accounting firms get a partner that understands their operational challenges and helps them turn reconciliation and banking tasks into efficient, integrated processes.

What is bank reconciliation software?

It matches your accounts with bank transactions, helping UK firms reduce errors, save time, and meet MTD compliance.

Which bank reconciliation software is MTD-compliant?

Xero, QuickBooks, Sage, Zoho Books, and FreeAgent are all HMRC-recognised and support MTD VAT submissions.

Is bank reconciliation software suitable for small UK firms?

Yes. Tools like FreeAgent, Zoho Books, and KashFlow are ideal for freelancers and small firms needing simple, affordable solutions.

Do I need multi-currency support in my software?

If you or your clients deal internationally, choose software like Xero or QuickBooks that supports multi-currency reconciliation.

Is there free bank reconciliation software for UK businesses?

Zoho Books offers a free plan for UK firms earning under £35,000. FreeAgent is also free with select UK business bank accounts.

Reduce time on manual reconciliation tasks with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂