Sorting financial transactions into the right categories is a time-consuming and frustrating task. Many businesses and financial teams still rely on manual processes, which often lead to mistakes, inconsistencies, and wasted effort. When transactions are miscategorised, financial reports become unreliable, making it harder to track spending, plan budgets, or analyse cash flow.

As businesses grow, handling large amounts of transaction data manually becomes nearly impossible. Banks, fintech companies, and accounting software providers are now turning to AI-powered transaction categorisation to solve these problems.

We will guide you through:

What Is Transaction Categorisation?

Transaction Categorisation is the process of grouping financial transactions into specific categories like “Rent,” “Utilities,” or “Marketing Expenses.” It helps businesses, banks, and individuals track spending, manage budgets, and generate financial reports. Without proper categorisation, financial records become disorganised, making it harder to analyse cash flow and prepare for taxes.

📚 Open Banking Real-Time Transaction Data Explained

How Transactions Are Categorised Traditionally

- Manual Sorting: Transactions are reviewed and assigned to categories manually.

- Basic Rules: Some systems use keyword matching (e.g., transactions with “Uber” go under “Transport”).

- Bank Codes: Banks assign broad transaction types, but these often lack detail.

These methods are slow and prone to errors. They don’t adapt well to changing spending patterns or new merchants.

Challenges of Manual and Rule-Based Categorisation

Handling New Merchants: New vendors often get labeled as “Uncategorised” because older systems can’t recognise them.

- Time-Consuming: Sorting transactions manually takes hours, especially for businesses with high transaction volumes.

- Inconsistencies: The same transaction can end up in different categories, creating reporting errors.

- Inaccuracy: Simple rules fail when transactions don’t match expected keywords.

- Scalability Issues: As transaction volumes grow, manual sorting becomes unmanageable.

How AI Improves Transaction Categorisation

Traditional Transaction Categorisation relies on manual processes or rule-based systems, both of which struggle with accuracy and efficiency. AI-driven Transaction Categorisation eliminates these issues by analysing spending patterns, learning from past data, and categorising transactions automatically with minimal human input.

AI Adoption in Finance

AI adoption in finance has grown significantly, rising from 45% in 2022 to an expected 85% by 2025. Additionally, 60% of companies are now integrating AI across multiple business areas, enhancing efficiency and decision-making.

How AI-Powered Transaction Categorisation Works

- Pattern Recognition

- AI scans thousands of transactions to identify common spending behaviours.

- It detects merchant names, transaction types, and recurring payments.

- Context-Based Classification

- AI doesn’t just rely on keywords. It looks at multiple factors like transaction history, amount, and category trends.

- A payment to “Apple” could be a business expense (a laptop) or a personal purchase (a music subscription), and AI can tell the difference.

- Self-Learning and Adaptation

- AI continuously improves by learning from new data.

- If a new vendor appears, AI analyses past categorisation patterns to assign the correct category without manual intervention.

- Real-Time Processing

- AI categorises transactions as they happen, providing instant financial insights.

- Businesses and individuals no longer need to manually adjust or correct transaction records.

Advantages of AI in Transaction Categorisation

- Higher Accuracy – AI reduces errors by learning from historical transaction data.

- Faster Processing – AI categorises transactions instantly, removing the need for manual review.

- Consistency – The same transaction is always categorised the same way, preventing misclassifications.

- Scalability – Works efficiently regardless of transaction volume.

- Adapts to New Merchants – AI automatically recognises and categorises transactions from new vendors.

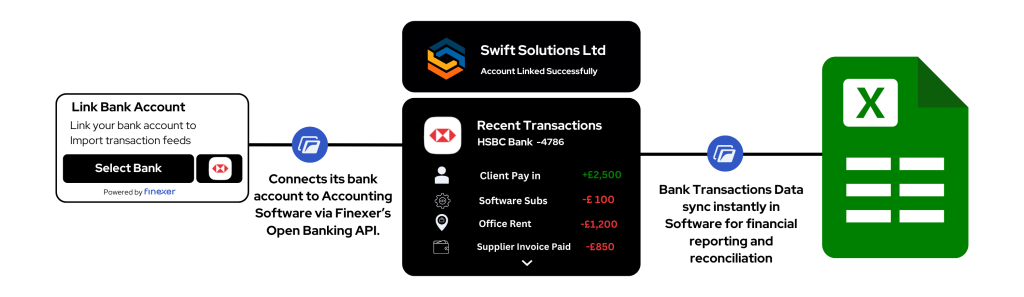

How Open Banking Improves Transaction Categorisation

Open Banking allows banks and authorised third-party providers to securely share financial data through standardised APIs. This capability significantly improves Transaction Categorisation by providing accurate, detailed, and timely transaction data directly from banking systems.

1. Accurate and Detailed Transaction Data

- Open Banking APIs deliver transaction details directly from banks, including merchant names, transaction descriptions, payment locations, and precise timestamps.

- This comprehensive data eliminates ambiguities common in traditional bank statements, improving categorisation accuracy.

Example:

Instead of vague descriptions like “Card Payment 12345,” Open Banking might clearly show “Starbucks London,” allowing the transaction to be accurately categorised as “Food & Drink.”

2. Consistent and Standardised Data Formats

- Previously, different banks used various data formats, complicating categorisation. Open Banking standardises data across financial institutions, enabling consistent categorisation regardless of the customer’s bank.

- Standardisation helps AI systems quickly understand and classify transactions without needing constant manual updates.

3. Instant Access to Real-Time Data

- Open Banking enables immediate transaction updates, meaning categorisation happens as soon as a transaction occurs.

- Real-time data ensures financial reports and budgeting tools reflect current spending, giving businesses and consumers immediate insights.

4. Enhanced Recognition of Recurring Transactions

- Open Banking clearly identifies recurring payments, direct debits, and subscriptions, making categorisation straightforward and reliable.

- Businesses benefit by easily tracking regular expenses, such as software subscriptions, rent, or utilities.

How AI and Open Banking Work Together

AI-based categorisation needs high-quality data to function effectively. Open Banking provides this data in a structured, timely manner, allowing AI models to accurately identify spending patterns and assign categories. This combination significantly reduces the need for human involvement and manual corrections.

Practical Example:

With Open Banking, a finance app instantly recognises a new subscription service as a recurring transaction. The AI immediately categorises it under “Subscriptions” without manual input, improving reporting accuracy from day one.

📚 Customer Onboarding Using Open Banking

Benefits of Open Banking in Transaction Categorisation

For Businesses:

- Clearer visibility of spending.

- Improved budgeting accuracy.

- Simplified financial reporting and auditing.

For Consumers:

- Better financial planning with accurate spending insights.

- Immediate updates on spending habits through personal finance apps.

- Less manual effort in tracking personal budgets.

In summary, Open Banking greatly strengthens Transaction Categorisation by providing richer, standardised, and timely financial data, allowing AI to categorise transactions more effectively than ever before.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

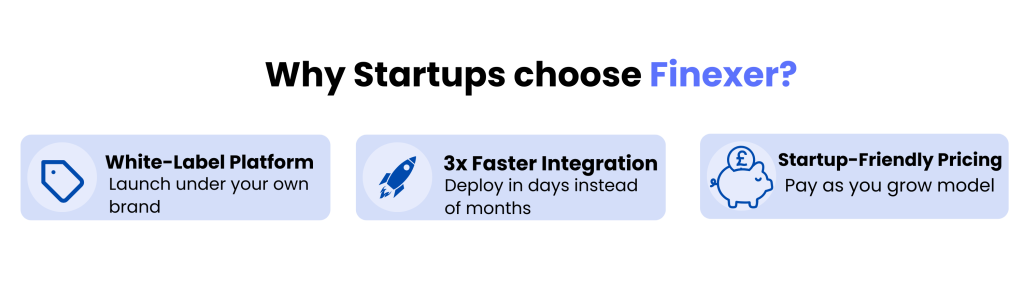

Why Choose Finexer for Transaction Categorisation

Finexer simplifies Transaction Categorisation by providing clear, accurate, and real-time data from multiple banks through a single, easy-to-use platform. Built on secure Open Banking technology, Finexer helps businesses quickly understand financial transactions without complexity.

What Finexer Offers:

- Clear Transaction Categories:

Easily group and identify the purpose of each transaction, making spending patterns simple to see and manage. - Real-Time Financial Data:

Get immediate access to detailed transaction information and account balances, helping you make faster, smarter financial decisions. - Easy Customisation:

Finexer’s white-label solution allows your brand to remain front and center. Customise consent screens to match your branding, creating a seamless user experience. - Automatic Updates & Notifications:

Receive instant notifications through webhooks whenever transactions occur or account information changes. This keeps your financial data consistently up-to-date without manual effort.

Additional Advantages of Finexer:

- Instant Customer Verification:

Verify customer identities quickly through their bank account data, speeding up onboarding while staying compliant with KYC and AML regulations. - Better Financial Insights:

Finexer’s categorisation helps you easily understand client spending, making it simpler to offer tailored financial advice and improve credit decisions. - Developer-Friendly Integration:

Finexer provides flexible APIs that are simple to integrate into your existing systems, reducing technical effort and speeding up deployment.

How accurate is AI-powered transaction categorisation compared to manual methods?

AI-powered categorisation typically achieves over 95% accuracy, significantly surpassing manual and rule-based methods, which often hover around 60-75%. AI continuously learns from new data, enhancing accuracy over time.

How does AI handle new or unknown vendors?

When encountering new vendors, AI analyses past transaction patterns and similar spending behaviors to automatically assign accurate categories, eliminating the common “uncategorised” issue.

Can AI categorise transactions instantly as they occur?

Yes. AI-driven categorisation processes transactions in real-time, instantly assigning them accurate categories. This helps businesses maintain current and precise financial reporting and budgeting.

Is AI transaction categorisation compatible with all UK banks?

hrough Open Banking standards, Finexer’s AI-powered categorisation connects seamlessly with over 99% of UK banks, ensuring comprehensive coverage and scalability for your business.

How quickly can I integrate Finexer’s transaction categorisation into my business?

Integration with Finexer is swift and straightforward. Our flexible, developer-friendly APIs allow most businesses to integrate within days, 3x faster than the Market ensuring minimal disruption to your existing workflows and quick realisation of benefits.

Categorising Transactional data with Finexer is easier than ever; book a demo now and get 14 days free Trial!