As more transactions shift online, businesses face growing challenges in offering secure, cost-effective, and flexible payment options to their customers. The demand for digital payments is at an all-time high, yet many businesses struggle with rising transaction fees, fraud risks, and regulatory compliance.

This is where Payment Service Providers (PSPs) play a crucial role. By acting as intermediaries between businesses, customers, and financial institutions, PSPs simplify digital transactions, allowing businesses to accept payments through credit and debit cards, digital wallets, bank transfers, and real-time payment networks. They also ensure that transactions are processed securely while complying with evolving financial regulations.

This guide will explore what Payment Service Providers do, how they work, and the key benefits they offer in 2025.

we will guide you through:

UK Digital Payments Growth

The UK’s digital payments market is expected to reach USD 547.70 billion in 2025, with a compound annual growth rate of 11.60% projected to increase the market size to USD 948.12 billion by 2030.

What is a Payment Service Provider (PSP)

A Payment Service Provider (PSP) is a third-party company that allows businesses to accept various electronic payment methods by acting as an intermediary between the business, customer, and financial institutions. PSPs facilitate secure and efficient transactions by providing the infrastructure and services needed to accept payments.

Multiple Payment Options: PSPs allow businesses to accept payments from a variety of sources, including:

- Credit and debit cards

- Digital wallets (e.g., Apple Pay, Google Pay)

- Bank transfers and Direct Debits

- Real-time payments(e.g. Stripe,Finexer)

In today’s market, where convenience and security are top priorities, having a PSP is essential for any business looking to provide a high-quality, frictionless payment experience.

📚 Learn about bank transfer modes

The Core Functions of a Payment Service Provider

Examining a PSP’s core functions and how it facilitates the payment process helps one fully understand its value.

Merchant Account Provisioning

A merchant account is a special type of bank account that allows businesses to accept payments. PSPs provide this account, serving as a temporary holding place for funds until they are settled into the business’s main bank account.

Payment Gateway Integration

A payment gateway is a secure online platform that enables the authorisation of payments for online transactions. It encrypts sensitive information, such as credit card details, making it safe for customers to pay online. Many PSPs provide both a merchant account and payment gateway, streamlining the setup process for businesses.

Transaction Processing

PSPs handle the entire transaction process, acting as a bridge between the customer’s bank, the card network, and the merchant’s account. Here’s a simplified look at how this process works:

- Payment Initiation: The customer enters payment information and initiates a transaction.

- Data Transmission: The PSP securely transmits the payment data to an acquiring bank (or payment processor).

- Authorisation Request: The acquiring bank forwards the request to the card network, which contacts the customer’s issuing bank.

- Approval/Denial: The issuing bank verifies the payment and approves or denies it based on available funds and security checks.

- Settlement: Once approved, the funds are routed back to the acquiring bank and then to the PSP’s merchant account, which is ready for final transfer to the business’s main account.

This seamless process allows businesses to accept real-time payments while ensuring every transaction’s security and accuracy.

Key Services Offered by Payment Service Providers

PSPs offer more than just basic transaction processing. They provide an array of services that add value to the customer payment experience and help businesses manage payments more effectively.

Security and Compliance Tools

PSPs help businesses remain PCI DSS (Payment Card Industry Data Security Standard) compliant, providing encryption and fraud prevention measures to protect both the business and its customers from security breaches. Most PSPs also offer advanced fraud detection tools, such as:

- Tokenisation: Replaces sensitive card data with a unique identifier (token), preventing exposure of card details during transactions.

- 3D Secure Authentication: Adds an extra layer of protection for online payments by requiring additional verification from the customer’s bank.

Reporting and Analytics

To help businesses make informed decisions, PSPs offer detailed transaction reports and analytics, often available in real-time. These reports can provide insights into customer behaviour, identify payment trends, and assist in financial reconciliation.

Recurring Billing and Subscription Management

For businesses with subscription-based models, PSPs simplify recurring billing, automatically processing scheduled payments without requiring customers to re-enter information. This is invaluable for businesses looking to maintain steady cash flow and reduce churn in subscription-based offerings.

The Growing Importance of PSPs in 2025

The global digital payments market is projected to reach $16.59 trillion by 2028, growing at a CAGR of 9.25% from 2024. This growth is driven by the increasing adoption of digital wallets, which now account for 50% of global eCommerce spending and 30% of point-of-sale transactions.(source)

PSPs play a critical role in this ecosystem by enabling businesses to keep up with consumer preferences. For instance, 75% of consumers prefer using their preferred payment method when shopping, and 13% abandon their carts if their desired option isn’t available. By integrating multiple payment methods such as credit cards, digital wallets, and Buy Now, Pay Later (BNPL) options, PSPs help businesses reduce cart abandonment and boost sales.

📚 Top 7 Open Banking Trends for 2025

Benefits of Using a Payment Service Provider

Using a PSP provides numerous advantages, particularly for small and medium-sized businesses looking to simplify their payment processes without compromising on security or flexibility.

Cost Efficiency

By outsourcing payment processing to a PSP, businesses save on the costs of building and maintaining an in-house payment system. PSPs often offer competitive rates due to the high volume of transactions they process across their clients.

Comprehensive Payment Solutions

PSPs offer a one-stop shop for payment processing, from card and digital wallet payments to Direct Debit and bank transfers. This allows businesses to provide their customers with a wide range of payment options, increasing convenience and boosting sales potential.

Reduced Complexity

Setting up a payment system in-house can be complex, requiring compliance with industry standards, securing customer data, and managing financial settlements. PSPs take on these responsibilities, freeing up business resources to focus on growth and customer service.

Enhanced Customer Trust and Security

With industry-standard compliance and security features, PSPs provide customers with a trustworthy platform to conduct transactions. Features like fraud detection and data encryption increase customer confidence, leading to more completed transactions and fewer abandoned carts.

Scalability

PSPs are designed to scale with business needs, meaning that as your transaction volume grows, your PSP can continue to support you without the need for major changes to your payment infrastructure.

Factors to Consider When Choosing a Payment Service Provider

Selecting the right PSP is about more than just costs; it’s about aligning with your business goals and meeting customer expectations.

1.Fee Structure

Compare transaction fees, setup costs, and any hidden charges. Some PSPs offer flat-rate pricing, while others have variable rates based on volume.

2.Supported Payment Methods

Ensure the PSP can handle the payment types most relevant to your customers, from cards to local payment solutions.

3.Integration Capabilities

Look for compatibility with your e-commerce platform, POS system, or accounting software to avoid complex development work.

4.Reliability and Reputation

Investigate a PSP’s track record for uptime, security measures, and user reviews.

5.Customer Support

Payment issues can arise at any time, so 24/7 support is often a must-have.

📚 Compare Top 5 Open Banking Providers in the UK

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How Finexer Can Help

Finexer offers a suite of advanced solutions tailored to meet the unique needs of today’s businesses. With innovative tools and dedicated support, Finexer helps businesses streamline payments and build trust with their customers.

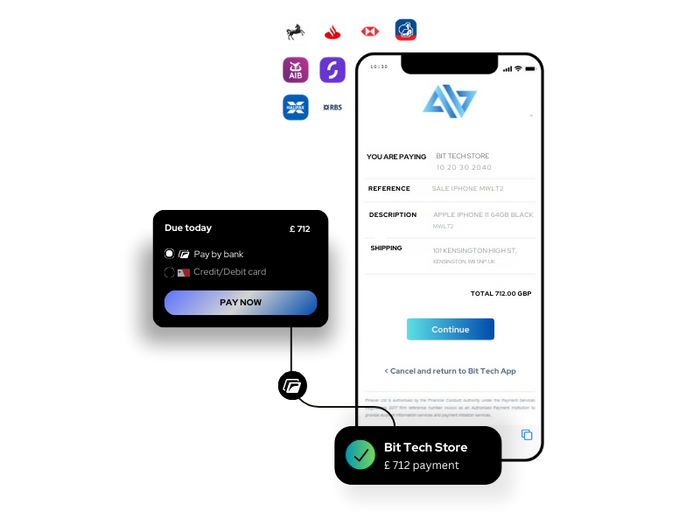

PayByBank for Lower Fees and Real-Time Payments

Finexer’s PayByBank service bypasses traditional card networks, enabling direct bank-to-bank payments that are not only cost-effective but also instantaneous. For businesses seeking faster cash flow and lower transaction fees, PayByBank provides a powerful alternative to credit card processing.

Scalable and Fast Deployment

Unlike many PSPs, Finexer’s solutions deploy up to three times faster than traditional providers, allowing businesses to start accepting payments quickly and with minimal technical hassle. Finexer’s payment solutions are also built to scale, making them ideal for growing businesses.

Customer Support and Industry Expertise

With dedicated support and in-depth knowledge of the payments industry, Finexer’s team guides businesses through setup, integration, and ongoing management. This hands-on approach means businesses have a reliable partner as they navigate their payment needs.

Conclusion

Payment Service Providers have become indispensable for businesses aiming to provide seamless, secure, and diverse payment options. By partnering with an experienced provider like Finexer, businesses can leverage powerful tools like PayByBank and advanced verification services to reduce costs, improve cash flow, and build trust with customers. To learn more about how Finexer can support your payment processing needs, get in touch today and explore the possibilities of PSPs tailored to your business growth.

How do Payment Service Providers help businesses scale?

A PSP allows businesses to accept payments globally without needing direct agreements with banks. This helps companies:

->Expand internationally by offering local payment options.

->Reduce cart abandonment by supporting customer-preferred payment methods.

->Process high transaction volumes efficiently.

What is the difference between a PSP and a payment processor?

A payment processor is responsible for moving funds between banks, while a PSP offers a full suite of payment solutions including transaction processing, fraud protection, payment gateways, and settlement services.

What is the difference between PSP and payment gateway in the UK?

In the UK payment industry, a PSP offers a full range of merchant services, including settlement and compliance, while a payment gateway only authorises and transmits transactions.

How do businesses choose the best Payment Service Provider?

Consider these factors:

->Transaction fees and cost structure.

->Supported payment methods (cards, BNPL, wallets, etc.).

->Integration options (e-commerce platforms, POS systems).

->Fraud prevention and security features.

->Regulatory compliance (PCI DSS, FCA regulations).

How does Finexer help businesses with Payment Service Provider solutions?

Finexer provides:

->Access to 99% of UK banks for direct payments.

->Lower transaction fees through PayByBank services.

->3x Fast deployment of secure payment solutions.

->24/7 support for businesses managing transactions.

Looking for an Affordable Payment service provider? We are here to help 🙂 Book a demo Now!

![What Are Payment Service Providers? A 2025 Guide for Businesses 1 Guide to Payment Service Providers[PSP's] in 2025](/wp-content/uploads/2024/11/PSP-Guide.png)