Onboarding for accounting firms should be a smooth process. A business needs financial services, your firm is ready to help, and everything should move forward seamlessly. But in reality, many firms struggle with lengthy verification steps, manual document reviews, and compliance hurdles that slow down the process.

Instead of a quick and straightforward start, firms often deal with back-and-forth document requests, delays in identity verification, and clients abandoning the process halfway through. The longer onboarding takes, the higher the chance of losing potential clients.

At the same time, firms must follow strict regulations. KYC (Know Your Customer) and AML (Anti-Money Laundering) laws require careful client verification to prevent fraud and meet legal requirements. This makes onboarding for accounting firms more than just an administrative step—it’s a critical part of running a compliant and secure business.

Why Does Onboarding for Accounting Firms Take So Long?

Many firms find themselves stuck between security and client convenience:

- They need to verify client identities properly but rely on manual checks that slow things down.

- They must collect multiple documents but risk frustrating clients with long forms and repeated requests.

- They need to follow compliance rules but struggle to balance efficiency with regulatory demands.

As accounting firms look for ways to improve client acquisition and retention, onboarding remains one of the biggest bottlenecks. The challenge isn’t just about signing up clients quickly—it’s about doing so in a way that is both secure and hassle-free.

We will guide you through:

The Challenges in Onboarding for Accounting Firms

Onboarding for accounting firms is more than just signing up a new client—it’s about verifying identities, ensuring compliance, and collecting the right financial details before any services begin. However, many firms still rely on outdated processes that slow everything down.

1. Slow and Manual Processes

For many accounting firms, onboarding still involves manual document collection, data entry, and back-and-forth approvals. This creates unnecessary delays and a frustrating experience for both clients and staff.

- Clients are required to upload multiple documents, such as ID proof, bank statements, and business records.

- Manual verification means staff have to cross-check details, which increases the chance of errors.

- Approval times vary depending on workload, leading to delays that discourage potential clients.

The longer the onboarding process, the more likely clients will hesitate or choose another firm with an easier process.

2. High Drop-Off Rates Due to Lengthy Forms

When clients sign up with an accounting firm, they don’t expect to fill out multiple lengthy forms asking for repetitive information. Unfortunately, many firms still require:

- Extensive personal and business details manually entered by the client.

- Multiple document uploads, which can be time-consuming.

- Additional verification steps before onboarding is complete.

A complicated process increases drop-off rates, meaning potential clients abandon onboarding midway or delay completing it. If the experience feels like too much effort, clients may reconsider working with the firm.

Client Loyalty and Onboarding

88% of clients are more likely to stay loyal if onboarding is smooth and transparent. Conversely, delays or unclear processes lead to client attrition. Source: Journal of Accountancy.

3. Compliance and Regulatory Hurdles

Accounting firms must follow strict KYC and AML regulations to ensure that clients are properly verified before offering financial services. However, compliance requirements can make onboarding more complex.

- Collecting valid identification and financial records takes time.

- Verification errors or missing documents result in delays and extra steps.

- Firms must store and manage sensitive client data securely, increasing administrative overhead.

While compliance is essential, firms need a way to meet these requirements without making onboarding unnecessarily difficult.

4. Risk of Fraud and Data Inconsistencies

Traditional onboarding methods also come with security risks. When firms rely on email submissions and manual document uploads, they expose themselves to:

- Identity fraud, where fake documents or manipulated records are submitted.

- Data mismatches, leading to repeated verification requests.

- Human errors in manual document reviews.

Without a secure, reliable way to verify client details, firms risk onboarding clients who may not meet compliance standards or unknowingly accepting fraudulent applications.

A Faster, Safer Alternative to Traditional Onboarding

Traditional onboarding for accounting firms often involves manual identity verification, multiple document uploads, and repetitive compliance checks. This approach can slow down the process, frustrate potential clients, and increase the risk of errors.

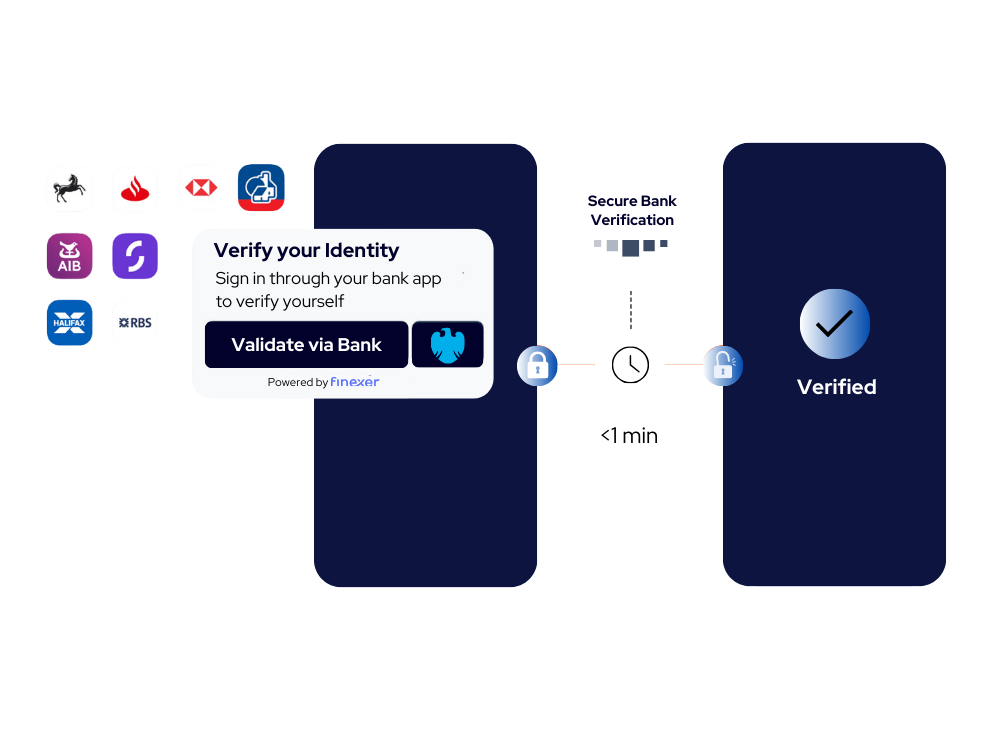

Bank account validation offers a practical solution. It uses real-time financial data to verify a client’s identity, reducing the need for manual checks and multiple document submissions. By allowing clients to securely log in through their bank, firms can quickly obtain key information such as the client’s name and account status.

How Bank Account Validation Works

- Secure Client Login:

Clients choose the “Verify with Bank” option and log in securely through Open Banking protocols. - Instant Data Retrieval:

The system retrieves verified details directly from the client’s bank, such as their full name, account status, and other essential data. - Reduced Manual Processing:

With accurate information provided automatically, firms no longer need to rely on time-consuming manual document reviews. - Compliance Support:

The verified bank data supports the firm’s efforts to meet KYC and AML requirements, thereby reducing the risk of fraud.

Why This Approach Is Effective for Accounting Firms

- Quicker Client Approvals:

The process eliminates the need for multiple document uploads and manual reviews, which means clients are approved faster. - Lower Drop-Off Rates:

A straightforward, automated verification process helps keep potential clients engaged throughout onboarding. - Increased Accuracy and Security:

Using data directly from trusted financial institutions minimizes the chances of errors and reduces the risk of identity fraud. - Less Administrative Burden:

With automated verification, staff can focus on delivering quality services rather than handling tedious compliance checks.

Real-World Example

VirtualSignature-ID (VSID), a UK Government-accredited eSignature and digital identity service provider, needed a partner to support its growing open banking requirements, especially for robust KYC processes. Focused on serving legal and accountancy sectors, VSID sought to integrate compliant software that would simplify digital identity verification and accounting integration.

VSID partnered with Finexer because they required a solution that was flexible and tailored to their business needs. As David Kern, CEO of VSID, explained:

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package. Finexer has proven to be more than a provider—they’re a trusted partner who understands our vision and helps us achieve it.”

This partnership allowed VSID to overcome challenges related to manual identity verification and lengthy KYC processes by adopting Finexer’s compliant open banking technology. Key benefits included:

- Streamlined Compliance: Integration of compliance-ready software that meets KYC and AML standards.

- Improved Accounting Integration: Faster, more reliable transfer of verified data into VSID’s systems.

- Cost and Time Savings: Reduced manual intervention and enhanced workflow efficiency.

VSID’s experience demonstrates that a focused, business-driven approach to open banking can significantly improve digital identity verification, making the onboarding process more secure and efficient for legal and accountancy sector clients.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Accounting Firms Choose Finexer for Onboarding & Compliance

Accounting firms face a constant challenge in verifying client identities quickly and accurately while complying with strict KYC and AML regulations. Finexer addresses these needs by providing a unified solution that integrates several verification methods into one platform. Here are some of the key reasons why accounting firms opt for Finexer for their KYC processes:

Integrated Identity Verification

Finexer combines document scanning, facial recognition, and bank data authentication into a single process. This unified approach means that accounting firms can verify client identities without requiring clients to fill out lengthy forms manually, reducing both errors and fraud risks.

Direct Access to UK Bank Data

With integration covering nearly all UK banks, Finexer provides real-time data verification. This direct connection ensures that the information used for identity verification is current and reliable, minimizing the risk of falsified details.

Faster Onboarding:

By automating many steps of the verification process, Finexer enables accounting firms to complete onboarding up to three times faster than with traditional manual methods. This acceleration means firms can start serving new clients sooner and reduce the chance of losing them during the signup process.

Regulatory Compliance Made Simple:

Finexer’s infrastructure is FCA-authorised, ensuring adherence to GDPR, AML, and KYC regulations. Automated checks not only reduce the risk of non-compliance but also lessen the administrative burden on firms, allowing them to focus on their core services.

Robust Fraud Prevention:

Utilizing multi-layer checks—including facial recognition and bank-level authentication—Finexer effectively reduces the risk of identity fraud and unauthorized access. Matching client data through various means increases confidence in the verification process.

Flexible Pricing and Customisation:

Finexer offers a transparent, pay-as-you-grow pricing model without locking firms into long-term contracts. Additionally, the solution can be customised to reflect a firm’s branding and specific operational needs, making it a practical choice for businesses of all sizes.

By combining real-time data verification with advanced security features, Finexer provides accounting firms with a secure, compliant, and efficient way to handle KYC. This focus on simplicity and accuracy helps firms build trust with their clients and maintain a competitive edge in the industry.

Try Sign in using bank with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂