VAT errors cost UK businesses time and money. Miscategorised transactions lead to incorrect VAT returns, HMRC penalties, and audit complications. Manual categorisation creates bottlenecks during month-end close. Accountants spend hours reviewing bank feeds and assigning categories to hundreds of transactions.

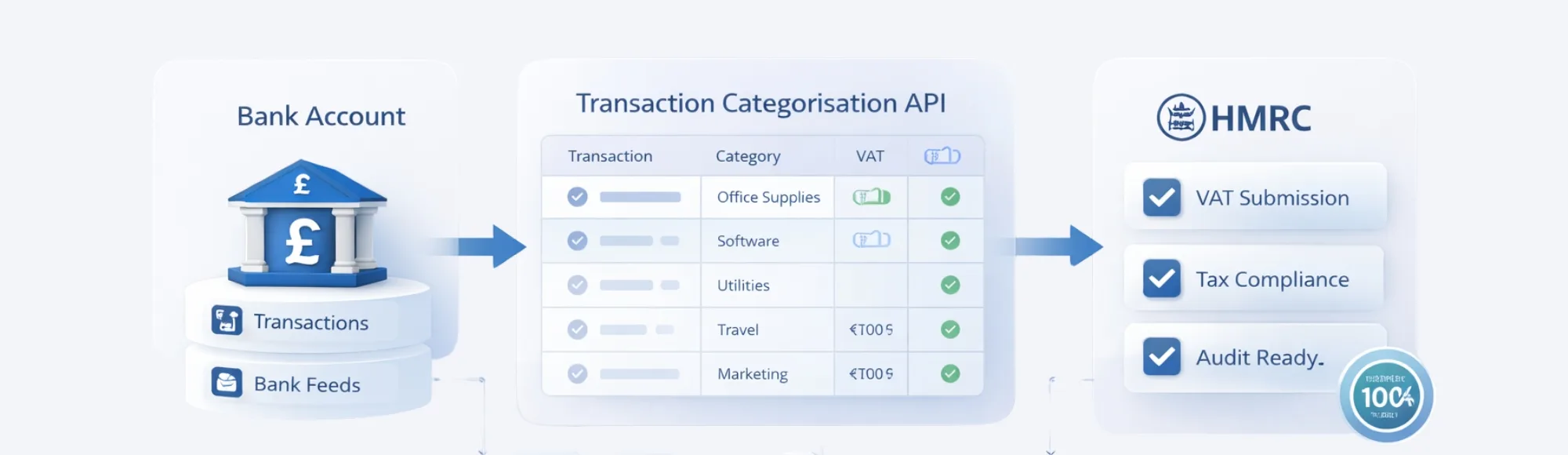

A transaction categorisation API removes this operational burden. Bank transactions are categorised automatically based on merchant data, transaction patterns, and payment context. The categorisation happens at the point of data ingestion, not after manual review.

UK accounting firms, bookkeeping platforms, and financial software providers use this method to reduce errors and speed up reconciliation. Transactions are classified into tax-relevant categories without human intervention.

What Is a Transaction Categorisation API?

A transaction categorisation API analyses bank transaction data and assigns relevant categories based on merchant information, transaction type, and spending patterns. Categories align with accounting standards and VAT requirements used by UK businesses.

The API processes transaction descriptions, merchant identifiers, and payment metadata. Each transaction receives a category label that matches bookkeeping conventions. This allows accounting software to generate reports without manual data entry.

Why Manual Transaction Categorisation Creates VAT Filing Risks

Bank feeds deliver raw transaction data. Descriptions are often incomplete or unclear. A payment to “AMZN MKTP” could be office supplies, software subscriptions, or inventory purchases-each with different VAT treatment.

Accountants review each line item. They interpret vague descriptions. They assign categories based on best judgment. This process introduces errors when transactions are misclassified or when context is missing.

Misclassified expenses affect VAT returns. Office supplies claimed at standard rate when zero-rated items were purchased. Travel expenses categorised as entertainment. Each error compounds during quarterly VAT submissions.

HMRC audits reveal these discrepancies. Corrections trigger additional filings. Interest charges apply to underpaid VAT. The administrative cost of fixing errors exceeds the time saved by manual processing.

How Does Bank Transaction Categorisation Work?

Transaction enrichment APIs connect to bank feeds through Open Banking rails. Raw transaction data is received from UK banks. The API analyses merchant data, transaction codes, and payment references.

Categorisation rules are applied based on merchant identity. A payment to “TESCO STORES” is categorised as groceries or supplies based on business context. A direct debit to “BT GROUP PLC” is identified as telecommunications expense.

The categorised data is returned to accounting software with standardised labels. VAT rates are assigned based on category rules. The transaction is ready for bookkeeping without manual review.

This method is used by UK fintech platforms and accounting automation tools. Transaction enrichment APIs improve categorisation accuracy by adding merchant details and context to raw banking data. Human review is reserved for edge cases, not routine entries.

What Improves When Transaction Categorisation Is Automated?

Month-end close happens faster. Transactions are pre-categorised when they arrive. Accountants review exceptions instead of processing every line item. Reconciliation time reduces significantly.

VAT return accuracy improves. Categories align with HMRC requirements from the start. Expense classifications are consistent across reporting periods. Audit trails are maintained automatically.

Client onboarding accelerates for accounting firms. New clients connect their bank accounts. Historical transactions are categorised in bulk. The bookkeeping backlog is cleared before the first monthly review.

Transaction Categorisation Methods Compared

| Criteria | Manual Categorisation | Transaction Categorisation API |

|---|---|---|

| Processing Time | Hours per month | Seconds per transaction |

| VAT Error Rate | Higher – depends on interpretation | Lower – rule-based consistency |

| Scalability | Limited by staff capacity | Handles high transaction volume |

| Audit Trail | Manual documentation required | Automated with timestamps |

| Setup Time | Non-immediate start | 3–5 weeks implementation support |

How UK Accounting Firms Use Transaction Categorisation APIs

Bookkeeping platforms integrate the API into their bank feed processing. Clients authorise Open Banking access to their business accounts. Transactions sync automatically and arrive pre-categorised.

Accountants review categorised transactions in their workflow. Exceptions are flagged for manual classification. Standard transactions flow directly to financial reports. VAT summaries generated without additional data entry.

This approach is used by UK firms managing multiple SME clients. Each client’s transactions are categorised according to their business type and VAT registration status. The system adapts to industry-specific expense patterns.

Does This Method Meet UK Accounting Standards?

Transaction categorisation follows UK GAAP principles for expense classification. Categories map to standard Chart of Accounts structures used by accounting software. VAT treatment aligns with HMRC guidance for different expense types.

The API processes data through FCA-regulated Open Banking connections. Client authentication happens through their bank’s security measures. No login credentials are shared with third parties.

Audit trails are maintained for every categorisation decision. Transaction metadata is preserved. Category assignments can be reviewed and adjusted if business rules change.

Where Finexer Fits in Your Bookkeeping Workflow

Finexer provides bank transaction categorisation through direct connections to 99% of UK banks. Transactions are enriched with merchant data and categorised based on your accounting rules. Implementation happens 2-3x times faster than market alternatives, with technical support provided during period.

The API integrates with existing accounting platforms. Categorised transactions sync to your software automatically. Your team benefits from usage-based pricing with reduced transaction processing costs while improving VAT filing accuracy.

What is a transaction categorisation API?

A transaction categorisation API automatically assigns accounting categories to bank transactions based on merchant data and payment context, reducing manual bookkeeping work.

How does transaction enrichment improve VAT accuracy?

Transaction enrichment APIs provide detailed merchant information and consistent categorisation rules, ensuring expenses are classified correctly for VAT purposes.

Can categorisation rules be customised for different businesses?

Yes, categorisation rules can be configured based on industry type, business size, and specific VAT requirements for each client.

Is bank transaction categorisation secure?

Yes, data is accessed through FCA-regulated Open Banking connections with client authentication through their bank’s existing security measures.