Open banking API examples matter when you’re evaluating providers for production environments. Most businesses don’t need another generic list. They need to know which banking APIs actually work when processing real payments.

UK companies face a specific problem. They spend weeks evaluating open banking api providers that look identical on paper. Then they discover the differences during implementation – when it’s too late. Learn more about how open banking works in practice across different UK business models.

The real questions don’t get answered in sales calls. Does the API maintain uptime during high-volume periods? Which UK banks does it genuinely connect to? How long does technical support actually take to respond when something breaks?

This guide examines ten open banking apis currently operating in UK production environments. We’ve included what each API handles, genuine bank coverage, and the operational details that matter when you’re building payment infrastructure.

What Makes Open Banking APIs Different from Traditional Banking APIs?

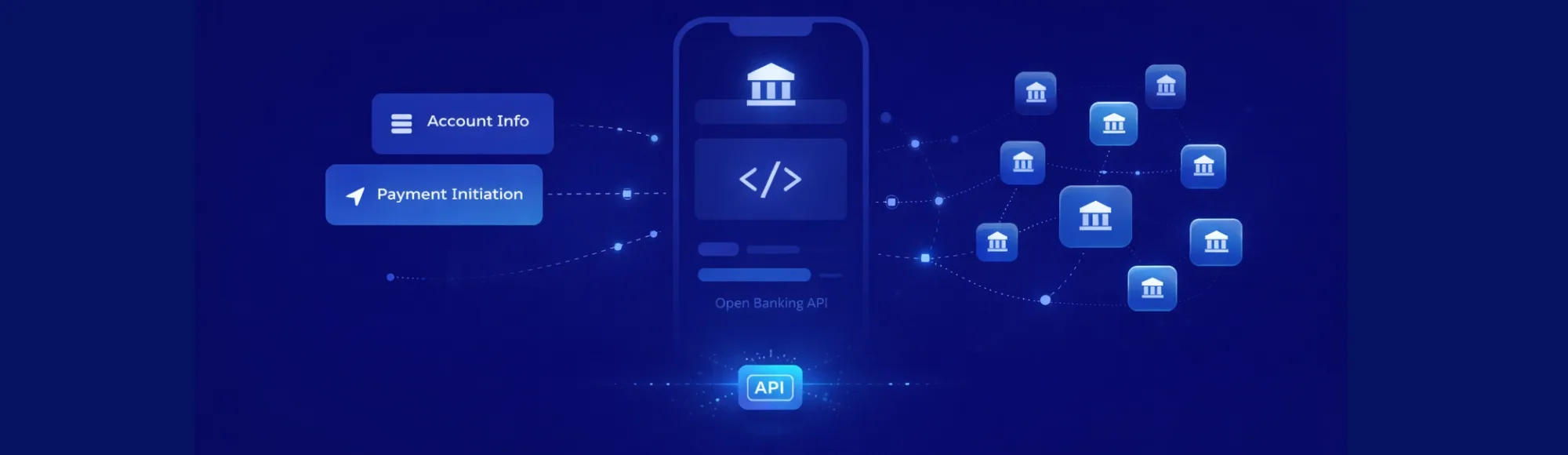

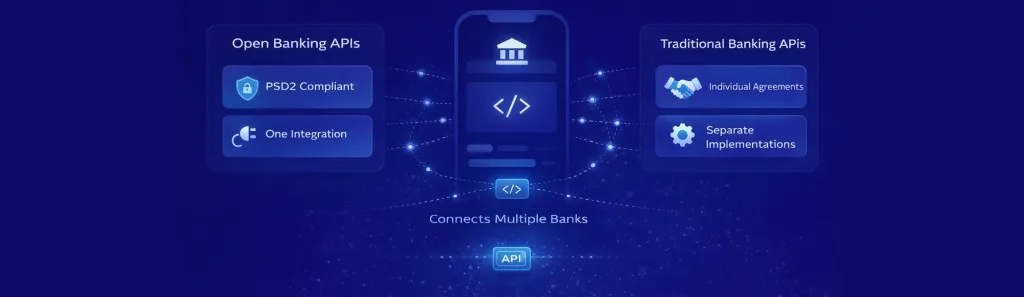

Open banking APIs operate under PSD2 regulations. They must meet specific security standards. They must provide standardised access to account information.

Traditional banking APIs were built for internal use. They need individual bank relationships for each connection.

The practical difference shows up during deployment. Open banking APIs connect to multiple banks through one integration. Traditional approaches need separate agreements for each banking partner. You also need separate technical implementations for every single bank.

Most businesses save 4-6 weeks during the initial setup. You avoid negotiating individual contracts with each bank.

How Do Businesses Actually Use Open Banking API Providers?

UK businesses use open banking apis for three main functions. Payment initiation, account verification, and transaction data analysis.

The most common setup connects your business application to customer bank accounts. It enables real-time payment processing. Explore popular banking API implementations to understand different use cases.

Here’s a practical example. A retail business verifies customer account details before processing refunds. A SaaS company checks payment method validity before converting trial users to paid subscribers. The API handles the bank connection, customer authentication, and data retrieval. You don’t build these connections yourself.

Top 10 Open Banking API Examples Operating in UK Markets

1. Finexer Pay-by-Bank API

Finexer’s API connects to 99% of UK banks. It handles payment initiation and account verification.

The system processes transactions through the Faster Payments network. No card networks. No intermediary processors.

Integration typically takes 2-3 weeks. Onboarding support is included throughout. The API manages Strong Customer Authentication through the customer’s banking app. You don’t need additional security layers.

2. Plaid UK

Plaid provides account aggregation across UK and European banks. Their API retrieves transaction history, account balances, and standing order information.

The system categorises transactions automatically. This helps financial management applications. Integration requires handling their webhook system for real-time updates.

Bank coverage is reasonable but not comprehensive. You’ll need to check whether they support your specific customer banks.

3. TrueLayer

TrueLayer offers payment initiation and account information services. Their API covers most UK high street banks and several challenger banks.

The platform includes a test environment with simulated bank responses. This speeds up development. However, you need additional testing against live bank environments before going to production.

Documentation is thorough. Technical support can be slow during peak periods.

4. Token.io

Token focuses on payment initiation. They support single and recurring payments. Their API handles refunds through the same connection that processes initial payments.

The system includes payment status tracking with granular states. This matters when customers need to see exactly where their payment sits in the processing queue.

Implementation complexity is moderate. Expect 4-6 weeks for deployment.

5. Yapily

Yapily provides a unified API across multiple European markets. Their UK coverage includes major retail banks and most building societies.

The platform offers different connection methods depending on bank capabilities. Some integrations use dedicated connections. Others go through the bank’s standard open banking interface.

Response times vary by connection type. This affects user experience during checkout.

6. Modulr

Modulr combines payment accounts with API access. Businesses can hold funds and initiate payments through the same platform.

This setup works for marketplaces or platforms that need to collect, hold, and distribute funds. The API handles payment routing and reconciliation.

Pricing includes both account fees and API charges. Calculate total costs carefully.

7. GoCardless Bank Pay

GoCardless extended their direct debit platform with instant bank payments. Their API processes one-off payments whilst maintaining existing recurring payment infrastructure.

Integration is straightforward for current GoCardless users. New implementations require setting up both the payment infrastructure and the API connection.

The system works well for businesses already using GoCardless for direct debits.

8. ClearBank

ClearBank provides banking infrastructure with API access to payment rails. Their system connects directly to UK payment schemes.

The API handles Faster Payments, CHAPS, and Bacs transactions. This matters for businesses that need specific payment rails or want to match existing banking operations.

Setup requires more technical expertise than consumer-focused alternatives.

9. Banked

Banked specialises in pay-by-bank checkout experiences. Their API focuses on e-commerce integration with pre-built components for common platforms.

The system includes hosted payment pages. These handle the bank selection and authentication flow. This reduces frontend development but limits customisation options.

Good for standard checkout flows. Less suitable for custom payment experiences.

10. Volt

Volt operates across UK and European markets. They focus on payment initiation. Their API processes real-time payments with status confirmation.

The platform includes fraud detection tools that analyse payment patterns. This adds a security layer beyond standard Strong Customer Authentication requirements.

Cross-border payment support is available but check individual country coverage carefully.

What Should You Check Before Choosing an Open Banking API?

Bank Coverage: Don’t just look at total numbers. Verify the API connects to banks your customers actually use. Total coverage statistics mean nothing if your specific customer base isn’t supported.

Uptime Records: Request incident reports. Ask for historical uptime data. Production systems need consistent availability. Good averages can hide regular outages that disrupt your business.

Integration Support: Check what support comes with implementation. Some providers offer basic documentation. Others provide dedicated technical assistance. The difference matters when you hit unexpected issues. Read our complete open banking API guide for detailed integration considerations.

Pricing Structure: Understand how costs scale with transaction volume. Usage-based pricing typically works better than fixed plans for growing businesses. You’re not locked into tier structures that don’t match your actual volume.

Regulatory Standing: Confirm the provider holds appropriate FCA authorisation. This isn’t just about compliance. It affects liability when things go wrong. Check their regulatory status directly with the FCA.

How Finexer’s Open Banking Infrastructure Differs

Finexer’s platform handles payment initiation and account verification through one integration. The system connects to UK banks without requiring individual banking relationships.

Implementation includes 3-5 weeks of dedicated onboarding support. This covers technical integration, testing, and launch preparation. Most businesses complete deployment 2-3 times faster than with alternative solutions.

The platform operates on usage-based pricing. No fixed monthly plans. Businesses pay for actual transactions processed. This aligns costs with revenue. Transaction costs typically reduce by up to 90% compared to card processing.

White-label options are available for businesses that need their own branding throughout the payment flow. The API handles all regulatory requirements. It operates under your business identity. Customers never see third-party branding.

What is an open banking API?

It’s a regulated interface that lets authorised third parties access bank account data and initiate payments with customer consent under PSD2.

Which banks are covered by UK open banking APIs?

All major UK banks including Barclays, HSBC, Lloyds, NatWest, Santander, plus challenger banks like Monzo, Revolut, and Starling.

How long does open banking API integration take?

Typically 2-8 weeks depending on complexity and provider support. Simpler implementations with good support finish in under 3 weeks.

Are open banking APIs cheaper than card payments?

Yes. They cost 70-90% less because they bypass card networks and process through direct bank transfers.

What security measures do open banking api providers use?

Strong Customer Authentication, encrypted connections, and FCA-regulated access with liability frameworks protecting both businesses and consumers.

Get Started with Finexer

A regulated, faster way to enable Open Banking API integration in the UK

Book a Demo now