Choosing the right noda open banking alternative matters for UK businesses. Your payment infrastructure affects transaction costs, settlement speed, and which customers can actually pay you.

If your current provider isn’t meeting expectations, evaluating alternatives makes sense. Bank coverage, pricing transparency, deployment complexity, and ongoing support all play a role in operational efficiency.

Finexer focuses exclusively on UK operations. The platform connects to 99% of UK banks. Usage-based pricing aligns costs with actual transaction volume. Both Payment Initiation Services (PIS) and Account Information Services (AIS) are FCA-regulated.

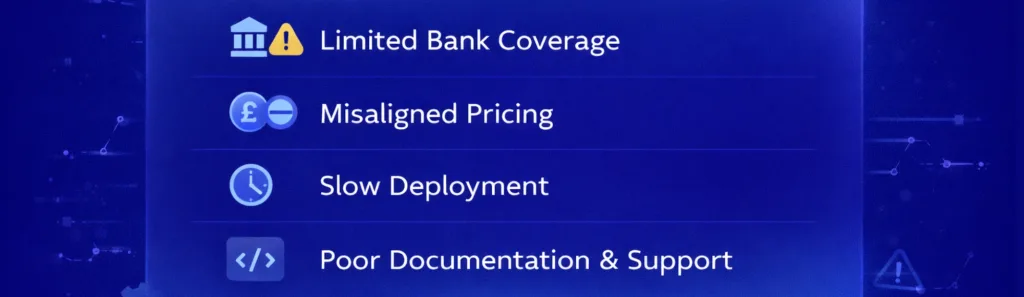

What Issues Do Businesses Face with Current Providers?

Businesses seeking a noda alternative typically face specific operational challenges that drive them to explore a noda open banking alternative.

Bank coverage creates checkout friction. When a customer’s bank isn’t supported, the transaction fails. You lose the sale. Your support team handles complaints.

Some providers focus on pan-European coverage but have gaps in UK regional banks. Others connect well to major institutions but miss digital challengers. Finding the right noda alternative means ensuring complete UK bank connectivity.

Pricing models don’t match transaction reality. Fixed monthly fees charge the same amount whether you process 100 transactions or 10,000. Tiered pricing forces you to predict volume months in advance.

Deployment timelines vary significantly. Some providers complete technical onboarding in weeks. Others require months of integration work, testing phases, and compliance checks. A suitable noda ob alternative should offer faster implementation without compromising quality.

API documentation quality makes the difference. Clear integration guides, working code samples, and responsive technical support reduce deployment complexity.

How Does Finexer Address These Challenges?

As a leading noda open banking alternative in the UK market, Finexer addresses these operational pain points directly.

UK Bank Coverage: Finexer connects to 99% of UK banks. This includes all major high street institutions, digital challengers like Monzo and Starling, and business banking platforms. Complete coverage reduces payment friction and support tickets. This comprehensive connectivity makes Finexer a reliable open banking replacement provider.

Usage-Based Pricing: You pay for actual transaction volume. No fixed monthly fees. No tier structures that force volume predictions. Growing businesses aren’t penalised. Seasonal operations don’t overpay during quiet months. This transparent pricing model distinguishes Finexer as a practical noda alternative.

Technical Integration: Documentation covers authentication, payment initiation, account information requests, and webhook handling. Dedicated technical support is available during onboarding. Deployment timeline depends on your technical resources and testing requirements.

Direct Support: Direct technical support means you’re not routed through general ticket queues. Real-time payment status updates reduce status inquiries. Clear error messaging helps troubleshoot integration issues.

How Do UK Open Banking Providers Compare?

When evaluating an open banking replacement provider, businesses should examine multiple providers based on their specific operational requirements.

Finexer – UK Market Specialist

What they offer: As a dedicated noda open banking alternative, Finexer provides 99% UK bank coverage including all major high street banks, digital challengers (Monzo, Starling, Revolut), and regional building societies. Usage-based pricing model without fixed monthly fees or tier structures.

Technical approach: REST API with comprehensive documentation. Sandbox environment for testing. Direct technical support during integration and ongoing operations.

Regulatory status: FCA-authorised for both Payment Initiation Services (PIS) and Account Information Services (AIS) in the UK.

Best suited for: UK-focused businesses prioritising domestic bank coverage, transparent pricing, and dedicated technical support. Particularly effective for businesses with variable transaction volumes or seasonal patterns seeking a reliable noda alternative.

Worth noting: Exclusively UK operations mean no international payment connectivity. This focused approach allows deeper integration with UK banking infrastructure, making it an ideal noda ob alternative for domestic operations.

TrueLayer – Established Enterprise Platform

What they offer: Comprehensive UK bank coverage with strong relationships across major institutions. Extensive API documentation with detailed integration guides. Large developer community and established enterprise client base.

Technical approach: Well-documented REST APIs. Multiple SDKs available. Robust testing environments. Enterprise-grade infrastructure with high availability guarantees.

Regulatory status: FCA-authorised AISP and PISP. Strong compliance framework with regular audits.

Best suited for: Businesses requiring proven enterprise-scale infrastructure. Companies needing comprehensive documentation and established integration patterns. Organisations with complex compliance requirements.

Worth noting: Pricing typically uses tiered structures. Pan-European focus means development resources are spread across multiple markets.

Yapily – Pan-European Connectivity

What they offer: Multi-country coverage across European markets. Single API for cross-border open banking operations. Strong focus on regulatory compliance across jurisdictions.

Technical approach: Unified API covering multiple European countries. Country-specific documentation. Standardised integration approach across markets.

Regulatory status: Regulated across multiple European jurisdictions. Comprehensive compliance framework for cross-border operations.

Best suited for: Businesses operating in multiple European markets. Companies requiring unified open banking access across borders. International operations needing consistent API structure.

Worth noting: European breadth may result in less depth for UK-specific features. Regional bank coverage in the UK may not match UK-focused providers.

Plaid – US Infrastructure Expanding Globally

What they offer: Strong US market presence with robust developer tools. Growing UK bank connectivity. Unified infrastructure for businesses operating in both US and UK markets.

Technical approach: Well-established API design patterns from US market. Comprehensive SDKs and developer resources. Strong focus on developer experience.

Regulatory status: FCA-authorised for UK operations. Strong US regulatory track record being applied to UK market.

Best suited for: Companies with existing Plaid implementations in the US. Businesses seeking consistent infrastructure across US and UK operations. Organisations prioritising developer experience.

Worth noting: UK operations are newer compared to their US infrastructure. Bank coverage still expanding in UK market compared to established UK-focused providers.

GoCardless – Direct Debit Specialist

What they offer: Deep expertise in UK Direct Debit infrastructure. Strong recurring payment workflows. Subscription billing focus with automated collection cycles.

Technical approach: APIs optimised for recurring payments. Strong integration with accounting platforms. Automated retry logic for failed payments.

Regulatory status: Bacs-approved bureau. FCA-regulated payment institution. Strong UK Direct Debit compliance.

Best suited for: Subscription businesses with recurring revenue models. Companies requiring automated Direct Debit management. Organisations with high volumes of repeat payments.

Worth noting: Primarily focused on Direct Debit rather than broader open banking payment initiation. Less suitable for one-off payment scenarios.

Volt – Real-Time Payment Focus

What they offer: Real-time payment infrastructure across multiple markets. Instant settlement capabilities. Strong focus on payment speed and confirmation.

Technical approach: Real-time payment rails integration. Instant payment status updates. Low-latency API infrastructure.

Regulatory status: Regulated payment institution with appropriate authorisations across operating markets.

Best suited for: Businesses where payment speed is critical. High-value transactions requiring instant confirmation. Time-sensitive payment scenarios.

Worth noting: Multi-market focus means less specialisation in UK-specific banking infrastructure compared to UK-only providers.

Token – Open Banking Platform

What they offer: Comprehensive open banking platform covering multiple markets. Both PIS and AIS capabilities. White-label solutions for branded experiences.

Technical approach: Flexible API design supporting various use cases. Comprehensive webhook system for real-time updates. Strong focus on customisation.

Regulatory status: Appropriately regulated across operating jurisdictions. Compliance framework covering multiple markets.

Best suited for: Businesses requiring highly customised payment flows. Companies needing both payment initiation and account information services. Organisations prioritising white-label capabilities.

Worth noting: Multi-market platform means development resources aren’t exclusively focused on UK banking peculiarities.

Each provider brings different strengths to the table. Your choice depends on whether you prioritise UK coverage depth, European breadth, Direct Debit automation, enterprise integration maturity, or cross-border capabilities.

For more detailed analysis comparing specific features and pricing models, see this comprehensive Noda alternatives guide.

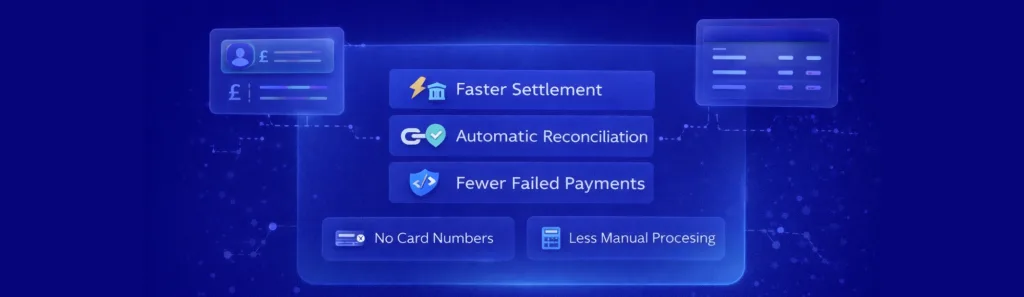

Where Do Open Banking Payments Create Value?

Direct bank transfers settle faster than traditional methods. Reconciliation happens automatically because payment data includes clear references. Failed payments are less common with open banking compared to card payments.

Manual payment processing reduces because bank-to-bank transfers don’t require card number entry. Your finance team spends less time on payment administration.

Learn how businesses use open banking for payroll and invoicing or accounting and ERP integration.

When Does Switching Providers Make Sense?

Provider migration creates disruption. The benefits need to outweigh the costs.

Switch when bank coverage directly affects revenue. If customers abandon purchases because their banks aren’t supported, coverage gaps cost you sales.

Switch when pricing structure misaligns with your model. If fixed fees consume margins or tier structures penalise growth, evaluate usage-based alternatives.

Switch when support quality affects operations. If slow response times delay issue resolution, dedicated support may justify switching costs.

Migration makes sense when current pain points clearly exceed switching costs.

Ready to Evaluate Alternatives?

UK businesses need clear answers on bank coverage, pricing transparency, technical integration complexity, and ongoing support quality when searching for a noda ob alternative.

Finexer focuses exclusively on UK operations. 99% bank coverage includes regional institutions alongside major banks. Usage-based pricing removes fixed fees. Direct technical support is available during integration and ongoing operations.

As a proven noda open banking alternative, Finexer delivers the operational capabilities UK businesses require without unnecessary complexity. Whether you’re seeking a noda alternative for better bank coverage, transparent pricing, or dedicated support, evaluating Finexer against your specific requirements makes practical sense.

What makes Finexer different as a Noda open banking alternative?

Finexer offers 99% UK bank coverage, deploys 2-3 times faster than market alternatives, and uses usage-based pricing instead of fixed tiers.

Does Finexer offer both PIS and AIS for UK businesses?

Yes, Finexer provides FCA-regulated payment initiation and account information services for businesses operating in the UK.

What happens to past transaction records when changing providers?

Your previous provider retains historical data, whilst Finexer begins processing all new transactions once the system goes live.

Can Finexer maintain our brand identity during payments?

Yes, white-label options keep your branding visible throughout the entire payment process for customers.

Get Started with Finexer

FCA-regulated open banking provider delivering 99% UK bank coverage and faster deployment for A2A payments

Book a Demo Now