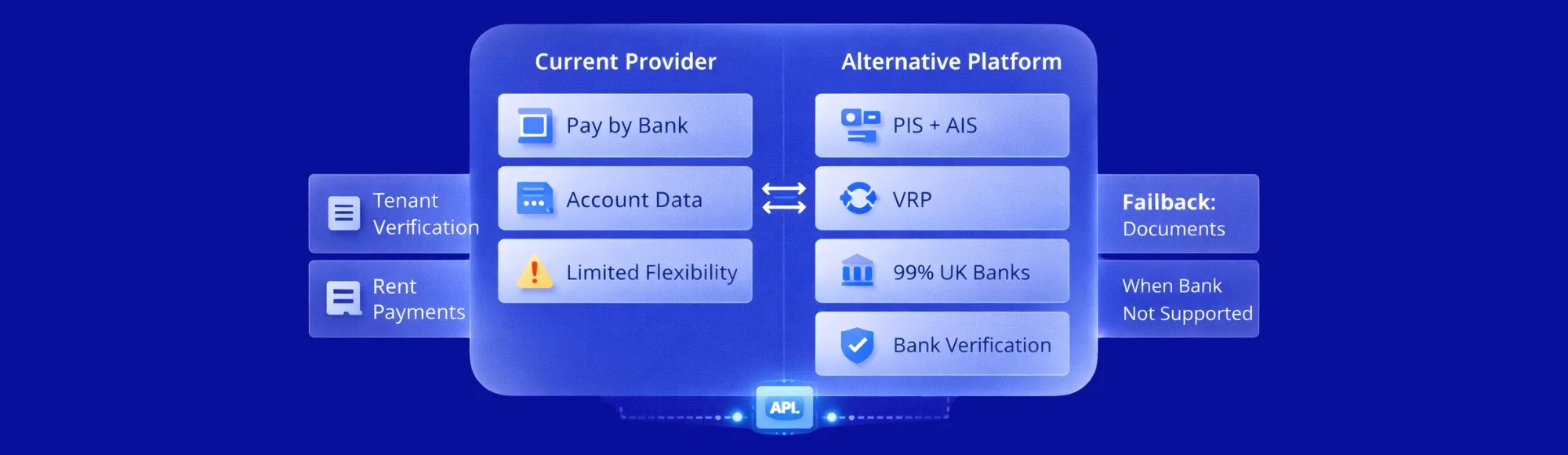

Many UK businesses using Open Banking for payments and account data eventually reach a point where they evaluate GoCardless alternatives. This may be driven by expanding product requirements, need for VRP, pricing considerations, coverage expectations, or technical support preferences.

Finding the right gocardless open banking alternative requires understanding what your payment infrastructure actually needs. Finexer operates as an FCA-regulated Open Banking platform providing Payment Initiation Services, Account Information Services, Variable Recurring Payments, and bank account verification with 99% UK bank coverage and assisted migration support.

When Businesses Consider Switching from GoCardless Open Banking

Several operational triggers lead businesses to evaluate gocardless alternatives for their payment infrastructure.

Requirement for Variable Recurring Payments often becomes critical when subscription billing needs automation without repeated customer authentication. Broader UK bank coverage matters when transaction failures impact revenue.

Combined AIS and PIS in one platform reduces integration complexity. More predictable pricing helps with financial planning. Faster technical support minimises downtime during critical periods.

Switching is typically a strategic optimisation rather than a reactionary move. Most businesses evaluating a gocardless open banking alternative do so to align technical capabilities with evolving commercial requirements rather than addressing immediate problems with the GoCardless OB service.

What to Look for in a GoCardless Open Banking Alternative

Evaluation criteria determine whether a gocardless open banking alternative meets operational needs.

UK bank coverage affects payment success rates directly. Payment Initiation handles Pay by Bank transactions. Account Information Services retrieves transaction data for reconciliation.

Variable Recurring Payments support matters for subscription models. Bank account verification prevents fraud during onboarding. API reliability reduces maintenance work.

Security and compliance alignment protects business operations. Migration support determines deployment speed. Usage-based pricing models provide cost control as volumes change.

Leading GoCardless Alternatives in the UK

Multiple platforms operate as gocardless alternatives in the UK Open Banking space:

| Platform | Description |

|---|---|

| Finexer | FCA-regulated platform providing PIS, AIS, VRP, and bank verification with 99% UK bank coverage and white-label capabilities. |

| TrueLayer | Offers payment and data services with Open Banking connectivity across UK banks. |

| Tink | Provides data aggregation and payment initiation across European markets including the UK. |

| Yapily | Connects to UK banks for payment and data services through Open Banking APIs. |

| Token.io | Operates Open Banking payment infrastructure with UK bank coverage. |

| Plaid | Offers account connectivity and verification services in UK markets. |

| Volt | Provides real-time payment solutions using Open Banking rails. |

| Bud | Delivers transaction data and financial insights through Open Banking APIs. |

How Different Platforms Position Themselves

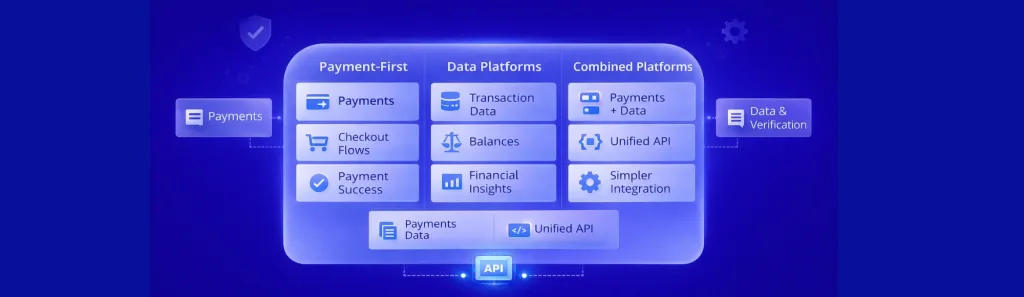

Platforms typically fall into three categories.

Payment-first platforms focus on transaction processing, checkout flows, and payment success rates. Data and aggregation platforms prioritise transaction history, balance checking, and financial insights.

Combined payments and data platforms offer both capabilities through unified APIs. This reduces integration work and simplifies technical architecture.

Combined Payments & Data Platforms

Platforms offering both PIS and AIS address multiple use cases through single integrations.

Single API access covers payment initiation and account information retrieval. VRP availability supports subscription billing. High UK bank coverage reduces transaction failures.

Usage-based pricing models align costs with actual volumes. Assisted migration helps with deployment.

Finexer operates Open Banking connectivity using FCA-authorised infrastructure. The platform connects to 99% of UK banks and deploys 2-3 times faster than market alternatives. White-label capabilities maintain brand consistency through payment journeys.

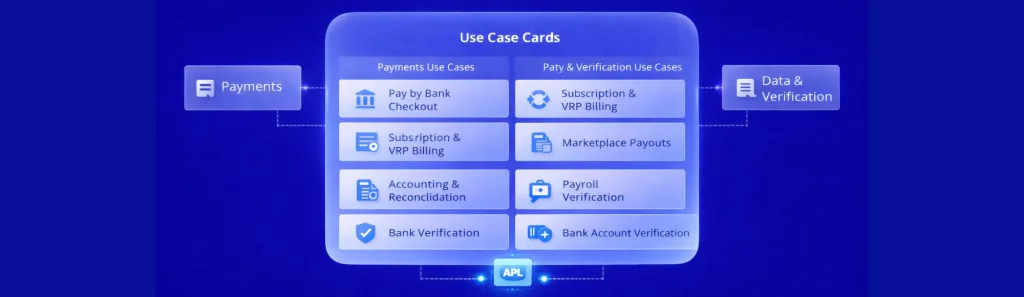

Common Use Cases After Switching Providers

Businesses switching from a gocardless open banking alternative typically focus on specific workflows that deliver immediate operational value.

Pay by Bank checkout reduces transaction costs compared to card payments. Subscription and VRP billing automates recurring collections. Marketplace payouts handle seller payments directly.

Accounting and reconciliation pulls transaction data into financial systems. Payroll verification confirms employee bank accounts before salary transfers. Bank account verification validates customer details during onboarding.

How Migration Typically Works

Migration follows structured steps to minimise disruption.

API mapping identifies equivalent endpoints between old and new platforms. Authentication flows, webhook configurations, and data structures need alignment.

Sandbox testing validates payment flows, data retrieval, and verification processes. Error handling and edge cases require testing before production.

Parallel run processes test transactions through new infrastructure whilst maintaining existing connections. Success rates and integration issues become visible.

Production cutover switches live traffic to new platform. Monitoring tracks transaction processing and system performance.

Choosing the Right Alternative

Internal questions guide provider selection.

Does the business need VRP for recurring payments? Are both payments and data required? What monthly transaction volumes need support?

Which banks must connect for customer coverage? What support level does the technical team require? How quickly does deployment need to complete?

Pricing models affect costs differently at various scales. Fixed fees work against variable volumes. Usage-based pricing charges for actual transactions.

Implementation speed determines when benefits begin. Some providers require months for deployment. Technical documentation quality affects integration time.

Why Choose Finexer as Your GoCardless Open Banking Alternative

Businesses looking for a gocardless open banking alternative need a platform that addresses coverage gaps, deployment speed, and pricing flexibility.

Finexer connects to 99% of UK banks, eliminating transaction failures from incomplete coverage. The platform deploys 2-3 times faster than market alternatives.

Account data retrieval works through secure bank APIs. Transaction history, balance information, and account details flow into business systems for accounting and ERP integration. The data comes through in structured formats that reduce reconciliation work.

Usage-based pricing aligns costs with actual transaction volumes, removing the risk of paying for unused capacity. White-label capabilities maintain brand consistency throughout payment journeys. FCA-regulated infrastructure covers PIS, AIS, VRP, and bank account verification through a single integration.

UK businesses evaluating gocardless alternatives benefit from Finexer’s UK-only focus, which delivers superior performance for domestic payments compared to platforms serving multiple markets. When switching from the GoCardless OB service, businesses reduce transaction costs by up to 90% whilst accessing comprehensive UK bank coverage and assisted migration support.

What triggers businesses to look for GoCardless Open Banking alternatives?

Businesses typically evaluate alternatives when requiring VRP functionality, broader UK bank coverage, combined AIS and PIS capabilities, or more flexible pricing structures.

Do VRP mandates transfer automatically when switching Open Banking providers?

VRP mandates require customer re-authorisation through new infrastructure as they are provider-specific and cannot transfer between platforms.

What bank coverage should UK businesses expect from GoCardless alternatives?

Leading platforms connect to major UK high street banks, digital challengers, and business banking platforms with coverage 99% of UK banks.

How does pricing differ between Open Banking providers?

Pricing models vary between fixed monthly fees based on tiers and usage-based pricing charging per transaction, with different structures affecting costs at various volumes.

Get Started with Finexer

FCA-regulated open banking provider with 99% UK bank coverage and complete migration support

Book A Demo Now