What You Will Discover:

Introduction

The accounting and ERP landscape is experiencing a fundamental shift through open banking integration. According to the Financial Conduct Authority’s 2023 report, businesses using open banking APIs have reduced their accounting reconciliation time by 72% on average. This transformation is particularly significant in the UK, where the Open Banking Implementation Entity (OBIE) reports that over 54.5 million successful open banking payments were processed in the first half of 2023, marking a six-fold increase from just two years prior. For accounting and ERP startups, this surge in adoption represents both an opportunity and a necessity to integrate open banking capabilities into their solutions.

You’re in the Right Place if you’re…

Leading an accounting or ERP startup in the UK and looking to integrate open banking into your platform. As you explore the landscape of API providers, you need a partner who understands your unique startup challenges and can scale with your growth – from handling your first thousand transactions to serving a thriving customer base across multiple banks.

Impact on Business Financial Operations

The traditional approach to financial data management in accounting and ERP systems has long been a source of inefficiency and error. Recent analysis from UK Finance shows that businesses implementing open banking APIs in their accounting systems reduce manual data entry errors by 91% and save an average of 16 hours per week in reconciliation tasks. This dramatic improvement stems from the elimination of manual data entry and the introduction of automated reconciliation processes, fundamentally changing how businesses manage their financial operations.

Building an accounting solution? → Let’s explore Open banking USP for Startups or rather Talk to our Open banking expert

Understanding the Open Banking Advantage

Open banking APIs have reshaped the possibilities for accounting and ERP systems by providing direct access to real-time financial data. A study by Accenture reveals that 78% of UK businesses cite improved cash flow management as the primary benefit of open banking integration in their accounting software. The ability to access real-time transaction data, automate reconciliation processes, and initiate payments directly through accounting systems has transformed financial management from a reactive to a proactive process.

Real-Time Financial Visibility

Modern accounting and ERP solutions require immediate access to accurate financial data to provide valuable insights. Through open banking APIs, these systems can now offer real-time visibility into account balances, transaction histories, and payment statuses across multiple banking relationships. This immediate access to financial information enables businesses to make informed decisions about cash flow, inventory management, and resource allocation without the delays traditionally associated with banking data updates.

Automated Reconciliation Systems

The integration of open banking APIs has revolutionised transaction reconciliation in accounting systems. By providing standardised, real-time transaction data directly from banks, these APIs enable automatic matching and categorisation of transactions. According to recent studies by the Association of Chartered Certified Accountants (ACCA), automated reconciliation through open banking reduces processing time by up to 85% compared to manual methods⁵.

The integration of banking data with accounting and ERP systems demonstrates tangible benefits for businesses, as shown in recent research by the Open Banking Implementation Entity. Two key findings from their 2022 Impact Report reveal how this technology affects day-to-day business operations and financial management.

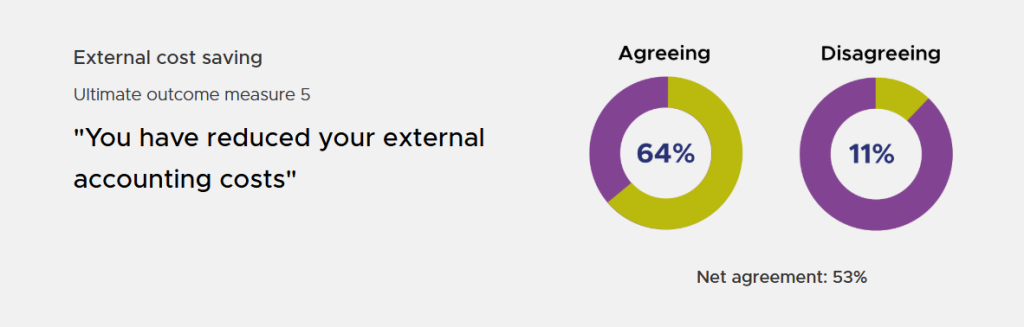

According to the report, 64% of businesses agree that connecting their banking data with their systems has reduced their external accounting costs, with a net agreement rate of 53%. This significant cost reduction suggests that when businesses integrate their banking data directly into their accounting systems, they spend less on outsourced accounting services and manual data processing.

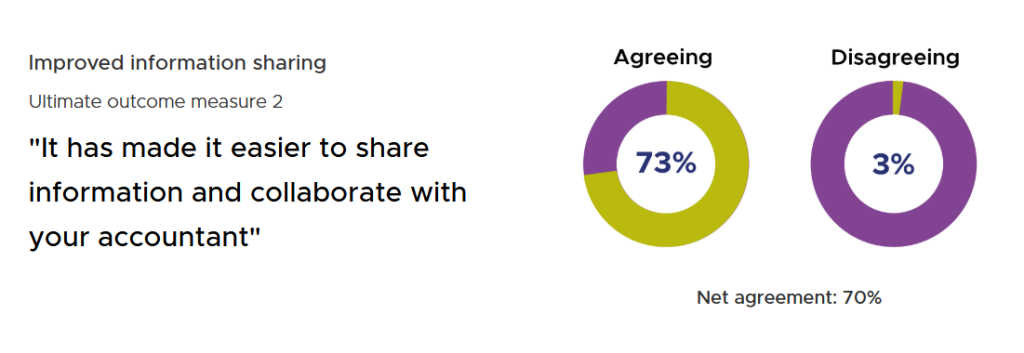

Even more striking is the improvement in collaboration between businesses and their accountants. The report shows that 73% of businesses agree that this integration has made information sharing and collaboration with accountants easier, achieving a strong net agreement rate of 70%. This high level of agreement indicates that direct banking connections are removing traditional barriers in professional financial relationships.

Why Finexer is the Best Open banking API provider for accounting & ERP

Specialised Features for Business Software

Finexer has developed its open banking infrastructure with specific attention to accounting and ERP requirements. The platform’s API suite addresses the unique challenges these systems face when handling financial data and transactions.

Advanced Data Processing

Finexer’s API delivers pristine financial data directly from UK banks, maintaining the integrity of transaction information crucial for accounting accuracy. When an ERP system connects through Finexer, it receives standardised data that seamlessly integrates with existing accounting processes. This standardisation eliminates the need for complex data transformation and reduces the risk of reconciliation errors.

Smart Transaction Management

The platform excels in handling complex transaction scenarios common in business operations. For instance, when processing supplier payments, the system can manage multiple payment schedules, track payment statuses, and automatically update accounting records. This integration helps maintain accurate financial records without manual intervention.

Bank Coverage and Integration

With connections to 99% of UK banks, Finexer enables accounting and ERP startups to serve clients regardless of their banking relationships. This comprehensive coverage means businesses can offer their solutions to any UK company without worrying about bank compatibility issues. The system processes everything in real-time, from balance checks to payment confirmations, ensuring accounting records always reflect the current financial position.

Building an ERP solution in the UK? → Let’s discuss your integration needs

Implementation and Business Benefits

Practical Integration Benefits

Finexer’s API integration process is designed specifically for accounting and ERP startups, with deployment speeds up to three times faster than standard solutions. The platform includes pre-built components for common accounting functions, reducing development time and complexity.

Automated Compliance Management

Financial compliance is crucial for accounting and ERP systems. Finexer’s FCA-authorised infrastructure automatically handles regulatory requirements and updates, ensuring continuous compliance without adding operational overhead. This automation is particularly valuable for startups managing financial data for multiple clients.

Cost-Effective Growth

Understanding the economic challenges startups face, Finexer offers consumption-based pricing that scales with your business growth. This model allows accounting and ERP startups to offer sophisticated financial features without large upfront costs. The platform handles growth from 100 to 100,000 transactions with 98% uptime, requiring no additional technical investment.

Real-World Applications

Consider an accounting startup serving small businesses. Through Finexer’s API, they can offer features like:

- Automated bank data reconciliation

- Real-time cash flow monitoring

- Instant payment processing

- Automated expense categorisation

- Multi-bank account management

These capabilities help transform basic accounting software into a comprehensive financial management solution. To get a detailed explanation about all the use cases of Open banking for accounting & ERP -> Click here

Access the best open banking api in the UK for Accounting & ERP solutions; Book a demo Now 🙂