Category: Open Banking

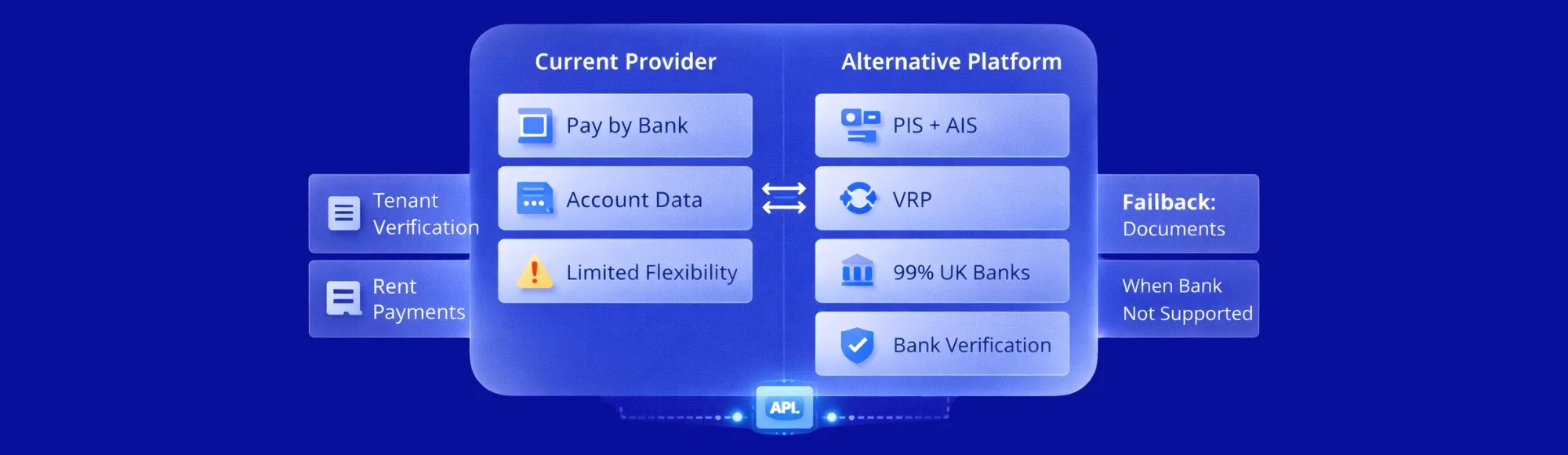

Switching from GoCardless Open Banking: UK Alternatives for Payments & Data APIs

Looking for GoCardless alternatives? Switch to Finexer for 99% UK bank coverage, VRP support, and complete migration assistance in 3-5 weeks

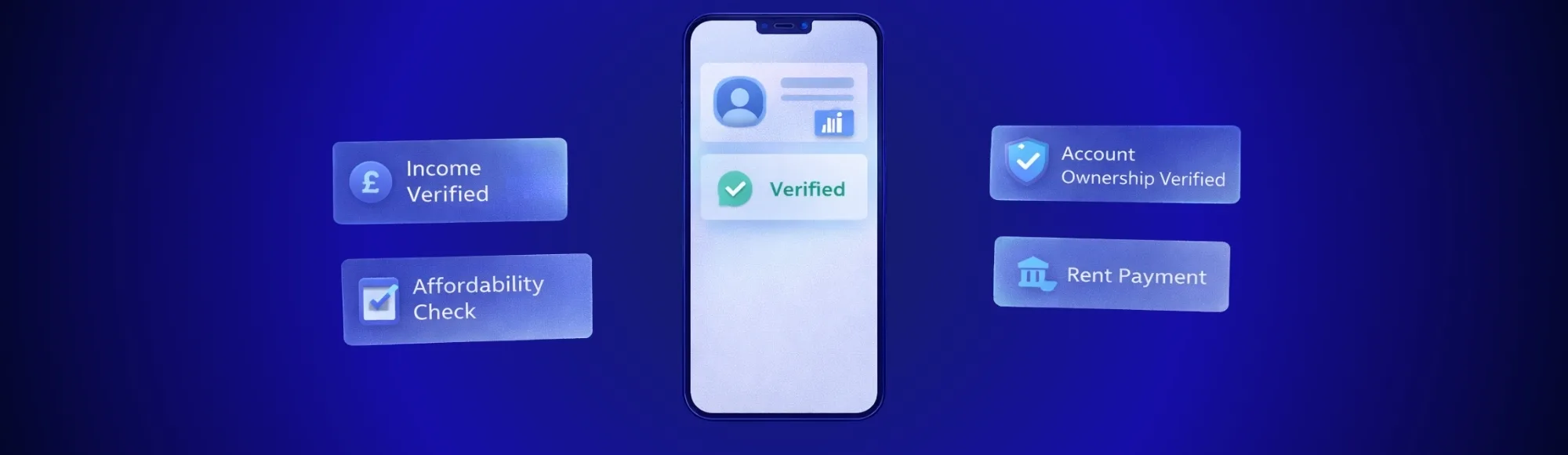

Open Banking for Renting: How Letting Agents Automate Tenant Affordability & Rent Payments

How letting agents use open banking for renting to automate tenant checks. Verify affordability faster with Finexer’s real-time bank data access.

Looking for a Noda Open Banking Alternative? Compare UK Providers for Payment Initiation & Account Information Services

Looking for a Noda open banking alternative? Switch to Finexer for 99% UK bank coverage, faster deployment, and usage-based payments.

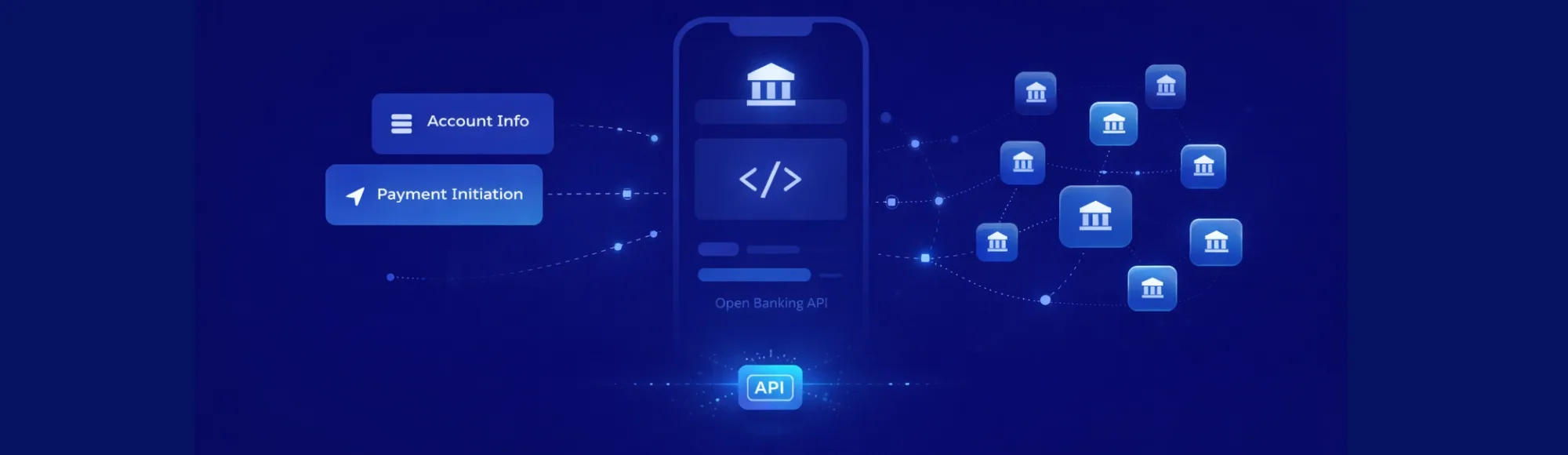

Top 10 Open Banking API Examples That Power Real AIS Products in the UK

Discover 10 open banking API examples powering real UK businesses. Compare providers, bank coverage & integration times. Reduce costs by 90% with Finexer.

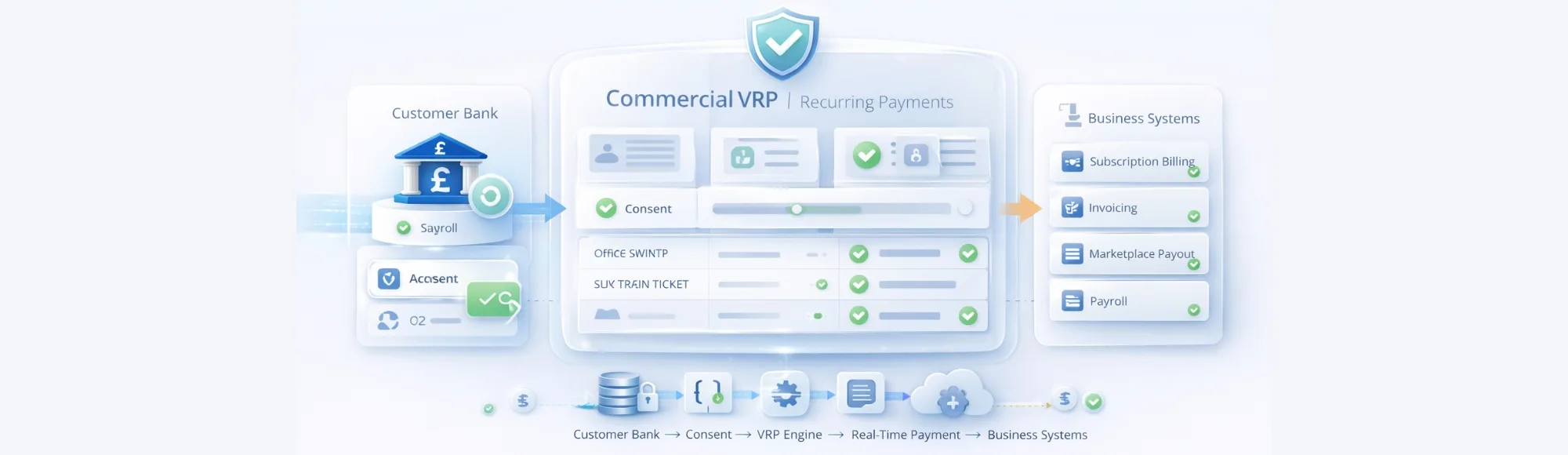

FCA Confirms Commercial VRP: What UK Businesses Must Prepare For

FCA confirms commercial variable recurring payments in the UK. Learn how to prepare your payment infrastructure and reduce costs with Finexer’s VRP platform.

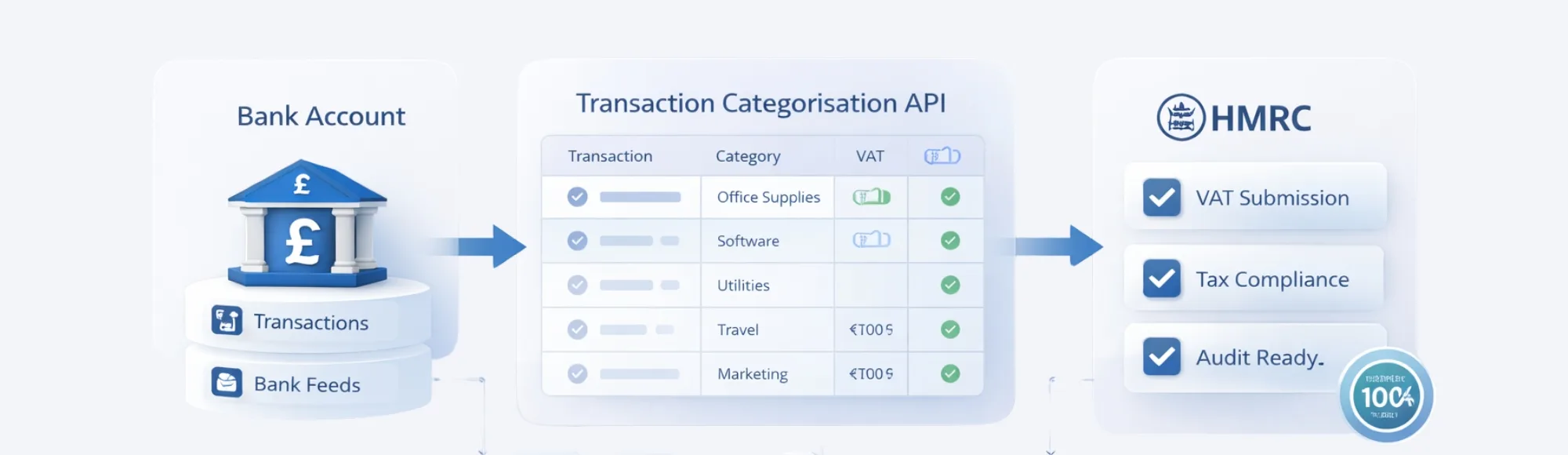

Transaction Categorisation API for Audit-Ready Bookkeeping: How UK Firms Reduce VAT Errors

See why transaction categorisation APIs outperform manual processing with faster setup, lower VAT errors, and automated audit trails.

A2A Payments in the UK: Buyer Checklist for Choosing an Open Banking Provider

Learn how to choose the right A2A payments provider in the UK with this open banking buyer checklist covering bank coverage, pricing, success rates, and speed.

How Far Back Do Source of Funds Checks Go in the UK? Complete Guide

UK source of funds checks usually cover 3–6 months of history. Learn what affects lookback periods and how Finexer automates faster, compliant verification.

Bank Account Verification in the UK: How to Confirm Customer Details Instantly (Without Manual Checks)

Confirm customer bank details in seconds, cut failed payments, and speed up onboarding with Finexer’s instant bank account verification.

Free MTD Software for Landlords: What’s Actually Free and What Can Cost You Penalties

Free MTD software for landlords often misses key features. Discover what’s truly free, what triggers penalties, and how to stay compliant.

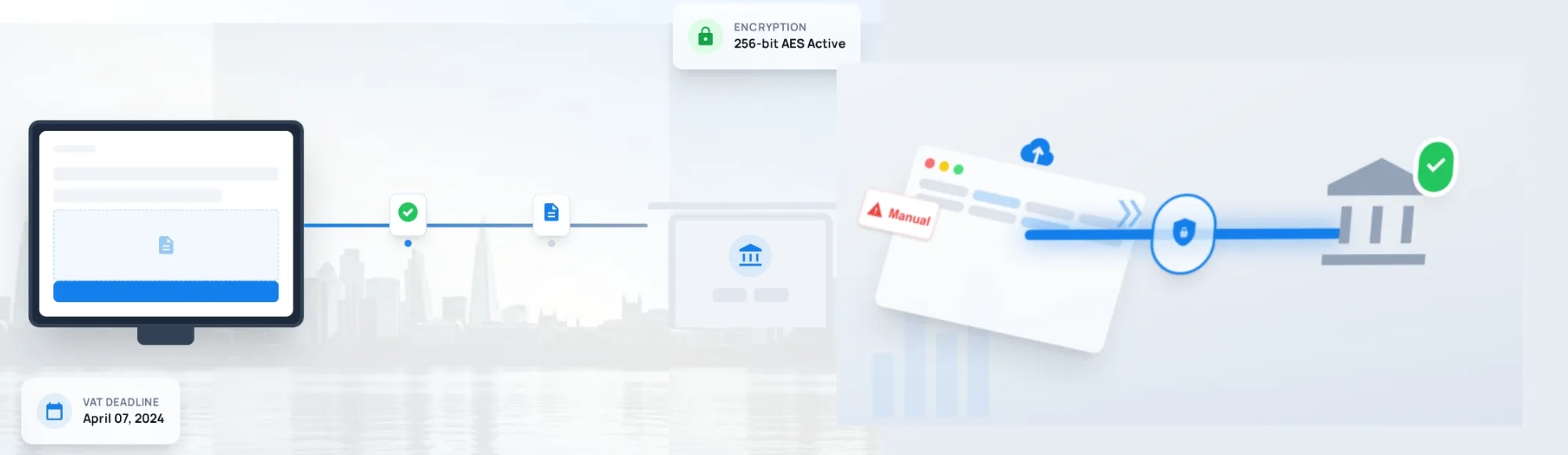

MTD Bridging Software: What UK Businesses Must Check Before Choosing One

Struggling with HMRC VAT submissions? Learn how to choose the right MTD bridging software to avoid errors, ensure compliance, and submit VAT smoothly.

Buy now pay later guide: How it works and Top UK providers

Our guide to Buy now pay later. Learn how it works and compare top UK providers like Klarna, Clearpay, PayPal, and Zilch.

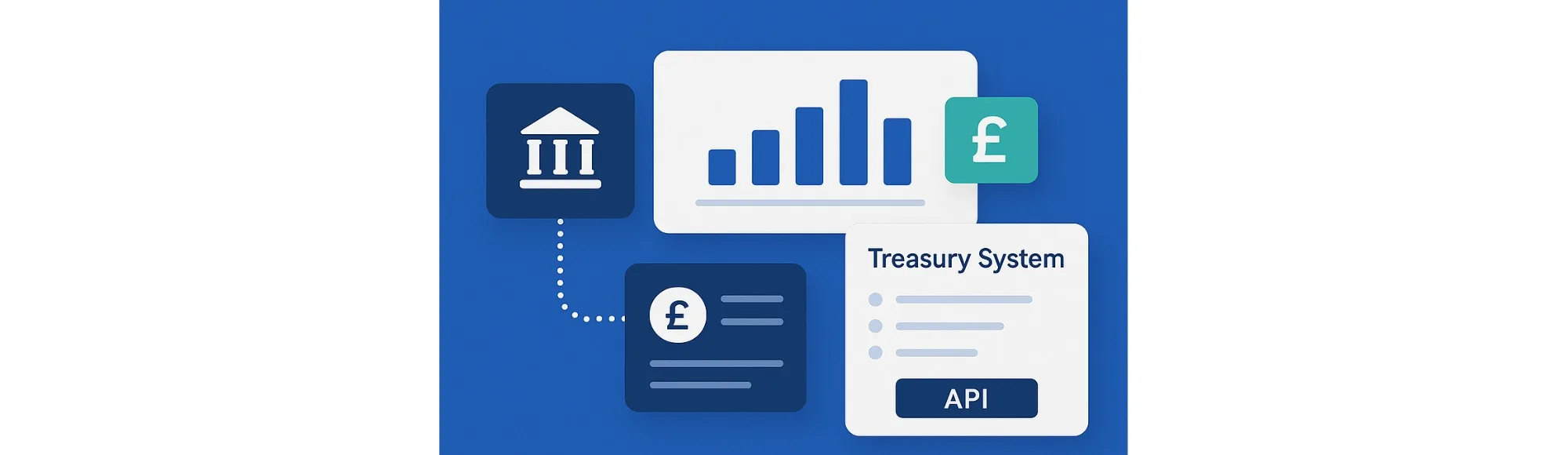

Open Banking API Integration for Enterprise Treasury Management Systems

See how UK enterprises enhance treasury management systems with real-time bank data via Open Banking APIs. Finexer provides fast, clean connectivity

Testing Open Banking Integrations: Sandbox vs Live Data Scenarios

Learn about testing Open Banking integrations using sandbox and live data. Understand real bank behaviour, authentication friction, and safe rollout steps.

Evaluating an Open Banking Partner: 10 Red Flags to Watch For

Before choosing an Open Banking partner, review the 10 red flags that affect bank coverage, data quality, uptime, and compliance for UK businesses.

From Raw to Reliable: How Categorised Bank Data Transforms Credit Underwriting

Learn how categorised bank data strengthens affordability checks, reveals risk signals, and improves underwriting accuracy for UK lenders. Practical insights included.

UK Open Banking Governance 2025–26: Key Standards Every Provider Must Track

A clear guide to UK open banking governance for 2025–26. Learn the standards, reporting rules, consent requirements, and how Finexer supports compliant usage.

Faster client onboarding with Open banking for law firms

Find how Open Banking helps UK law firms speed up client onboarding. Reduce onboarding friction, simplify AML/SoF compliance, and improve client experience.

Choosing the Right Payment Initiation Platform in UK: A Checklist

Compare leading UK payment initiation platforms by coverage, pricing, speed, and support. Explore the best choice for your business in 2025.

What Is a Payment Initiation Service (PIS) and How It Works in the UK

Learn what a Payment Initiation Service (PIS) is, how it works in the UK, and why it’s changing the way businesses handle payments using open banking APIs.

A UK Lender’s Guide to Better Risk Assessments with Bank Data

Learn how UK lenders can use real-time bank data to build faster, fairer, and more accurate risk assessments.

Screen Scraping vs Open Banking: Why UK Businesses Are Making the Switch in 2026

Learn why UK businesses are replacing screen scraping with secure, PSD2-compliant Open Banking APIs. Discover safer, faster data access with Finexer.

Open Banking in Practice: Real-World Examples Transforming Accounting Workflows

Learn how accountants use open banking in practice for faster reconciliation, cleaner audits, and real-time financial accuracy across UK firms.

Integrated Digital Banking for UK SME’s

Learn how integrated digital banking helps UK SMEs manage payments, data, and cashflow in one place. Find how Finexer connects it all securely!

Open Banking Security: 5 Myths Every UK Business Owner Still Believes

Discover the truth about open banking security in the UK. Learn how FCA rules, consent-based access, and Finexer’s APIs keep business data safe.

The Most Cost-Effective Open Banking API for UK Businesses

Compare the most cost-effective Open Banking APIs for UK firms. Explroe pricing, coverage, and deployment insights

5 Real-World Examples of Successful TPPs in Open Banking

Discover how leading TPPs are transforming UK Open Banking. Learn from real examples of secure, compliant, and data-driven financial innovation.

In-House vs Outsourced Open Banking Integration: Costs, Security, and Speed

Learn how to plan open banking integration in the UK. Compare build vs buy, timelines, licensing, security, and cost with a step-by-step process.

7 Questions to Ask Before Choosing a Bank Data API

Setup Bank Data API Instantly with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now UK businesses are increasingly turning to direct bank connections to reduce payment costs and improve customer experience. With over 5 billion real-time transactions processed last year, the demand for reliable banking infrastructure has…

![Top 7 Source of Wealth APIs in the UK [Comparison Guide] 30 Top 7 Source of Wealth APIs in the UK [Comparison Guide]](/wp-content/uploads/2025/10/Source-of-wealth-APIs-in-the-UK-jpg.webp)

Top 7 Source of Wealth APIs in the UK [Comparison Guide]

Try Finexer for Instant Source of wealth Checks Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now As UK regulators tighten anti-money-laundering (AML) oversight, firms are rapidly shifting from manual document reviews to automated Source of Wealth (APIs). In 2024 alone, UK financial institutions increased their investment in compliance…